Water-based Degreaser Market Outlook:

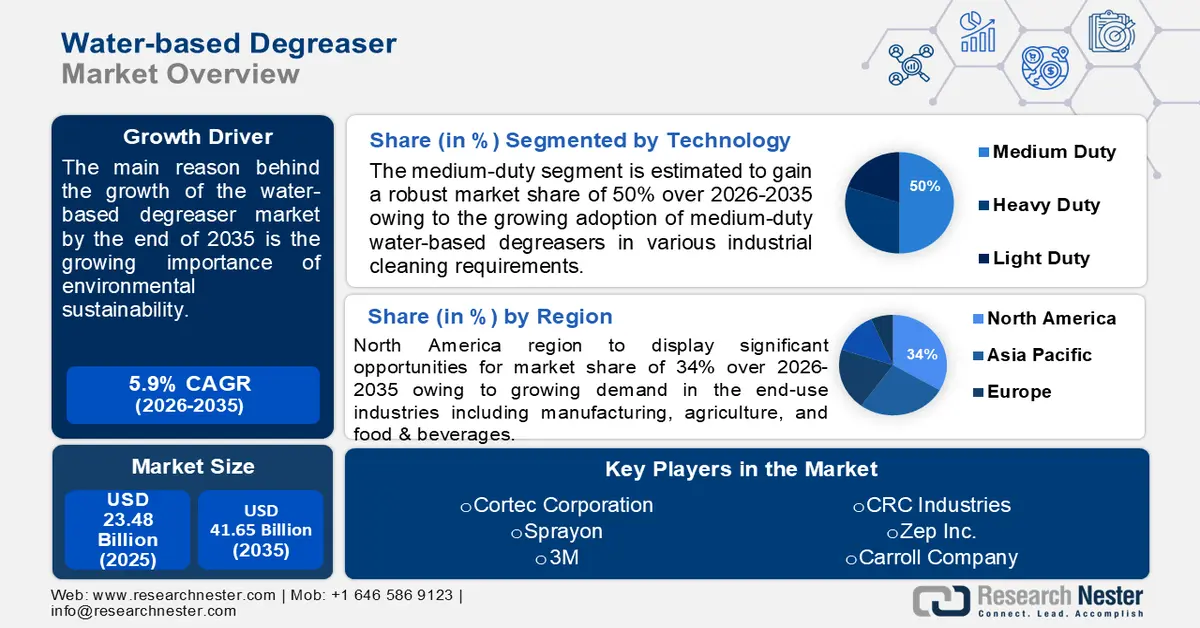

Water-based Degreaser Market size was over USD 23.48 billion in 2025 and is projected to reach USD 41.65 billion by 2035, witnessing around 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of water-based degreaser is evaluated at USD 24.73 billion.

The market is rising at a significant rate as environmental sustainability becomes more and more important. Increased sales were a result of the use of water-based degreasers, which are preferred since they have less of an adverse effect on the environment than their solvent-based counterparts.

For instance, to assist buyers in identifying greener cleaning products, the EPA oversees the Safer Choice program, which certifies products that include safer components for human health and the environment. In addition to the Safer Choice label, the EPA provides the Design for the Environment (DfE) designation for antimicrobial goods including disinfectants and sanitizers.

Key Water-based Degreaser Market Insights Summary:

Regional Highlights:

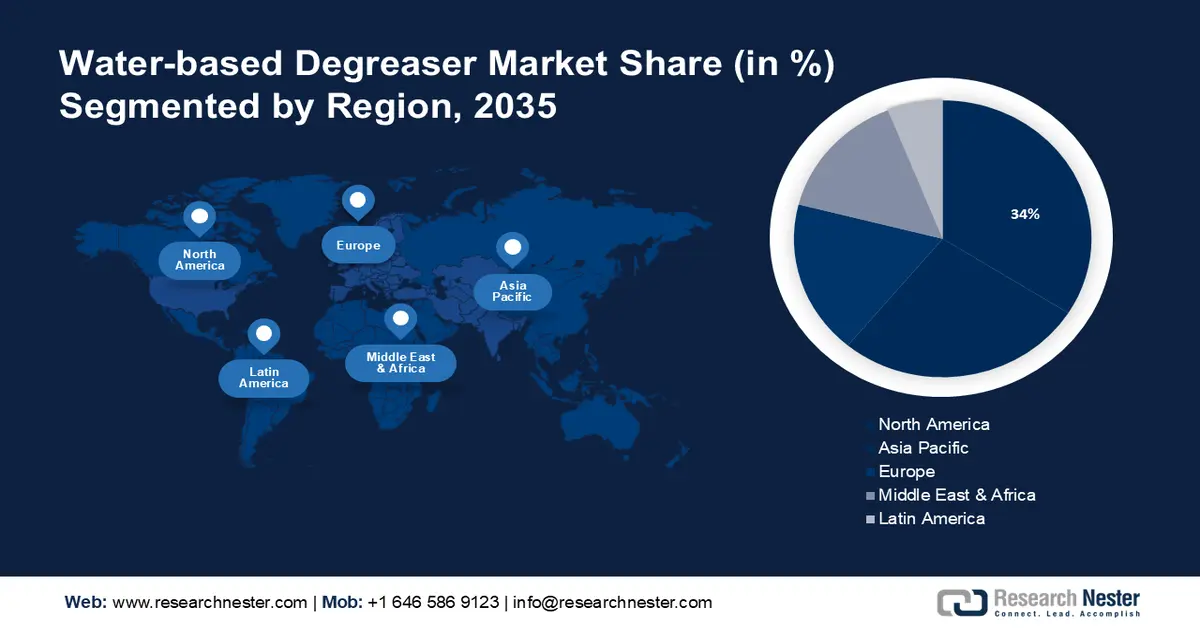

- North America is predicted to hold the largest revenue share of 34% by 2035, driven by the rising demand across manufacturing, agriculture, and food & beverage industries.

- Asia Pacific is expected to register a growth rate of around 13.4% during 2024–2035, impelled by the increasing online sales of water-based degreasers.

Segment Insights:

- Medium Duty segment is projected to account for more than 50% share by 2035, propelled by the growing adoption of medium-duty water-based degreasers in various industrial cleaning requirements.

- Metal Surface segment is anticipated to reach USD 26 Billion by 2035, owing to the rising use of metal surfaces to meet industrial degreasing needs.

Key Growth Trends:

- Stringent government regulations

- Growing environmental concerns among manufacturers

Major Challenges:

- Environmental concerns and meeting the intensive cleaning requirements

- Lack of adoption of water based degreasers in heavy settings

Key Players: Cortec Corporation, Sprayon, 3M, CRC Industries, Zep Inc., Carroll Company, Nyco Products Company, BG Products Inc., ABRO Industries Inc., DuPont de Nemours, Inc.

Global Water-based Degreaser Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.48 billion

- 2026 Market Size: USD 24.73 billion

- Projected Market Size: USD 41.65 billion by 2035

- Growth Forecasts: 5.9%

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, Canada, France

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 1 December, 2025

Water-based Degreaser Market - Growth Drivers and Challenges

Growth Drivers

-

Stringent government regulations - The water-based degreaser market is driven by strict laws controlling chemical use and industrial emissions. The necessity to comply with environmental rules is expected to drive the sales of water-based degreasers. This driver emphasizes how important regulatory frameworks are in influencing market dynamics and encouraging the use of eco-friendly cleaning products. For instance, the Toxic Substances Control Act (TSCA), which was amended in 2016 is the main law governing chemical management in the United States. Therefore, this factor is expected to drive the market growth.

-

Growing environmental concerns among manufacturers - Water Based Degreasers are a type of cleaning solution that is made up of water, and natural and biodegradable ingredients such as surfactants, bio-solvents, or enzymes. Water-based Degreasers are much safer and less dangerous than solvent Degreasers, which contain hazardous chemicals that could be a significant threat to the environment.

It is because they are more easily biodegradable, which means that the microorganisms in the environment can break down them spontaneously and do not cause any lasting damage. A crucial factor to consider for companies that wish to reduce their environmental impact is the biodegradability of water-based degreasers. - Rapid shift towards industrialization among emerging economies - Building factories has become essential as industrialization has accelerated in underdeveloped countries. Emerging economies have seen an increase in the building of factories for various industries, including paints, marine products, vehicles, ships, and aircraft.

As a result, there is a growing need for efficient and environmentally safe cleaning products like water-based degreasers. The need for these cleaning solutions has skyrocketed in tandem with the growth of manufacturing. Because they are less harmful to the environment, emit fewer volatile organic compounds, and are non-toxic, water-based degreasers are recommended over traditional ones.

Challenges

-

Environmental concerns and meeting the intensive cleaning requirements - There are examples of evidence where the need for thorough cleaning is at odds with the environmentally beneficial properties of degreasers based on water. These difficulties made it difficult for water-based treatments to be widely used in demanding environments like manufacturing facilities with strict cleaning specifications.

This moderation highlights the industry's continued attempts to find a middle ground between environmental friendliness and satisfying the high cleaning requirements of specific applications. Stakeholders must tackle these obstacles to guarantee the sustained implementation of water-based degreasers in various industrial environments as the industry develops. - Lack of adoption of water-based degreasers in heavy settings - Heavy-duty application issues are a significant restriction in the water-based degreaser market. Evidence includes cases in which the need for thorough cleaning clashes with the environmentally favorable properties of water-based degreasers.

These issues are expected to hamper the widespread adoption of water-based solutions in heavy-duty settings, such as manufacturing plants with stringent cleaning needs. This constraint highlights the industry's continual efforts to strike a compromise between environmental friendliness and achieving the rigorous cleaning requirements of certain applications.

Water-based Degreaser Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 23.48 billion |

|

Forecast Year Market Size (2035) |

USD 41.65 billion |

|

Regional Scope |

|

Water-based Degreaser Market Segmentation:

Type Segment Analysis

Medium duty segment is expected to hold more than 50% water-based degreaser market share by 2035. The segment growth can be attributed to the growing adoption of medium-duty water-based degreasers in various industrial cleaning requirements. The medium duty class not only proved to be the most popular but also demonstrated the highest growth rate.

This indicates that businesses are increasingly looking for cleaning solutions that are effective yet safe for the environment, and water-based degreasers are emerging as a top choice. The success of this market segment underscores how water-based degreasers can be tailored to suit various duty levels and can help organizations achieve their sustainability goals while maintaining high standards of cleanliness.

Application Segment Analysis

In water-based degreaser market, metal surface segment is anticipated to reach USD 26 Billion by 2035. The segment growth can be credited to the growing adoption of metal surfaces to meet metal degreasing requirements. Because it must maintain clean metallic surfaces, the steel industry is the one that uses the most metal-cleaning chemicals. This problem can be solved using industrial metal cleaners, which not only clean equipment without requiring disassembly and reassembly but also stop corrosion after cleaning.

The manufacturing sector's growing need for industrial cleaning and maintenance is fueling the market's expansion. In addition, the growing construction industry especially in developing nations offers a substantial market for metal surface cleaning solutions because of how much metal buildings and machinery are used in these projects.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

Application Method |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Water-based Degreaser Market - Regional Analysis

North America Market Insights

North America industry is predicted to hold largest revenue share of 34% by 2035. The market growth in the region is also expected on account of the growing demand in the end-use industries including manufacturing, agriculture, and food & beverages. Consequently, laws in this region encourage the development of water-based degreasers and other cleaning supplies. According to the American Lung Association, the United States Environmental Protection Agency maintains a list of items that satisfy its Safer Choice standards for cleaning and other purposes.

As consumers in the United States become more conscious of the possible health risks associated with traditional cleaning chemical exposure, they are selecting safer substitutes. According to the Environmental Working Group, studies reveal that individuals employed in the cleaning sector are 50% percent more likely to experience asthma attacks and 43% percent more likely to acquire chronic obstructive pulmonary disease.

Lung cancer risk is considerably higher for women employed in this sector. People's worries for their safety and well-being are the reason for this. Because green cleaning solutions often contain natural ingredients that are less harmful to human health, they are likely to be of interest to those who place a high value on their family's health and happiness.

Businesses from a variety of industries in Canada are adopting sustainable goals and incorporating eco-friendly practices into their daily operations. Consequently, this has led to a cascading effect across supply chains, as companies prioritize eco-friendly cleaning solutions to better match their sustainability objectives. For instance, in September 2023, Bunzl Canada announced the debut of REGARDTM, a new line of environmentally friendly cleaning products.

APAC Market Insights

APAC water-based degreaser market is expected to witness growth rate of around 13.4% from 2024 to 2035, and will hold the second position owing to the growing online sales of water-based degreasers in the region. Customers now choose to shop online for a variety of products, including house cleaners, as a result of the widespread use of smartphones and the increase in internet usage.

China will be one of Asia's most promising markets because of rising levels of disposable money, which drive consumers to forgo traditional cleaning techniques in favor of more modern ones, including new technology and innovation. According to figures released by the National Bureau of Statistics, China's per capita disposable income in the first quarter of 2024 was roughly USD 1,624.57. This represents a nominal increase of 6.2 percent year over year.

The number of households in South Korea has increased as a result of factors like urbanization and modifications to family patterns. There is an increasing need for cleaning supplies for the home, especially bathrooms, as the number of homes rises. Furthermore, single-person families have significantly increased in South Korea, particularly among young individuals and the elderly. Therefore, these factors are expected to increase the demand in water-based degreaser in South Korea.

Water-based Degreaser Market Players:

- Cortec Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sprayon

- 3M

- CRC Industries

- Zep Inc.

- Carroll Company

- Nyco Products Company

- BG Products Inc.

- ABRO Industries Inc.

- DuPont de Nemours, Inc.

Water-based degreaser market’s key players are increasingly focusing on product innovation and development to fulfill changing consumer demands and preferences. Expansion into emerging areas, as well as strategic alliances and collaborations, are important market growth tactics.

Recent Developments

- Cortec Corporation launched VpCI®-415, a heavy-duty, biodegradable, water-based alkaline cleaner and degreaser that provides excellent flash corrosion protection. When stored indoors, VpCI®-415 provides corrosion protection for up to six months. VpCI®-415 is developed to meet aircraft cleaning and corrosion protection requirements. The compounds in VpCI®-415 change hydrocarbons in such a way that water can be used to remove deposits. Metered VpCI®-415 can be used in steam cleaners, power washers, dip tanks, and other cleaning machines.

- Sprayon introduced a new product called Sprayon® CD1219. A water-dilutable solution that works well to remove grease, soap films, ink, glue, oil, tar, or tar stains is Sprayon® CD1219 Water-Based Citrus Degreaser. Hard surfaces including metal, vinyl, fiberglass, Formica, finished wood, porcelain, and painted surfaces are safe to use with it.

- Report ID: 6180

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Water-based Degreaser Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.