Wireless Implants Market Outlook:

Wireless Implants Market size was valued at USD 8.87 billion in 2025 and is likely to cross USD 46.82 billion by 2035, registering more than 18.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wireless implants is assessed at USD 10.31 billion.

The market is expanding exponentially owing to the advanced devices that allow ongoing, real-time monitoring of physiological readings and yield unparalleled insight into the health patterns of patients. In addition, the demand for wireless implant fabrication is driven by a range of front-running drivers that include battery technologies and the increasing need for remote monitoring of patients. For instance, in March 2023, an European patent was awarded for multi-mode antenna technology developed by AntennaWare. It satisfies all the propagation requirements for communication from the surface to implantable devices inside the human body enabling seamless, reliable, continuous communications with implanted devices.

In addition, with aging patient populations come concomitant disease prevalence similarly heightened by heart disease, diabetes, and neurodegenerative disease. For instance, in the December 2023 ABS report, the 2022 National Health Survey data revealed 12.6 million people, or one in two, had at least one chronic illness (49.9%). Compared to men, women were more likely to have at least one chronic condition (52.3% versus 47.4%). It compels healthcare systems to implement creative solutions that satisfy the requirement of lower resource consumption with the highest patient outcomes. As the medical landscape continues to change, the use of wireless implants is well-positioned to revolutionize individualized medicine and patient care.

Key Wireless Implants Market Insights Summary:

Regional Highlights:

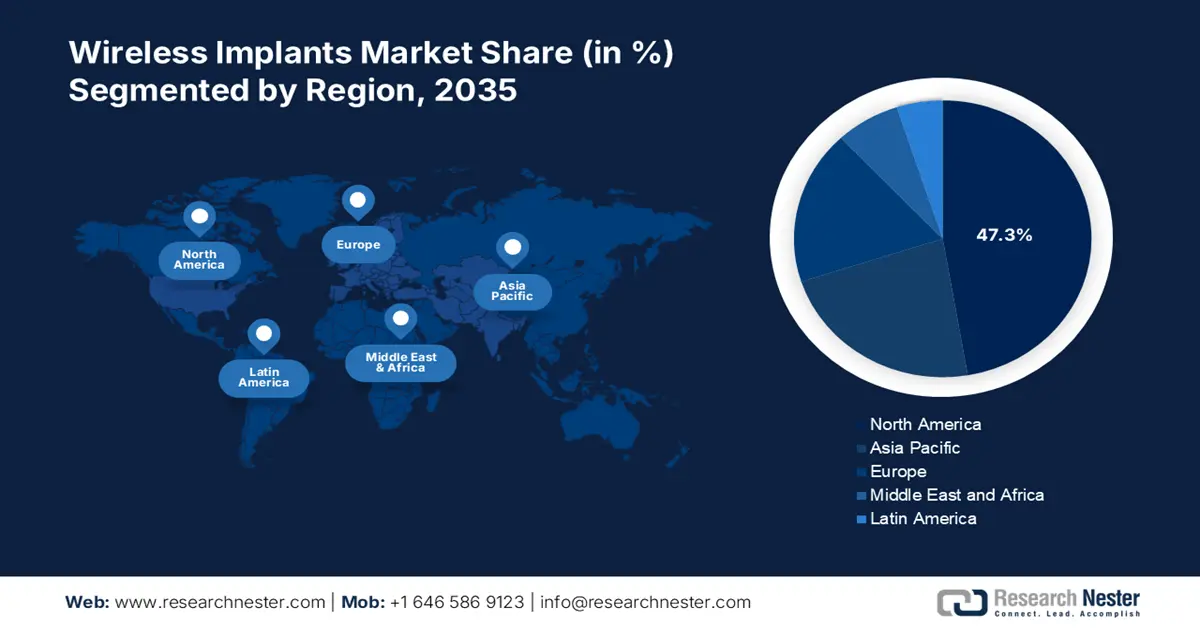

- North America dominates the wireless implants market with a 47.3% share, driven by rising connectivity in healthcare and IoT integration, supporting strong growth prospects through 2035.

Segment Insights:

- Orthopedic Implants segment are expected to capture a 50.20% share by 2035, driven by their extensive use in rehabilitation of musculoskeletal diseases.

Key Growth Trends:

- Cybersecurity enhancements

- Focus on patient-centric care

Major Challenges:

- Stigma and ethical concerns

- Insurance and reimbursement issues

- Key Players: Siemens Healthineers, LivaNova PLC, NXP Semiconductors, Biotronik SE & Co. KG, Ekso Bionics Holdings, Inc., and more.

Global Wireless Implants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.87 billion

- 2026 Market Size: USD 10.31 billion

- Projected Market Size: USD 46.82 billion by 2035

- Growth Forecasts: 18.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Wireless Implants Market Growth Drivers and Challenges:

Growth Drivers

- Cybersecurity enhancements: A growth driver in the wireless implants market is to secure encryption for implant-to-healthcare system communication. It provides manufacturers and healthcare providers to minimize risks of unauthorized access and data leakage. For instance, in November 2024, the strategic alliances between Medcrypt with BioT, Extra Security, Real-Time Innovations (RTI), and Stratigos Security ensured digital safety. By providing medical device manufacturers with all-inclusive cybersecurity solutions, such as cryptography, vulnerability management, penetration testing, and FDA compliance assistance, the action enhances medical device cybersecurity.

- Focus on patient-centric care: A pivotal stimulator in the market is where clinicians can personalize treatment and monitoring protocols through patient-specific information supplied by always-connected implanted devices. Such personalization involves the patient and improves compliance, enabling the possible monitoring of patients and providers. For instance, in October 2023, ZS announced the release of the AI-powered ZAIDYNTM Connected Health solution which facilitates innovation for payers, healthcare providers, and pharmaceutical companies. It helps them to better understand unmet needs, interact with patients, and enhance health outcomes.

Challenges

- Stigma and ethical concerns: In the wireless implants market, patient privacy and autonomy are among the most powerful arguments against, as people refrain from implanted devices due to intrusive monitoring or abuse of data. This is a moral issue of patient consent boundaries and coercive care in the health industry, which would break down trust among patients and practitioners. By addressing such issues, good communication, ethical governance, and strong data protection safeguard confidence in establishing trust in wireless implants. Thus, encourages their adoption into everyday clinical practice.

- Insurance and reimbursement issues: A remarkable challenge in the market is the lack of uniform reimbursement techniques by different payers. Hence, there is no consensus among medical professionals regarding coverage of wireless implant procedures and their expenses. Such uncertainty discourages medical facilities from embracing new implant technology since they might have to pay without guaranteed reimbursement streams. Furthermore, reimbursement gaps have to be confronted through consensus policymaking to allow broader acceptability and integration of wireless implants into healthcare systems.

Wireless Implants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.1% |

|

Base Year Market Size (2025) |

USD 8.87 billion |

|

Forecast Year Market Size (2035) |

USD 46.82 billion |

|

Regional Scope |

|

Wireless Implants Market Segmentation:

Application (Orthopedic Implants, Cardiovascular Implants, Neurological Implants)

In wireless implants market, orthopedic implants segment is set to capture revenue share of over 50.2% by 2035, because of their extensive use in the rehabilitation and recovery of musculoskeletal diseases. In addition, the strategic moves and acquisitions help medical professionals to enhance patient outcomes. For instance, in February 2024, Zeda, Inc. announced that it acquired The Orthopaedic Implant Company (OIC). The strategic acquisition has reinforced Zeda's dedication to revolutionizing the manufacturing and distribution of medical devices globally. With the patient populations demanding improved recovery results, wireless orthopedic implants with sensors allow for monitoring of recovery rate.

End user (Hospital, Ambulatory Surgical Centers, Clinics)

The hospital segment is emerging as one of the most prominent segments in the wireless implants market largely driven by effective treatment of patients and operational efficiency. With wireless implant technology, hospitals can receive information about the patient's condition in real-time, and thus the intervention can be undertaken within the time limit and the limitation of the complication reduced. For instance, in April 2023, Honeywell revealed that it has created a real-time health monitoring system that captures and logs patients' vital signs remotely as well as in the hospital. Using a skin patch and cutting-edge sensing technology, this solution instantly transmits vital sign data to medical professionals via mobile devices and online dashboards.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless Implants Market Regional Analysis:

North America Market Statistics

By 2035, North America wireless implants market is set to dominate over 47.3% revenue share, characterized by increased patient capability for monitoring through seamless connectivity and information sharing. This growth is spurred significantly by the demand for timely health data to enable physicians to make decisions and act promptly. Consequently, the convergence of wireless implants and Internet of Things technology is providing an active care model placing the region at a front position of innovation and adoption of advanced medical technology with a consequent radical change towards improved healthcare outcomes.

The most significant growth driver in the U.S. market is the enhanced telehealthcare ecosystem, as well as its corresponding requirement for wireless implants for the distant management and monitoring of patient health. For instance, in January 2025, the NeuroFlow and Iris acquisitions proved as a testament to the strength of the businesses built at Quartet and Innovate. This acquisition helped to avail the advantages of NeuroFlow’s core technological expertise in behavioral health and Iris's expertise in telepsychiatry.

In Canada the growth in the wireless implants market is growing rapidly due to the country’s heightened emphasis on personalized medicine, leveraging wireless implant technology to provide customized treatment based on patient-specific data. For instance, in September 2022, through the Canadian Embassy in Berlin and the National Research Council Industrial Research Assistance Program (NRC IRAP), Global Affairs Canada (GAC) applied to participate in the Canadian Personalised Medicine R&D Partnering Mission to Germany. Establishing industrial R&D partnerships between German and Canadian organizations with an eye toward future commercialization, the personalized medicine industries displayed great promise as economic engines.

Asia Pacific Market Analysis

The Asia Pacific wireless implants market is expanding at a rapid pace owing to enhanced demand for state-of-the-art healthcare solutions. Furthermore, increasing investment in digital health technologies and healthcare infrastructure facilitates the accessibility and integration of wireless implant devices. The growth is further fueled to a great extent by the increase in the prevalence of chronic disease and aging populations. The governments and the private sector are increasingly adopting sophisticated medical technologies that will enable remote monitoring and timely intervention.

In India, the market is spurred by the burgeoning epidemic of chronic disease and the need for cost-containment healthcare services. In addition, the government action in terms of initiatives, ensured the development of digital health infrastructure and closing healthcare gaps between rural and urban areas. For instance, in January 2025, India's collaborative framework for coordinating public-private efforts, bridging healthcare gaps, and developing scalable models for worldwide adoption is the focus of the World Economic Forum's Digital Healthcare Transformation (DHT) Initiative. The theme for the World Economic Forum's Annual Meeting 2025 was collaboration for the intelligent age, driving the market growth.

In China, the market is witnessing substantial growth with massive investments in healthcare technology and increased emphasis on innovation. In addition, the growth is fueled by enormous aging population and the growing disease burden of chronic diseases, and healthcare professionals are looking for new solutions that can offer real-time data collection and analysis. For instance, in November 2020, according to estimates by the National Library of Medicine, over 10 million China people suffered from stroke, coronary heart disease (CHD), and obesity, and about 100 million people developed diabetes and chronic obstructive pulmonary disease (COPD).

Key Wireless Implants Market Players:

- Medtronic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Boston Scientific Corporation

- Cochlear Limited

- Zimmer Biomet Holdings, Inc.

- St. Jude Medical (now part of Abbott)

- Dexcom, Inc.

- Siemens Healthineers

- LivaNova PLC

- NXP Semiconductors

- Biotronik SE & Co. KG

- Ekso Bionics Holdings, Inc.

- MicroPort Scientific Corporation

- Nevro Corp.

- Sensirion AG

The companies’ landscape in the market is rapidly changing due to the incorporation of artificial intelligence and machine learning into wireless implant technology. For instance, in January 2024, Medtronic plc announced that its MicraTM AV2 and MicraTM VR2, the next generation of its market-leading miniature, leadless pacemakers, have earned the CE (Conformité Européenne) Mark. The novel to the prospects of precision medicine, revolutionizing market competition more intensely.

Here's the list of some key players:

Recent Developments

- In April 2024, GE HealthCare announced the release of Artificial Intelligence (AI)-powered Caption AI software for quick cardiac evaluations on Vscan Air SL at the point of care. It helped physicians to utilize Vscan Air SL handheld ultrasound for automated ejection fraction estimation to assist in clinical decision-making across cardiac settings.

- In April 2023, Neuspera Medical announced that its next-generation Neuspera ultra-miniaturized system was approved by the US FDA. It consisted of a micro-implant that administers neurostimulation therapy via a wireless platform.

- Report ID: 7251

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireless Implants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.