Water Treatment Polymers Market Outlook:

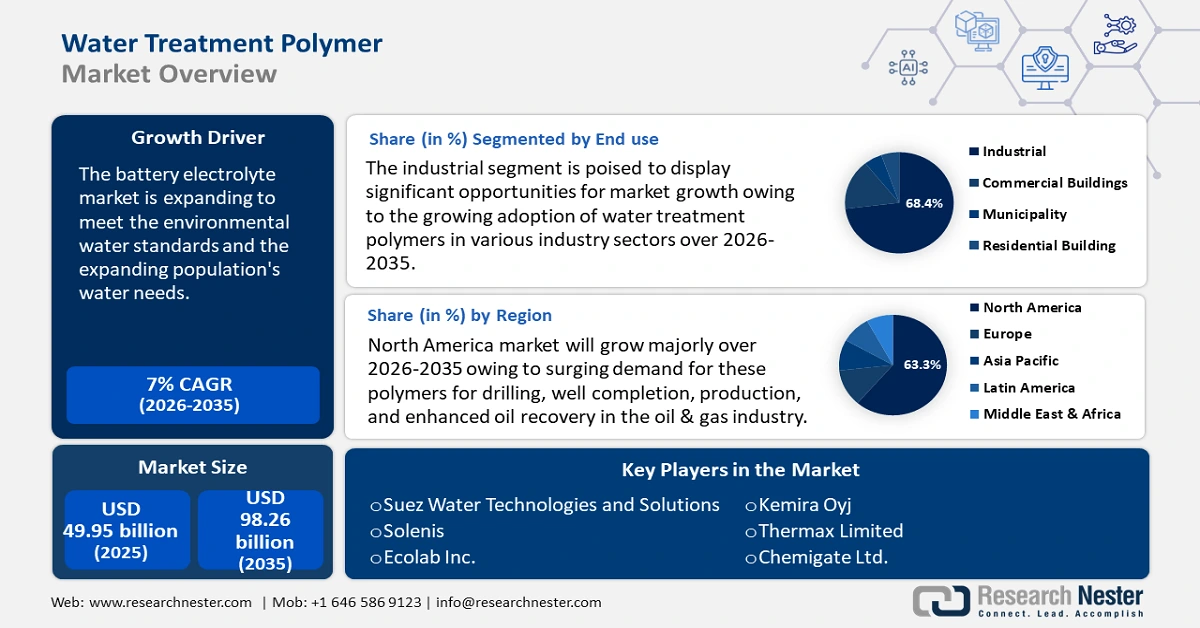

Water Treatment Polymers Market size was over USD 49.95 billion in 2025 and is projected to reach USD 98.26 billion by 2035, growing at around 7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of water treatment polymers is evaluated at USD 53.1 billion.

The water treatment polymers market is experiencing significant growth as it adapts to the increasing environmental standards and the rising demand for clean water driven by a growing global population. This expansion is fueled by the need for effective solutions to address water pollution and enhance the water quality available for various uses, including drinking, agriculture, and industrial processes. As regulations become more stringent to protect natural water resources, the demand for innovative polymer-based solutions that facilitate efficient water treatment processes is on the rise. According to the UN World Water Development Report, 2.2 billion people lacked access to safely regulated drinking water as of 2022. Water treatment polymers are employed in manufacturing processes, cooling and heating systems, and consumer applications.

Polymers are extremely effective in the treatment of wastewater. These molecular chains help to separate the wastewater's solid and liquid components. Once the two components of wastewater are separated, it is much easier to finish the treatment process by isolating solids and treating liquids, leaving clean water suitable for safe disposal or use in other industrial applications. Numerous industries, including thermoelectric power plants, semiconductors, pharmaceuticals, food and beverage, mining and metal, oil and gas, and petrochemicals, are experiencing a surge in demand for these polymers.

Key Water Treatment Polymer Market Insights Summary:

Regional Highlights:

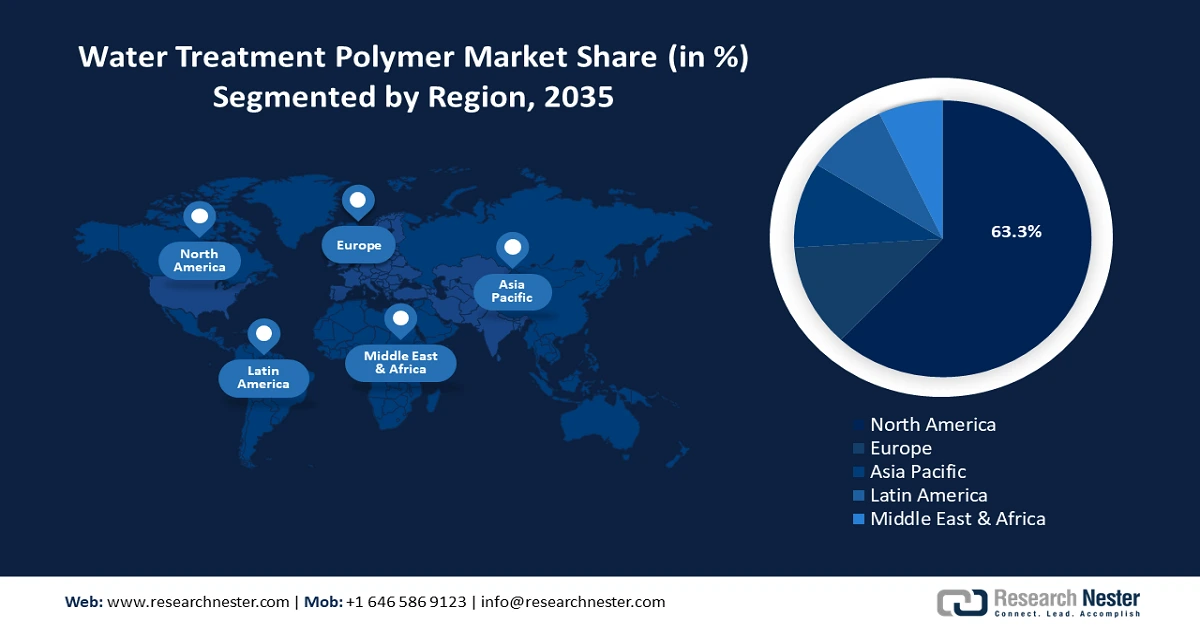

- North America commands a 63.3% share in the water treatment polymers market, driven by surging demand from the oil & gas industry for enhanced recovery, positioning it for robust growth through 2035.

- Europe's water treatment polymers market is projected to see huge growth through 2035, attributed to increased government initiatives for water & wastewater treatment.

Segment Insights:

- The Industrial segment is expected to hold a 68.40% market share by 2035, fueled by the adoption of water treatment polymers in industrial sectors like semiconductors.

- The Water Treatment segment of the Water Treatment Polymers Market is expected to capture a significant share by 2035, fueled by rising clean water demand and global awareness of treated water benefits.

Key Growth Trends:

- Rapid industrialization

- Shift towards sustainable polymers

Major Challenges:

- Environmental concerns surrounding the potential for overused polymers

- Higher cost of wet sludge

- Key Players: Suez Water Technologies and Solutions, Solenis, Ecolab Inc., Kemira Oyj, Thermax Limited, Chemigate Ltd., Alken-Murray Corporation, Aries Chemical, Inc., Chemco Products Inc., SNF Group.

Global Water Treatment Polymer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 49.95 billion

- 2026 Market Size: USD 53.1 billion

- Projected Market Size: USD 98.26 billion by 2035

- Growth Forecasts: 7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (63.3% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Water Treatment Polymers Market Growth Drivers and Challenges:

Growth Drivers

- Rapid industrialization: Water treatment polymers are in high demand due to the rapid industrialization across the world, especially in the industrial sector for uses like heat exchanger fluids and steam generation. According to United Nations Educational, Scientific and Cultural Organization (UNESCO), industry and energy are responsible for 19% of global freshwater withdrawals, including groundwater. The discharge of almost 80% of all wastewater produced into waterways pollutes the environment and endangers aquatic life and human health.

Moreover, the release of heavy metals into the environment from painting and electroplating waste is a consequence of advancements in industrial technologies. One of the most promising methods for removing heavy metals from wastewater is the adsorption process, which uses inexpensive materials. Also, composites are gaining popularity due to their high mechanical feasibility, enhanced stability, and potential absorptivity. - Shift towards sustainable polymers: Biopolymers enhance water treatment by creating flocs that improve the removal of particles and contaminants. Chitosan, alginate, and starch-based polymers are particularly effective due to their biodegradability and low environmental impact. FUR4Sustain, a European network for FURan-based chemicals and materials for sustainable development, is addressing the issues of traditional petrol-based polymers through innovative solutions based on furan compounds. The initiative promotes 2.5-furan dicarboxylic acid (FDCA), a renewable chemical derived from agricultural waste and forestry by-products. FDCA serves as an eco-friendly alternative to petrochemical acids, contributing to sustainable practices in water treatment and material production.

Water treatment procedures can become more ecologically conscious by substituting these biopolymers for conventional chemical coagulants. In addition to addressing issues with water quality, this change advances the overarching objective of encouraging sustainability in water management techniques. - Increased government regulations: Government laws for wastewater treatment and reinjection policies are another factor escalating the growth of the water treatment polymers market. For instance, the Government of India has tightened restrictions, requiring large users to recycle half of their effluent by 2031 to reduce water wastage. Organizations that use more than 5,000 liters per day need to register and implement thorough treatment procedures.

Additionally, in 2020, Europe established minimum standards for urban wastewater reuse and mandated transparency and risk management definitions. Crop profitability, downstream cascade reuse, and water scarcity will restrict the actual influence of regulation on circular economy goals.

Challenges

- Environmental concerns surrounding the potential for overused polymers: Operators attempting to resolve a settle ability issue may add polymer; however, adding too much polymer results in a negative charge, which precludes flocculation and worsens the situation. Furthermore, large volumes of polymer can blind filter presses and media, resulting in further pollution concerns. This may impede the water treatment polymers market from growing.

- Higher cost of wet sludge: Composed of 90-95% water and 5-10% garbage, sludge is produced during the wastewater treatment process. Along with personnel and energy expenditures, one of the biggest expenses for wastewater treatment plants is the transportation and disposal of water-heavy sludge, also known as biosolids or solids, which may hinder the expansion of the water treatment polymers market.

Water Treatment Polymers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7% |

|

Base Year Market Size (2025) |

USD 49.95 billion |

|

Forecast Year Market Size (2035) |

USD 98.26 billion |

|

Regional Scope |

|

Water Treatment Polymers Market Segmentation:

End use (Residential Buildings, Commercial Buildings, Municipality, Industrial)

In water treatment polymers market, industrial segment is projected to dominate revenue share of around 68.4% by the end of 2035. The segment growth can be attributed to the growing adoption of water treatment polymers in various industry sectors such as thermoelectric power plants, semiconductors, pharmaceuticals, food & beverage, oil & gas, and petrochemicals for adhesives, oil recovery, and water treatment. The semiconductor industry’s demand for ultrapure water underscores the challenge of water consumption, as creating 1,000 gallons of ultrapure water requires approximately 1,400 to 1,600 gallons of municipal water. An average chip manufacturing facility uses about ten million gallons daily, equivalent to the water consumption of 33,000 US families. With rising wastewater levels, specialized polymers play a crucial role in managing this waste while enhancing performance and efficiency in various applications, making them vital for sustainable semiconductor manufacturing. The demand for treated water for steam generation, cooling towers, and other industrial equipment, including oil and gas treatment for power generation, is expected to increase as power plants focus on enhancing their output.

Product Type (Polyacrylamides, Polyacrylates, Quaternary Ammonium Polymers, Polyamines)

The polyacrylamides segment in water treatment polymers market will garner a notable share in the forecast period. The segment growth is expected to be driven by the growing need for polyacrylamide in drinking water purification facilities, industrial wastewater treatment facilities, and municipal sewage treatment facilities. Additionally, government regulatory agencies in several nations are focusing on the water treatment sector which will expand the segment growth. The potable water treatment sector has made significant use of polyacrylamide's ionic forms. The lengthy polymer chains of polyacrylamide act as a bridge between trivalent metal salts such as ferric and aluminum chlorides.

The flocculation rate is significantly increased as a result. As a result, raw water's total organic content (TOC) can be significantly reduced by water treatment facilities. Polyacrylamide and its derivatives are also frequently used in subsurface applications like enhanced oil recovery. The economics of traditional waterflooding can be improved by injecting high-viscosity aqueous solutions that are produced with low quantities of polyacrylamide polymers.

Application (Preliminary Treatment, Water Treatment, Sludge Treatment)

The water treatment segment is estimated to gain a significant share in water treatment polymers market by 2035. The segment growth can be credited to the growing demand for clean water with the increasing global population. Countries are now aware of the detrimental impacts of pollutants ranging from heavy metals to persistent organic waste. This has led to significant expenditure and attention being paid to lessening the effects of released water on the environment and people. Water treatment polymers work well as flocculants, which combine the contaminants in the water and facilitate purification. Therefore, it is anticipated that the demand for water treatment polymers will increase shortly due to the increased awareness of the use of treated water globally.

Our in-depth analysis of the global water treatment polymers market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Water Treatment Polymers Market Regional Analysis:

North America Market Statistics

North America water treatment polymers market is anticipated to capture revenue share of over 63.3% by 2035. The market growth in the region can be attributed to the surging demand for these polymers for drilling, well completion, production, and enhanced oil recovery in the oil & gas industry. As the region continues to develop fracking technologies, the enhanced oil recovery technology is expected to play a significant role in oil and gas extraction operations, driving regional water treatment polymers market expansion. Furthermore, the presence of several agencies in the U.S. like the Environmental Protection Agency (EPA), and UN-water has mandated that industries treat water before it is disposed out of the facility.

In Canada, the growing demand for prudent water management and wastewater treatment has increased as a result of shifting climatic patterns and the acknowledgment of water shortage as a global problem. Therefore, the country is actively engaging in research & development efforts to explore sustainable and cost-effective wastewater treatment techniques for rural communities.

Europe Market Analysis

Europe will encounter huge growth in the water treatment polymers market during the forecast period. The market is growing in the region due to the increased government initiatives for water & wastewater treatment. For instance, the European Commission proposed to amend the urban wastewater treatment regulation in October 2022 to align with the EU's policy goals for pollution reduction, the circular economy, and climate action. One of the main projects within the EU's zero pollution action plan for land, water, and air is the legislation.

Among Europe's leading producers of chemicals is Germany. Since the nation is home to several important industries, water treatment laws are essential for reducing pollution. Sales of water treatment polymers are anticipated to increase in Europe as a result of strict regulations about water treatment, particularly in Germany. Polyacrylamides are the most widely used product type segment in Germany due to their growing use in metal recovery by flocculation of metal through the preparation of metal salts.

Key Water Treatment Polymers Market Players:

- Suez Water Technologies and Solutions

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solenis

- Ecolab Inc.

- Kemira Oyj

- Thermax Limited

- Chemigate Ltd.

- Alken-Murray Corporation

- Aries Chemical, Inc.

- Chemco Products Inc.

The water treatment polymers market will continue to grow due to major players making significant R&D investments to broaden their product ranges. Important market developments include new product releases, contractual agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. The manufacturers need to provide affordable products to grow and thrive in a more cutthroat and expanding market environment.

Recent Developments

- In January 2024, Solenis, a leading global producer of specialized chemicals for water-intensive industries, plans to expand its operations in Suffolk, Virginia. The business plans to develop a new 80,000-square-foot production facility, packaging facility, and tank farm, as well as a new rail spur, to handle the production of polyvinyl amine (PVAm) polymer compounds used in paper and cardboard manufacturing.

- In September 2023, SUEZ signed two new substantial contracts in the water and waste markets to help China meet its carbon neutrality target by 2060. In Chongqing, SUEZ is working with a long-standing partner to improve the resilience of the city's water supply system by building a new water treatment facility.

- Report ID: 6823

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Water Treatment Polymer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.