Wind Turbine Rotor Blade Market Outlook:

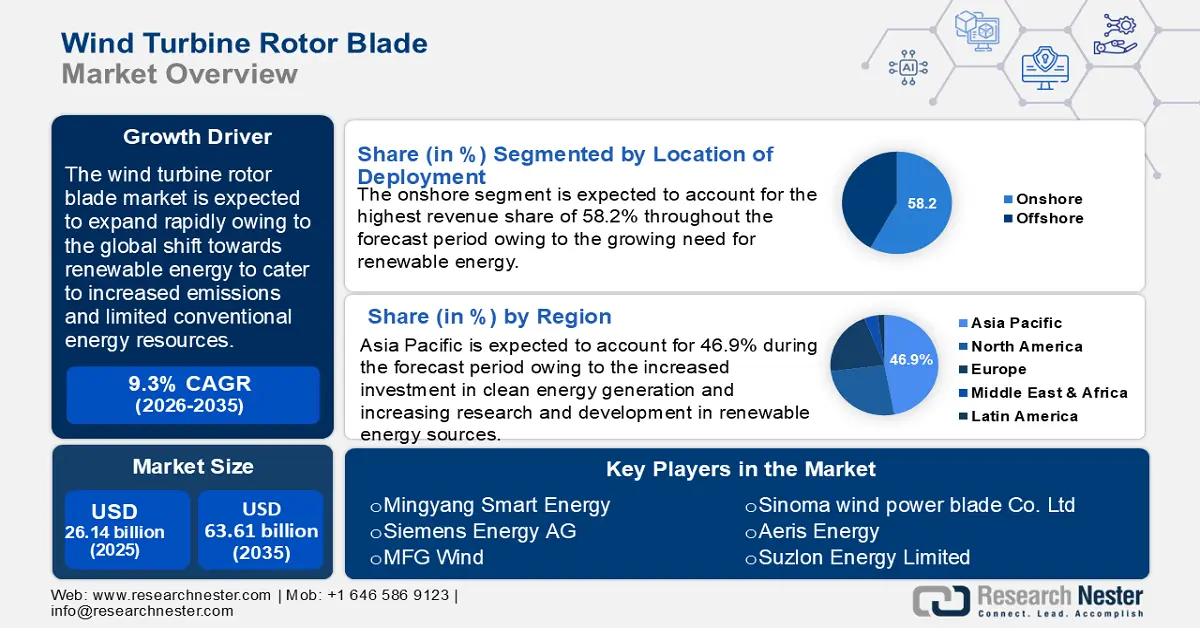

Wind Turbine Rotor Blade Market size was over USD 26.14 billion in 2025 and is poised to exceed USD 63.61 billion by 2035, witnessing over 9.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wind turbine rotor blade is estimated at USD 28.33 billion.

The wind turbine rotor blade market is anticipated to expand owing to the global shift towards renewable energy to cater to increased emissions and limited conventional energy resources. Wind energy is expected to become a more viable energy source as countries work to cut their carbon emissions and combat climate change. Government and corporate entities investing in wind power projects drive the need for advanced and efficient rotor blades. For instance, in 2022, 77.6 GW of additional wind generating capacity was added globally to power networks, increasing the total installed wind capacity to 906 GW1, an increase of 9% from 2021.

In the upcoming years, technological developments in rotor blade materials and design are expected to fuel wind turbine rotor blade market expansion. Blade strength and durability have greatly increased while weight has decreased due to innovations such as carbon fiber and other composite materials. As a result, wind energy is becoming a more competitive alternative when compared to conventional fossil fuels since wind turbine efficiency has increased.

Key Wind Turbine Rotor Blade Market Insights Summary:

Regional Highlights:

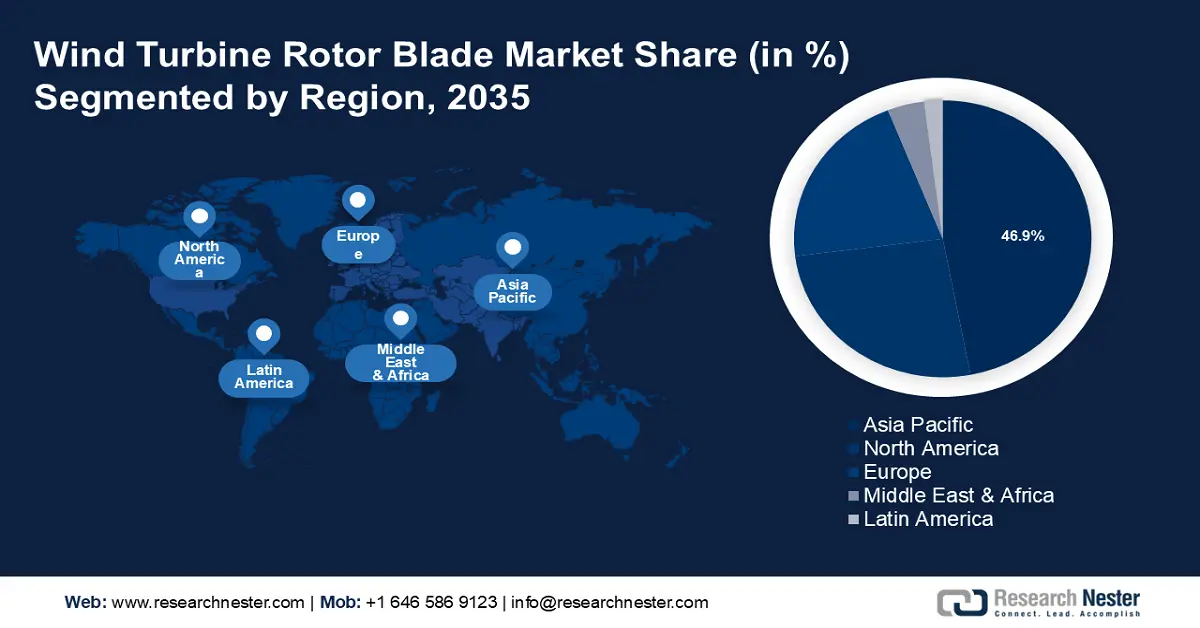

- Asia Pacific’s wind turbine rotor blade market will dominate around 46.9% share by 2035, driven by investments in clean energy generation, urbanization, technological advancements, and the need for energy efficiency.

Segment Insights:

- The carbon fiber segment in the wind turbine rotor blade market is expected to dominate by 2035, driven by superior performance, lower weight, and better energy absorption of carbon fiber blades.

- The onshore segment in the wind turbine rotor blade market is projected to experience lucrative growth till 2035, attributed to the growing need for renewable energy and cost-effectiveness of onshore wind farms.

Key Growth Trends:

- Growing power consumption

- Greater emphasis on wind power

Major Challenges:

- High cost

- Growing uptake of cleaner alternative energy sources

Key Players: Mingyang Smart Energy, Siemens Energy AG, MFG Wind, Sinoma Wind Power Blade Co. Ltd, Aeris Energy, Suzlon Energy Limited, LM Wind Power, Vestas Wind Systems A/S, General Electric.

Global Wind Turbine Rotor Blade Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.14 billion

- 2026 Market Size: USD 28.33 billion

- Projected Market Size: USD 63.61 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Denmark, India

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 18 September, 2025

Wind Turbine Rotor Blade Market Growth Drivers and Challenges:

Growth Drivers:

- Growing power consumption: The market for wind turbine rotor blades is anticipated to rise subsequently increasing emphasis on wind energy expansion. The wind turbine rotor blade market is expected to grow at a faster rate owing to the high demand for efficient energy production, sustainable energy sources, and the positioning of wind power-producing technologies to maximize electricity generation. Wind energy is becoming immensely popular as the safest and most environmentally friendly way to provide for the world's expanding energy needs.

The transition to cleaner energy sources and the growing electricity demand are driving up the rate of infrastructure development. For example, in June 2022, China released its 14th Five-Year Plan for renewable energy. It contains an ambitious goal of generating 33% of power by renewables by the end of 2025 with a target of 18% for wind and solar technology. - Greater emphasis on wind power: The market for wind turbine rotor blades is anticipated to rise as a result of the increased importance of wind energy expansion. Modern rotor blade wind energy greatly reduces its carbon footprint, which is good for the environment. Alternative energy sources are becoming more popular due to several environmental problems associated with conventional fuels. About 40% of the energy produced from renewable sources is electricity.

- Growing investment in wind power: Increasing investments in the construction of wind farms and related technologies is a key factor expected to fuel wind turbine rotor blade market growth. Increased wind energy investment spurs competition among manufacturers, improving rotor blade quality, design, and cost. Wind power investments are further encouraged by growing worries about climate change and a global push towards cleaner energy sources. This shift encourages more funding for wind energy projects along with sustainable development objectives.

Challenges:

- High cost: The expansion of the wind turbine rotor blade market is expected to be hampered by the high costs of R&D and difficulties encountered during transportation. One logistical problem for offshore wind farms is handling and moving massive rotor blades from production facilities to installation locations.

- Growing uptake of cleaner alternative energy sources: Natural gas and solar power are the primary alternative clean power sources that pose a threat to the wind power industry. As more people turn to cleaner energy sources such as solar and gas, the need for wind energy is predicted to drop. Several governments across the globe have developed policies that are conducive to the development of gas and solar power infrastructure.

Wind Turbine Rotor Blade Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 26.14 billion |

|

Forecast Year Market Size (2035) |

USD 63.61 billion |

|

Regional Scope |

|

Wind Turbine Rotor Blade Market Segmentation:

Location of Deployment Segment Analysis

Onshore segment in the wind turbine rotor blade market is poised to showcase lucrative growth rate through 2035 owing to the growing need for renewable energy. Onshore wind farms are less expensive than offshore wind farms due to several variables, including ease of installation and transportation. They emit relatively little emissions and have no negative effects on the environment surrounding them. Furthermore, as wind turbines and farmland typically coexist, there is no toxic spillage or contamination of the land.

For example, the International Energy Agency (IEA) released data in July 2023 which showed 900 GW of built wind power, 93% was in onshore systems and the remaining 7% was in offshore wind farms. While offshore wind is still in its infancy, with capacity only found in 20 nations, onshore wind is a developed technology used in 115 countries worldwide.

Blade Material Segment Analysis

Based on the blade material, the carbon fiber segment is likely to account for around a 76.2% wind turbine rotor blade market share by 2035. Carbon fiber has several advantages and is well known for its superior all-around performance in large-scale wind turbine blades. Due to its strength and rigidity over fiberglass, carbon fiber helps reduce the mass of wind turbine blades. Based on a study conducted by Sandia National Laboratories researchers, wind blades made of carbon fiber weigh 25% less than those made of conventional fiberglass materials. In areas with less wind, carbon fiber blades absorb more energy.

Our in-depth analysis of the global market includes the following segments:

|

Location of Deployment |

|

|

Blade Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wind Turbine Rotor Blade Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is expected to account for largest revenue share of 46.9% by 2035, owing to several factors, including investment in clean energy generation, increasing research and development in renewable energy sources, the swift urbanization process, technological advancements, and the need for enhanced energy efficiency. Asia Pacific's wind energy capacity was estimated to be 509 thousand megawatts in 2023.

China is one of the world's largest consumers of renewable energy. To meet its domestic energy needs, the country is focused on increasing its capacity for renewable energy. CarbonBrief estimates that China will deploy 1,200 GW of wind and solar energy well in advance of the 2030 deadline due to the country's rapidly expanding renewable energy industry.

Japan wind turbine rotor blade market will be driven by favorable government regulations and technological developments. The government has started many programs and regulations to encourage the expansion of wind energy and renewable energy in the nation. The local government, for instance, presented its Offshore Wind Industry Vision to set aside 1 GW of offshore wind capacity per year until 2030.

North America Market Insights

North America wind turbine rotor blade market is expected to experience a stable CAGR during the forecast period due to the region's growing energy demand and high usage of wind turbines. To contribute to a more sustainable wind turbine lifecycle, U.S. manufacturers and energy producers are anticipated to prioritize sustainability initiatives, such as recycling and reusing old blades. As the sector develops, the U.S. is anticipated to become a pioneer in wind energy innovation, utilizing wind energy to cater to rising energy needs.

Wind Turbine Rotor Blade Market Players:

- TPI Composites Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mingyang Smart Energy

- Siemens Energy AG

- MFG Wind

- Sinoma wind power blade Co. Ltd

- Aeris Energy

- Suzlon Energy Limited

- LM Wind Power

- Vestas Wind Systems A/S

- General Electric

The wind turbine rotor blade market is fragmented in nature. Some of the leading companies in the market include Siemens Gamesa Renewable Energy, S.A., LM Wind Power, Vestas Wind Systems A/S, and Enercon GmbH. They are focused on expanding their customer base, responding to shifting customer expectations, and increasing R&D activities to enhance product quality. These prominent figures will probably set up specialized research and development facilities across various geographical areas. These facilities would have a focus on delivering outstanding products that either match or surpass consumer expectations. Here are some leading players in the wind turbine rotor blade market:

Recent Developments

- In May 2024, Siemens Energy AG announced the sale of Siemens Gamesa Renewable Energy's turbine division, an Indian subsidiary. Despite obstacles, the corporation intends to concentrate on the European and American markets and will still provide services in India.

- In October 2023, Mingyang Smart Energy launched a 22MW offshore wind turbine. With a rotor diameter exceeding 310 meters, the MySE 22MW offshore turbine is anticipated to be the most potent in the world. It is designed for high-wind regions where typical wind speeds range from 8.5 to 10 meters per second.

- Report ID: 6410

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wind Turbine Rotor Blade Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.