Water Tube Chemical Boiler Market Outlook:

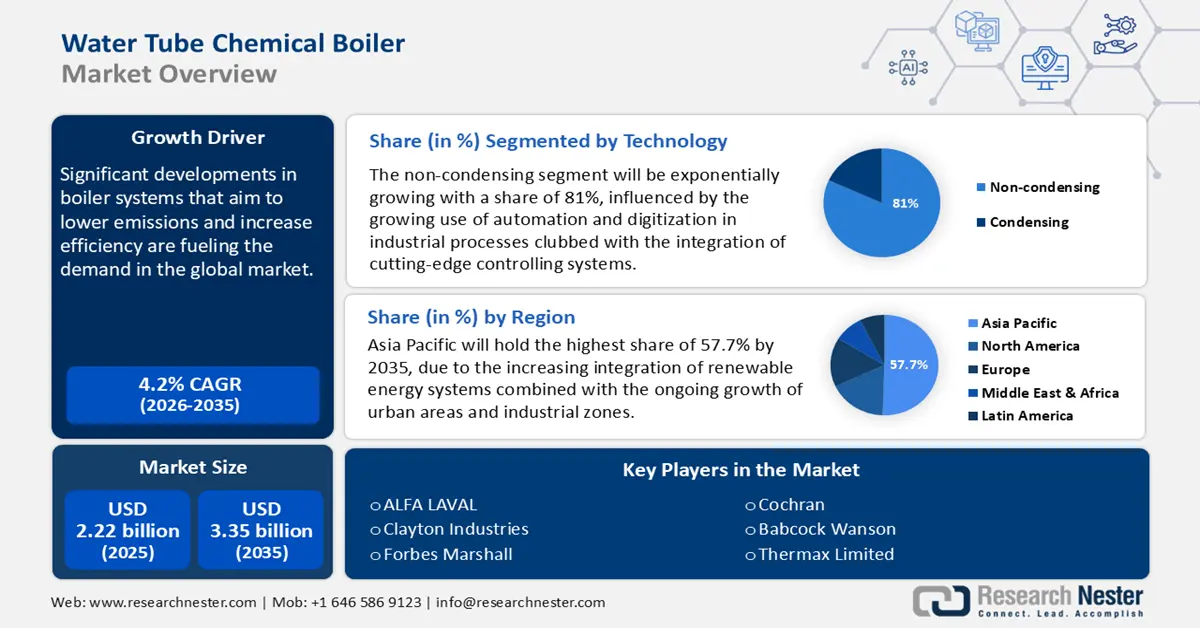

Water Tube Chemical Boiler Market size was valued at USD 2.22 billion in 2025 and is likely to cross USD 3.35 billion by 2035, registering more than 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of water tube chemical boiler is assessed at USD 2.3 billion.

An increasing rate of industrialization and rising production of chemicals are fueling the water tube chemical boiler market expansion. In addition, the need for energy-efficient solutions in various industries is demanding fuel-efficient boilers. For instance, Bryan Boilers' BFIT introduced a 100 HP water-tube system, which is designed to meet environmental regulations with 30 to 40% annual fuel savings.

To increase the product-market fit, manufacturers are focused on reducing downtime and enhancing both performance and operating safety, digital monitoring and automation in boiler operations are being developed further. For instance, in August 2021, Prometha Connected Boiler Solutions developed apps for iOS and Android smartphones. It provides real-time data analytics and system intelligence to monitor boiler system performance remotely. Furthermore, it aims at achieving real-time monitoring and to unfold predictive maintenance of the systems.

Key Water Tube Chemical Boiler Market Insights Summary:

Regional Highlights:

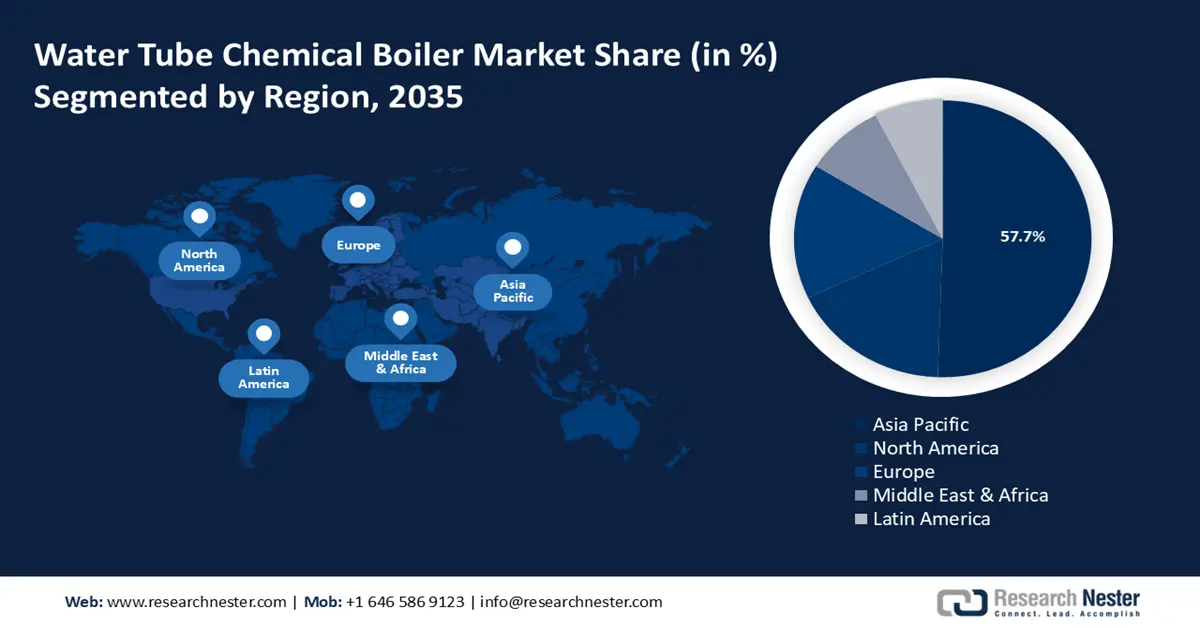

- Asia Pacific commands a 57.7% share in the water tube chemical boiler market, driven by rapid industrialization fueling growth through 2026–2035.

Segment Insights:

- The <10 MMBtu/hr segment is anticipated to see notable growth by 2035, driven by the demand for energy-efficient solutions in moderate-scale industrial chemical operations.

- The Non-condensing segment is anticipated to hold an 81% market share by 2035, driven by lower setup and maintenance costs combined with fuel flexibility.

Key Growth Trends:

- Increasing industrial demand

- Expansion of infrastructure

Major Challenges:

- Market demand fluctuations

- Skilled labor shortage

- Key Players: Thermax Limited, Thermodyne Boilers, Victory Energy Operations LLC, Viessmann, Forbes Marshall.

Global Water Tube Chemical Boiler Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.22 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 3.35 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (57.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, Germany, United States

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 14 August, 2025

Water Tube Chemical Boiler Market Growth Drivers and Challenges:

Growth Drivers

- Increasing industrial demand: The water tube chemical boiler market has gained an increasing industrial demand over time, attributable to the vigorous process of industrialization and the growth in chemical and petrochemical industries. Applications requiring high pressures and temperatures are predominantly sought by these industries, efficiently transmitted through water tube boilers. The trend toward cleanliness, and the use of natural gas and biofuels is accelerating the demand.

Moreover, water tube boilers become preferable for large-scale operations as they can accommodate fluctuating demand. For instance, typical boiler efficiencies range from about 90% for the best solid biomass fuel boilers, to around 95% for oil- and natural gas-fired boilers. In addition, water tube boilers are adaptable and can be blend with any kind of fuel. This feature enables industries in moving forward with adopting more environmentally friendly practices. - Expansion of infrastructure: The increasing amount of infrastructure expansions in the water tube chemical boiler market is driven by several strategic developments in the manufacturing sector. The growth is driven by the increasing need for energy-efficient and large-capacity boilers. For the upgrades in energy-intensive sectors, companies are investing heavily in industrial facilities and modernization of old structures.

In June 2023, AtmosZero developed a revolutionary modular electrified boiler to replace fossil fuel-powered industrial boiler systems. Boiling water for process steam accounts for over 7% of the world's energy consumption. Furthermore, its ground-breaking solution is developing an economical and scalable approach for decarbonizing steam with a vision to eliminate emissions.

Challenges

- Market demand fluctuations: Some of the critical factors causing the fluctuations in this market are the volatility in the global energy and raw material markets. As fuel prices such as natural gas, coal, and oil are changing, the boiler-dependent industries generally reduce or accelerate investments in new boiler installations. Moreover, price volatility in commodities and supply chain disruptions have also impacted the manufacturing process of water tube boilers, thereby making the schedule of the manufacturers tangled with production as well as pricing structures.

- Skilled labor shortage: The lack of talented human resource not only impacts production but also the maintenance of these intricate systems. Manufacturing and operating water tube boilers demand a degree of knowledge in metallurgy, welding, thermodynamics, and advanced engineering. With the ongoing increase in the demand for boilers that work under high pressure and high temperature, the design, installation, and therefore, maintenance is that much more difficult and requires efficient manpower.

The primary cause of this shortage is the aging workforce. This problem is aggravated further by the reluctance of younger generations to enter heavy industry and technical trades, as they perceive them as less desirable compared to working in a technologically driven economy. For instance, The U.S. Bureau of Labor Statistics has reported that almost 50.0% of the manufacturing workforce is age 45 or older, and this gap is increasing as workers retire without enough new entrants in their place to fill their roles.

Water Tube Chemical Boiler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 2.22 billion |

|

Forecast Year Market Size (2035) |

USD 3.35 billion |

|

Regional Scope |

|

Water Tube Chemical Boiler Market Segmentation:

Technology (Non-condensing, Condensing)

The non-condensing segment consumes a significant share of 81% of the water tube chemical boiler market. The main factor for the dominance is that it tends to have relatively lower setup and maintenance costs compared to the condensing type. In addition, it comes in a simpler design making them cheaper to install and simpler to maintain in applications where consistency and reliability are major concerns. These systems can further permit use with any type of fuel, hence encouraging flexibility within the chemical industry, where the selection of fuel may be based on availability and cost.

Capacity (< 10 MMBtu/hr, 10 - 25 MMBtu/hr, 25 - 50 MMBtu/hr, 50 - 75 MMBtu/hr, 75 - 100 MMBtu/hr, 100 - 175 MMBtu/hr, 175 - 250 MMBtu/hr, > 250 MMBtu/hr)

The water tube chemical boiler market is dominated by water tube chemical boilers with less than 10 MMBtu/hr at 32.0% due to their versatility in using smaller setups for industrial operations along with specialized processes involved in some chemical applications. This capacity is especially suitable for plants with moderate heat and steam requirements owing to the increased adoption of energy-efficient and cost-effective solutions. The areas such as India, China, and Southeast Asia are rapidly industrializing and urbanizing, with a growing focus on improving the efficiency of operations.

As these economies continue to ramp up their capacities for chemical processing, the demand for <10 MMBtu/hr boilers will soar exponentially. Moreover, the growth driver includes the implementation of strict environmental regulations toward emissions so that innovative smaller, cleaner, and energy-efficient water tube boilers are made. Therefore, the <10 MMBtu/hr segment of the water tube chemical boiler market will continue to dominate in the future, following the global pace toward sustainability and optimal operational cost.

Our in-depth analysis of the water tube chemical boiler market includes the following segments

|

Capacity |

|

|

Technology |

|

|

Product |

|

|

Fuel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Water Tube Chemical Boiler Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific accounts for the largest share of the water tube chemical boiler market with 57.7%, mainly due to rapid industrialization and the presence of strong economies such as India and China, who are hugely investing in infrastructure projects and industries for advanced boiler technologies to meet demand, as well as stringent environmental regulations for power. Furthermore, ongoing urban and industrial zone expansion as well as the growing integration of renewable energy systems with current boiler units is projected to support industry growth.

China is leading, owing to its sizeable industrial base and government initiatives for carbon emissions reduction. This intent by the country to update its boiler system with newer, more energy-efficient models aligns comprehensively with lowering carbon gas emissions toward its 2060 target for carbon neutrality. Such innovations by manufacturers in China include biomass-fueled boilers and smart boiler systems. A shift from traditional coal to cleaner varieties such as natural gas and biomass is further propelling the water tube chemical boiler market.

India witnessed the trend of an increase in demand for water tube chemical boilers in energy-intensive industries and the domestic companies are focused on expanding their reach in the foreign markets. For instance, the international order booking for Thermax Limited increased from USD 13.6 billion in FY 2020-2021 to USD 18.78 billion in FY 2021-22. In addition, the local government's Make in India initiative with increased investments in infrastructure development promotes the establishment of new industrial plants with efficient and high-capacity boilers.

North America Market Analysis

The landscape of the water tube chemical boiler market in North America is influenced by stringent EPA regulations on industrial emissions such as Nitrogen oxides (NOx) and Sulfur Oxides (SOx) which push the companies to make investments in low-emission boilers. For instance, in March 2024 Babcock & Wilcox's thermal business segment signed an agreement worth USD 246 million for a significant gas conversion project at a power plant in North America. The project entails switching the plant's two coal-fired boilers, which have a combined capacity of more than 1,000 megawatts, to natural gas operation.

In the U.S., industrial energy consumption accounts for approximately about 1/3rd of total energy utilization with a remarkable portion systematically distributed into various segments such as steam generation, highlighting the significance of efficient boilers. In addition, acceleration in the adoption of boilers with the use of cleaner fuels creates lucrative opportunities in the water tube chemical boiler market. Moreover, efficiency leads to reduced operational costs and an approach towards minimizing energy expenditures.

The water tube chemical boiler market in Canada is likely to experience a surge in growth owing to the streamlined focus of provinces with a strong industrial and energy base. The nation's regulatory framework aims to achieve twofold objectives namely environmental and economic. Denoting a healthy environment and a robust economy. Key sectors contributing to the demand include oil and gas, chemicals, and power generation. Thus, industrial expansion and innovation thrust the growth.

Key Water Tube Chemical Boiler Market Players:

- ALFA LAVAL

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ariston Holding N.V.

- Babcock & Wilcox Enterprises, Inc.

- Babcock Wanson

- BM GreenTech Berhad

- Bosch Industriekessel GmbH

- Clayton Industries

- Cleaver-Brooks

- Cochran

- Forbes Marshall

- Miura America Co., LTD.

- Rentech Boiler Systems, Inc.

- Thermax Limited

- Thermodyne Boilers

- Victory Energy Operations LLC

- Viessmann

The water tube chemical boiler market is exponentially transforming with key players that emphasize inculcating advanced technologies and smart solutions to boiler systems' operational reliability and efficacy. Additionally, these reputable businesses leverage their extensive experience and commitment to sustainability. Moreover, focusing on introducing niche applications and fostering innovation to meet the rising demand across various industries assists them in remaining competitive while striving to increase their revenue share in the market. Some of these market players are:

Recent Developments

- In January 2024, Victory Energy Operations and Powerhouse Combustion & Mechanical Corporation extended their sales partnership. The latter was designated as the authorized sales representative for Victory Energy products in California and Nevada. This included water tube boilers, firetube boilers, HRSGs, VISION burners, economizers, and rental units.

- In April 2021, Viessmann's ViCare Thermostat and ViCare control system app, Vitodens 100-W, was introduced equipped with built-in WiFi and high compatibility quality, which can be fully controlled from a smartphone or tablet.

- Report ID: 6561

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Water Tube Chemical Boiler Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.