Wire Harness Market Outlook:

Wire Harness Market size was valued at USD 95.9 billion in 2025 and is likely to cross USD 160.73 billion by 2035, expanding at more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wire harness is assessed at USD 100.47 billion.

The wire harness market expansion is attributed to the increasing demand for automotive and electrical components. As vehicles become more technologically advanced feature-rich, the need for sophisticated wiring systems grows. Additionally, the rise of electric vehicles (EVs) and hybrid vehicles has further fueled the demand for wire harnesses, as these vehicles require more complex wiring for their power systems and electronics. According to the International Energy Agency (IEA), global sales of new electric cars increased by 3.5 million in 2023 compared to 2022, representing a 35% year-over-year rise to nearly 14 million registered vehicles. In 2023, about 18% of all automobiles sold were electric, up from 14% in 2022.

The increase in construction activities also contributes to wire harness market growth, as wire harnesses are required for various electrical applications in buildings and industrial equipment. Wire harnesses are required for the electrical wiring of elevators and escalators. These are also used to install complicated lighting systems in commercial and residential buildings and security systems.

Key Wire Harness Market Insights Summary:

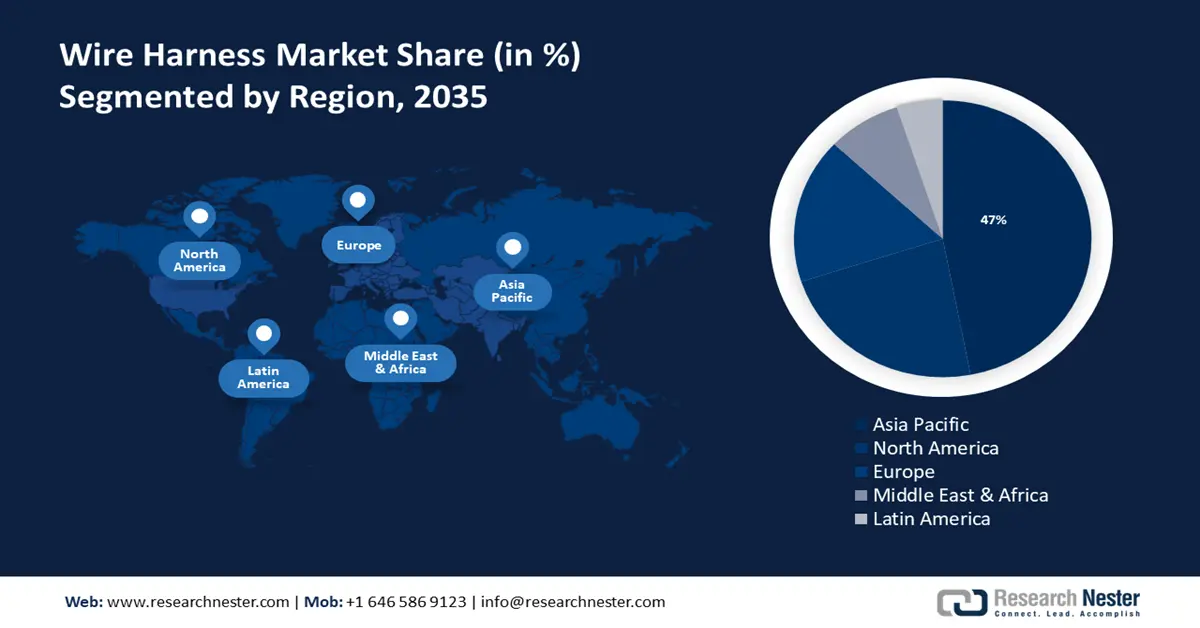

Regional Highlights:

- The Asia Pacific wire harness market will dominate around 47% share by 2035, driven by large-scale investment in renewable energy like wind and solar.

Segment Insights:

- The metallic wire harness segment in the wire harness market is forecasted to capture a significant share by 2035, driven by demand for copper wire harnesses due to EV growth and superior conductivity.

- The wire harness terminals segment in the wire harness market is anticipated to experience significant growth through 2026-2035, driven by the crucial role of terminals in ensuring reliable electrical connections in automation.

Key Growth Trends:

- Rising need for heating, ventilation, and air conditioning (HVAC) systems

- Expanding aerospace and defense industry

Major Challenges:

- Safety standards

- Complexity and customization

Key Players: AME Systems (Vic) Pty Ltd, Aptiv PLC, BorgWarner, Inc., Coroplast Fritz Müller GmbH & Co. KG, DRÄXLMAIER Group, Elcom International Pvt. Ltd., Samvardhana Motherson.

Global Wire Harness Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 95.9 billion

- 2026 Market Size: USD 100.47 billion

- Projected Market Size: USD 160.73 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Mexico

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 17 September, 2025

Wire Harness Market Growth Drivers and Challenges:

Growth Drivers

- Rising need for heating, ventilation, and air conditioning (HVAC) systems: As more residential, commercial, and industrial buildings are constructed, the demand for HVAC systems rises. Wire harnesses are essential for the electrical wiring that powers and controls these systems. Moreover, with growing awareness of indoor air quality and climate control, there is a heightened focus on installing efficient HVAC systems, driving up the need for reliable wiring solutions. Nearly 90% of residential households in the United States own air conditioning equipment, which is driving demand for HVAC systems. Over 50% of HVAC consumers are willing to pay for a more environmentally friendly and energy-efficient HVAC system.

- Expanding aerospace and defense industry: Modern aircraft are equipped with advanced avionics and electronic systems, which necessitate sophisticated wire harnesses. The integration of new technologies, such as fly-by-wire systems and advanced navigation systems, drives demand for high-performance wire harnesses. Additionally, the defense sector continuously upgrades its technology and equipment, including fighter jets, helicopters, and ground support systems. Wire harnesses are crucial for these advanced defense systems, which require reliability and durability under extreme conditions.

- Flourishing agriculture sector: The rise of precision agriculture technologies, which include GPS-guided equipment and automated machinery, requires advanced wiring systems. Wire harnesses are essential for connecting sensors, controllers, and actuators in precision farming equipment, such as tractors and combine harvesters. Modern agriculture machinery, including robotic systems and automated irrigation systems use wire harnesses to connect various electronic components and ensure reliable performance. Furthermore, the expansion of greenhouse and indoor farming also drives demand for wire harnesses.

Challenges

- Safety standards: Wire harnesses must meet stringent safety standards to ensure fire or electrical safety. Compliance with standards such as Underwriters Laboratories (UL) or International Electrotechnical Commission (IEC) can increase production costs and require rigorous testing.

- Complexity and customization: Designing and producing custom wire harnesses involves longer development cycles. This includes time for design, prototyping, testing, and validation, which can delay time-to-market for both manufacturers and their customers. Moreover, the production of complex or highly customized wire harnesses often demands specialized skills and expertise. This can increase labor costs and require additional training or hiring of skilled personnel.

Wire Harness Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 95.9 billion |

|

Forecast Year Market Size (2035) |

USD 160.73 billion |

|

Regional Scope |

|

Wire Harness Market Segmentation:

Material Segment Analysis

Metallic segment is set to capture over 70% wire harness market share by 2035. Metals such as copper and aluminum are favored for their excellent electrical conductivity. Copper, in particular is commonly used in automotive wire harnesses due to its superior conductivity and reliability, which are essential for efficient power and signal transmission. As vehicles get more advanced, particularly with the rise of EVs, the demand for copper wire harnesses is increasing. According to the International Copper Association, by 2027, it is anticipated that there will be 27 million electric vehicles on the road (including HEV, PHEV, BEV, Ebus HEV, and BEV), up from 3 million in 2017. This will increase copper consumption in EVs from 185,000 metric tons in 2017 to 1.74 million metric tons by 2027.

Component Segment Analysis

The wire harness terminals segment in the wire harness market is projected to experience a significant increase in the CAGR during the projected timeframe. Wire harness terminals are crucial components that ensure reliable electrical connections and efficient signal transmission that makes them essential across various industries. For instance, in industrial automation, terminals are used to control systems, sensors, and actuators. Their reliability is crucial for the smooth operation of automated machinery and equipment.

End-user Segment Analysis

The automotive segment is predicted to have notable growth in the wire harness market shortly on account of the growing integration of advanced driver assistance systems (ADAS) for vehicle safety. As of 2022, over 92.7% of new vehicles in the U.S. had at least one ADAS. ADAS and electrification have made wiring harness connectors necessary to exchange data between various ADAS system components and to link sensors, computers, and numerous additional system components.

Our in-depth analysis of the wire harness market includes the following segments:

|

End–user |

|

|

Component |

|

|

Material |

|

|

Propulsion |

|

|

Transmission |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wire Harness Market Regional Analysis:

APAC Market Insights

The wire harness market in Asia Pacific industry is set to hold largest revenue share of 47% by 2035 during the forecast year due to the rising investment and development in renewable energy. Wire harnesses are crucial in renewable energy systems, such as wind turbines, solar panels, and energy storage systems, as they ensure sufficient and reliable power transmission. According to the Institute for Energy Economics and Financial Analysis, there is a potential investment of USD 1.1 trillion in solar PV and offshore wind energy in Asia Pacific between 2025 and 2050, which could result in the production of 873 gigawatts (GW) of clean energy.

The surging electrification of aircraft in Japan is likely to create a huge demand for wire harnesses in the aerospace sector, as they are essential to allow for the distinct layout and systems of each aircraft. For instance, the engineering company IHI Technologies has been selected by Japan's New Energy and Industrial Technology Development Organization (NEDO) to develop airplane electrification technologies, including megawatt generators and an aircraft electric turbo compressor for its Green Innovation Fund initiative.

With a strong network of wire harness producers, China is equipped to serve its rapidly expanding electronics industry and provide outstanding solutions for cable wrapping and wiring looms.

Lately, South Korea has become one of the biggest players in the Asian electric vehicle (EV) business, which will have an effect on the market for automotive wire harnesses.

North America Market Insights

Over the anticipated period, North America wire harness market is expected to see a notable increase in revenue driven by the surging penetration of telecommunication services. This has a substantial impact on the demand for wiring harnesses, which are specialized assemblies made up of cables, wires, connections, and other components designed to accommodate faster data transfer speeds. More than 85% of North Americans have a high-speed internet connection, reflecting the region's significant telecommunications service penetration.

Wire harness demand in the U.S. is rising in tandem with the increasing number of cutting–edge features being added to ICE–based vehicles, particularly passenger cars.

Increasing emphasis on enhancing vehicle fuel efficiency in Canada may augment the wire harness market by the end of 2035. For instance, between 2011 and 2025, fuel efficiency for light–duty vehicles sold in Canada is expected to increase by over 35%.

Wire Harness Market Players:

- Kromberg & Schubert

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AME Systems (Vic) Pty Ltd

- Aptiv PLC

- BorgWarner, Inc.

- Coroplast Fritz Müller GmbH & Co. KG

- DRÄXLMAIER Group

- Elcom International Pvt. Ltd.

- Samvardhana Motherson International Ltd.

- Kunshan Huguang Auto Harness Co. Ltd.

The wire harnesses market is set to rise owing to the growth of key players in this market. These key players are focusing on advancing their services and adopting novel methods to sustain themselves in the industry. Some of these key players include:

Recent Developments

- In September 2023, Samvardhana Motherson International Ltd. established a new wiring harness facility in the United Arab Emirates (UAE), to achieve balanced growth across all sectors of the economy and diversify the economy in a way that guarantees the Emirate's sustainable development and adherence to national goals.

- In November 2022, Kromberg & Schubert a leading German manufacturer of complex wiring systems declared the launch of its new Fujairah Free Zone facility, which will employ more than 3,000 people to work toward the goal of producing around 49 million automobile wire and cable pieces annually.

- Report ID: 6341

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wire Harness Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.