- An Outline of the Global Web Scraping Software Market

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions and Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Service/ Solution Providers

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Forces of Market Constituents

- Factors/Drivers Impacting the Growth of the Market

- Market Trends for Better Business Practices

- Key Market Opportunities for Business Growth

- Major Roadblocks for the Market Growth

- Government Regulation: How they Would Aid Business?

- Industry Risk Analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Web Scraping Software Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Impact of Recession on the Global Economy

- Industry Supply Chain Analysis

- End-User Analysis

- Regional Analysis

- Technology Analysis

- Analysis of Global Web Scraping Software Price

- Analysis of Web Scrapping

- Use Case Analysis

- PESTLE Analysis of IT Industry

- Competitive Positioning: Strategies to Differentiate a Company from Its Competitor

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share (2022)

- Business Profile of Key Enterprise

- Octopus Data, Inc.

- Detailed Overview

- Assessment of key offerings

- Analysis of growth strategies

- Exhaustive analysis on key financial indicators

- Recent developments and strategies

- Mozenda, Inc.

- SysNucleus

- Import.io

- Web Scraper

- Zyte Group Limited

- Ficstar Software, Inc.

- QL2 Software, LLC

- oxylabs.io

- Datahut

- Diggernaut, LLC

- Diffbot

- Grepsr

- Apify

- Parsehub.com

- X-Byte Enterprise Crawling

- Octopus Data, Inc.

- Global Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Global Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Geography

- North America, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Europe, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Asia Pacific, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Latin America, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Middle East and Africa, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- North America Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- North America Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Country

- US, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Canada, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- US Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- Canada Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Canada Web Scraping Software Market Segmentation Analysis (2023-2036

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- Asia Pacific Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Asia Pacific Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Country

- China, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- India, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Japan, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Indonesia, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Malaysia, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Australia, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Vietnam, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- South Korea, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Thailand, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rest of Asia Pacific, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- China Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- China Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- India Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- India Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- Japan Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Japan Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- Indonesia Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Indonesia Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- Malaysia Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Malaysia Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- Australia Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Australia Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- Vietnam Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Vietnam Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- South Korea Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- South Korea Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- Thailand Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Thailand Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

- Rest of Asia Pacific Web Scraping Software Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Rest of Asia Pacific Web Scraping Software Market Segmentation Analysis (2023-2036)

- By Deployment

- Cloud Based, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- On-premises, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Organization Size

- Small and Medium Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Large Enterprises, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Content Scraping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Price Monitoring, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Contact Scrapping, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Retail and E-Commerce, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Healthcare, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- BFSI, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Logistics and Transportation, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Advertising and Marketing, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Real Estate, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Tourism, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Deployment

Web Scraping Software Market Outlook:

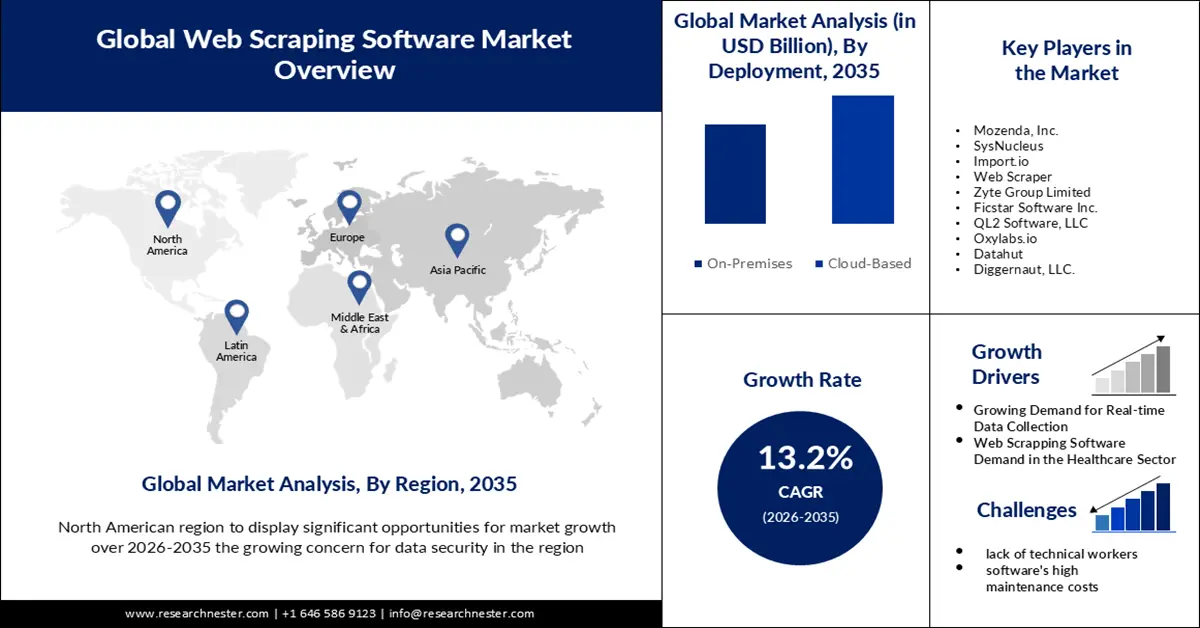

Web Scraping Software Market size was over USD 782.5 million in 2025 and is projected to reach USD 2.7 billion by 2035, growing at around 13.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of web scraping software is evaluated at USD 875.46 million.

It is expected that the rise in e-commerce will have an impact on this growth. Globally, there are projected to be over 3 billion digital purchasers by 2023. This amounts to about 32 percent of the global populace. The need for web scraping software will therefore likely increase. It is predicted that a technique called web scraping will be used often to gather product data from several e-commerce websites, including Google Shopping, Amazon, eBay, and others.

In addition to these, real estate companies frequently employ web scraping to add properties that are for sale or rent to their databases. A real estate agency, for example, might use MLS data scraping to develop an API that refreshes its website with updated data automatically. In this way, the person who finds this advertisement on their website becomes the agent and represents the property.

Key Web Scraping Software Market Insights Summary:

Regional Highlights:

- North America region in the scraping software market is projected to command a 45% share by 2035, attributed to its rising need for pricing-strategy optimization across industries and heightened emphasis on data security.

- Asia Pacific region is anticipated to secure a significant revenue share by 2035, shaped by strong SME presence and limited willingness to invest in premium tools amid abundant free software alternatives.

Segment Insights:

- Cloud-based segment in the scraping software market is projected to secure a remarkable revenue share by 2035, supported by expanding cloud-based solution adoption and the increasing use of API-enabled, remotely accessible scraping architectures.

- Large enterprises segment is anticipated to capture substantial market share by 2035, fueled by growing enterprise reliance on automated large-scale data collection and analytics capabilities.

Key Growth Trends:

- Growing Demand for Real time Data Collection

- Web Scrapping Software Demand in the Healthcare Sector

Major Challenges:

- CAPTCHA blockers and IP blockers

- A lack of technical workers could prevent the web scraping software market from expanding.

Key Players: Mozenda, Inc., SysNucleus, Import.io, Web Scraper, Zyte Group Limited, Ficstar Software Inc., QL2 Software, LLC, Oxylabs.io, Datahut, Diggernaut, LLC., Apify, Parsehub, X-Byte Enterprise Crawling, Diffbot, Grepsr.

Global Web Scraping Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 782.5 million

- 2026 Market Size: USD 875.46 million

- Projected Market Size: USD 2.7 billion by 2035

- Growth Forecasts: 13.2%

Key Regional Dynamics:

- Largest Region: North America (45% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, India, Japan

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 25 November, 2025

Web Scraping Software Market - Growth Drivers and Challenges

Growth Drivers

- Growing Demand for Real-time Data Collection- As most websites regularly change, either in terms of structure format or even content, real-time web scraping is an essential feature for any online scraper. Only a real-time web scraping service can notify a user of such changes as soon as they happen. Real-world examples of continuously updated data include stock prices, real estate listings, weather reports, and pricing variations.

- Web Scrapping Software Demand in the Healthcare Sector- Interpersonal contact is no longer the only source of information for the healthcare sector. Moreover, healthcare businesses have embraced digitalization in distinctive ways, and to keep up with the times, industry players such as doctors, nurses, patients, and pharmacists are improving their technical skills. In the existing healthcare system, where decisions are made only based on data, web scraping can improve lives, educate people, and increase awareness. In the healthcare industry, web scraping can improve lives by offering sensible solutions, as individuals now depend on more than just doctors and pharmacists. The healthcare industry will have access to 50 petabytes of data. A wide range of data, including health insurance records, legislative needs and requirements, research findings, and more, are housed in this area. Some important conclusions that may be drawn from this data are as follows.

- Increasing Use of Advanced Technology for Web Crawling- The increasing need for superior data is making web scraping increasingly important for companies worldwide. The internet is home to an endless supply of unstructured data, and with it, untapped opportunities. Selenium can be used to mimic the process of accessing a webpage using a conventional web browser. When clean text and accompanying titles need to be extracted, boilerpipe is a great option. A Java package called Boilerpipe was created expressly to extract both structured and unstructured data from web pages. It has the ability to remove unnecessary HTML elements and other background content from the websites in an intelligent manner.

Challenges

- CAPTCHA blockers and IP blockers- The process of scraping data from websites is not always easy. IP filtering and CAPTCHA are only two of the many difficulties users may encounter when retrieving data. These techniques are employed by platform owners as an anti-web-scraping measure, which may impede clients' access to data. The Fully Automated Public Turing Test to Tell Computers and Humans Apart, or CAPTCHA, is used to identify and stop bots from accessing websites. Restricting service registrations to human users and preventing ticket inflation are the primary goals of CAPTCHAs. Not only do they undermine SEO techniques, but they also pose a threat to well-functioning bots like Googlebot, which gathers content from the internet and assembles it into a searchable index for the Google search engine. Banning IP addresses is the most often used method of preventing web scrapers from getting access to a website's data. When a website detects that numerous requests are coming from the same IP address, this typically happens. The website would either totally prohibit the IP address or restrict its access if it wants to cease the scraping activity.

- A lack of technical workers could prevent the web scraping software market from expanding.

- The software's high maintenance costs could impede the market's expansion.

Web Scraping Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.2% |

|

Base Year Market Size (2025) |

USD 782.5 million |

|

Forecast Year Market Size (2035) |

USD 2.7 billion |

|

Regional Scope |

|

Web Scraping Software Market Segmentation:

Deployment Segment Analysis

Cloud-based segment in web scraping software market is expected to capture remarkable revenue share by the end of 2035. The market for cloud-based solutions is expanding significantly. The advantages of cloud-based online scraping tools are driving the growth of new categories. Browser extensions, like Google Chrome extensions, are frequently used to enable cloud scraping services, the real scraping process occurs on the cloud or server. They can therefore be configured and accessed from any place or device (Windows, Mac, Linux, Web, Smartphone). The majority of cloud-based data extraction services provide APIs so that programmers may use their platform to construct code or scripts to scrape data from websites. Local web scraping programs are missing this feature. This has a significant role in the segment's expansion as well. The market for cloud apps is valued at more than USD 150 billion. By 2025, 200 ZB of data will be kept in the cloud. The cloud stores 60% of all corporate data worldwide.

Organization Size Segment Analysis

By the end of 2035, large enterprises segment is poised to capture substantial web scraping software market share. web scraping enables businesses to automatically collect and arrange data from websites, enabling them to obtain enormous amounts of data from the internet in large enterprises. Organizations can create new data sets using this data that can be used in a variety of ways for analysis and deployment. Web scraping is essential for enterprises of all sizes but majorly opted by the large enterprises. Web scraping software is a valuable tool for both the retail and manufacturing sectors. It can be used for a variety of tasks, such as tracking competitors' pricing strategies, keeping an eye on manufacturers' compliance with minimum price requirements, gathering product images and descriptions from different manufacturers, tracking customer feedback, and more.

Our in-depth analysis of the global web scraping software market includes the following segments:

|

Deployment |

|

|

Organization Size |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Web Scraping Software Market - Regional Analysis

North American Market Insights

The web scraping software market in North America industry is estimated to account for largest revenue share of 45% by 2035, Web scraping software is needed in the area by businesses in a variety of industries, such as sports, air freight, and transportation, in order to establish suitable pricing strategies. Web scraping software is now more important in the region than ever for keeping abreast of business developments, particularly in the transportation sector where complex ticket structures and dynamic pricing have increased market competition. Furthermore, growing concerns about data security are supporting the growth of the market in this region. In the US in 2022, there were almost 1801 occurrences of data compromise.

APAC Market Insights

Asia Pacific region in web scraping software market is estimated to hold significant revenue share by the end of 2035. Due to the fierce rivalry, the majority of enterprises in the internet scraping software sector provide their goods for free for a limited time in the Asia Pacific region. As a result, many businesses refuse to invest in equipment that might lower operational costs. Moreover, because of the availability of various software suppliers, small and medium-sized firms (SMEs) dominate the online scraping software industry and are less inclined to invest in premium software, preferring to employ complementary solutions. All of these problems are expected to impede market expansion in the region.

Web Scraping Software Market Players:

- Octopus Data Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mozenda, Inc.

- SysNucleus

- Import.io

- Web Scraper

- Zyte Group Limited

- Ficstar Software Inc.

- QL2 Software, LLC

- Oxylabs.io

- Datahut

- Diggernaut, LLC.

- Apify

- Parsehub

- X-Byte Enterprise Crawling

- Diffbot

- UiPath Inc.

- Grepsr

Recent Developments

- Oxylabs' pro bono project, "Project 4β," has announced a new partnership with Debunk.org, an organization whose mission is to counteract government-sponsored propaganda and Internet misinformation. Through the partnership, Oxylabs would provide Debunk.org with free access to its state-of-the-art web scraping technology and knowledge to combat false material on the internet.

- Uipath, announced the launch of web scraping with the help of UI automation experience. By using the new technology, the structured data, HTML tables, HREF, or SRC can be easily accessed. It enables to get of sorted data by specified columns. Moreover, the user can collect information from different web pages with this new web scraping.

- Report ID: 5041

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Web Scraping Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.