Water Treatment Systems Market Outlook:

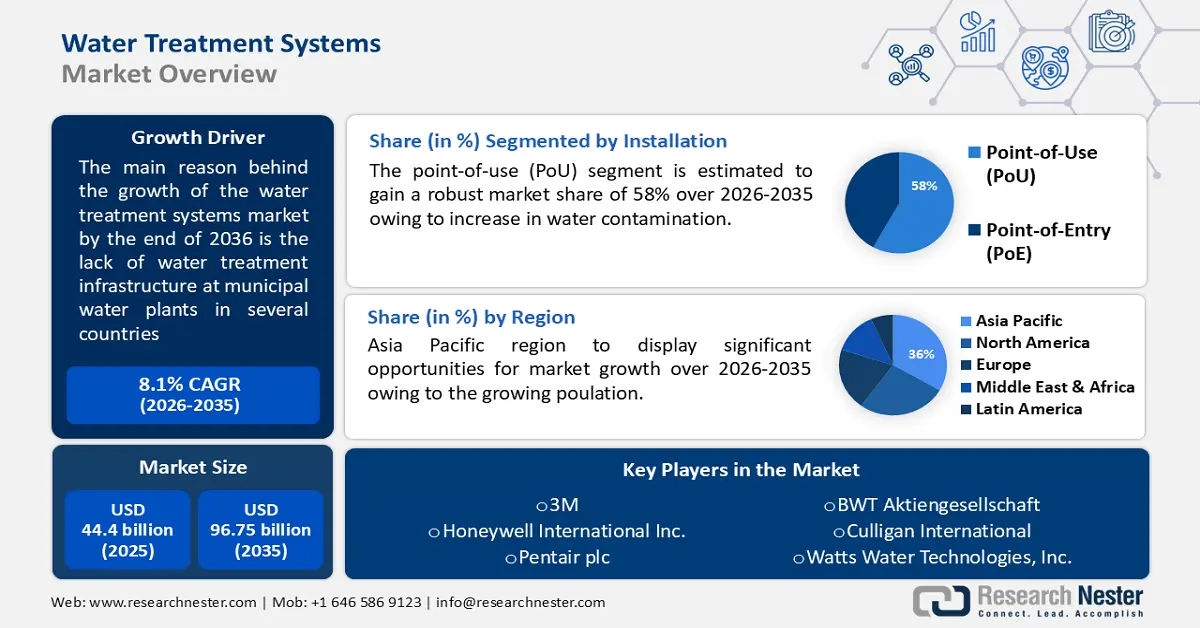

Water Treatment Systems Market size was over USD 44.4 billion in 2025 and is anticipated to cross USD 96.75 billion by 2035, growing at more than 8.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of water treatment systems is assessed at USD 47.64 billion.

The water treatment systems market is predicted to grow due to the growing demand to reduce water contamination. Many people around the world were alarmed by rising levels of water contamination. By mixing dangerous chemical compounds and microbes, more industrial activity is polluting the surface water. These dangerous substances are of immediate danger to human health. According to a report by World Health Organization (WHO), at least 1.7 billion people worldwide will be using feces-contaminated drinking water in 2022. The biggest threat to the safety of drinking water is microbiological contamination brought on by feces. Installation of water treatment devices in individual dwellings or buildings is encouraged by the lack of water treatment infrastructure at municipal water plants in several countries. Therefore, this factor is impacting the growth of the water treatment systems market.

Key Water Treatment Systems Market Insights Summary:

Regional Highlights:

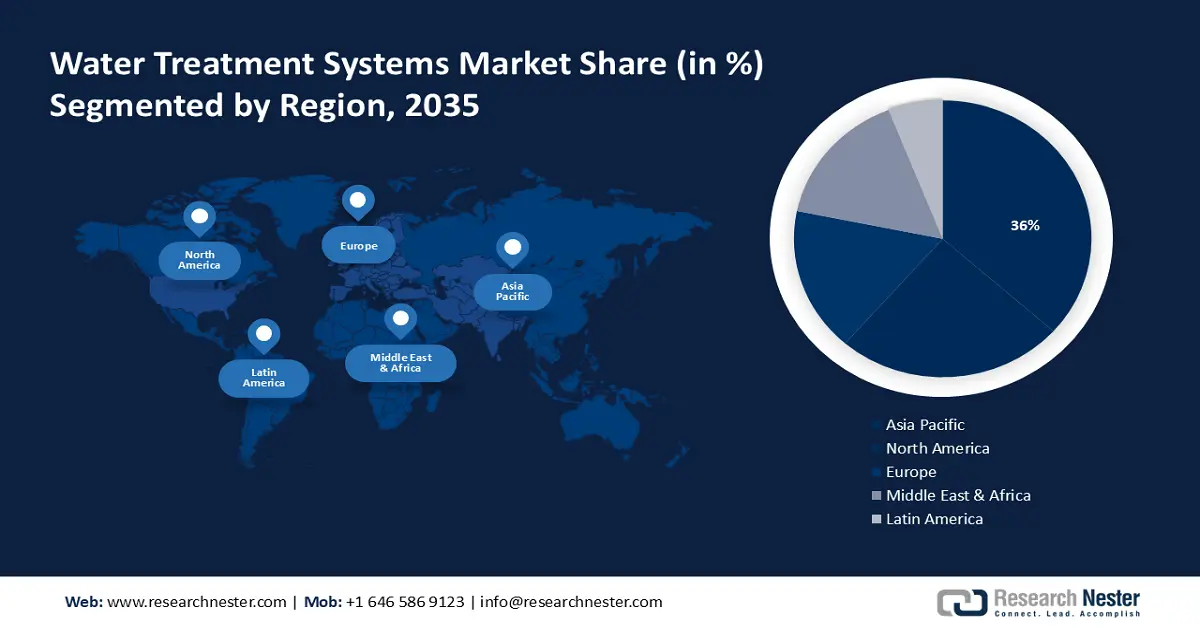

- Asia Pacific water treatment systems market is expected to capture 36% share by 2035, fueled by rising water contamination and poor municipal treatment.

- North America market will secure the second largest share by 2035, fueled by demand for residential and commercial water systems.

Segment Insights:

- The point-of-use segment in the water treatment systems market is anticipated to hold a 58% share by 2035, propelled by the increase in water contamination and lack of safe drinking water.

- The reverse osmosis segment in the water treatment systems market is projected to secure a 35% share by 2035, driven by its ability to remove 99% of water impurities and technological advances.

Key Growth Trends:

- Growing implementation of laws and regulations

- Increasing demand for advanced water treatment solutions

Major Challenges:

- Increased operational and maintenance costs

Key Players: 3M, Honeywell International Inc., DuPont, Pentair plc, BWT Aktiengesellschaft, Culligan International, Watts Water Technologies, Inc., Aquasana, Inc., Calgon Carbon Corp., Pure Aqua, Inc., LG Electronics.

Global Water Treatment Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 44.4 billion

- 2026 Market Size: USD 47.64 billion

- Projected Market Size: USD 96.75 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Water Treatment Systems Market Growth Drivers and Challenges:

Growth Drivers

- Growing implementation of laws and regulations - Fresh water makes up only three percent of the water on Earth and just 1.2% of that can be consumed as drinking water. Therefore, the increasing implementation of various laws and legislation to ensure the supply of safe drinking water to the masses is fueling water treatment system market growth.

For instance, The United States' drinking water quality is safeguarded under the Safe Drinking Water Act (SDWA). In addition to this, by 2024, every household in rural India is expected to have access to sufficient and clean drinking water via individual tap connections due to the Jal Jeevan Mission.

- Increasing demand for advanced water treatment solutions - Global sales of water treatment systems have surged due to the introduction of novel technologies and their integration into various systems, including RO+UV systems.

For instance, by introducing a line of fashionable, distinctive, and high-end goods, Blue Star Limited, the top air conditioning and commercial refrigeration firm in India, has announced its debut in the home water purifier market. The company's initial product offering will be household water purifiers; over time, it will expand to include commercial water filtration devices.

- Increased integration of IoT in water supply systems - The entire infrastructure for the supply and distribution of water is monitored by the Internet of Water. Because it offers residents of rural and remote locations a reliable water supply during these water-scarce times, the Internet of Things is a disruptive force for water treatment utilities.

For instance, the introduction of the "O&M Support Digital Solution" was announced by Hitachi, Ltd. By using digital technologies like artificial intelligence (AI) and the Internet of Things (IoT) to collect and analyze a variety of data about the operations of the water supply and sewerage business, this service will help ensure stable operations of plants. Future developments in water treatment systems market are anticipated to increase the rate at which potable water is produced, making it easier to supply the expanding population.

Challenges

- Increased operational and maintenance costs - In addition to their original capital expenses, water treatment systems often incur continuing operating and maintenance costs for things like energy usage, chemical treatment, membrane replacement, and system monitoring. The total cost of ownership (TCO) of water treatment systems can build up over time for large-scale installations. Therefore, this factor may act as a barrier to the growth of the water treatment systems market.

Growing concern regarding aging infrastructure - The majority of wealthy nations struggle with the issue of aging infrastructure. These nations still employ antiquated water treatment infrastructure that was constructed decades ago. To upgrade and reinstall these outdated infrastructures, significant financial outlays are required. Therefore, this factor may hinder the growth of the water treatment system market.

Water Treatment Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 44.4 billion |

|

Forecast Year Market Size (2035) |

USD 96.75 billion |

|

Regional Scope |

|

Water Treatment Systems Market Segmentation:

Installation Segment Analysis

In water treatment systems market, point-of-use segment is projected to account for revenue share of around 58% by 2035. The segment growth is propelled by the increase in water contamination. PoUs are essential for the treatment of drinking water in underdeveloped areas because they are easy to use, affordable, require little maintenance, and are grid-independent.

According to a 2023 UNESCO report, 3.6 billion people (46%) do not have access to securely managed sanitation, and 2 billion people (26%) do not have access to safe drinking water globally. These systems are of great use in health care settings, especially for the treatment of patients who have an impaired immune system. The segment for point-of-use water treatment systems is expected to increase significantly over the forecast period, as a result of various factors such as population growth, increased awareness about the benefits of water treatment, and technological advances in this area.

Technology Type Segment Analysis

By the end of 2035, reverse osmosis segment is anticipated to dominate water treatment systems market share of around 35%. To remove 99% of water impurities while offering the same quality as drinking water, RO systems are using innovative membrane filter technology. Therefore, water purification is frequently performed by such systems. They're considered to be the most efficient way of treating hard water. The reverse osmosis system is typically connected to a mechanical and activated carbon filter.

RO water purifiers are available in a variety of sizes and shapes, including wall-mounted, tabletop, under-sink, and under-the-counter models. To support the growth of this sector, reverse osmosis technology has a higher efficiency, a higher capacity, and a lower economic cost compared to other technologies.

According to a National Institutes of Health report, the groundwater in NCP has sufficiently high removal or rejection efficiency (91–98%) for important elements including TDS, hardness, alkalinity, silica, and significant ions (Ca2+, Mg2+, Na+, Cl−, and SO42−) for the RO stations now in operation.

Our in-depth analysis of the water treatment systems market includes the following segments:

|

Installation |

|

|

Technology Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Water Treatment Systems Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to dominate majority revenue share of 36% by 2035. The region's rising levels of water contamination are to blame for the expansion. Also, it is expected that the region's limited access to a clean drinking water supply will contribute to the increased use of water treatment technology. Furthermore, the nation's point-of-use systems have become increasingly popular at home due to inadequate treatment infrastructure at municipal treatment facilities.

The water treatment systems market is poised to grow at a rapid rate in China led by the growing installment of water treatment systems in residential and commercial. Reverse osmosis, disinfection, and distillation systems are examples of water treatment systems that are predicted to see an increase in demand across a range of end-use industries due to the rapid expansion of industrial activity and rising levels of water pollution. For instance, about 70% of the nation's rivers and lakes are unsuitable for human use due to toxic human and industrial waste dumping, which has contaminated up to 90% of the groundwater in the nation.

In Korea, the water treatment systems market is projected to grow substantially during the forecast timeline. The market is growing in the nation owing to the several initiatives taken by the government to support water treatment and filtration processes. For instance, in 2023, South Korea declared the beginning of a new project to design wastewater treatment facilities that will automate management and operation through the use of artificial intelligence (AI) technologies.

The demand for water purifiers in both the household and commercial sectors is being driven by environmental concerns about single-use plastics and the carbon footprint of water purifying procedures. These factors are responsible for the market's rise in Japan.

North America Market Insights

By 2035, North America region is anticipated to hold the second position owing to the high uptake of water treatment systems among consumers. Moreover, the expansion of the water treatment systems market is driven by the presence of large-scale commercial producers and their well-established distribution networks. The industrial share of water treatment systems (point of use) and water filter use are further driven by the strong growth of regional commercial sectors including banking, telecom, and IT.

The water treatment systems market is growing in the United States due to the growing adoption of various water treatment systems in the residential sector to treat wastewater. According to a recent report by the US Environmental Protection Agency, septic systems in the US provide service to over 60 million people. Septic or other decentralized treatment systems service about one-third of all new construction.

In Canada, the water treatment systems market is slated to grow significantly influenced by the growing population and surge in construction projects. For instance, Canada, which has more than 40 million citizens as of 2024, is ranked 37th in the globe in terms of population. It makes up around 0.5% of all countries worldwide.

Water Treatment Systems Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- DuPont

- Pentair plc

- BWT Aktiengesellschaft

- Culligan International

- Watts Water Technologies, Inc.

- Aquasana, Inc.

- Calgon Carbon Corp.

- Pure Aqua, Inc.

- LG Electronics

Recent Developments

- DuPont Water Solutions was awarded the 2023 Energy and Sustainability Award from The American Institute of Chemical Engineers (AIChE) for creating a line of energy-efficient reverse osmosis (RO) membranes that help decarbonize the water purification process. Reverse osmosis membranes for industrial applications, such as DuPontTM FilmTecTM Prime RO, use up to 20% less energy and can improve permeate quality by up to 60%, which means fewer chemicals are used throughout the water purification process.

- Culligan Water, a leader in the world and innovator in providing top-notch water treatment and services, announced the introduction of Cullie, the first AI waterbot. The newest invention from the pioneer of the water industry, Cullie uses ChatGPT conversational capabilities to improve online interactions and offer 24/7 educational help to improve the Culligan customer experience.

- Report ID: 6103

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Water Treatment Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.