Water-Soluble Polymer Market Outlook:

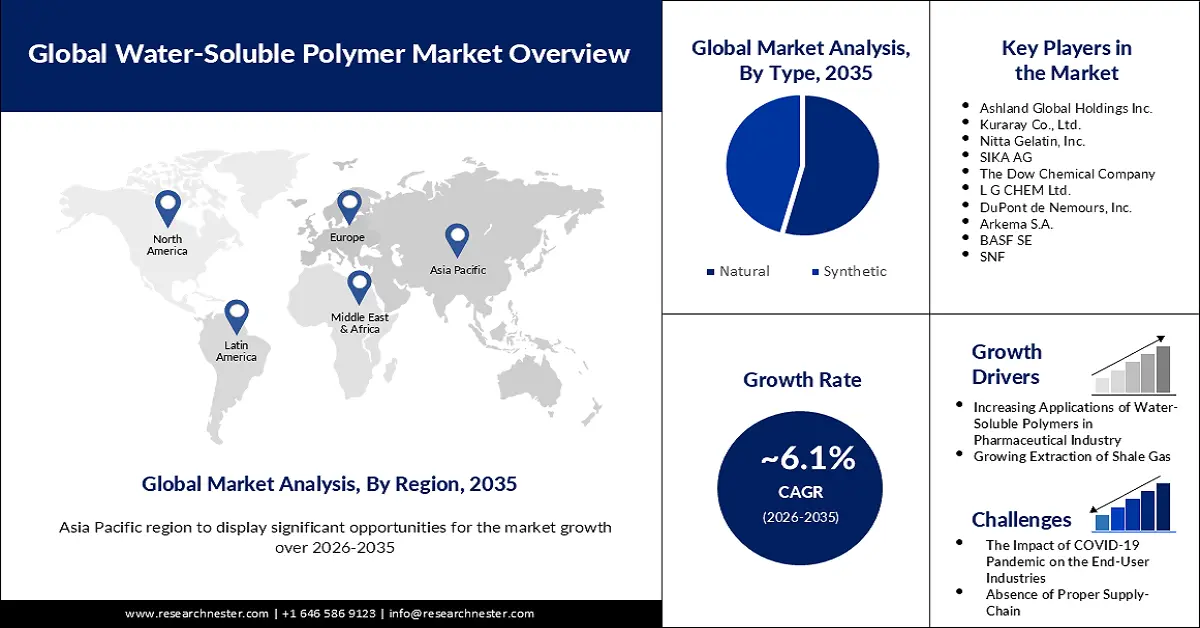

Water-Soluble Polymer Market size was over USD 41.43 billion in 2025 and is anticipated to cross USD 74.9 billion by 2035, growing at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of water-soluble polymer is assessed at USD 43.7 billion.

The growth of the market can be attributed to the increasing use of these polymers in a variety of end-user industries. The chemical industry is a major component of the economy. The rise in the chemical industry is projected to spur the product supply. According to the World Bank, the Chemical industry in the U.S. accounted for 16.43% of manufacturing value-added in 2018. With the growing demand from end-users, the market for chemical products is expected to grow in the future. According to UNEP (United Nations Environment Program), the sales of chemicals are projected to almost double from 2017 to 2030.

Furthermore, the expanding demand for bio-based acrylamide and its increasing usage in the pharmaceutical business is expected to most certainly provide manufacturers with several prospects. Its applications in processing minerals, wastewater from factories and municipalities treatment, oil sand tailings dewatering, paper manufacturing, and biotechnology are also likely to contribute to market growth over the projection period.

Key Water-Soluble Polymer Market Insights Summary:

Regional Highlights:

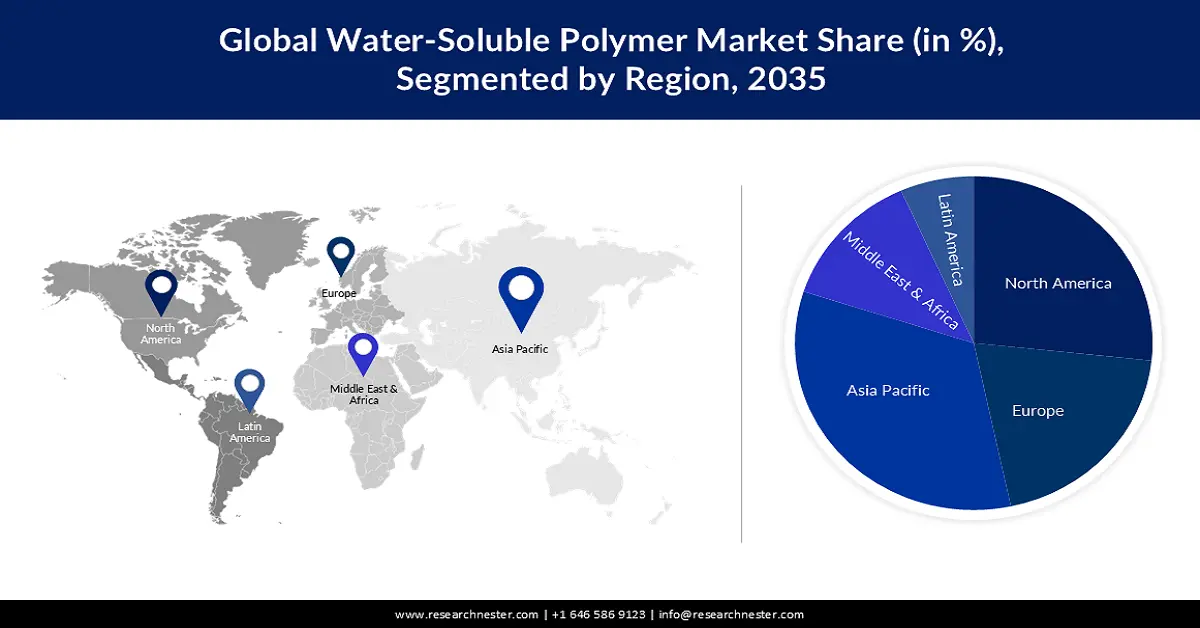

- Asia Pacific’s water-soluble polymer market will hold around 42% share by 2035, fueled by rising investments in water treatment projects, widespread polymer production in China, and growing wastewater treatment needs.

- North America market will achieve a noteworthy share by 2035, attributed to increasing shale gas and petroleum production, boosting demand for polymers in oil and gas extraction processes.

Segment Insights:

- The natural segment in the water-soluble polymer market is anticipated to secure a 57% share by 2035, driven by the eco-friendly, biodegradable, and food-safe nature of natural water-soluble polymers.

- The guar gum segment in the water-soluble polymer market is projected to achieve a 35% share by 2035, driven by its thickening, stabilizing, and binding properties for food and medicinal applications.

Key Growth Trends:

- Growing Oil and Gas Industry

- The Rise in Water Treatment Industry

Major Challenges:

- Growing Oil and Gas Industry

- The Rise in Water Treatment Industry

Key Players: SPCM S.A., Ashland Global Holdings Inc., Kuraray Co., Ltd., Nitta Gelatin, Inc., SIKA AG, The Dow Chemical Company, L G CHEM Ltd., DuPont de Nemours, Inc., Arkema S.A., BASF SE, SNF.

Global Water-Soluble Polymer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 41.43 billion

- 2026 Market Size: USD 43.7 billion

- Projected Market Size: USD 74.9 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 9 September, 2025

Water-Soluble Polymer Market Growth Drivers and Challenges:

Growth Drivers

- Growing Oil and Gas Industry- Water-soluble polymers are widely used in the oil and gas sector, notably in the upstream and midstream segments. Drilling, well conclusion, cementing, oil and gas well creation, diverting substances, well stimulation, deposit formation management, and the treatment of oil and oil-contaminated facilities are all applications for it. To maximize efficiency in production and meet expanding energy needs, oil companies mainly rely on hydraulic fracturing and chemical increased oil recovery procedures. In December 2020, US oil production (including crude oil and condensate) hit 11.2 million barrels per day (b/d), and US natural gas extraction (gross withdrawals) hit 112.6 billion cubic feet per day (Bcf/d).

- The Rise in Water Treatment Industry- Water-soluble polymer substances are essential components of solid-liquid separation units used to remediate procedure effluents. They are water-soluble polymers with long chains that separate Non-settling tiny particles from aqueous solutions. Mineral processing, commercial and residential wastewater treatment, paper manufacturing, and biotechnology all require water-soluble polymers. China plans to build or update 80,000 kilometers of sewage collection pipeline systems between 2021 and 2025, as well as increase sewage treatment capacity by 20 million cubic meters per day.

- Increasing Applications of Water-Soluble Polymers in the Pharmaceutical Industry- Total global pharmaceutical sales were expected to be approximately USD 900 billion in 2018, growing to nearly USD 1500 billion by 2021.

- Major Growth in Food & Beverages Sector- The beverage industry's revenue is expected to reach US$91.03 billion in 2023. The food service business reached pre-pandemic levels by 2021. In 2021, the food service businesses in the United States supplied around $2.12 trillion in food.

- Expansion in Global Detergent Industry- The global laundry detergent industry was worth slightly under 120 billion US dollars in 2019. The market's worth is expected to rise year after year, reaching almost 180 billion US dollars by 2026.

Challenges

- The Impact of the COVID-19 Pandemic on the End-User Industries

- Absence of Proper Supply-Chain

- The Environmental Impacts of Synthetic Water Soluble Polymers- Large molecular weight polyacrylamides are extensively used as a flocculant in sewage treatment and as a viscosity modifier in improved recovery of oils. Overconsumption and insufficient treatment may damage local water sources, harming the region's ecology and fauna. Polyethylene having a high molecular weight is also less damaging to the ecosystem. During the procedure, nevertheless, these plastics are subjected to a hostile mechanical, chemical, and thermal environment. This issue enables high molecular weight substances to decay and break down, affecting their chemical and physical attributes and stifling market expansion overall.

Water-Soluble Polymer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 41.43 billion |

|

Forecast Year Market Size (2035) |

USD 74.9 billion |

|

Regional Scope |

|

Water-Soluble Polymer Market Segmentation:

Type Segment Analysis

The market is segmented and analyzed for demand and supply by type into natural, and synthetic. Out of these, the natural segment is estimated to gain the largest market share of about 57% in the year 2035. Natural water-soluble polymer outperform synthetic water-soluble polymer and provide easy access to ecological accreditation. Its ability to dissolve in both cold and hot water, biodegradable characteristics, and organic nature make it a high-performance, appealing, eco-friendly solution that fits the needs of consumers, regulations, and the community. Natural materials account for more than 90% of the water-soluble polymers utilized in food and beverage industries. In this end use, gelatin (from animal bones and hides) and casein (from milk) are used massively among all water-soluble polymers. Natural water-soluble polymers perform a wide range of functions in packaged foods, usually at modest levels of usage (less than 1% by weight).

Material Segment Analysis

The global water-soluble polymer market is also segmented and analyzed for demand and supply by material into guar gum, polyvinyl alcohol, casein, gelatin, and others. Amongst these segments, the guar gum segment is expected to garner a significant share of around 35% in the year 2035. The Guar gum segment is expected to dominate the industry in the next years. Guaran, a water-soluble polysaccharide, accounts for 85% of the gum's composition. Guar gum is utilized as a food ingredient in the food and beverage sector owing to its stabilizing, thickening, and binding qualities, which provide a smooth texture. They extend the shelf life of prepared foods. likewise, the substance is frequently utilized in medicinal dosage forms, primarily as a binder in tablet production. Gaur gums are favored over synthetic plastics because they are non-toxic, economical, environmentally friendly, and widely available.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Material |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Water-Soluble Polymer Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 42% by 2035. According to the report by the Asia-Pacific Economic Cooperation (APEC), the chemical industry of the APAC region represents more than 45% of global chemical production. Moreover, As reported by the Government of India's Ministry of Jal Shakti, the proportion of rural residents with access to clean and sufficient drinking water within locations improved to 61.5% in FY 2022 from 55.2% in FY 2021. In addition, numerous firms in India, including Suez, Abengoa, and SPML Infra, are spending money on water treatment assignments, which are projected to fuel the Asia Pacific market. Also, water-soluble polymers are widely produced and consumed in China. As the wastewater treatment sector expands throughout the projection period, regional requirements for polymers including polyacrylamide, a frequently employed flocculating and coagulating compound in treating wastewater, are likely to rise and expand the market growth.

North American Market Insights

The market in the North American region is anticipated to gain a noteworthy market share throughout the forecast period owing to the increasing production of shale gas, and other petroleum products in the region. The increasing use of these polymers in the extraction of shale gas is expected to boost regional market growth. The oil and gas industry's rising requirement for these components is mostly for drilling, well conclusion, manufacturing, and enhanced oil recovery procedures. The enhanced oil recovery technique will likely grow into a substantial component of the extraction of oil and gas operations as the United States proceeds to improve fracking technology, fueling regional market expansion. Growing demand from the oil and gas sector is expected to drive the expansion of the market, owing to the better customizability afforded by these polymers over conventional injection fluids used in enhanced oil recovery.

Europe Market Insights

Europe is expected to increase at a rapid pace throughout the projected time frame, owing to increasing demand from the detergent and personal care product industries. Water-soluble polymers are used as additions in commercial liquid laundry detergents and liquid dishwashing products. Rising consciousness about the benefits of staff hygiene during the COVID-19 pandemic is predicted to drive consumer demand for detergent items, boosting the development of the water-soluble polymers industry.

Water-Soluble Polymer Market Players:

- SPCM S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ashland Global Holdings Inc.

- Kuraray Co., Ltd.

- Nitta Gelatin, Inc.

- SIKA AG

- The Dow Chemical Company

- L G CHEM Ltd.

- DuPont de Nemours, Inc.

- Arkema S.A.

- BASF SE

- SNF

Recent Developments

- SNF announced the launch of FLOCARE NAT 132, a multifunctional water-soluble polymer used to create skin care formulations, which is 67% naturally derived.

- Arkema S.A. to acquire a subsidiary of Ashland Global Holdings Inc., to expand its additive and ingredients portfolio.

- Report ID: 3533

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Water-Soluble Polymer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.