Wireless Connectivity Market Outlook:

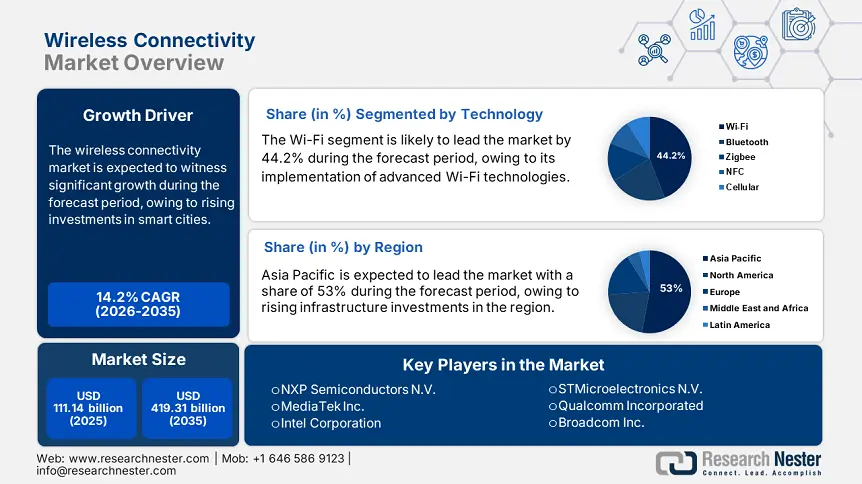

Wireless Connectivity Market size was over USD 111.14 billion in 2025 and is poised to exceed USD 419.31 billion by 2035, growing at over 14.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wireless connectivity is estimated at USD 125.34 billion.

Rising consumer demand for wearable technology and electronic devices such as smartwatches, fitness monitors, and wireless earpieces is accelerating the adoption of wireless technology, including Bluetooth, NFC, and UWB. These devices depend on uninterrupted wireless connections to provide their health monitoring services in addition to contactless payment functions and accurate location tracking, making them more convenient for users. Companies are spending time and investments in the accuracy and efficiency of wearable device batteries and interconnection capabilities. In November 2024, Oura partnered with Dexcom to integrate the leader in glucose monitoring systems data alongside Oura health metrics, which serves users with detailed health insights. The medical industry demonstrates an upward trend in the combination of wireless technologies for health monitoring solutions.

Key Wireless Connectivity Market Insights Summary:

Regional Highlights:

- Asia Pacific dominates the Wireless Connectivity Market with a 53% share, fueled by rising infrastructure investments and technological developments, strengthening its position through advanced connectivity solutions by 2035.

- The Wireless Connectivity Market in North America anticipates significant growth by 2035, fueled by planned infrastructure improvements and technological developments.

Segment Insights:

- The Wi-Fi segment of the Wireless Connectivity Market is projected to achieve a 44.20% share from 2026 to 2035, fueled by the implementation of advanced Wi-Fi technologies improving efficiency.

Key Growth Trends:

- Surge in demand for smart infrastructure and smart cities

- Growth in V2X communication

Major Challenges:

- Limited rural and remote connectivity

- Interoperability issues and fragmentation

- Key Players: MediaTek Inc., Intel Corporation, Murata Manufacturing Co. Ltd., and STMicroelectronics N.V.

Global Wireless Connectivity Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 111.14 billion

- 2026 Market Size: USD 125.34 billion

- Projected Market Size: USD 419.31 billion by 2035

- Growth Forecasts: 14.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (53% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, Taiwan, India

Last updated on : 12 August, 2025

Wireless Connectivity Market Growth Drivers and Challenges:

Growth Drivers

- Surge in demand for smart infrastructure and smart cities: Globally, governments are investing heavily to merge wireless technologies due to the emphasis on building smart infrastructure and smart cities for intelligent traffic management, as well as public safety systems and smart grids. The developments of smart infrastructure and smart city technology rely on technologies such as Low-Power Wide Area Networks, LoRaWAN, and NB-IoT, as they offer extensive coverage and optimized energy consumption capabilities.

The widespread use of cutting-edge technologies such as LoRaWAN is operationalizing smart meters, waste management systems, and environmental monitoring tools to offer real-time data acquisition capabilities, fueling the urban quality of life standards. In November 2024, Milesight strengthened its strategic IoT partnership with Actility by integrating Milesight's LoRaWAN gateway leadership with its ThingPark technology platform to offer advanced industrial IoT solutions. LPWAN technologies are proving essential for smart city development as their partnerships are aimed at improving urban resource management alongside higher population living standards.

- Growth in V2X communication: The automotive sector is integrating vehicle-to-everything (V2X) communication systems, V2X and 5G and Cellular vehicle-to-anything (C-V2X), and dedicated short-range communications (DSRC) for developing connected vehicles and autonomous systems. The wireless technologies operate as core elements for real-time traffic data communication, vehicle automation, and collision prevention to deliver safer transportation efficiency enhancements. The Federal Communications Commission introduced new spectrum rules in November 2024 for advancing C-V2X communications technology. The decision from the Federal Communications Commission is making 30 megahertz of the 5.9GHz band available for Intelligent Transportation Systems (ITS), promoting innovative developments between wireless and transport sectors for road safety advancement.

Challenges

- Limited rural and remote connectivity: The low population density in remote areas and difficult topography is an important challenge to telecommunications companies to find expanded wireless network deployment unprofitable due to high infrastructure installation costs. There are fewer investments in these regions due to the high expenses involved in laying fiber-optic cables, installing base stations, and network operations. Unreliable internet access is restricting the adoption of IoT-driven technology and wireless market development for industries like agriculture and mining, along with telemedicine services.

- Interoperability issues and fragmentation: The wireless connectivity market is encountering substantial hurdles owing to incompatibility problems and standard diversity that exists between Bluetooth, Zigbee, LoRaWAN, and Wi-Fi. Business operations are experiencing integration difficulties due to different devices requiring different protocols, which pushes companies to pay additional costs to work with various standards.

Wireless Connectivity Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.2% |

|

Base Year Market Size (2025) |

USD 111.14 billion |

|

Forecast Year Market Size (2035) |

USD 419.31 billion |

|

Regional Scope |

|

Wireless Connectivity Market Segmentation:

Technology (Wi-Fi, Bluetooth, Zigbee, NFC, Cellular)

Wi-Fi segment is poised to hold more than 44.2% wireless connectivity market share by 2035, owing to the increasing implementation of advanced Wi-Fi technologies. The implementation of Wi-Fi 6 and Wi-Fi 6E is resulting in significant advancements while simultaneously increasing the system capacity and operational efficiency, especially in smart homes, offices, and public facilities. Technological advancements are accelerating the demand for Wi-Fi throughout healthcare facilities, along with retail stores and manufacturing facilities.

In November 2024, Cisco introduced AI-powered Wi-Fi 7 access points for instant network optimization that delivers improved speed, reduced latency, and increased security. These access points have specific functionality for business and enterprise networks, making them effective for enhancing network reliability and efficiency in bandwidth-intensive applications. The product launch highlights the potential of Wi-Fi to stand as an essential technology for modern wireless network infrastructure.

Application (Robotics, Medical, Packaging, Food, Beverage, and Tobacco, Military and Aerospace, Materials Handling, Machine Tools)

The robotics segment in wireless connectivity market is expected to witness steady growth due to the adoption of AI by manufacturers for implementation and designed standardized connectivity frameworks. AI-enabled robots are offering greater versatility, agility as well as flexibility, due to their ability to learn from data, adapt to new tasks, and optimize performance in real-time.

Companies are collaborating to incorporate AI in home appliances, for instance, in January 2025, LG announced its alliance with Samsung to integrate Microsoft's Copilot AI technology into LG home products for the purpose of advanced AI space transformation. Through their partnership, LG devices are continually improving user experiences by observing activities followed by automatic adjustments of settings such as temperature settings while providing recommendations on nearby coffee shops.

Our in-depth analysis of the global wireless connectivity market includes the following segments:

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless Connectivity Market Regional Analysis:

Asia Pacific Market Analysis

By 2035, Asia Pacific wireless connectivity market is expected to capture over 53% share. This growth is attributed to rising infrastructure investments along with technological developments. Additionally, recent developments in laser communication are providing new remote connectivity options as researchers are optimizing data transmission efficiency and reliability. The newly developed technologies are serving applications in defense assets and space communications.

The incorporation of AI technology has become a common practice for companies in China that are working to optimize their wireless connectivity solutions through their products and services. Business organizations are embedding AI models in their intelligent systems to enhance the connection between users and products. Major telecommunications providers are also working together with AI developers to create new wireless technological advancements based on AI principles. For instance, in September 2024, Geespace expanded its satellite constellation to 30 units by launching 10 new low-Earth-orbit satellites. The project established a goal of supplying nonstop worldwide communication services.

The wireless connectivity market in India is highlighting a significant expansion, owing to investments in infrastructure. The local government is allocating investments in satellite spectrum without the auction process, meeting international standards. The satellite networking market is expected to gain consumer selection through this method, lowering entry barriers and attracting foreign countries. The wireless connectivity market in the region is also witnessing growth due to major investments in 5G. In October 2024, the Swedish telecommunications company Ericsson won a multibillion-dollar 5G equipment deal from Indian telecommunications provider Bharti Airtel. These strategic partnerships are improving wireless connectivity throughout the country to satisfy escalating consumer demand for quick data services.

North America Market

The wireless connectivity market in North America is expected to witness a significant expansion during the forecast period due to planned infrastructure improvements and modern technological developments. Companies in the region are directing substantial capital toward fiber-optic network development for better service speed and quality, and are progressing toward fiber connectivity by replacing its previous copper wire system, delivering quick online connections to its customers. The wireless connectivity market in the region is also influenced by service consolidation efforts. Communication companies are delivering bundled services, including voice calling, video streaming, broadband access, and cable television services.

The wireless connectivity market in the U.S. is anticipated to increase at a fast pace due to the strategic spectrum reallocation, as well as integration of satellite technology. The Federal Communications Commission is directing its resources into reallocating spectrum as part of efforts to boost mobile broadband capacity. This program is helping to solve the increasing wireless service needs by enabling mobile network growth across the country while improving national connectivity. In addition, mobile operators in the country are actively integrating satellite technology with their networks to elevate gaps in remote areas. The companies are developing satellite communication systems for network connectivity that work in areas with network unreachability. Satellite communication implementation is strengthening networks and expanding user access, thus accelerating market growth in the country.

The wireless connectivity market in Canada is experiencing significant growth, owing to new improvements in wireless networking technologies and regulatory changes. In August 2024, the Canadian Radio-television and Telecommunications Commission forced large telecommunications firms to share their fiber internet infrastructure with competitive smaller businesses throughout the entire country.

Key Wireless Connectivity Market Players:

- NXP Semiconductors N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MediaTek Inc.

- Intel Corporation

- Murata Manufacturing Co., Ltd.

- Microchip Technology Inc.

- STMicroelectronics N.V.

- Qualcomm Incorporated.

- Texas Instruments Incorporated

- Broadcom Inc.

- Infineon Technologies AG

The wireless connectivity market is highly competitive, driven by advancements in Wi-Fi, Bluetooth, 5G, and IoT technologies. Key players such as Qualcomm, Broadcom, Intel, MediaTek, Cisco, and Huawei are leading innovations in high-speed, low-latency connectivity solutions. The market is shaped by increasing demand for smart devices, industrial automation, and connected vehicles. Companies are focusing on chipset development, network infrastructure expansion, and strategic partnerships to enhance performance and coverage. The rollout of 6G research and the growing adoption of Wi-Fi 7 and Bluetooth 5.3 are further intensifying competition, with differentiation based on speed, security, and energy efficiency.

Here are some key players operating in the global wireless connectivity market:

Recent Developments

- In January 2024, Ceva, Inc. and Sunplus Technology Co., Ltd., expanded their collaboration for the integration of Ceva’s latest RivieraWaves Bluetooth audio solution into Sunplus’ Airlyra family of HD audio processors. Designed for wireless speakers, soundbars, and premium audio devices, the first Airlyra processors featuring this technology are already shipping to some of the world’s top audio brands.

- In February 2024, Quectel Wireless Solutions introduced four new wireless modules: the FCU741R and FCS950R for Wi-Fi and Bluetooth connectivity, along with the HCM010S and HCM111Z for Bluetooth applications. This latest expansion of Quectel’s module portfolio offers designers and developers a wider range of options, addressing varying requirements in size, cost, and power efficiency.

- Report ID: 7374

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireless Connectivity Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.