Winch Market Outlook:

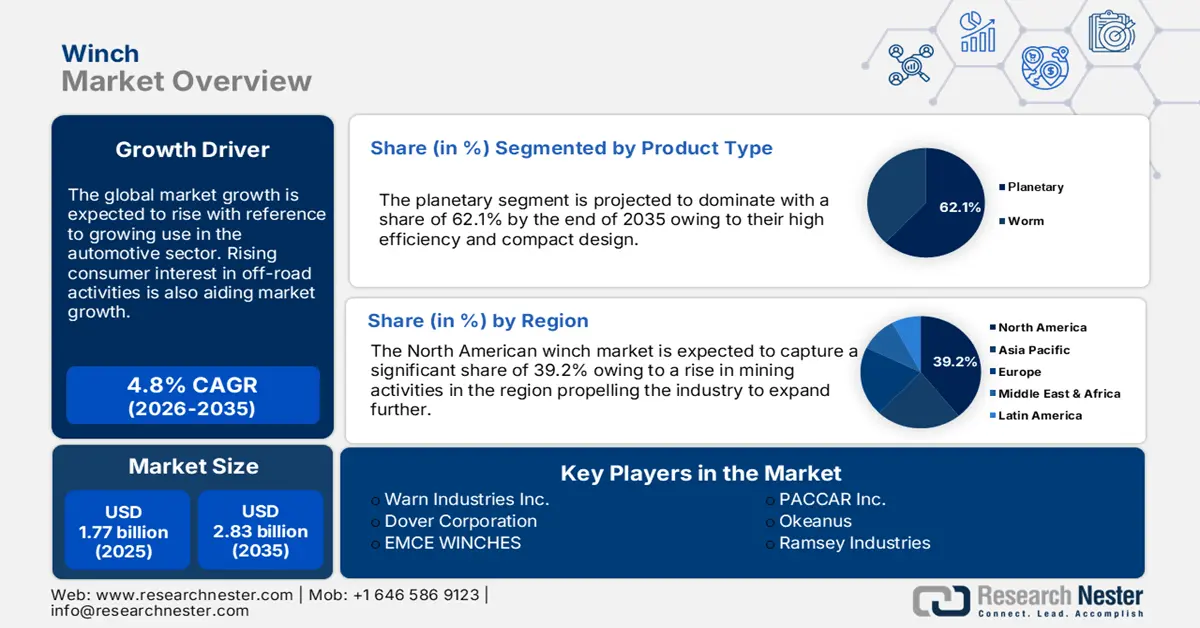

Winch Market size was valued at USD 1.77 billion in 2025 and is set to exceed USD 2.83 billion by 2035, expanding at over 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of winch is estimated at USD 1.85 billion.

The global surge in construction and infrastructure projects, including bridges, highways, skyscrapers, and industrial facilities, is significantly driving demand for winches. These devices play a critical role in lifting and pulling heavy loads, ensuring efficiency and safety in construction operations. As urbanization accelerates in developing regions, the need for reliable winching systems becomes indispensable for handling complex construction tasks, further fueling the growth of the winch market across diverse applications. According to the World Bank report published in December 2024, private sector infrastructure investment commitments totaled USD 45.7 billion for 252 projects in 2020.

The marine sector relies heavily on winches for essential operations such as anchoring, towing, and mooring, which are crucial for safe and efficient maritime activities. Winches play a vital role in ensuring stability and control during various maritime operations. As offshore exploration, oil and gas projects, and global shipping continue to expand, the demand for durable and high-performance winches is steadily increasing. This trend is especially evident in coastal regions and countries focusing on enhancing their maritime trade and logistics infrastructure, which further contributes to the growth of the winch market.

Key Winch Market Insights Summary:

Regional Highlights:

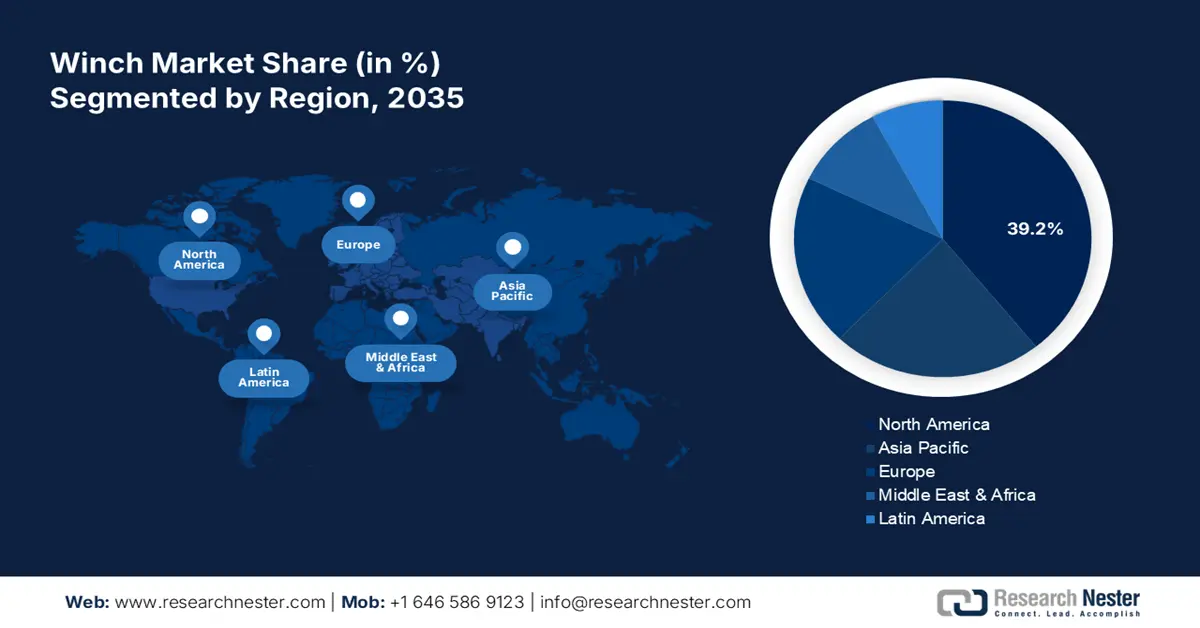

- North America leads the Winch Market with a 39.2% share, supported by the construction sector’s reliance on winches for lifting and pulling heavy materials, fostering strong growth through 2026–2035.

Segment Insights:

- The Mobile Crane segment is set to hold a dominant market share by 2035, attributed to urbanization and increased infrastructure and renewable energy projects.

- The Planetary segment of the Winch Market is projected to maintain around 62.1% share by 2035, propelled by superior torque, compact design, and efficiency in heavy-duty applications.

Key Growth Trends:

- Increasing use in mining operations

- Military and defense applications

Major Challenges:

- Maintenance and durability issues

- High initial costs

- Key Players: Warn Industries Inc., Dover Corporation, EMCE WINCHES, Ingersoll Rand, Inc..

Global Winch Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.77 billion

- 2026 Market Size: USD 1.85 billion

- Projected Market Size: USD 2.83 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Winch Market Growth Drivers and Challenges:

Growth Drivers

- Increasing use in mining operations: Mining and heavy industrial operations rely on robust winching systems for transporting heavy equipment, materials, and minerals, making them crucial for efficient operations. According to an EIA report published in October 2024, there were 560 coal mines accounted for in the U.S. in 2023, up from 548 previously. As mining activities expand, especially in resource-rich emerging economies, the demand for winches capable of handling extreme conditions, such as high loads, harsh terrains, and underground environments, is increasing. This trend is driven by the need for reliable and durable winching solutions to enhance productivity and operational safety., in turn expanding the winch market.

- Military and defense applications: The defense sector relies on winches for essential operations, such as vehicle recovery, heavy equipment handling, and logistics support, enhancing operational efficiency in challenging environments. Increasing defense budgets and modernization efforts are creating opportunities for advanced winching systems. In 2021, global military spending surpassed two trillion dollars, reaching USD 2113 billion. Winches play a critical role in military mobility, infrastructure development, and disaster response, highlighting their importance in the global market. This trend indicates a positive outlook for continued innovation and adoption of winching solutions in defense operations. Thus propelling the market.

Challenge

- Maintenance and durability issues: winches are frequently exposed to heavy loads, extreme temperatures, and challenging environments, causing wear and tear over time. This necessitates regular maintenance and timely repairs to ensure optimal performance and safety. However, the cost of maintenance, especially for specialized for heavy duty winches, can be high, and repairs may be particularly challenging in remote or industrial locations with limited access to skilled technicians or spare parts and restricting the winch market

- High initial costs: Advanced winching systems, such as hydraulic and electric winches, require significant upfront investment due to their sophisticated technology and high-quality components. The substantial initial costs can be a barrier for small and medium-sized businesses, particularly in price price-sensitive regions. This financial challenge limits the widespread adoption of advanced winches, slowing overall winch market growth and preventing many businesses from upgrading their equipment.

Winch Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 1.77 billion |

|

Forecast Year Market Size (2035) |

USD 2.83 billion |

|

Regional Scope |

|

Winch Market Segmentation:

Product Type (Planetary, Worm)

By product type, the planetary segment is predicted to dominate winch market share of around 62.1% by the end of 2035. The segment is growing due to its superior torque transmission, compact design, and high efficiency. Planetary winches are ideal for handling heavy loads in industries such as construction, mining, and marine. Their robust build ensures durability under harsh conditions, while their ability to provide consistent performance. For instance, in September 2024, Gearmatic introduced the GM12A hydraulic planetary hoist, specifically engineered for demanding marine and drilling applications. The GM12A has a rated line pull of 12,000 lb (5,443 kg) and is constructed using high-quality materials, ensuring it meets customer requirements for both functionality and serviceability, propagating the market.

Application (Commercial Recovery, Mobile Crane, Military, Work Boat, Utility)

The mobile crane segment is projected to dominate the global winch market due to its diverse applications and essential role in various industries. Winches are extensively used in construction, infrastructure development, and industrial projects worldwide, enhancing operational efficiency. Mobile cranes equipped with winches are vital for lifting and transporting heavy loads, making them indispensable for large-scale operations. As urbanization accelerates and the development of smart cities and renewable energy initiatives gains momentum, the demand for mobile cranes continues to rise. This trend not only strengthens the market position of mobile cranes but also emphasizes their significance in meeting modern construction and environmental needs., expanding the market.

Our in-depth analysis of the global winch market includes the following segments:

|

Product Type |

|

|

Application |

|

|

Operation |

|

|

Pulling Capacity |

|

|

End use |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Winch Market Regional Analysis:

North America Market Statistics

North America winch market is predicted to capture revenue share of over 39.2% by 2035. The construction sector heavily relies on winches for lifting and pulling heavy materials, especially in high-rise building projects and infrastructure development. In 2024, the construction sector saw a 12% growth in gross output and over USD 2 trillion in stable spending. As urbanization continues across North America, the demand for winches is growing due to their ability to enhance efficiency and safety in operations. Additionally, the growing interest in outdoor recreation ensures that even consumer-grade winches remain a thriving market segment.

The U.S. marine industry, including shipping, fishing, and recreational boating, continues to grow. Winches are essential for anchoring, mooring, and fishing applications, and driving their adoption. Additionally, stricter marine safety regulations are pushing the use of advanced and reliable winch system. Renewable energy projects, such as wind and solar farms, often require the use of winches for installation and maintenance tasks. It is anticipated that domestic solar energy generation will rise by 75% and wind by 11% by 2025. The U.S. government’s emphasis on renewable energy expansion is expected to boost demand in winch market.

As a global leader in mining, Canada requires robust equipment for extracting minerals. In August 2023, as per the Minister of Natural Resources Canada, 694,000 jobs in urban, rural, and distant areas of the nation were directly or indirectly related to the mines sector in 2022. The mining industry made about 6% of Canada's nominal GDP in 2022, or USD 148 billion, both directly and indirectly. Winches are heavily utilized in mining operations for tasks like hauling loads, positioning machinery, and underground exaction, fueling the market growth. The country’s commitment to renewable energy, including wind farms, often requires winches for the installation and maintenance of turbines. This rising focus on sustainability initiatives contributes to the winch market growth.

Asia Pacific Market Analysis

The APAC region is set to attain a lucrative winch market share. The region is experiencing significant infrastructure development, including bridges, ports, railways, and urban construction. In November 2023, in Asia Pacific, there is a great demand for new infrastructure. According to the Asian Development Bank, the region's infrastructure needs will require USD 1.7 trillion annually until 2030. Winches play a vital role in lifting and pulling heavy materials, making them essential in these projects. Governments across the region, such as India and China, are investing heavily in infrastructure to boost economic growth, driving the demand in winch market. The Region is increasingly investing in renewable energy projects, including wind and solar farms. Winches are used for tasks such as tower installation and maintenance, making them indispensable in this sector, propagating the market.

The rapid growth of e-commerce in China has led to increased demand for warehousing and logistics equipment. The International Trade Administration report published in April 2023 states, that over USD 710 million digital buyers made purchases in China through online retail, totaling USD 2.2 trillion. Winches are used for material handling in warehouses, making them essential for efficient operations in this market. The additional, shift toward electric and hydraulic winches, which offer greater efficiency, safety, and ease of use compared to traditional manual winches, is driving market expansion. These advanced winches are increasingly preferred across industries, aligning with the demand for modernized equipment, and expanding the winch market.

The rapid expansion of infrastructure projects in India, such as highway construction, metro rail projects, and smart city initiatives, is significantly driving the demand in the market . In 2020-21, India achieved a record highway construction speed of 37 km/day, expanding the National Highway network from 91,287 km in 2014 to 146,145 km in 2023 as per the Ministry of Road Transport & Highways. These projects require heavy lifting and pulling equipment, making winches essential for construction and engineering operations. The government’s increased spending on infrastructure, such as the National Infrastructure Pipeline) is further boosting this trend. Furthermore, the country’s strategic focus on port development and offshore resource exploration further boosts, the demand for marine-specific winches . thus propelling the market

Key Winch Market Players:

- Columbus McKinnon Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Warn Industries Inc.

- Dover Corporation

- EMCE WINCHES

- Ingersoll Rand, Inc.

- Mile Marker Industries, LLC

- PACCAR Inc.

- Okeanus

- Ramsey Industries

- Smittybilt Inc.

Key companies in the winch market are driving innovation through advanced technologies like remote-controlled systems, hydraulic and electric winches with improved efficiency, and enhanced safety features such as overload protection and automatic braking. In November 2024, Signia Aerospace acquired the Goodrich Hoist & Winch business from Collins Aerospace, specializing in helicopter rescue hoists and cargo winches. They are also integrating smart sensors and IoT connectivity for real-time monitoring, catering to diverse applications, in construction, marines, and energy sectors, ensuring higher reliability and performance. These strategic moves inspire other global leaders to introduce more innovative products, propelling the winch market. Such key players include:

Recent Developments

- In October 2024, Dover Corporation announced that its subsidiary, Dover Resources, has successfully completed the acquisition of Warn Industries Inc. This strategic move was finalized for approximately USD 325 million in cash, enhancing Dover's portfolio and market presence significantly.

- In October 2023, TWG, a Dover Corporation division, launched the dp EL22 Electric Winch, which features a rated line pull of 22,000 lbs. The EL22 offers an industrial-grade, high-performance DC electric winch, setting it apart from typical consumer-grade electric winches.

- In February 2020, ITOCHU Corporation has announced a significant strategic investment in Winch Energy Limited. This investment will be conducted through its wholly owned subsidiary, ITOCHU Europe PLC, to enhance energy solutions.

- In August 2020, Okeanus delivered an active heave compensated umbilical winch and A-Frame style LARS to NiGK Corporation, deployed by JOGMEC for deep-sea mining missions. The system was crucial for handling a seabed drill and was manufactured at Okeanus’ Houston facility.

- Report ID: 6844

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Winch Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.