Wealthtech Solutions Market Outlook:

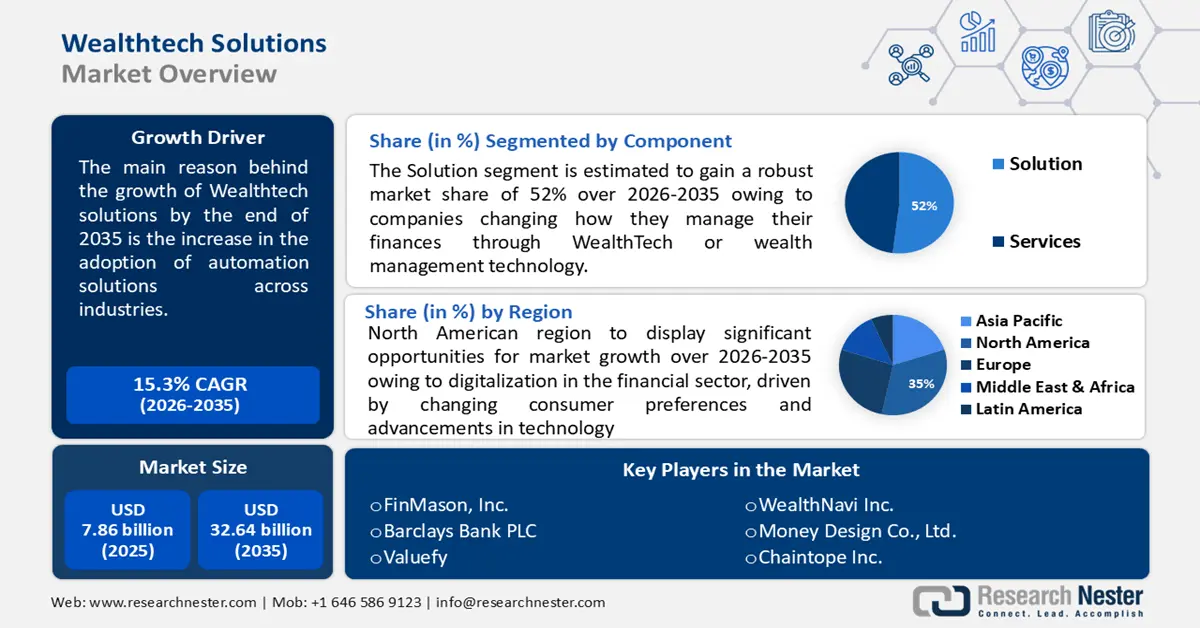

Wealthtech Solutions Market size was over USD 7.86 billion in 2025 and is projected to reach USD 32.64 billion by 2035, growing at around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wealthtech solutions is evaluated at USD 8.94 billion.

The increase in the adoption of automation solutions across industries is fueling the growth of the wealthtech solution market. By using wealthtech solutions, companies and banks can understand new-generation client demands, such as tech-enabled financial solutions, automatic rebalancing, and portfolio building. As per the statistics of US Census Bureau, working with cutting-edge technologies for automation might expose about 30% of all workers.

Moreover, wealthtech solutions help companies discover the demands of the next generation of customers, including those for tech-enabled financial solutions, automatic rebalancing, and portfolio development.