Waste Paper Management Market Outlook:

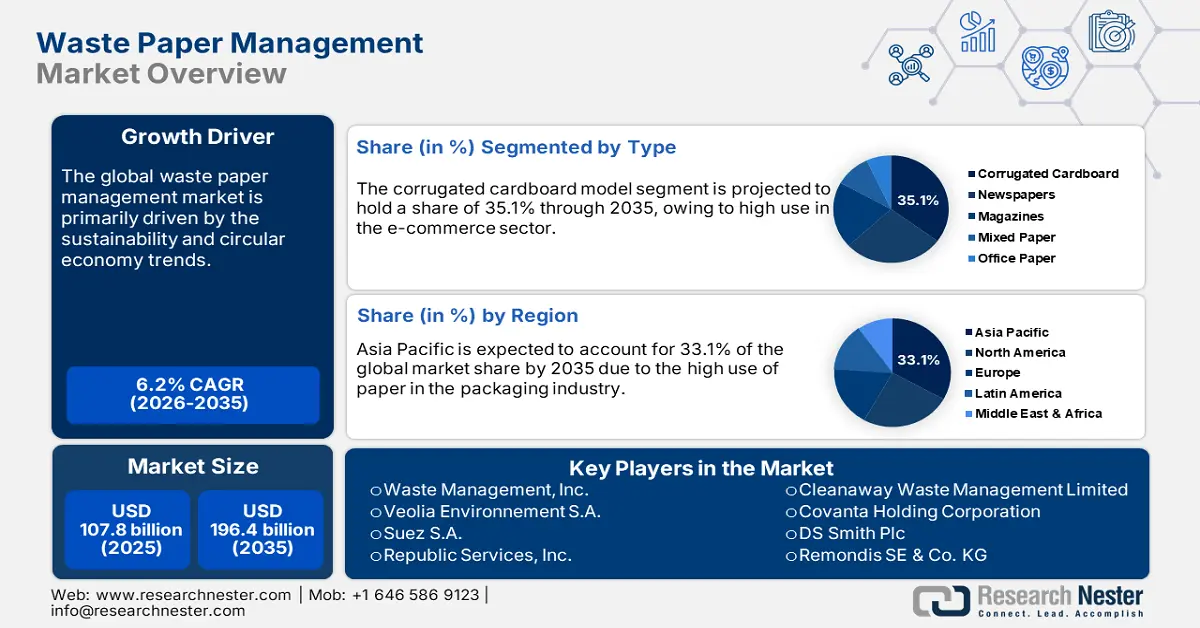

Waste Paper Management Market size was USD 107.8 billion in 2025 and is estimated to reach USD 196.4 billion by the end of 2035, expanding at a CAGR of 6.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of waste paper management is assessed at USD 114.4 billion.

The sales of waste paper management solutions are expected to increase at a high pace during the forecast period. The American Forest & Paper Association (AF&PA) has announced that 67.9% of paper consumed in the United States was recycled in 2022, indicating that nearly 68% of paper consumed was recycled. In 2022, the recycling rate for old corrugated containers (also known as cardboard, OCC) was 93.6%, which is an increase from last year's figure. The 3-year average recycling rate (2020-2022) for OCC was 91.3%. The robust recycling activities in developed countries, driven by strict environmental regulations and climate commitments, are poised to open lucrative opportunities for waste paper management solution producers.

As for the imports, the U.S. received million tons of mixed paper and sorted paper, which reflects two-way raw material flows essential to the reprocessing industry. Such developments directly influence domestic availability and processing line utilization rates. Furthermore, the price fluctuations in shipping and raw material availability often influence plant-level operational margins, particularly for downstream manufacturers reliant on consistent feedstock quality.

Key Waste Paper Management Market Insights Summary:

Regional Highlights:

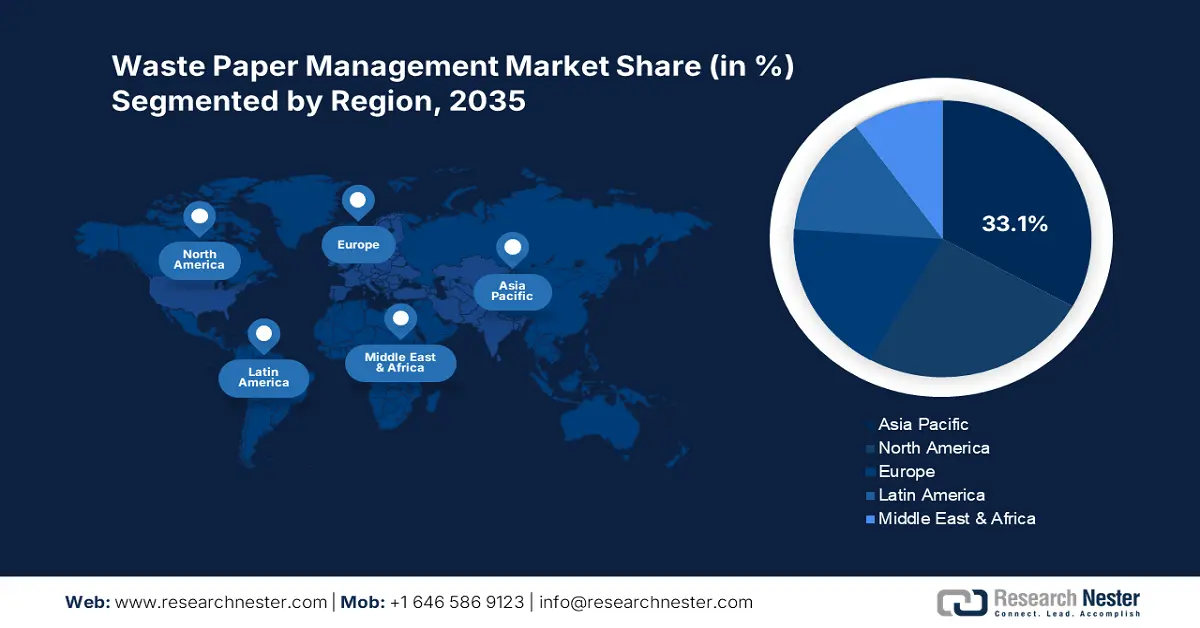

- The Asia Pacific market is estimated to hold a 33.1% share by 2035, driven by rising government investments in recycling technologies, digitalization, and high paper usage in packaging.

- The North America market is projected to hold a 25% share by 2035, owing to strict circular economy regulations, environmental protection mandates, and growing e-commerce packaging demand.

Segment Insights:

- The corrugated cardboard sub-segment is projected to account for 35.1% share by 2035, driven by government mandates on recycled packaging, particularly in the e-commerce sector.

- The industrial waste paper sub-segment is expected to hold 39.5% share by 2035, impelled by high-volume generation from manufacturing and ICT sectors along with strict recycling regulations.

Key Growth Trends:

- Rise in e-commerce trade

- Shift toward sustainability

Major Challenges:

- Limited public awareness

- Competition from alternatives

Key Players: Waste Management, Inc., Veolia Environnement S.A., Suez S.A., Republic Services, Inc., Cleanaway Waste Management Limited, Covanta Holding Corporation, DS Smith Plc, Remondis SE & Co. KG, CJ Logistics Corporation, Ramky Enviro Engineers Ltd., SWM Environment Sdn Bhd, Shanks Group plc, Clean Harbors, Inc., Eurovia Services, Hansol Paper, Muda Holdings Berhad (Muda Paper Mills), Tamil Nadu Newsprint & Papers Ltd (TNPL), Pratt Industries, Sonoco Recycling (Sonoco Products Co.)

Global Waste Paper Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 107.8 billion

- 2026 Market Size: USD 114.4 billion

- Projected Market Size: USD 196.4 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: South Korea, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 10 September, 2025

Waste Paper Management Market - Growth Drivers and Challenges

Growth Drivers

- Rise in e-commerce trade: The rising e-commerce trade is driving a high use of paper and cardboard in packaging. UNCTAD estimated that worldwide e-commerce sales grew to more than $27 trillion in 2022, using the latest data available for businesses in 43 developed and developing countries. Saudi Arabia has committed $1.4 million to support UN Trade and Development’s (UNCTAD) efforts to develop its work on measuring e-commerce and the digital economy. This reflects high-earning opportunities for paper sorting and recycling technology manufacturers.

- Shift toward sustainability: The strict regulation aimed at the circular economy and sustainability is driving a shift toward recycling technologies. The pulp and paper mills are increasingly investing in paper waste management solutions to reduce water and energy usage and align with mandates. For instance, in 2021, the European paper value chain committed to recycling 76% of all paper consumed by 2030, a 76% ‘recycling rate’. At a 70.5% recycling rate in 2022, Europe remains at least 10% ahead of the rest of the world, where the average global recycling rate in 2021 was 59.9%. The increasing importance of recycling is set to propel the application of waste paper management systems in the paper and pulp industry.

- Rising demand for recycled paper products: The increasing consumer demand for recycled paper products is driven by environmental advantages and decreased cost. So, this demand drives manufacturers to procure recycled paper and accelerated amounts, leading to a need for enhanced waste paper management and recycling. The trend toward recycled paper products specifically will continue to be a catalyst for the growth of the waste paper management market.

Emerging Trade Dynamics in Paper Goods

The trade of paper goods significantly drives the waste paper management market by increasing the volume of post-consumer and industrial paper waste. As global demand for packaging, printing, and hygiene products rises, so does the need for efficient recycling and disposal systems. This surge fuels investment in collection, sorting, and pulping infrastructure to recover valuable fiber. Ultimately, the paper goods trade supports the circular economy by linking consumption with sustainable waste recovery and reuse.

Top Exporters and Importers of Paper Goods in 2023

|

Exporters (2023) |

Export Value (USD Billion) |

Importers (2023) |

Import Value (USD Billion) |

|

China |

35.5 |

United States |

29.7 |

|

United States |

28.5 |

China |

29.3 |

|

Germany |

27.6 |

Germany |

20.1 |

Source: OEC

1.Global Trade in Recovered Paper

Recovered paper trade drives the waste paper management market by creating a global demand for sorted, high-quality recyclable fiber. As countries tighten import standards and contamination thresholds, waste management systems are forced to improve sorting, collection, and processing infrastructure. This trade incentivizes investment in recycling technologies and promotes circular economy practices. Ultimately, it transforms paper waste from a disposal challenge into a valuable resource stream for sustainable production.

Top Exporters and Importers of Recovered Paper in 2023

|

Exporters |

Export Value (USD Billion) |

Importers |

Import Value (USD Billion) |

|

United States |

2.63 |

India |

1.36 |

|

United Kingdom |

0.577 |

Germany |

0.66 |

|

France |

0.454 |

Vietnam |

0.639 |

Source: OEC

Challenges

- Limited public awareness: Limited awareness among end users in underdeveloped markets continues to hinder the adoption of waste paper management solutions, with resistance to change slowing the integration of recycling technologies. In developed regions, many small-scale enterprises still overlook the benefits of waste paper recycling, contributing to low participation rates. This lack of engagement across both market types restricts the scalability and commercial viability of recycling technologies. As a result, production and sales in the waste paper management sector face significant barriers to growth.

- Competition from alternatives: The growing adoption of digital communication is steadily reducing paper consumption, leading to a direct decline in the trade of waste paper recycling systems. According to the U.S. Census Bureau, office paper usage has consistently dropped over the past decade, signaling shrinking revenue opportunities for waste paper management firms. Additionally, the rise of alternative packaging materials like plastics and bioplastics is further curbing demand for traditional paper recycling solutions. Together, these shifts are reshaping the market landscape and challenging the growth of recycling technologies.

Waste Paper Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 107.8 billion |

|

Forecast Year Market Size (2036) |

USD 196.4 billion |

|

Regional Scope |

|

Waste Paper Management Market Segmentation:

Type Segment Analysis

The corrugated cardboard is projected to hold 35.1% of the global waste paper management market share by 2035. Government mandates on recycled packaging, particularly in the e-commerce sector, are fueling the growth. The U.S. Environmental Protection Agency (EPA) reveals that corrugated boxes are made from the largest portion of municipal solid waste packaging waste in the U.S. The forefront role of public entities in the recycling initiatives is likely to fuel the use of water paper management technologies.

Source Segment Analysis

The industrial waste paper segment is poised to capture 39.5% of the global waste paper management market share by 2035. The high-volume generation from the manufacturing and ICT sectors is primarily fueling the sales of waste paper management systems. The analysis by the International Trade Administration (ITA) estimates that North America and the EU industrial sector are witnessing a sharp increase in recycled material sourcing mandates. According to the American Forest & Paper Association (AF&PA), 65–69% of the paper recovered in the U.S. was recycled in 2023. According to 2023 estimates, the paper industry recycles around 60% of its output, making it one of the most recycled products in the country. Strict regulations are compelling manufacturers to minimize landfill disposal, thereby driving strong demand for industrial paper waste collection and management solutions. This regulatory push encourages businesses to adopt more sustainable waste practices and invest in advanced recycling infrastructure. As compliance becomes increasingly critical, the market for efficient paper waste systems continues to expand. These dynamics are reshaping industrial waste strategies toward circular and eco-conscious models.

End use Segment Analysis

The packaging is projected to hold 28.1% of the global waste paper management market share by 2035. The growth of this segment is largely driven by the surge in global e-commerce, rising demand for sustainable packaging, and regulatory mandates promoting the use of recycled materials. Recycled waste paper has become a staple in producing corrugated boxes, cartons, and wrapping products, increasingly replacing virgin fiber. As consumer preferences continue to shift toward eco-friendly alternatives, packaging remains the central driver of expansion in the waste paper recycling market. This momentum signals a broader transition toward circular packaging solutions across industries.

Our in-depth analysis of the waste paper management market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Source |

|

|

Process |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Waste Paper Management Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific waste paper management market is estimated to account for 33.1% of the global revenue share through 2035. The increasing shift toward digitalization and rising government investments in recycling technologies are poised to fuel the trade of waste paper management technologies in the years ahead. The high use of paper in the packaging sector is also contributing to the increasing sales of waste paper management solutions. China, Japan, India, and South Korea are the most profitable marketplaces for waste paper management companies.

In China, the sales of waste paper management technologies are poised for rapid growth, driven by substantial government investments and widespread adoption across manufacturing and ICT sectors. Market expansion is further supported by the integration of nonstandard recycling businesses and individual vendors, which is projected to boost economic benefits to 3,312.5 yuan per tonne by 2030. However, this progress comes with an environmental trade-off, as greenhouse gas emissions are expected to rise to 942.9 kgCO₂eq. The surge in public-private partnerships is set to accelerate the trade and deployment of advanced waste paper management solutions nationwide.

Waste and Scrap of Other Paper or Paperboard in 2023

|

Region / Country |

Export Value (US$ thousands) |

Quantity (Kg) |

|

Japan |

19,612.59 |

88,991,000 |

|

China |

226.32 |

507,974 |

|

India |

3.10 |

3,875 |

|

Indonesia |

158.27 |

786,013 |

|

Malaysia |

95.38 |

364,014 |

|

Australia |

207.46 |

1,246,110 |

|

South Korea (Korea, Rep.) |

5,932.81 |

15,552,000 |

Source: WITS

North America Market Insights

The North American waste paper management market is estimated to account for 25% of the global revenue share through 2035. The strict frameworks to meet the circular economy and regulations mandating environmental protection are set to double the revenues of waste paper management solutions in the coming years. The boosting of e-commerce trade and high use of paper in food and beverage packaging are also propelling the sales of waste paper management technologies. Canada and the U.S. are both the most opportunistic markets for waste paper management companies.

The resource conservation policies and waste reduction models in the U.S are increasing the adoption of waste paper management solutions. The rising government spending is estimated to fuel the sales of IoT-enabled smart waste management systems. Key companies are employing advanced waste paper management technologies to boost their recycling rates. The rise in e-commerce trade is also set to fuel the application of paper recycling and sorting solutions during the study period. The 2023 recycling rate for cardboard is identified as 71-76%. The rate accounts for all major collection streams and utilizes a more comprehensive analysis of U.S. trade data, which encompasses the industrial, commercial, institutional, and residential paper waste from all sources

Europe Market Insights

The European waste paper management market is estimated to account for 18% of the global revenue share through 2035. The increasing demand for recycled paper and paperboard for packaging and industrial uses. Corrugated and creped segments in particular are seeing sustained growth, driven by e-commerce and sustainable packaging trends. Recovery and sorting infrastructure continue to modernize with new and improved recovery, sorting, and separation technology. Policy restrictions on exports of recovered paper are also strengthening domestic reduction in exports and recycling, increasing efficiency improvements, and greater industry consolidation over the whole region.

Exports of Paper and Paperboard, Corrugated, Creped, and Others in 2023

|

Country / Region |

Export Value (USD 1000) |

Quantity (Kg) |

|

United Kingdom |

11,316.74 |

3,923,910 |

|

Germany |

28,474.09 |

8,194,080 |

|

France |

27,451.68 |

8,018,820 |

|

Italy |

53,014.49 |

18,737,700 |

|

Spain |

3,299.08 |

1,580,160 |

Source: WITS

Key Waste Paper Management Market Players:

- Waste Management, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Veolia Environnement S.A.

- Suez S.A.

- Republic Services, Inc.

- Cleanaway Waste Management Limited

- Covanta Holding Corporation

- DS Smith Plc

- Remondis SE & Co. KG

- CJ Logistics Corporation

- Ramky Enviro Engineers Ltd.

- SWM Environment Sdn Bhd

- Shanks Group plc

- Clean Harbors, Inc.

- Eurovia Services

- Hansol Paper

- Muda Holdings Berhad (Muda Paper Mills)

- Tamil Nadu Newsprint & Papers Ltd (TNPL)

- Pratt Industries

- Sonoco Recycling (Sonoco Products Co.)

The waste paper management market is highly competitive in nature, owing to the strong presence of key players. The sustainability initiatives and circular economy trends are necessitating leading companies to introduce next-gen waste paper management solutions. Domestic players in the developing regions are more focused on strategic partnerships and collaborations with others to increase the product offerings. The automation trend is likely to increase the application of advanced technologies in the development of waste paper management systems by industry giants.

Recent Developments

- In March 2024, Veolia Environnement S.A. announced the launch of its Smart Waste Platform, incorporated with IoT sensors, AI-driven analytics, and cloud-based monitoring. This innovation led to a 15.4% rise in digital service revenues within three months of deployment.

- In January 2024, Republic Services Inc. launched an enhanced version of its customer-facing Digital Recycling App. This introduction reported a 12.4% rise in active app users by the second quarter of 2024.

- Report ID: 7743

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Waste Paper Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.