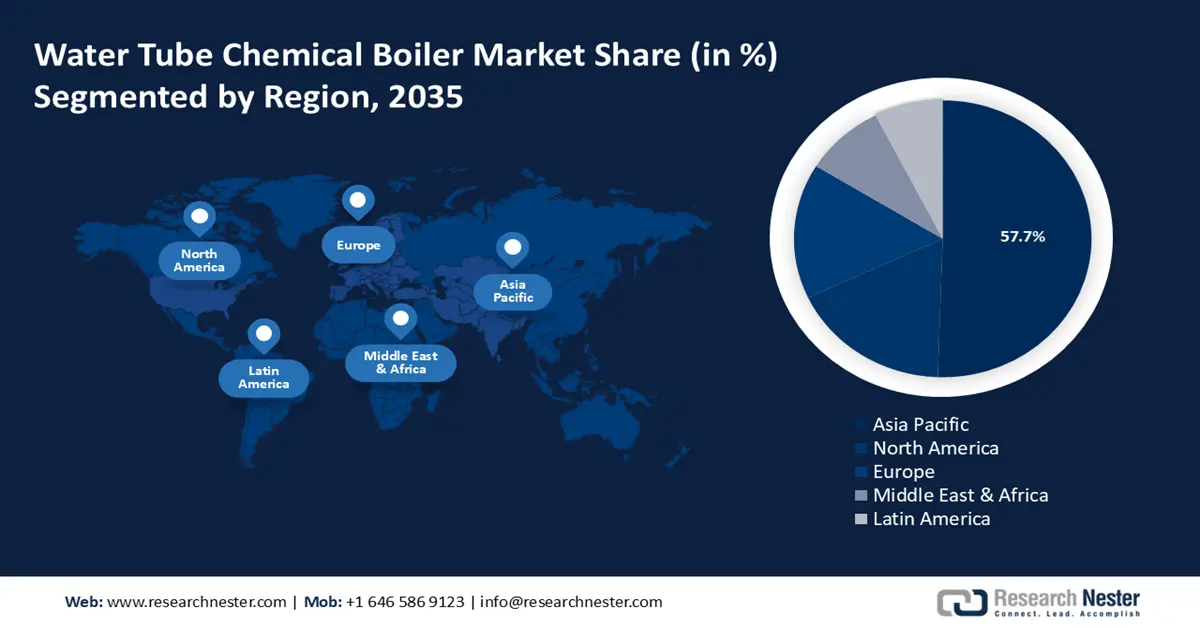

Water Tube Chemical Boiler Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific accounts for the largest share of the water tube chemical boiler market with 57.7%, mainly due to rapid industrialization and the presence of strong economies such as India and China, who are hugely investing in infrastructure projects and industries for advanced boiler technologies to meet demand, as well as stringent environmental regulations for power. Furthermore, ongoing urban and industrial zone expansion as well as the growing integration of renewable energy systems with current boiler units is projected to support industry growth.

China is leading, owing to its sizeable industrial base and government initiatives for carbon emissions reduction. This intent by the country to update its boiler system with newer, more energy-efficient models aligns comprehensively with lowering carbon gas emissions toward its 2060 target for carbon neutrality. Such innovations by manufacturers in China include biomass-fueled boilers and smart boiler systems. A shift from traditional coal to cleaner varieties such as natural gas and biomass is further propelling the water tube chemical boiler market.

India witnessed the trend of an increase in demand for water tube chemical boilers in energy-intensive industries and the domestic companies are focused on expanding their reach in the foreign markets. For instance, the international order booking for Thermax Limited increased from USD 13.6 billion in FY 2020-2021 to USD 18.78 billion in FY 2021-22. In addition, the local government's Make in India initiative with increased investments in infrastructure development promotes the establishment of new industrial plants with efficient and high-capacity boilers.

North America Market Analysis

The landscape of the water tube chemical boiler market in North America is influenced by stringent EPA regulations on industrial emissions such as Nitrogen oxides (NOx) and Sulfur Oxides (SOx) which push the companies to make investments in low-emission boilers. For instance, in March 2024 Babcock & Wilcox's thermal business segment signed an agreement worth USD 246 million for a significant gas conversion project at a power plant in North America. The project entails switching the plant's two coal-fired boilers, which have a combined capacity of more than 1,000 megawatts, to natural gas operation.

In the U.S., industrial energy consumption accounts for approximately about 1/3rd of total energy utilization with a remarkable portion systematically distributed into various segments such as steam generation, highlighting the significance of efficient boilers. In addition, acceleration in the adoption of boilers with the use of cleaner fuels creates lucrative opportunities in the water tube chemical boiler market. Moreover, efficiency leads to reduced operational costs and an approach towards minimizing energy expenditures.

The water tube chemical boiler market in Canada is likely to experience a surge in growth owing to the streamlined focus of provinces with a strong industrial and energy base. The nation's regulatory framework aims to achieve twofold objectives namely environmental and economic. Denoting a healthy environment and a robust economy. Key sectors contributing to the demand include oil and gas, chemicals, and power generation. Thus, industrial expansion and innovation thrust the growth.