White Oil Market Outlook:

White Oil Market size was valued at USD 2.26 billion in 2025 and is expected to reach USD 3.19 billion by 2035, registering around 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of white oil is evaluated at USD 2.33 billion.

The growth of the market can be attributed to the increasing demand for electric vehicles. In reality, white oil is necessary for electric automobiles. Although the majority of electric vehicles are powered by electricity, many of them use lithium batteries, which need, well, lithium, also known as white oil. By 2037, there are likely to be about 40 million EVs in Europe. Nonetheless, imports of lithium for batteries account for practically all of the continent's lithium supply.

In addition to these, factors that are believed to fuel the market growth of white oil include the rising demand for medicines for various diseases, moreover, this demand is also propelled by rising cases of chronic diseases. White oil is used as mineral oil for the formulation of various tablets and capsules. Pharma distributors and merchants noted that they anticipate a jump in demand of at least 30% for chronic treatment drugs such as those for diabetes and hypertension before the price hike. Furthermore, throughout the following three years, to 2026, a total of 300 new medications are anticipated to be released.

Key White Oil Market Insights Summary:

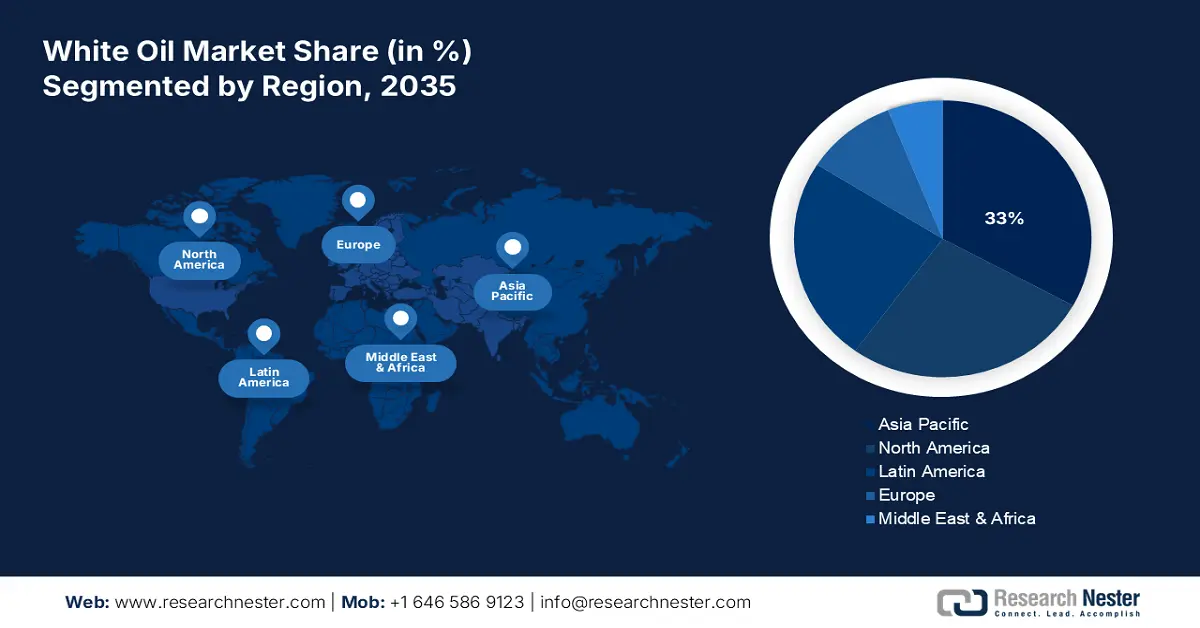

Regional Highlights:

- Asia Pacific white oil market achieves a 33% share by 2035, attributed to the increasing manufacturing in the textile industry, particularly in China and India.

- North America market will attain a 24% share by 2035, fueled by the rising demand for automobiles and white oil's essential role in the automobile industry.

Segment Insights:

- The naphthenic segment in the white oil market is anticipated to hold a significant share by 2035, driven by its superior low-temperature performance and growing tire manufacturing.

- The personal care segment in the white oil market is expected to maintain the largest share by 2035, driven by increasing demand for personal care products from adults and children.

Key Growth Trends:

- Growing Sales of Automobiles

- Rising Production in Pharmaceutical Industry

Major Challenges:

- Environmental Concerns associated with white oil production

- Availability of Alternative Products

Key Players: NYNAS AB, Calumet Specialty Products Partners, L.P, Chevron Corporation, ExxonMobil Corporation, Petro-Canada Lubricants Inc., Renkert Oil, Atlantic Performance Oils, Sasol, Sonneborn LLC, H & R GROUP.

Global White Oil Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.26 billion

- 2026 Market Size: USD 2.33 billion

- Projected Market Size: USD 3.19 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

White Oil Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Sales of Automobiles – White oil is used in the fabrication of automotive tires and in the formulation of the lubricants for the engine. Before the epidemic, it was predicted that 80 million cars would be sold internationally. Even after the pandemic, the recovery of the automotive sector was impressive, around 66 million cars were sold globally in 2022, and about 67 million units in 2021.

-

Rising Production in Pharmaceutical Industry – Premium white oils are utilized to manufacture the adjuvants used in animal immunization; these adjuvants account for up to 50% of the final product. In order to seek maximum effectiveness, it is essential that adjuvant be produced from the purest white oil possible.

-

Rising Demand for Insecticide – White oil is used to manage a variety of insect pests in gardens by working as an insecticide. The spray stops insects from breathing, which results in their asphyxia and eventual death. According to the Food and Agriculture Organization of the United States estimates, pests are responsible for up to 40% of annual losses in global crop production. Around USD 220 billion is lost to plant diseases each year, and at least USD 70 billion is lost to invasive insects.

-

Rising Need for Cosmetics & Personal Care Products – It is typically utilized as a principal or supporting ingredient in the creation of personal hygiene products, including bodywash, cream and lotion formulations, baby oil, sunblocks, cosmetics, depilatories, and bath oils. Around 80% of American women use cosmetics daily, which translates to 161 million people spending nearly USD 15,000 on them over the course of a lifetime. Moreover, the typical woman spends approximately between USD 200,000 and USD 300,000 on skincare and cosmetics.

-

Increasing Demand for Plastic – White oil is employed in the manufacture of expandable polystyrene, PVC, and thermoplastic rubber. The output of plastic rose exponentially, reaching 400 MT by 2020. If things continue as they are, plastic manufacturing may have doubled by 2040 and is likely to increase 2.5 times by 2050.

Challenges

-

Environmental Concerns associated with white oil production - A mining boom has been sparked by the need for lithium supplies for electric cars, and wherever it is found, the hunt for "white oil" poses a threat to the environment. To reduce carbon emissions, countries are pushing electric cars into the market and even turning fuel cars into electric ones. Anyone owning an electric vehicle entails a significant amount of mining, refining, and other harmful operations. The mining procedure harms humans, animals, and their habitat.

- Availability of Alternative Products

- Lack of Sufficient Raw Materials

White Oil Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 2.26 billion |

|

Forecast Year Market Size (2035) |

USD 3.19 billion |

|

Regional Scope |

|

White Oil Market Segmentation:

Application Segment Analysis

The global white oil market is segmented and analyzed for demand and supply by application into plastics & elastomers, adhesives, personal care, agriculture, textile, food & beverage, pharmaceutical, metalworking applications, and other applications. Out of the nine applications of white oil, the personal care segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the increasing demand for personal care products from both adults and children. These products include shampoo, hair oils, fragrances, moisturizers, baby oil, and other baby products. White oil have anti-bacterial properties therefore it is used in baby products to increase the product’s benefits. In 2020, around 4 million Americans used store-brand shampoo at least eight times a week. Moreover, Johnson & Johnson, a multinational American corporation that manufactures medical equipment, pharmaceuticals, and consumer packaged goods, made sales of baby care items of around 2 billion US dollars in 2021.

Product Type Segment Analysis

The global white oil market is also segmented and analyzed for demand and supply by product type into light paraffinic, heavy paraffinic, and naphthenic. Amongst these three segments, the naphthenic segment is expected to garner a significant share of in the year 2035. These oils' exceptional low-temperature performance enhances the low-temperature properties of the lubricant formulations. In addition, naphthenic base oils perform better at low temperatures than paraffinic oils, which makes them suitable for the formulation of hydraulic and automatic transmission fluids. Naphthenic base oils are widely utilized in many industries, including the fabrication of tires, industrial equipment, and automobiles. The growth of the segment is expected on the account of rising manufacturing of tires. As per the estimated volume of tires sold worldwide in 2022 is close to 2.7 billion units.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Application |

|

|

By Grade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

White Oil Market Regional Analysis:

APAC Market Insights

The Asia Pacific white oil market, amongst the market in all the other regions, is projected to hold the largest market share of about 33 % by the end of 2035. The growth of the market can be attributed majorly to the increasing manufacturing in the textile industry. In the textile business, white mineral oils are used for a wide range of purposes, including yarn lubricant, sewing machine oil, industrial fabrics, and fiber lubricant. It offers lubricity and oxidative stability, while lowering the risk of discoloration. In December 2022, China manufactured around 3 billion meters of textiles for garments. The volume of textiles produced each month was consistent and was greater than three billion meters. In addition to this, India ranks seventh in the world for textile exports, that include clothes, household goods, and technological products. It is the second-largest manufacturer of textiles and apparel in the world. The textile and apparel sector contributes 12% of exports, 13% of industrial production, and 2.3% of the nation's GDP.

North American Market Insights

The North American white oil market, amongst the market in all the other regions, is projected to hold the second largest share of about 24% during the forecast period. The growth of the market can be attributed majorly to the increasing demand and sales of automobiles. White oil is used as an essential raw material in the automobile industry. The third quarter of 2022 saw a 24 percent growth in new vehicle sales in the US market. Moreover, around 600,000 light trucks and vehicles were sold in the three months that concluded on September 30, 2022. It was higher than nearly 400,000 during the same time in 2021.

Latin America Market Forecast

Latin America region is projected to observe substantial growth through 2035. The growth of the market can be attributed majorly to the increasing demand for hair oil and other hair care products. Owing to the cheap manufacturing of white oil, it is used as a moisturizing agent in various skincare and hair care products. It traps moisture and reduces the dryness and fizziness in the hair. In 2020, with trade values of around 130 and nearly 107 million dollars in Chile and Mexico, respectively. They are the top Latin American countries for hair product imports. Moreover, Mexico exports hair products to other countries as well.

White Oil Market Players:

- NYNAS AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Calumet Specialty Products Partners, L.P

- Chevron Corporation

- ExxonMobil Corporation

- Petro-Canada Lubricants Inc.

- Renkert Oil

- Atlantic Performance Oils

- Sasol

- Sonneborn LLC

- H & R GROUP

Recent Developments

-

Petro-Canada Lubricants, Inc. announces the distribution partnership with Palmer Holland. The white mineral oil brands PURETOLTM and KRYSTOLTM from Petro-Canada will be distributed in the United States by Palmer Holland.

-

NYNAS AB released the findings on the use of NYTEX and NYFLEX naphthenic oils that with their use in fertilizers it decreased in caking and dust problems. Compared to untreated fertilizers, dusting is reduced by 50% when NPK fertilizers are treated with NYTEX 846.

- Report ID: 4728

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

White Oil Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.