Wireless Mobile Machine Control Market Outlook:

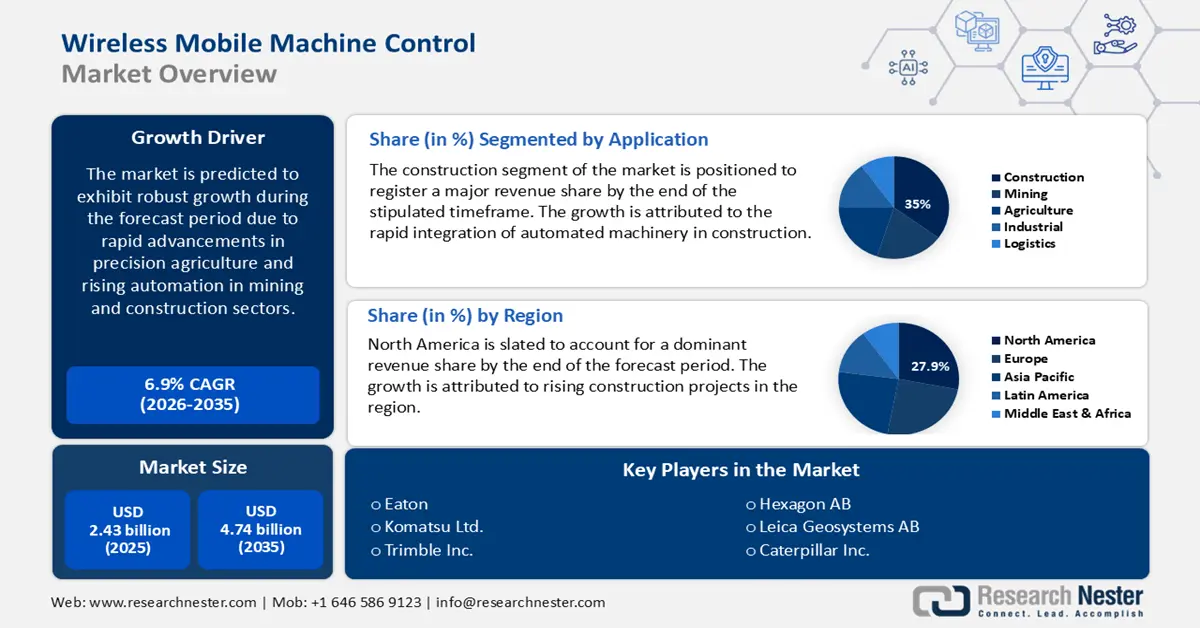

Wireless Mobile Machine Control Market size was valued at USD 2.43 billion in 2025 and is expected to reach USD 4.74 billion by 2035, registering around 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wireless mobile machine control is evaluated at USD 2.58 billion.

A major wireless mobile machine control market driver is the growing automation trends across various sectors. Rapid technological advancements have ensured operators can control machines remotely, which aligns with the global push to improve worker safety. Furthermore, the rapid integration of automation trends has bolstered demand for wireless mobile machine control systems. The table below indicates statistics on industrial robot installations that require wireless mobile machine control systems for improved remote operations.

|

Construction Automation Trends of Industrial Robots |

||

|

Name of the Industry |

Value Added |

Hours Worked |

|

Construction |

USD 1.3 trillion |

1.7 trillion |

|

Agriculture, Forestry, Fishing |

USD 295 billion |

379 million |

|

Auto and Other Transportation Manufacturing |

USD 854 billion |

526 million |

|

Mining & Quarrying |

USD 33 billion |

105 million |

Source: International Trade Administration

The statistics indicate the value added by industrial robotics in these sectors which is closely tied to the global push for automation in industries. In September 2024, the International Federation of Robotics (IFR) reported 4,281,585 industrial robot units working worldwide, which is a 10% increase from the previous year. With the rising value added by automation in multiple industries, the demand for wireless mobile machine control is anticipated to increase for effective management of heavy machinery and robots. Additionally, forecasted trends suggest that government initiatives promoting smart manufacturing and digitalization will create a conducive environment for the expansion of the wireless mobile machine control sector over the projected timeline.

A major driver of the wireless mobile machine control market is the proliferation of advanced communication technologies such as 5G and Wi-Fi 6, which provide low latency for real-time machine control. The growing adoption of autonomous and semi-autonomous machinery is supported by the improvement in communication technologies, which in turn leads to a steady demand for wireless mobile machine control systems. In February 2021, a study published in the Journal of Ambient Intelligence & Humanized Computing reported that the advent of 5G and Wi-Fi 6 will support rapid digitization and automation in multiple sectors. Additionally, the successful use cases, such as the implementation in the mining industry to operate heavy equipment remotely for worker safety, are favorable for the continued demand for wireless mobile machine control systems.

Key Wireless Mobile Machine Control Market Insights Summary:

Regional Highlights:

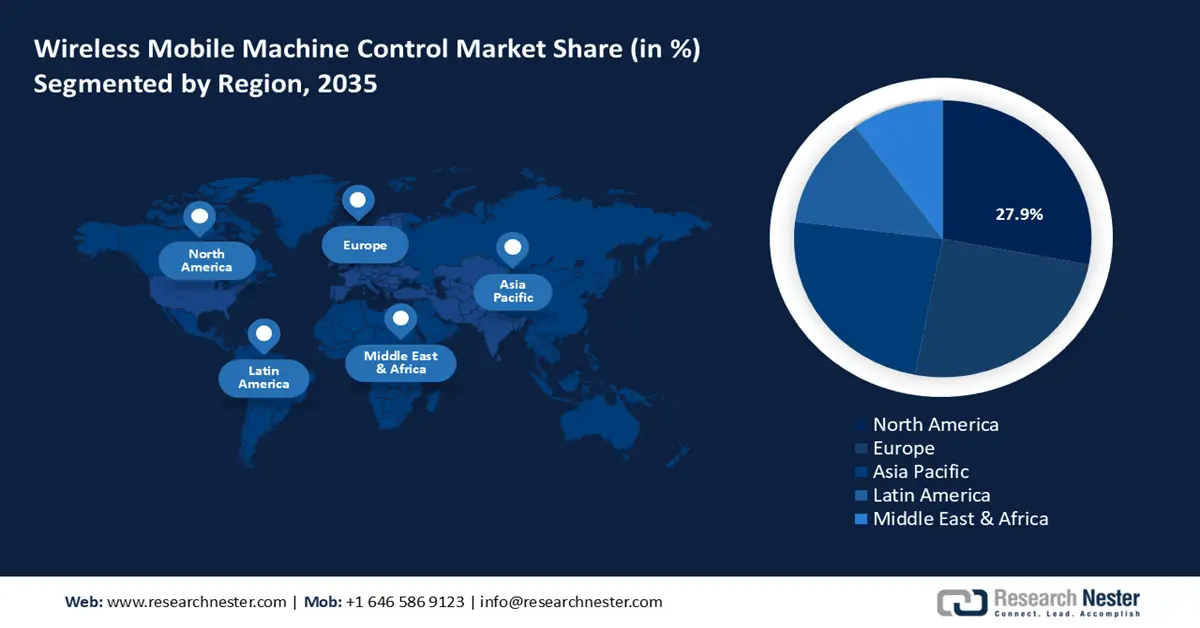

- By 2035, North America is anticipated to command over 27.9% share of the wireless mobile machine control market, underpinned by intensifying construction activities and large-scale regional mega projects.

- Europe is projected to record the fastest expansion through 2026–2035, sustained by escalating adoption of automated solutions across agriculture, mining, construction, and logistics.

Segment Insights:

- The construction segment is projected to account for over 35% share by 2035 in the wireless mobile machine control market, propelled by the rapid infusion of automation across global construction operations.

- By 2035, the excavator segment is set to advance its market position as demand accelerates, supported by rising infrastructure activities and the growing use of real-time wireless machine guidance systems.

Key Growth Trends:

- Expansion of smart city and smart manufacturing initiatives

- Advancements in precision agriculture

Major Challenges:

- Connectivity concerns

- Spectrum allocation challenges across regions

Key Players: Eaton, Komatsu Ltd., Cross Company, Allgon, Leica Geosystems AG, Trimble Inc., Hexagon AB, CNH Industrial N.V., Topcon Positioning Systems, Inc., Hitachi Construction Machinery Co., Ltd., Volvo Construction, Caterpillar Inc.

Global Wireless Mobile Machine Control Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.43 billion

- 2026 Market Size: USD 2.58 billion

- Projected Market Size: USD 4.74 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: North America (27.9% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 2 December, 2025

Wireless Mobile Machine Control Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of smart city and smart manufacturing initiatives: The growing advent of smart cities and smart manufacturing initiatives is poised to heighten the adoption of wireless mobile machine control systems. The systems ensure precision operations in infrastructure projects in smart cities, and technological advancements have ensured the remote monitoring of heavy machinery. Manufacturers are set to leverage demands from regions that are heavily investing in smart city infrastructure projects to supply wireless mobile machine control systems. The table below indicates a list of key smart city projects currently under construction or planned for future development. These projects have the potential to provide long-term steady demand for wireless machine control systems.

Global Smart City Projects

|

Under Construction |

Name of the Country |

To be Constructed/Planned |

Name of the Country |

|

Songdo International Business District |

South Korea |

Telosa |

The U.S. |

|

Dholera |

India |

Chengdu |

China |

|

King Abdullah Economic City |

Saudi Arabia |

The Line |

Saudi Arabia |

|

Masdar |

UAE |

The Orbit |

Canada |

|

Amravati |

India |

Shimizu-Mega City Pyramid |

Japan |

The under-construction/planned megaprojects are positioned to assist the wireless mobile machine control market by driving steady demand for the systems. With most of the projects planned for long-term construction, the demand for remotely controlled heavy machinery for precision work is likely to remain stable. Additionally, smart manufacturing initiatives have ensured greater automation for flexible production lines which is an emerging trend benefiting the sector’s growth.

- Advancements in precision agriculture: The accelerated adoption and advancements in precision agriculture remain a key driver of the wireless mobile machine control market. The agriculture industry trends indicate that precision agriculture has revolutionized farming practices to improve crop yields. Furthermore, machines such as GPS-guided harvesters and tractors, drones, and livestock monitoring systems are experiencing significant growth in adoption. The table below indicates the drone spray application trends in the U.S. and worldwide.

|

Drone Usage in Pesticide Spraying Trends |

|

|

Countries with the highest rate of drone adoption in pesticide spraying |

|

|

Highest use of small multi-rotor drones in farming |

|

Source: Agronomic Crops Network

The use of wireless machine control systems is vital in controlling unmanned machinery such as drones in precision agriculture practices, and the growing usage of drones coupled with the expanding farm area of precision agriculture is predicted to benefit the wireless mobile machine control market. Moreover, the automation trends that are on the rise in various sectors are set to be embraced by the agricultural sector globally in a bid to expand production for the rapidly growing world population. The convergence of these trends is projected to create a steady stream of profitable opportunities for manufacturers providing remote mobile machine control solutions.

- Increasing adoption of automation in mining: The mining industry is experiencing robust automation trends which bodes well for the application of wireless mobile machine control systems. The mining industry has been under scrutiny and the calls for inculcating stringent worker safety practices to mitigate mishaps have grown over the years. The wireless mobile machine control systems enable remote operation along with real-time monitoring of heavy machinery, which in turn reduces the risk of accidents and boosts productivity. An example of a successful use case is from the Sandvik Mining & Rock Technology mine. For instance, in May 2024, Sandvik partnered with Ambra Solutions to deploy over 497 miles of 4G/5G coverage in underground tunnels which is set to facilitate remote machine operations over high-definition video links.

In August 2024, the Institute of Materials, Minerals, & Mining published a paper estimating smart mines and autonomous machines to become more prevalent in the mining industry. The estimated proclivity of automation in mining during the wireless mobile machine control market’s projected timeframe is poised to ensure the sector’s steady growth.

Challenges

-

Connectivity concerns: Despite improvements in connectivity networks boosting low latency in wireless mobile machines, the market faces challenges in effectively maintaining connectivity in remote areas and harsh weather conditions. The challenge can derail the market’s growth by limiting adoption. Furthermore, disaster management initiatives and construction in remote regions, such as Alaska, provide opportunities for expanding applications of remote mobile machine control systems, and the connectivity gap has to be navigated by businesses operating in the sector.

- Spectrum allocation challenges across regions: The wireless mobile machine control systems rely heavily on radio frequency spectrum for communication. The lack of standardization in the allocation of spectrum across regions can pose a challenge to the wireless mobile machine control market. Agricultural and mining operations can face constraints owing to insufficient allocation of bandwidth which can reduce the effectiveness of wireless control solutions. Furthermore, for companies offering solutions globally, navigating the regulatory constraints can be complex.

Wireless Mobile Machine Control Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 2.43 billion |

|

Forecast Year Market Size (2035) |

USD 4.74 billion |

|

Regional Scope |

|

Wireless Mobile Machine Control Market Segmentation:

Application Segment Analysis

The construction segment is likely to capture wireless mobile machine control market share of over 35% by 2035. The construction industry remains the most prominent end user of wireless mobile machine control systems with the rapid proliferation of automation across the sector a major market driver. Real-time monitoring and automated control of equipment, such as bulldozers, excavators, graders, etc., reduce the scope of human error. Furthermore, major construction firms are leveraging rising opportunities in mega projects globally to increase the manufacturing capacity of intelligent control solutions for global trade. Refer to the table below for trends in global construction activity.

|

Global Construction Activity Trends |

|

|

|

Source: RICS

Additionally, the decrease in the cost of advanced sensors driven by the advancements in semiconductor technology facilitates the reduction in component pricing in the production of wireless mobile machine control systems. Lower production prices enable manufacturers to expand their portfolio and maintain consistent supply and maintenance for the construction sector.

The logistics segment of the wireless mobile machine control market is estimated to expand throughout the projected timeframe. The growth of the segment is attributed to the rising application of conveyor belts and forklifts which are remotely controlled for greater operational efficiency. Furthermore, the advent of automated material handling (AMH) systems facilitates real-time goods delivery benefiting the logistics providers to achieve zero inventories in retail stores. Emerging trends such as the adoption of smart warehouse solutions are set to boost the application of wireless mobile machine control systems in logistics.

Recent expansions by key players in the logistics industry offering automated material handling solutions is projected to boost demands for wireless mobile machine control solutions. For instance, in March 2024, Kenco Material Handling Equipment (MHE) Solutions announced the launch of Automation Guidance to expand the scope of MHE solutions to supply chain professionals.

Machine Type Segment Analysis

By machine type, the excavator segment of the wireless mobile machine control market is assessed to showcase growth by the end of 2035. The growing usage of excavators with advanced control systems is a major driver of the segment. Wireless mobile machine control systems allow real-time machine guidance ability which boosts operations. Furthermore, the global trends of rising infrastructure activities driven by rapid urbanization and investments is positioned to create a sustained demand for excavators fitted with wireless control systems.

Major players in the construction segment, such as Volvo Construction and Hitachi Global have released electric remote-controlled excavators to leverage the favorable trends within the market. For instance, in March 2023, Volvo Construction Equipment launched an advanced short-range remote-control solution for excavator operations. Additionally, in FY2023, Hitachi launched a medium-sized remote hydraulic excavator. The major companies in the construction market are likely to find lucrative opportunities in regions plagued with labor shortages, creating further revenue streams in the wireless mobile machine control sector.

Our in-depth analysis of the global wireless mobile machine control market includes the following segments:

|

Application |

|

|

Machine Type |

|

|

Technology |

|

|

Functionality |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless Mobile Machine Control Market - Regional Analysis

North America Market Insights

North America wireless mobile machine control market is expected to dominate revenue share of over 27.9% by 2035. The growing construction activities and mega projects in the region provide the most significant impetus to the regional market’s dominance. RICS estimated the Construction Activity Index (CAI) to be the highest in North America in the first quarter of 2024 which is poised to drive demand for remote-controlled construction equipment requiring wireless mobile machine control systems. Furthermore, the strong fiscal position of North America enables businesses to allocate greater resources toward capital-intensive equipment.

The public and private sectors benefit from the financial stability, allowing greater adoption of automation in various sectors. Additionally, companies with strong foothold in North America are launching new autonomous machines and technology which is beneficial for the growth in demand for wireless mobile machine control systems. For instance, in January 2025, John Deere, a major player in North America, announced new autonomous machines to support end users in agriculture, commercial landscaping, and construction indicating the lucrative potential to supply wireless machine control solutions.

The U.S. wireless mobile machine control market is set to account for a major revenue share in North America. Major drivers include increasing investment in precision agriculture and rapid adoption of automation across industries. Additionally, the advent of GPS and GNSS systems has improved safety across sectors. The U.S. Bureau of Labor Statistics published a report of declining labor productivity in the manufacturing and mining industries in 2023, which creates opportunities for heightened adoption of remote-controlled machines. The table below highlights productivity and output statistics for 2023 in the U.S.

|

U.S. Labor Output Statistics 2023 |

|

|

Labor Productivity |

|

|

Industry Output |

|

|

Unit Labor Costs |

|

Source: The U.S. Bureau of Labor Statistics

The declining productivity and increasing unit labor costs support the further adoption of automation systems in various sectors. The rise in the application of remotely monitored automation systems is poised to assist the continued growth of the U.S. wireless mobile machine control market.

The Canada wireless mobile machine control market is positioned to exhibit robust growth during the estimated market timeframe. The market’s growth is driven by the substantial increase in infrastructure investments. In July 2024, the government reported over USD 33 billion in funding in the Investing in Canada Infrastructure Program. Such large-scale fundings provide the financial support to invest in autonomous machinery for precision work, driving the demand for wireless mobile machine control systems. Furthermore, Canada has a burgeoning mining industry which is expected to remain a prominent end user of wireless machine control solutions. In September 2024, the World Economic Forum (WEF) reported the global wireless mobile machine control market for autonomous mining systems is anticipated to grow to USD 6.2 billion in 2026, with the domestic mining industry in Canada poised to be impacted by the trends.

Europe Market Insights

The Europe wireless mobile machine control market is slated to exhibit the fastest growth during the forecast period. The rising demand for automated solutions in sectors such as agriculture, mining, construction, and logistics drives the sector’s growth in Europe. Macro analysis of Europe indicates construction PMI at around 42 points which is favorable to boost demands for wireless mobile machine control systems. In June 2023, IFR reported that industries in the EU are investing heavily in robotics with 72 thousand industrial robot units installed in 2022, which is a 6% increase year-on-year. The convergence of these trends is poised to drive demand for the wireless mobile machine control market.

The Germany wireless mobile machine control market is projected to grow during the forecast timeline. Germany is renowned for its engineering excellence, paving the way for the adoption of automated construction solutions in the domestic market. Large-scale infrastructure projects, such as energy-efficient buildings and urban redevelopment hold the potential to provide opportunities for the supply of wireless mobile machine control systems. For instance, in September 2024, Deutsche Bahn launched a program to improve rail operations, infrastructure, and profitability by 2027 with specific targets to reduce infrastructure-related delays by 20%. Mega projects are poised to create a burgeoning demand for remotely monitored and controlled equipment which is beneficial for the growth of the wireless mobile machine control market in Germany.

The France wireless machine control market is anticipated to grow steadily during the stipulated timeframe. The country’s commitment to modernizing infrastructure is imminent to usher the market’s growth. Moreover, France’s commitment to sustainability is an emerging driver of the wireless mobile machine control market systems offering reduced emissions. The domestic market in France benefits from the EU’s broader push for digital transformation which creates a fertile ground for the adoption of wireless machine control solutions. In September 2024, the European Investment Bank (EIB) and the EU announced a USD 300.0 million loan in support of the Métropole Européenne de Lille’s investments in sustainable mobility, which is projected to create infrastructure projects with substantial financial backing driving demand for wireless mobile machine control systems.

Wireless Mobile Machine Control Market Players:

- Eaton

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Komatsu Ltd.

- Cross Company

- Allgon

- Leica Geosystems AG

- Trimble Inc.

- Hexagon AB

- CNH Industrial N.V.

- Topcon Positioning Systems, Inc.

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction

- Caterpillar Inc.

The wireless mobile machine control market is poised to expand during the stipulated period. Key players in the market are investing to improve the quality of wireless mobile machine control systems to mitigate lags and latency issues. Additionally, strategic acquisitions and partnerships widen the scope of services in emerging markets. Komatsu Ltd., a major player in the market, reported an 84.8% increase in net sales in FY2024 which augurs well for the potential for growth within the market.

Here are some key players in the wireless mobile machine control market:

Recent Developments

- In October 2024, Taleo announced a strategic expansion to bring the autonomous operation of heavy equipment to new industries beyond construction. The company also announced it has secured orders for 34 machines and has secured nine new customer deals in the pulp and paper; logging; port logistics; munition clearing; and agriculture industries.

- In January 2024, Bobcat announced that it will display the RogueX2 Autonomous Loader concept for the first time at Intermat 2024. RogueX2 is an all-electric and autonomous concept machine that produces zero emissions and features a lithium-ion battery, electric drive system, and electric actuated lift and tilt kinematics with no hydraulics.

- Report ID: 6981

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.