Wind Turbine Pitch and Yaw Drive Market Outlook:

Wind Turbine Pitch and Yaw Drive Market size was valued at USD 8.37 billion in 2025 and is set to exceed USD 17.25 billion by 2035, registering over 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wind turbine pitch and yaw drive is evaluated at USD 8.93 billion.

The wind turbine pitch and yaw drive market’s growth is driven by the global push for renewable energy sources to meet decarbonization targets and reduce dependency on fossil fuels. Pitch and yaw drives are positioned as essential components of wind turbines that allow optimal alignment with wind direction and maintain energy production in variable wind conditions. Technological advancements and the increasing output of wind farms are poised to assist the profitable surge of the sector. For instance, in June 2023, the International Energy Agency (IEA) forecasted wind energy output to double by 2028 and reach around 710 gigawatts (GW).

Technological advancements in pitch and yaw drive systems are a major driver of the sector. Improvements in durability and adaptability are poised to assist the growth of the global wind turbine pitch and yaw drive sector. For instance, in October 2023, research reviewed the efficacy of advancements in embedded control in condition monitoring systems (CMS) in providing tangible benefits to green energy. CMS enables early fault detection in pitch and yaw drives reducing unplanned downtime risks. Additionally, the reduction in wind energy costs is boosting the competitiveness with traditional energy sources. For instance, in November 2023, the World Economic Forum (WEF) stated large turbine blades that harvest more energy are a key factor in reducing the cost of wind power by 60% in the decade up to 2021.

The soaring demand for renewable sources of energy is positioned to create steady opportunities for the global wind turbine pitch and yaw drive sector. The key players in the sector can benefit from emerging markets where wind infrastructure is witnessing rapid expansion and development. Additionally, the rising investments in offshore wind energy projects via the installation of floating wind turbines are poised to increase opportunities within the sector. With growing advancements in predictive maintenance and AI-driven diagnostics, the sector is poised to continue its profitable growth surge by the end of the forecast period.

Key Wind Turbine Pitch and Yaw Drive Market Market Insights Summary:

Regional Highlights:

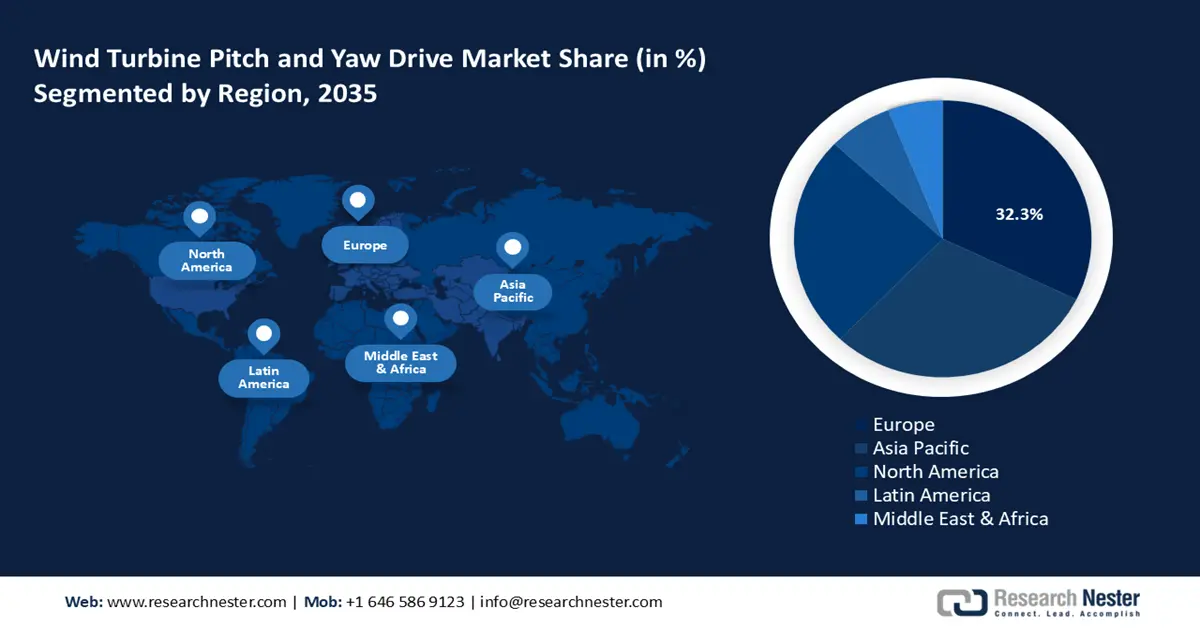

- Europe dominates the Wind Turbine Pitch and Yaw Drive Market with a 32.3% share, fueled by rising wind energy output and commitment to renewable energy targets, driving growth through 2026–2035.

Segment Insights:

- The Onshore segment is expected to achieve a notable share by 2035, driven by cost-effectiveness, ease of installation, and project expansion in emerging economies.

Key Growth Trends:

- Global shift to renewable energy sources

- Declining cost of wind energy and increase in offshore wind projects

Major Challenges:

- Environment and weather-related risks

- High initial costs of investment and maintenance

- Key Players: Suzlon, Envision, Bonfiglioli, GE Renewable Energy, Siemens, Enercon, Nordex, Comer Industries, Schaeffler Group, ABM Greiffenberger.

Global Wind Turbine Pitch and Yaw Drive Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.37 billion

- 2026 Market Size: USD 8.93 billion

- Projected Market Size: USD 17.25 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (32.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Germany, United States, Denmark, Spain

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 14 August, 2025

Wind Turbine Pitch and Yaw Drive Market Growth Drivers and Challenges:

Growth Drivers

- Global shift to renewable energy sources: The global push to adopt renewable energy sources and reduce dependency on energy derived from fossil fuels is positioned to boost the growth of the global wind turbine pitch and yaw drive market. The transition aligns with the global push for net zero emissions driving demands for wind turbine installations. An increase in the number of wind turbines drives demand for efficient pitch and yaw drive systems that can optimize energy capture through adjustments of the turbine blades. The surge in renewable energy projects associated with wind power is projected to create a steady stream of opportunities in the sector. For instance, in September 2024, Suzlon announced the largest wind energy order from India by NTPC Green Energy Limited to install a total of 370 wind turbine generators.

- Declining cost of wind energy and increase in offshore wind projects: The cost of renewables has seen a rapid decline over the years benefiting adoption that drives the growth of the global wind turbine pitch and yaw drive market. For instance, in September 2024, the International Renewable Energy Agency estimated 81% of renewable energy additions in 2023 to be cheaper than fossil fuel alternatives. The cost reduction enables increased investments in wind energy infrastructure as energy service solutions providers expand their wind energy portfolios. Additionally, lower energy costs have made wind power more accessible leading to greater adoption that boosts demand for pitch and yaw drive systems.

The sector’s growth is positioned to benefit from the rise in offshore wind projects. For instance, in September 2024, Vestas secured its first U.S. offshore wind project order from Equinor for 54 V236-15.0 MW turbines. The floating wind power sector’s growth is owed to high energy yield and drives demand for pitch and yaw drive systems. These systems assist in maximizing the energy output of offshore turbines. - Technological advancements in turbine efficiency: Advancements in pitch and yaw drive systems have assisted in improving turbine performance benefiting the growth of the global wind turbine pitch and yaw drive sector. Technological advancements have allowed pitch and yaw drives to make precise real-time adjustments, assisting turbines to capture energy much more effectively. For instance, in May 2024, research published highlighted the improved power capture capability of large-scale wind turbines using model-free coordinated pitch, yaw, and torque control that can estimate wind direction in diverse environmental conditions. The demand for upgraded pitch and yaw drive systems is positioned to increase owing to wind turbines operating better in variable wind conditions. Additionally, innovations are reducing overall maintenance and lifecycle costs making wind energy projects financially lucrative for energy solutions companies.

Challenges

- Environment and weather-related risks: A significant challenge to the wind turbine pitch and yaw drive sector are extreme weather conditions faced by offshore wind installations. Environmental conditions can put stress on pitch and yaw drive systems, causing mechanical failures. Additionally, adverse weather conditions can reduce the output of wind farms stifling profitability for businesses that can cause a dip in the expansion of wind energy infrastructure. Manufacturers continue to face challenges in providing robust pitch and yaw drive systems that can withstand extreme weather conditions.

- High initial costs of investment and maintenance: Wind turbine installations require substantial initial investments. Pitch and yaw drive systems add to the overall costs of the systems. The global market can face challenges in emerging economies with limited financial resources and competing renewable energy resources, such as solar PV. Reducing costs via economies of scale remains a significant challenge of the global wind turbine pitch and yaw drive sector.

Wind Turbine Pitch and Yaw Drive Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 8.37 billion |

|

Forecast Year Market Size (2035) |

USD 17.25 billion |

|

Regional Scope |

|

Wind Turbine Pitch and Yaw Drive Market Segmentation:

End use (Onshore, Offshore)

The onshore segment is likely to account for wind turbine pitch and yaw drive market share of around 65.4% by 2035. The segment’s growth is attributed to onshore wind farms continuing to remain a primary source of renewable energy across many regions. Increasing onshore wind projects drive demands for efficient pitch and yaw drive systems to maintain consistent power generation. The relatively lower cost and ease of installation of onshore turbines compared to offshore turbines drive increasing adoption and benefit the growth of the sector. Additionally, emerging economies are investing in expanding their onshore wind energy capacity to increase renewable energy generation creating a steady demand for pitch and yaw drive systems. For instance, in September 2024, GE Vernova announced the signing of multiple wind agreements in Spain during the second quarter of 2024.

The offshore segment of the global wind turbine pitch and yaw drive segment is poised to increase its revenue share during the forecast period. The segment’s growth is attributed to rising offshore wind projects. The segment is poised to grow in countries that have limited onshore space but abundant coastal wind resources such as China, the U.S., Italy, Turkey, etc. For instance, in November 2024, the World Bank and the Ministry of Energy and Natural Resources of Turkey launched a new wind energy roadmap that plans to target 5 GW of offshore wind energy power by 2035. Offshore wind turbines are susceptible to stronger winds that allow them to produce higher energy outputs, and also drive demands for robust pitch and yaw drive systems that can withstand saltwater corrosion and high winds. Additionally, favorable regulatory policies incentivizing investments in offshore wind energy are positioned to assist the continued growth of the segment. For instance, the offshore wind policy of the government of Japan provides GX Economic Transition Bonds for ten years on wind energy investments worth USD 153.8 billion.

Type (>3000 W, <1000 W – 3000 W, 1000 W)

By type, the >3000 W segment is poised to increase its revenue share in the global wind turbine pitch and yaw drive market. The segment’s growth is attributed to the deployment of large and powerful wind turbines in wind energy projects to maximize output. >3000 W segment is experiencing growing adoption in both onshore and offshore wind farms to improve efficiency and output. Additionally, advancements in pitch and yaw drive systems benefit the segment’s growth by integrating with larger wind turbines that offer improved durability. The rising energy demands globally are poised to increase the demand for pitch and yaw drive systems in this segment. For instance, in July 2024, Hydro-Quebec signed a partnership with two indigenous communities in Canada to develop 3000 MW of wind power capacity.

Our in-depth analysis of the wind turbine pitch and yaw drive market includes the following segments:

|

End use |

|

|

Type |

|

|

Pitch System |

|

|

Turbine Blade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wind Turbine Pitch and Yaw Drive Market Regional Analysis:

Europe Market Forecast

Europe industry is set to account for largest revenue share of 32.3% by 2035, The market’s growth in Europe is owed to a rise in wind energy output and the region’s commitment to renewable energy targets. The region benefits from a supportive regulatory ecosystem that incentivizes investments in wind energy. For instance, in August 2024, Wind Europe highlighted that the European Union’s wind power package is boosting the supply chain within the region. The package, supported by the European Investment Bank (EIB) has set up a USD 5.3 billion counter guarantee facility to support wind supply investments. The market is positioned to leverage the favorable trends and maintain its growth curve during the forecast period.

Germany is poised to hold a dominant share in the wind turbine pitch and yaw drive market of Europe. The market’s growth is attributed to the large-scale output of wind energy in the country driving demands for pitch and yaw drive systems. For instance, the World Population Review ranks Germany accounting for the third highest wind power capacity globally with 63.33 GW. Additionally, the sector is poised to benefit from the Energiewende policy of the country that is seeking to move Germany to a carbon-neutral energy system by 2045 by relying on renewable energy sources, including wind energy. As the country plans to retire coal power plants and phase out nuclear power, the output demands on wind farms are poised to increase significantly boosting the sector’s growth. Companies are leveraging the surging profit opportunities by expanding their wind portfolio in the country. For instance, in September 2024, ENCAVIS announced the expansion of its wind portfolio in Germany to over 300 MW after acquiring an 18 MW ready-to-build wind farm in Dannhausen.

France is poised to increase its revenue share in the wind turbine pitch and yaw drive market of Europe. The market in France is poised to benefit from the favorable regulatory policies of the European Union supporting investments in wind energy. Additionally, the government of France has committed to increasing the output of offshore wind energy farms which is poised to create opportunities in the market. For instance, in May 2024, Wind Europe highlighted that the country aims to have 18 GW of offshore wind by 2035 and 45 GW by 2050. The country held a floating wind power auction that is positioned to hasten its commercialization. Companies are leveraging the burgeoning opportunities in the domestic market. For instance, in July 2024, RWE announced the securing of 4 onshore wind projects at the bidding round conducted by the French CRE (Commission for the Regulation of Energy). These projects are poised to boost demands for robust pitch and yaw drive systems and assist the continued growth of the sector during the forecast period.

APAC Market Analysis

The Asia Pacific wind turbine pitch and yaw drive market is poised to register the fastest growth in the global market during the forecast period. The market’s growth is attributed to rising investments in renewable energy power generation to meet burgeoning electricity demands in the region. The region’s revenue growth is led by China, India, Japan, and South Korea. APAC countries produce large-scale renewable energy and advancements in infrastructure position the region to make strides in the pitch and yaw drive market for wind turbines. Additionally, China leads the global electricity demand as per the IEA creating a favorable trend within the reason for manufacturers to supply robust pitch and yaw drive systems.

China is poised to register the largest revenue share in the wind turbine pitch and yaw drive market of APAC. The domestic market is poised to register rapid growth owing to China being the largest producer of wind energy globally. For instance, Ember’s report in 2023 estimated China to be the highest wind power generating country globally. This creates burgeoning opportunities for pitch and yaw drive systems as onshore and offshore wind projects expand in the country. Additionally, the market’s growth is attributed to favorable government policies. For instance, the government plans to increase wind and solar power capacity by 1200 GW by 2030. Domestic companies in the country are leveraging the opportunities by providing robust wind energy solutions globally. For instance, in November 2024, Envision announced that it would supply a giga-scale wind farm in Egypt.

India is poised to increase its revenue share in the wind turbine pitch and yaw drive market of APAC during the forecast period. The market’s growth is owed to the country’s high output of wind power as it ranked 6th globally in wind energy capacity as of 2023 by Ember. Manufacturers are poised to leverage rising opportunities in onshore and offshore wind farms in the country. For instance, in September 2024, the Solar Energy Corporation of India issued a tender for the development of a 500 MW offshore wind power project in Gujarat. The demand for pitch and yaw drive systems is poised to surge domestically as the country seeks to increase renewable energy production as well as export systems for wind farms to benefit from the increasing global demands.

Key Wind Turbine Pitch and Yaw Drive Market Players:

- Suzlon

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Envision

- Bonfiglioli

- GE Renewable Energy

- Siemens

- Enercon

- Nordex

- Comer Industries

- Schaeffler Group

- ABM Greiffenberger

The global wind turbine pitch and yaw drive market is poised to register a profitable valuation during the forecast period. The key players in the market are investing in increasing their portfolio to leverage rising contracts related to wind power across various regions.

Here are some key players in the market:

Recent Developments

- In November 2024, Vårgrønn secured a 27.4% stake in the Baltic offshore wind farm in the German Baltic Sea, marking its entry into the German market. The deal positions Vårgrønn alongside German utility EnBW, which holds a 50.1% share and is responsible for operations and maintenance.

- In November 2024, ACCIONA Energia expanded its portfolio in the U.S. with the acquisition of two new wind farms of 150 MW each. The acquisition was estimated at USD 202.5 million and the two farms are poised to generate approximately 1.1 TWh of renewable energy every year.

- Report ID: 6700

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wind Turbine Pitch and Yaw Drive Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.