Water as a Fuel Market Outlook:

Water as a Fuel Market size was over USD 6.6 billion in 2025 and is projected to reach USD 21.62 billion by 2035, growing at around 12.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of water as a fuel is evaluated at USD 7.35 billion.

Water has a remarkable relation with energy production, from fossil fuel extraction to biofuel cultivation. The International Energy Agency (IEA) highlights that water captures 10.0% of global freshwater withdrawals share. The same source also states that globally there are around 21k desalination operation plants. Water and energy are interdependent on each other and are strongly influenced by population growth and climatic change. The energy’s increasing thrust for water is anticipated to reach 400 bcm by 2030. The leading companies in the water as a fuel sector are poised to grab lucrative opportunities in the coming years owing to a positive consumption of water for energy generation.

|

Global Water Consumption in the Energy Sector by Fuel and Power Generation Type in the Stated Policies Scenario, 2021 and 2030 |

||

|

Source |

2021 |

2030 |

|

Bioenergy |

17.5 bcm |

22.9 bcm |

|

Fossil Fuels |

18.8 bcm |

18.6 bcm |

|

Hydrogen |

1.6 bcm |

1.9 bcm |

|

Fossil Fuels (Power Generation) |

11.2 bcm |

10.3 bcm |

|

Nuclear |

4.0 bcm |

4.8 bcm |

|

Renewables |

1.0 bcm |

2.7 bcm |

Source: IEA

The rising fossil fuel prices owing to several factors such as scarcity, limited, extraction, and unfavorable supply chain policies are driving the attention of the countries on renewable energy production. Hydrogen produced locally from water and renewable energy is emerging as a vital pathway toward energy security. The limited reliance on foreign energy sources and increasing investments in local production are creating high-earning opportunities for key water as a fuel market players. Manufacturers are also targeting developing economies owing to their increasing energy needs.

Key Water as a Fuel Market Insights Summary:

Regional Insights:

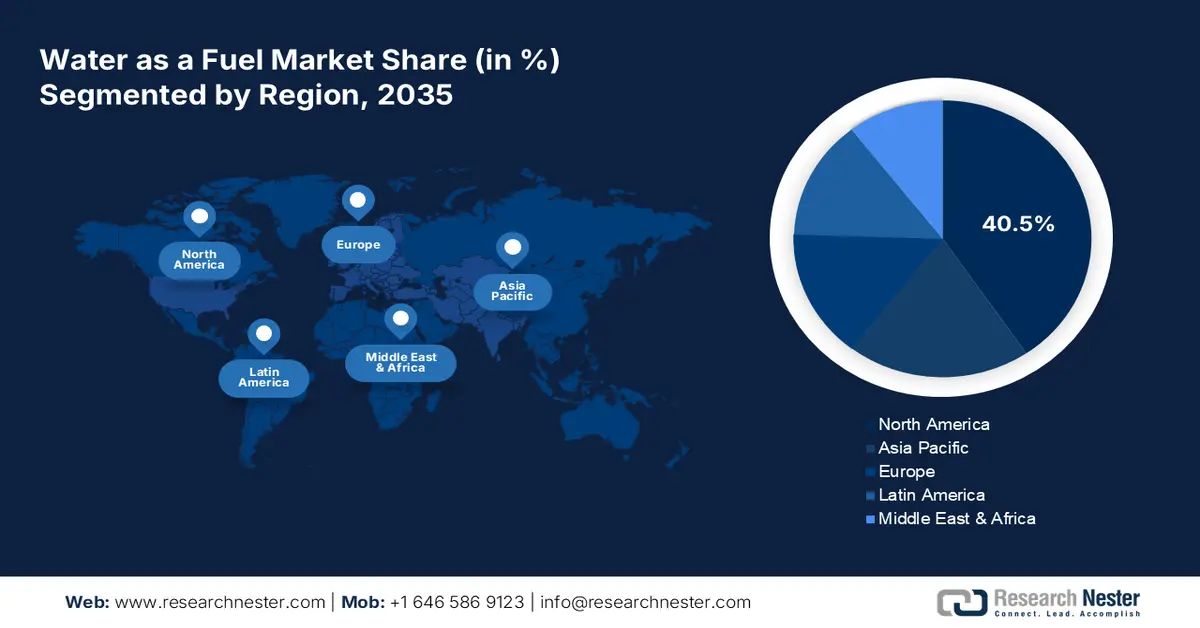

- North America water as a fuel market is projected to secure nearly 40.5% share by 2035, supported by rising adoption of net-zero vehicles and strengthened fuel infrastructure which together bolster market expansion.

- Asia Pacific is anticipated to grow at the fastest pace through 2035, spurred by strong industrial presence and favorable regulations encouraging advanced chemical and material adoption.

Segment Insights:

- The hydrogen segment is set to capture about 58.1% share by 2035, reinforced by supportive government policies advancing the uptake of hydrogen fuels.

- The automotive segment is forecast to hold more than 42.3% share by 2035, amplified by stringent environmental rules pushing the development of sustainable vehicles.

Key Growth Trends:

- Hydrogen fuel cell technologies gaining traction

- Increasing entries of new companies

Major Challenges:

- High cost limits adoption rate

- Infrastructure challenges driving high Capex

Key Players: ExxonMobil Corporation, Air Liquide, Orsted A/S, FuelCell Energy Inc., China Petroleum & Chemical Corporation, Iberdrola S.A., Plug Power Inc., Linde Plc, Enel Green Power Spa.

Global Water as a Fuel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.6 billion

- 2026 Market Size: USD 7.35 billion

- Projected Market Size: USD 21.62 billion by 2035

- Growth Forecasts: 12.6%

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 3 December, 2025

Water as a Fuel Market - Growth Drivers and Challenges

Growth Drivers

- Hydrogen fuel cell technologies gaining traction: The increasing implementation of strict environmental regulations to boost the adoption of clean energy solutions is expected to propel the overall water as a fuel market growth during the foreseeable period. The advancements in fuel cell technology and their rising use in zero-emission vehicles are further set to double the revenues of producers. Innovations leading to fuel efficiency and cost-effectiveness are projected to propel the sales of hydrogen fuel cell vehicles in the coming years. Manufacturers’ high investments in research and development activities aimed at the production of advanced catalysts and enhanced electrolyzers are anticipated to mitigate the hydrogen production prices and push the demand for water-based fuels.

- Increasing entries of new companies: Considering the increasing popularity of clean energy and fuel is uplifting the emergence of new companies. Net zero emission goals, circular economy trends, and government support in the forms of tax benefits, incentives, and schemes are driving appealing start-ups to enter in water as a fuel business. For instance, Infinium is a U.S.-based start-up that is gaining traction in the development of ultra-low carbon synthetic eFuels. In January 2025, Infinium announced the acquisition of gas conversion leader Greyrock Technology. This purchase was completed under Series C Preferred Stock fundraising led by Brookfield Asset Management.

Challenges

- High cost limits adoption rate: Water as a fuel is a complex and investment incentive business, which often creates challenges for budget-constrained companies. Green hydrogen and other eFuels are more costly than their conventional counterparts. The price-sensitive markets act as deterrents for the revenue growth of key players. The majority of consumers in these markets invest in fossil fuels owing to their cost-effectiveness and dominance. Thus, even though water as a fuel is an opportunistic water as a fuel market in the long run, currently it is expected to witness limited sales due to high costs and lack of awareness.

- Infrastructure challenges driving high Capex: The poor or low-standard infrastructure for hydrogen storage, transportation, and distribution is a major challenge for leading companies. Unlike gasoline or natural gas, hydrogen fuel requires advanced infrastructure including pipeline, storage, and refueling station, which drives up the need for high capital investment. Limited budgets act as a barrier to widespread sales of water fuel solutions, hampering the revenue growth of producers.

Water as a Fuel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.6% |

|

Base Year Market Size (2025) |

USD 6.6 billion |

|

Forecast Year Market Size (2035) |

USD 21.62 billion |

|

Regional Scope |

|

Water as a Fuel Market Segmentation:

Fuel Type Segment Analysis

Hydrogen segment is projected to account for water as a fuel market share of around 58.1% by 2035. The favorable government policies are prime supporters of the increasing sales of hydrogen fuels. The IEA report underscores that in 2023, the hydrogen demand totaled 97.0 million tonnes (Mt) globally, a rise of 2.5% compared to the previous year. The net-zero emission goals are set to boost the demand for hydrogen fuel in heavy industries and long-distance transport companies. The U.S., Europe, and China are the profitable marketplaces for hydrogen-based fuel producers. Furthermore, continuous innovations are estimated to augment the sales of low-emissions hydrogen production technologies in the coming years.

End use Industry Segment Analysis

In water as a fuel market, automotive segment is expected to hold revenue share of over 42.3% by the end of 2035. The stringent environmental regulations aimed at carbon emissions are driving innovations for the production of sustainable vehicles. The IEA study highlights that electric cars captured 18.0% of all cars sold in 2023. The increasing need for fuel efficiency and rising energy security concerns are fueling the demand for green vehicles. Tax credits and incentives are driving the attention of consumers to invest in electric and other eco-friendly vehicles, further fueling the consumption of water-based fuels.

Our in-depth analysis of the global water as a fuel market includes the following segments:

|

Fuel Type |

|

|

Technology |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Water as a Fuel Market - Regional Analysis

North America Market Insights

North America water as a fuel market is predicted to account for revenue share of around 40.5% by 2035. The increasing adoption of net zero-emission vehicles and the presence of advanced fuel infrastructure are propelling the overall market growth. The high investments in renewable energy sources and innovations in the aerospace sector are further anticipated to double the profits of water-based fuel companies in the coming years.

In the U.S., continuous innovations in fuel cell technologies are estimated to uplift the country's position in the global landscape. In February 2022, the U.S. Department of Energy (DOE) announced that electrolyzer and fuel cell supply chains are creating employment and economic growth opportunities in the country. By 2050, the electrolyzer capacity is expected to increase up by 1,000 gigawatts (GW) from 0.17 GW in 2022.

Canada’s swiftly expanding eco-friendly vehicle market is creating an opportunistic environment for green fuel producers. The implementation of strict emission regulations and tax benefits on sustainable vehicle adoption is estimated to offer double-digit YoY to key players. The report by Transport Canada states that zero-emission vehicles held an 11.7% share of light-duty vehicles in 2023.

|

Comparison of Fuel Cell Vehicles |

|||||

|

Specifications |

2025 Toyota Mirai XLE |

2024 Toyota Mirai XLE |

2023 Toyota Mirai Limited |

2023 Toyota Mirai XLE |

2022 Toyota Mirai Limited |

|

Class |

Compact |

Compact |

Compact |

Compact |

Compact |

|

Motor (kW) |

134 |

134 |

134 |

134 |

134 |

|

Transmission |

1-speed automatic |

1-speed automatic |

1-speed automatic |

1-speed automatic |

1-speed automatic |

|

Fuel |

hydrogen |

hydrogen |

hydrogen |

hydrogen |

hydrogen |

Source: Natural Resources Canada

Asia Pacific Market Insights

The Asia Pacific water as a fuel market is estimated to expand at the fastest pace during the study period. The strong presence of end use industries such as automotive, utility, electronics, and manufacturing are driving the sales of water-based fuels. The positive foreign direct investments and supportive regulations on the adoption of advanced chemicals and materials are further creating a profitable environment for water as fuel businesses. India, China, South Korea, and Japan are high-growth marketplaces for water-based fuel producers.

China’s automotive sector is expected to augment the consumption of water-based fuels in the coming years. Continuous innovations and climatic commitments are fueling the sales of hydrogen fuel cell vehicles in the country. Research Nester’s study estimates that around 5,600 hydrogen fuel electric vehicles were sold in China in 2023 and this number is expected to increase at a rapid pace during the foreseeable period.

The strong chemical and petrochemical industry of India is backing the sales of water-based fuels. Despite global uncertainty, the chemical market of India is expected to surpass USD 300 billion by 2030 says India Brand Equity Foundation (IBEF) report. The boom in clean energy projects is anticipated to propel water-based fuels in the coming years. The same source also estimates that the installed capacity of renewable energy is set to quadruple by 2030 from 205 GW in 2024. The country is focused on generating 5 million metric tons of green hydrogen annually by 2030 under the National Green Hydrogen Mission.

Water as a Fuel Market Players:

- ExxonMobil Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Liquide

- Orsted A/S

- FuelCell Energy Inc.

- China Petroleum & Chemical Corporation

- Iberdrola S.A.

- Plug Power Inc.

- Linde Plc

- Enel Green Power Spa

Water as fuel is both an opportunistic as well as challenging marketplace owing to supportive government policies and high investments. The gigantic players are employing organic and inorganic strategies to maximize their earnings and water as a fuel market reach. New product launches, technological innovations, mergers & acquisitions, collaborations & partnerships, and global expansion are some of the tactics widely employed by key players. New companies are investing heavily in research and development activities to stand out in the crowd.

Some of the key players include:

Recent Developments

- In November 2024, the U.S. Department of Energy (DOE) entered into a strategic partnership with Los Alamos National Laboratory (LANL) to accelerate market-facing research, development, and deployment of cutting-edge hydrogen fuel cell technologies. Such initiatives are aimed at attracting numerous players to earn high profits in the U.S. market.

- In July 2024, the California Governor’s Office of Business and Economic Development revealed that the U.S. Department of Energy (DOE) and ARCHES entered into an official USD 12.6 billion agreement to build a clean, renewable Hydrogen Hub in California. Last year, the federal government invested around USD 1.2 billion when California was selected as a national hub.

- Report ID: 7149

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Water as a Fuel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.