Wheat Protein Market Outlook:

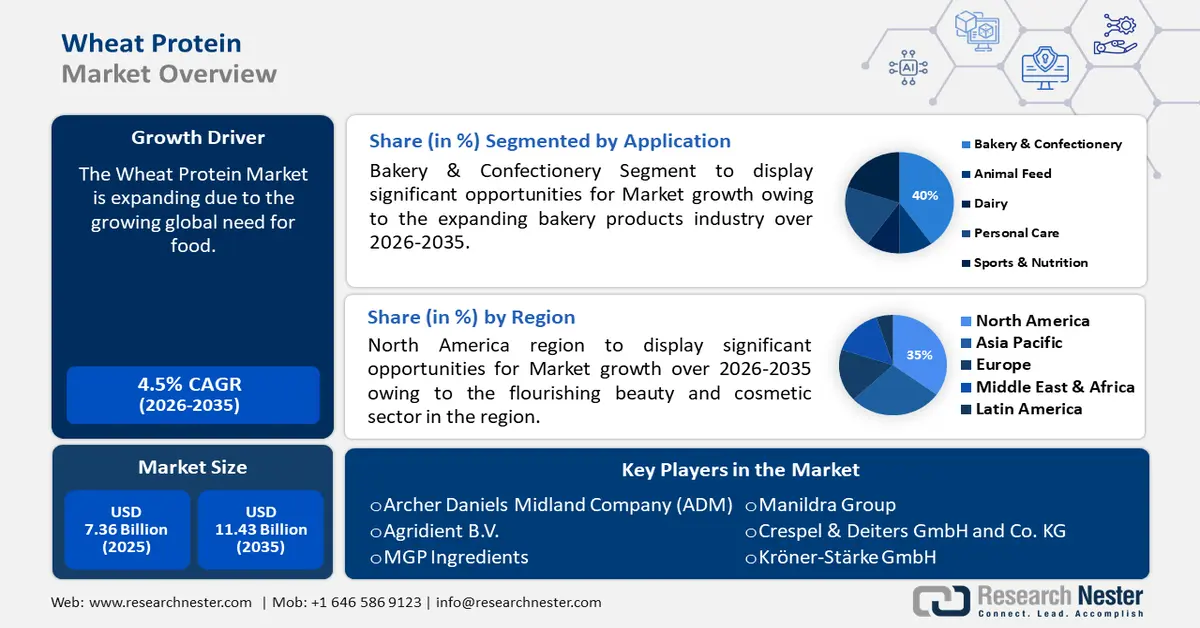

Wheat Protein Market size was valued at USD 7.36 billion in 2025 and is set to exceed USD 11.43 billion by 2035, registering over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wheat protein is estimated at USD 7.66 billion.

The expanding industry is thought to be propelled by the growing global need for food. As a result, the market for vegan food items grows, leading to higher demand for wheat protein since they are high in important amino acids, and have a high nutritional value.

As per the Food and Agriculture Organization, in 2050, a 60% increase in food production will be required to feed the 9.3 billion people that inhabit the planet.

Key Wheat Protein Market Insights Summary:

Regional Highlights:

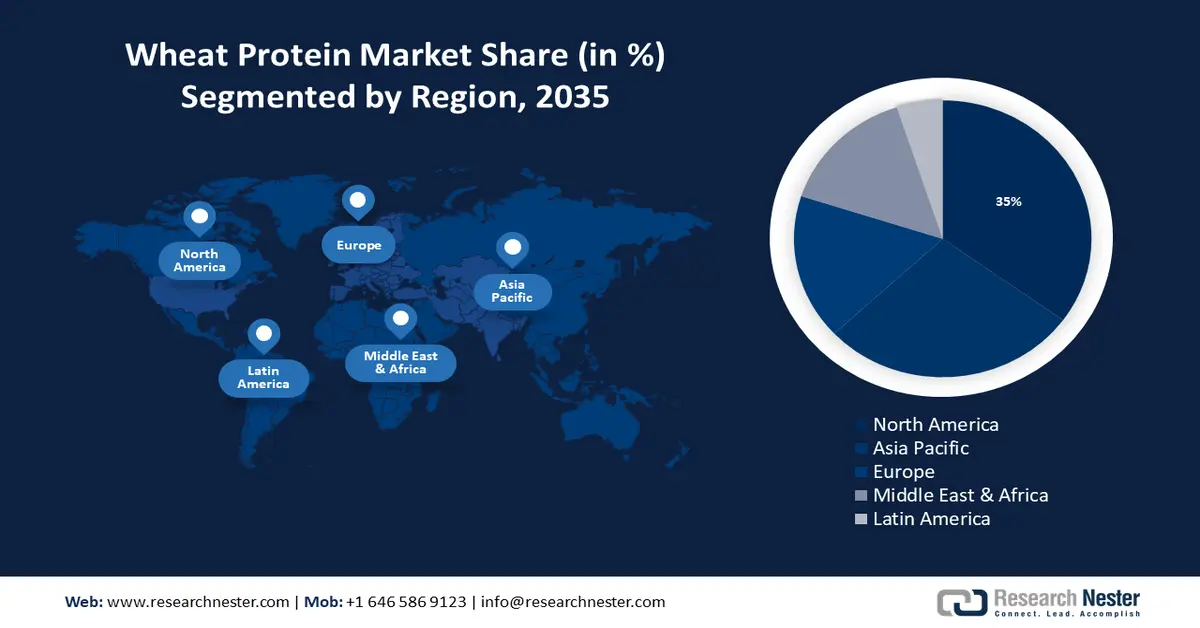

- North America wheat protein market will hold more than 35% share by 2035, driven by the flourishing beauty and cosmetic sector and rising demand for vegan cosmetics.

- Asia Pacific market will achieve the highest CAGR during 2026-2035, driven by rising personal disposable income and dietary shifts towards wheat protein.

Segment Insights:

- The bakery & confectionery segment in the wheat protein market is projected to attain a 40% share by 2035, fueled by the expanding bakery products industry.

- The wheat gluten segment in the wheat protein market is projected to hold a 38% share by 2035, attributed to consumers’ growing preference for sustainably produced food.

Key Growth Trends:

- Rising importance of plant-based proteins

- Growing burden of obesity

Major Challenges:

- Adverse effects of wheat protein

- Exorbitant cost of production

Key Players: Archer Daniels Midland Company (ADM), Agridient B.V., MGP Ingredients, Cargill, Incorporated, Manildra Group, Crespel & Deiters GmbH and Co. KG.

Global Wheat Protein Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.36 billion

- 2026 Market Size: USD 7.66 billion

- Projected Market Size: USD 11.43 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Wheat Protein Market Growth Drivers and Challenges:

Growth Drivers

- Rising importance of plant-based proteins - Concerns about the environment and human health are making plant-based diets more and more common, which has increased demand for wheat protein market, which contribute to a sustainable diet for all people on the planet.

For instance, of all the dietary protein sources currently available, plant-based sources account for more than 55% of the supply of proteins.

- Growing burden of obesity - Increased weight reduction may result from adding wheat proteins high in amino acids that regulate appetite, and also assist in curbing hunger and stopping overindulging.

According to the World Heart Federation, by 2025, up to 1 billion adults, or 12% of the global population, will be obese.

- Increasing adoption of pets - Pet food and aqua feed, particularly, contain wheat protein in a substantial amount since it is well known for having exceptional digestion, has little ash and fiber, and is devoid of anti-nutritional elements. For instance, more than 30% of households have pets worldwide.

Challenges

- Adverse effects of wheat protein - Due to gluten, wheat might cause issues such as wheat allergy, celiac disease, and other wheat-related illnesses in some people with gluten intolerance.

Moreover, supplementing with wheat protein can have several negative effects like bloating, weariness, and diarrhea to serious ones like hair damage from consuming too much wheat protein.

- Exorbitant cost of production - Varying prices of raw materials, and the need for specialized tools, labor, and knowledge to produce wheat protein, raise the production's overall cost, which are often factored into the final price of wheat protein products.

Wheat Protein Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 7.36 billion |

|

Forecast Year Market Size (2035) |

USD 11.43 billion |

|

Regional Scope |

|

Wheat Protein Market Segmentation:

Application Segment Analysis

Bakery & confectionery segment is poised to dominate around 40% wheat protein market share by the end of 2035. The segment growth can be attributed to the expanding bakery products industry. For instance, in 2024–2028, the global market for bread and bakery products is expected to expand by more than 6%.

The growth is fueled by the growing demand for bakery goods and convenience foods, leading to a higher need for wheat protein which finds increasing use in products including bread, cakes, biscuits, and other baked goods on account of its properties such as higher moisture content, better absorption of water, and the final product's softness.

In addition, a great addition to low-carb or keto baking is wheat protein isolate which can be used in place of eggs in a variety of bakery applications and is well known to give baked goods shape.

Form Segment Analysis

Dry segment in the wheat protein market is expected to hold the highest revenue share by 2035. The major factor for the expansion of the segment is the rising popularity of sports which has raised awareness of the value of a diet high in protein, that helps to increase glycogen, reduce muscle soreness, and promote muscle regeneration.

For instance, with around 2 billion fans worldwide, cricket is the second most-watched sport globally.

A diet high in protein is necessary for athletes, therefore additional dietary supplement such as dry wheat protein is utilized especially by bodybuilders and sportsmen to increase their protein intake and hasten muscle repair.

Product Segment Analysis

By the end of 2035, wheat gluten segment is expected to account for more than 38% wheat protein market share. Consumers growing desire for sustainably produced food is expected to boost the need for wheat gluten.

By 2023, there is expected to be over a 45% rise in the global demand for plant-based menu alternatives in restaurants, reflecting consumer preferences for sustainability.

The inexpensive and environmentally friendly wheat gluten is a cheap byproduct of the starch and bioethanol industries, which is proudly vegan-friendly and necessary for making plant-based meat substitutes.

Our in-depth analysis of the wheat protein market includes the following segments:

|

Product |

|

|

Concentration |

|

|

Application |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wheat Protein Market Regional Analysis:

North American Market Insights

North America industry is predicted to dominate majority revenue share of 35% by 2035. The market growth in the region is also expected on account of the flourishing beauty and cosmetic sector, which is primarily driven by the rising demand for vegan cosmetics. This may create a huge demand for wheat protein in the region as they are regarded as safe for health and is an authorized ingredient in cosmetics.

In the US, there is a great demand for wheat protein because these areas presently control the food sector, and the presence of major participants is studying creative ways to manufacture wheat protein products.

Consumers in Canada are starting to favor items with health advantages over animal protein, which will probably affect the market for wheat protein.

APAC Market Insights

Asia Pacific region in wheat protein market is projected to observe highest growth by the end of 2035 owing to the increasing personal disposable income in this region. Therefore, more and more individuals are spending on healthier and natural food products, including wheat protein.

Japan's farmers are planting more wheat and producing less rice, which has led to higher production of wheat proteins.

More than 4 thousand tons of wheat protein in paste form and over a thousand tons in powdered form accounted for the majority of Japan's domestic production volume of wheat proteins in 2022.

The size of the wheat protein market in China is set to rise due to population growth, and improved lifestyle.

Furthermore, the expanding market for natural and clean-label food items, and the growing preference for Western-style fast-consumption snacks, like bread and pastries in Korea may drive the market demand.

Wheat Protein Market Players:

- Crop Energies AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Archer Daniels Midland Company (ADM)

- Agridient B.V.

- MGP Ingredients

- Cargill, Incorporated

- Manildra Group

- Crespel & Deiters GmbH and Co. KG

- Kröner-Stärke GmbH

The wheat protein market consists of many key players who are launching various strategic initiatives to expand their market position in the industry.

Recent Developments

- Crop Energies AG plans to invest over EUR 95 million on a range of initiatives at its Wilton, UK-based subsidiary Ensus UK Ltd.'s production plant to lower CO2 emissions and solidify its position in the European ethanol and protein markets.

- Manildra Group introduced FiberGem, a premium-resistant wheat starch for baked goods, that has created exciting new opportunities for the development of high-protein, low-carb products.

- Report ID: 6185

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wheat Protein Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.