Global Warehouse Execution Systems Market

- An Outline of the Global Warehouse Execution Systems Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Warehouse Execution Systems

- Recent News

- Regional Demand

- Warehouse Execution Systems Market by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Warehouse Execution Systems Demand Landscape

- Warehouse Execution Systems Demand Trends Driven by Electrification, Downsizing, and Lightweighting (2026-2030)

- Root Cause Analysis (RCA) for discovering problems of the Warehouse Execution Systems Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Warehouse Execution Systems Market – Key Player Analysis (2024)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2024 (%)

- Business Profile of Key Enterprise

- Blue Yonder

- Dematic

- Infor

- Generix Group

- Softeon

- Honeywell Intelligrated, Inc.

- Oracle WMS

- Korber AG

- Swisslog Holding AG

- Ehrhardt Partner Group

- Invata Intralogistics

- Made4net

- Logiwa

- Toshiba Infrastructure Systems & Solutions Corporation

- Global Warehouse Execution Systems Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Warehouse Execution Systems Market Segmentation Analysis (2026-2030)

- By Deployment

- Cloud-Based, Market Value (USD Million), and CAGR, 2026-2030F

- On-Premises, Market Value (USD Million), and CAGR, 2026-2030F

- By Component

- Software, Market Value (USD Million), and CAGR, 2026-2030F

- Service, Market Value (USD Million), and CAGR, 2026-2030F

- Implementation & Integration Services, Market Value (USD Million), and CAGR, 2026-2030F

- Consulting Services, Market Value (USD Million), and CAGR, 2026-2030F

- Maintenance & Support Services, Market Value (USD Million), and CAGR, 2026-2030F

- By Application

- Sortation Systems, Market Value (USD Million), and CAGR, 2026-2030F

- Order Fulfillment, Market Value (USD Million), and CAGR, 2026-2030F

- Inventory Management, Market Value (USD Million), and CAGR, 2026-2030F

- Labor Management, Market Value (USD Million), and CAGR, 2026-2030F

- Shipping & Receiving, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Industry Vertical

- Retail & e-Commerce, Market Value (USD Million), and CAGR, 2026-2030F

- Logistics & Transportation, Market Value (USD Million), and CAGR, 2026-2030F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2030F

- Food & Beverage, Market Value (USD Million), and CAGR, 2026-2030F

- Pharmaceuticals & Healthcare, Market Value (USD Million), and CAGR, 2026-2030F

- Automotive, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Type

- Centralized WES (cWES), Market Value (USD Million), and CAGR, 2026-2030F

- Embedded WES (eWES), Market Value (USD Million), and CAGR, 2026-2030F

- Regional Synopsis, Value (USD Million), 2026-2030

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- By Deployment

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2030

- Increment $ Opportunity Assessment, 2026-2030

- Segmentation (USD million), 2026-2030, By

- By Deployment

- Cloud-Based, Market Value (USD Million), and CAGR, 2026-2030F

- On-Premises, Market Value (USD Million), and CAGR, 2026-2030F

- By Component

- Software, Market Value (USD Million), and CAGR, 2026-2030F

- Service, Market Value (USD Million), and CAGR, 2026-2030F

- Implementation & Integration Services, Market Value (USD Million), and CAGR, 2026-2030F

- Consulting Services, Market Value (USD Million), and CAGR, 2026-2030F

- Maintenance & Support Services, Market Value (USD Million), and CAGR, 2026-2030F

- By Application

- Sortation Systems, Market Value (USD Million), and CAGR, 2026-2030F

- Order Fulfillment, Market Value (USD Million), and CAGR, 2026-2030F

- Inventory Management, Market Value (USD Million), and CAGR, 2026-2030F

- Labor Management, Market Value (USD Million), and CAGR, 2026-2030F

- Shipping & Receiving, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Industry Vertical

- Retail & e-Commerce, Market Value (USD Million), and CAGR, 2026-2030F

- Logistics & Transportation, Market Value (USD Million), and CAGR, 2026-2030F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2030F

- Food & Beverage, Market Value (USD Million), and CAGR, 2026-2030F

- Pharmaceuticals & Healthcare, Market Value (USD Million), and CAGR, 2026-2030F

- Automotive, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Type

- Centralized WES (cWES), Market Value (USD Million), and CAGR, 2026-2030F

- Embedded WES (eWES), Market Value (USD Million), and CAGR, 2026-2030F Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- By Deployment

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2030

- Increment $ Opportunity Assessment, 2026-2030

- Segmentation (USD million), 2026-2030, By

- By Deployment

- Cloud-Based, Market Value (USD Million), and CAGR, 2026-2030F

- On-Premises, Market Value (USD Million), and CAGR, 2026-2030F

- By Component

- Software, Market Value (USD Million), and CAGR, 2026-2030F

- Service, Market Value (USD Million), and CAGR, 2026-2030F

- Implementation & Integration Services, Market Value (USD Million), and CAGR, 2026-2030F

- Consulting Services, Market Value (USD Million), and CAGR, 2026-2030F

- Maintenance & Support Services, Market Value (USD Million), and CAGR, 2026-2030F

- By Application

- Sortation Systems, Market Value (USD Million), and CAGR, 2026-2030F

- Order Fulfillment, Market Value (USD Million), and CAGR, 2026-2030F

- Inventory Management, Market Value (USD Million), and CAGR, 2026-2030F

- Labor Management, Market Value (USD Million), and CAGR, 2026-2030F

- Shipping & Receiving, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Industry Vertical

- Retail & e-Commerce, Market Value (USD Million), and CAGR, 2026-2030F

- Logistics & Transportation, Market Value (USD Million), and CAGR, 2026-2030F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2030F

- Food & Beverage, Market Value (USD Million), and CAGR, 2026-2030F

- Pharmaceuticals & Healthcare, Market Value (USD Million), and CAGR, 2026-2030F

- Automotive, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Type

- Centralized WES (cWES), Market Value (USD Million), and CAGR, 2026-2030F

- Embedded WES (eWES), Market Value (USD Million), and CAGR, 2026-2030F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- By Deployment

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2030

- Increment $ Opportunity Assessment, 2026-2030

- Segmentation (USD million), 2026-2030, By

- By Deployment

- Cloud-Based, Market Value (USD Million), and CAGR, 2026-2030F

- On-Premises, Market Value (USD Million), and CAGR, 2026-2030F

- By Component

- Software, Market Value (USD Million), and CAGR, 2026-2030F

- Service, Market Value (USD Million), and CAGR, 2026-2030F

- Implementation & Integration Services, Market Value (USD Million), and CAGR, 2026-2030F

- Consulting Services, Market Value (USD Million), and CAGR, 2026-2030F

- Maintenance & Support Services, Market Value (USD Million), and CAGR, 2026-2030F

- By Application

- Sortation Systems, Market Value (USD Million), and CAGR, 2026-2030F

- Order Fulfillment, Market Value (USD Million), and CAGR, 2026-2030F

- Inventory Management, Market Value (USD Million), and CAGR, 2026-2030F

- Labor Management, Market Value (USD Million), and CAGR, 2026-2030F

- Shipping & Receiving, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Industry Vertical

- Retail & e-Commerce, Market Value (USD Million), and CAGR, 2026-2030F

- Logistics & Transportation, Market Value (USD Million), and CAGR, 2026-2030F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2030F

- Food & Beverage, Market Value (USD Million), and CAGR, 2026-2030F

- Pharmaceuticals & Healthcare, Market Value (USD Million), and CAGR, 2026-2030F

- Automotive, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Type

- Centralized WES (cWES), Market Value (USD Million), and CAGR, 2026-2030F

- Embedded WES (eWES), Market Value (USD Million), and CAGR, 2026-2030F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- By Deployment

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2030

- Increment $ Opportunity Assessment, 2026-2030

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2030, By

- Segmentation (USD million), 2026-2030, By

- By Deployment

- Cloud-Based, Market Value (USD Million), and CAGR, 2026-2030F

- On-Premises, Market Value (USD Million), and CAGR, 2026-2030F

- By Component

- Software, Market Value (USD Million), and CAGR, 2026-2030F

- Service, Market Value (USD Million), and CAGR, 2026-2030F

- Implementation & Integration Services, Market Value (USD Million), and CAGR, 2026-2030F

- Consulting Services, Market Value (USD Million), and CAGR, 2026-2030F

- Maintenance & Support Services, Market Value (USD Million), and CAGR, 2026-2030F

- By Application

- Sortation Systems, Market Value (USD Million), and CAGR, 2026-2030F

- Order Fulfillment, Market Value (USD Million), and CAGR, 2026-2030F

- Inventory Management, Market Value (USD Million), and CAGR, 2026-2030F

- Labor Management, Market Value (USD Million), and CAGR, 2026-2030F

- Shipping & Receiving, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Industry Vertical

- Retail & e-Commerce, Market Value (USD Million), and CAGR, 2026-2030F

- Logistics & Transportation, Market Value (USD Million), and CAGR, 2026-2030F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2030F

- Food & Beverage, Market Value (USD Million), and CAGR, 2026-2030F

- Pharmaceuticals & Healthcare, Market Value (USD Million), and CAGR, 2026-2030F

- Automotive, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Type

- Centralized WES (cWES), Market Value (USD Million), and CAGR, 2026-2030F

- Embedded WES (eWES), Market Value (USD Million), and CAGR, 2026-2030F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- By Deployment

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2030

- Increment $ Opportunity Assessment, 2026-2030

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2030, By

- By Deployment

- Cloud-Based, Market Value (USD Million), and CAGR, 2026-2030F

- On-Premises, Market Value (USD Million), and CAGR, 2026-2030F

- By Component

- Software, Market Value (USD Million), and CAGR, 2026-2030F

- Service, Market Value (USD Million), and CAGR, 2026-2030F

- Implementation & Integration Services, Market Value (USD Million), and CAGR, 2026-2030F

- Consulting Services, Market Value (USD Million), and CAGR, 2026-2030F

- Maintenance & Support Services, Market Value (USD Million), and CAGR, 2026-2030F

- By Application

- Sortation Systems, Market Value (USD Million), and CAGR, 2026-2030F

- Order Fulfillment, Market Value (USD Million), and CAGR, 2026-2030F

- Inventory Management, Market Value (USD Million), and CAGR, 2026-2030F

- Labor Management, Market Value (USD Million), and CAGR, 2026-2030F

- Shipping & Receiving, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Industry Vertical

- Retail & e-Commerce, Market Value (USD Million), and CAGR, 2026-2030F

- Logistics & Transportation, Market Value (USD Million), and CAGR, 2026-2030F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2030F

- Food & Beverage, Market Value (USD Million), and CAGR, 2026-2030F

- Pharmaceuticals & Healthcare, Market Value (USD Million), and CAGR, 2026-2030F

- Automotive, Market Value (USD Million), and CAGR, 2026-2030F

- Others, Market Value (USD Million), and CAGR, 2026-2030F

- By Type

- Centralized WES (cWES), Market Value (USD Million), and CAGR, 2026-2030F

- Embedded WES (eWES), Market Value (USD Million), and CAGR, 2026-2030F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2030F

- By Deployment

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Warehouse Execution Systems Market Outlook:

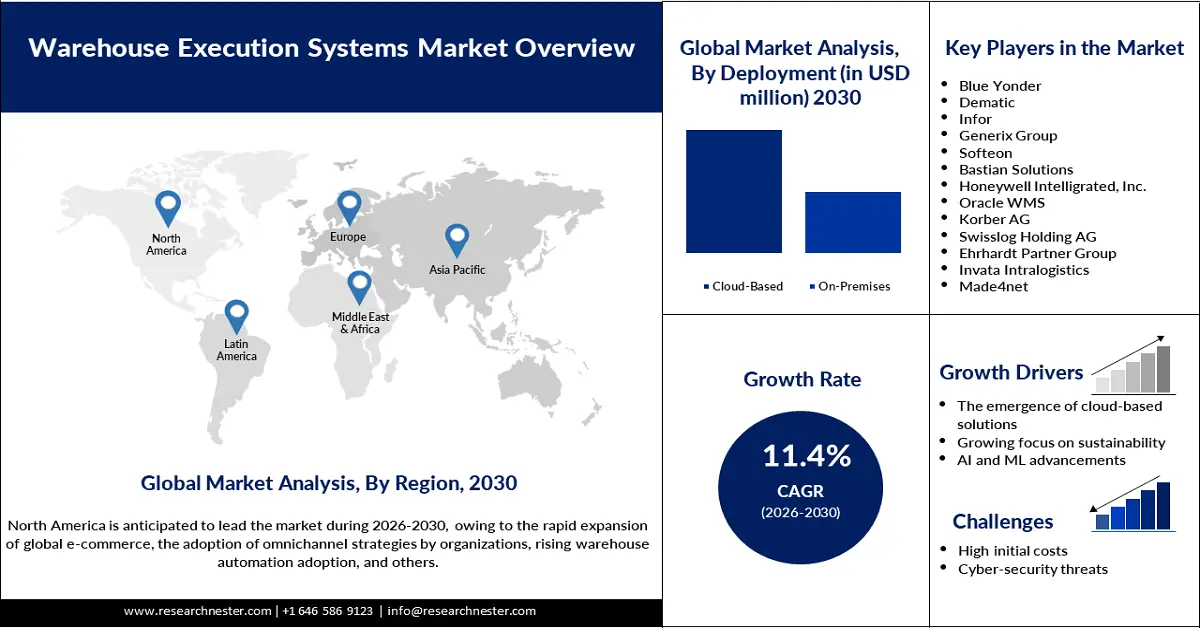

Warehouse Execution Systems Market size was valued at USD 3,269.1 million in 2025 and is expected to reach USD 5,600 million by the end of 2030, registering a CAGR of 11.4% during the forecast period, i.e., 2026-2030. In 2026, the industry size of warehouse execution systems is evaluated at USD 3,626.23 million.

The rapid expansion of the global e-commerce and omnichannel retail sector is a primary factor expected to fuel the warehouse execution systems market growth. To cope with the trend, organizations need efficiency, agility, and effective visualization in warehouse operations. This leads to rising demand for effective warehouse execution systems. Key players in the e-commerce industry are expanding their service lines, forcing business stakeholders to implement omnichannel strategies and adopt warehouse execution systems to remain in the market. For instance, in August 2025, Flipkart celebrated the success of one year of operations of its quick e-commerce offering, Flipkart Minutes, in India. Serving over 50 million people in its very first business year, Flipkart Minutes emerged as the fastest-growing e-commerce platform.

Growing adoption of advanced warehouse automation systems by organizations across several sectors is another factor that can fuel the warehouse execution systems market growth. Organizations are focused on integrating WES with automation technologies so that real-time decision-making and optimization of the warehouse workflows can make the warehouse maintenance increasingly seamless. As reported by the International Committee of the Fourth International in November 2023, a new, technologically advanced warehouse was inaugurated by the United Parcel Service. The company planned to engage more than 3,000 robots in heavy lifting. Such robots are likely to play a crucial role in WES in organizations.

Key Warehouse Execution Systems Market Insights Summary:

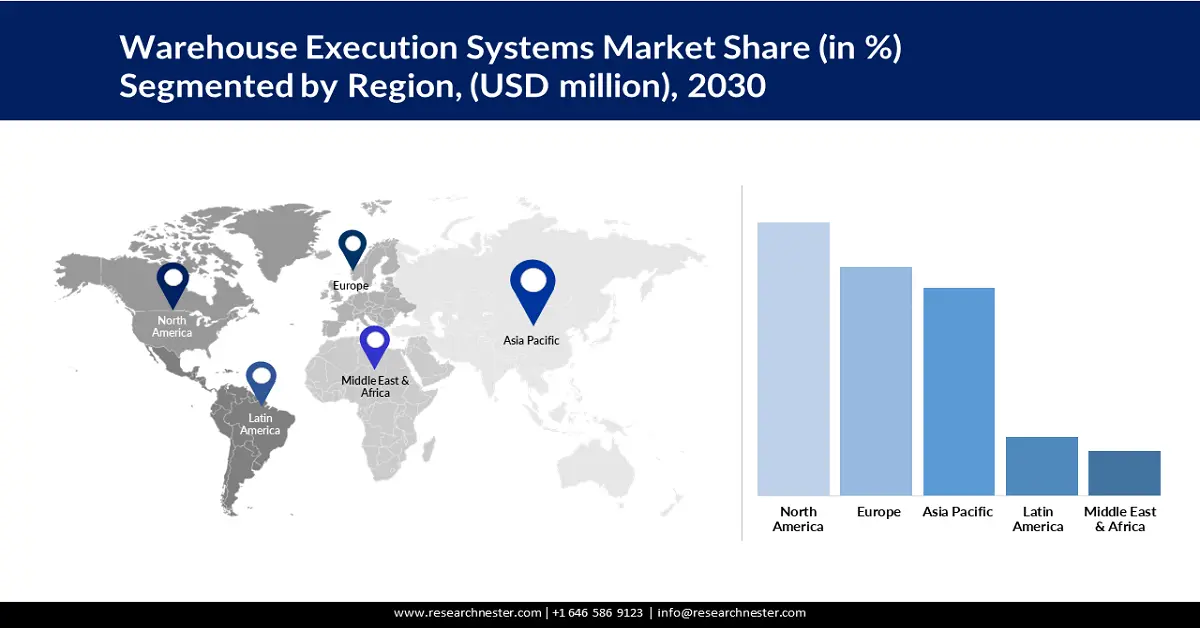

Regional Highlights:

- North America is projected to hold a substantial share of the warehouse execution systems market by 2030, attributed to a persistent labor shortage and the growing need for supply chain resilience.

- Europe is expected to command a robust revenue share by 2030, owing to stringent environmental regulations and rising industrialization across the region.

Segment Insights:

- The cloud-based segment of the warehouse execution systems market is projected to account for 71% of the market share by 2030, owing to its scalability, flexibility, and seamless integration with organizational information systems.

- The software segment is anticipated to capture a 66.9% revenue share by 2030, propelled by the rapid expansion of the e-commerce industry and the growing need for efficient and automated warehouse operations.

Key Growth Trends:

- The emergence of cloud-based solutions

- High focus on product development

Major Challenges:

- The need for high initial investments

- Cybersecurity threats

Key Players: Blue Yonder, Dematic, Infor, Generix Group, Softeon, Bastian Solutions, Honeywell Intelligrated, Inc., Oracle WMS, Korber AG, Swisslog Holding AG, Ehrhardt Partner Group, Invata Intralogistics, Made4net, Logiwa, Toshiba Infrastructure Systems & Solutions Corporation.

Global Warehouse Execution Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3,269.1 million

- 2026 Market Size: USD 3,626.23 million

- Projected Market Size: USD 5,600 million by 2030

- Growth Forecasts: 11.4% CAGR (2026-2030)

Key Regional Dynamics:

- Largest Region: North America (Highest Market Share by 2030)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Indonesia, Mexico, Brazil

Last updated on : 29 September, 2025

Warehouse Execution Systems Market - Growth Drivers and Challenges

Growth Drivers

- The emergence of cloud-based solutions: The emergence of cloud-based solutions fuels the market growth by providing the opportunity to enable scalability, integration abilities, and cost-effectiveness in warehouse management. Companies are consistently investing in designing cloud-based solutions that are likely to be compatible with different warehouse execution systems. For example, in August 2025, Honeywell announced the launch of its newly developed warehouse execution software that is available as a cloud-based platform. The cloud-based solution can be used in distribution and fulfillment operations in scalable, flexible, and cost-effective ways.

- High focus on product development: The focus of organizations on sustainability is enabling companies to implement energy-efficient solutions in organizational warehouse operations. For instance, in May 2025, Daifuku Intralogistics revealed its development of a WES software suite, Dainamics, an advanced automated solution. Through the use of the software suite in warehouse management, organizations are likely to drive operational, environmental, and economic improvements, since the integration of the system can help to reduce energy consumption and waste. Regulators globally are also obligating organizations to increase sustainability in operations, influencing a rising adoption of warehouse execution systems in streamlining warehouse management.

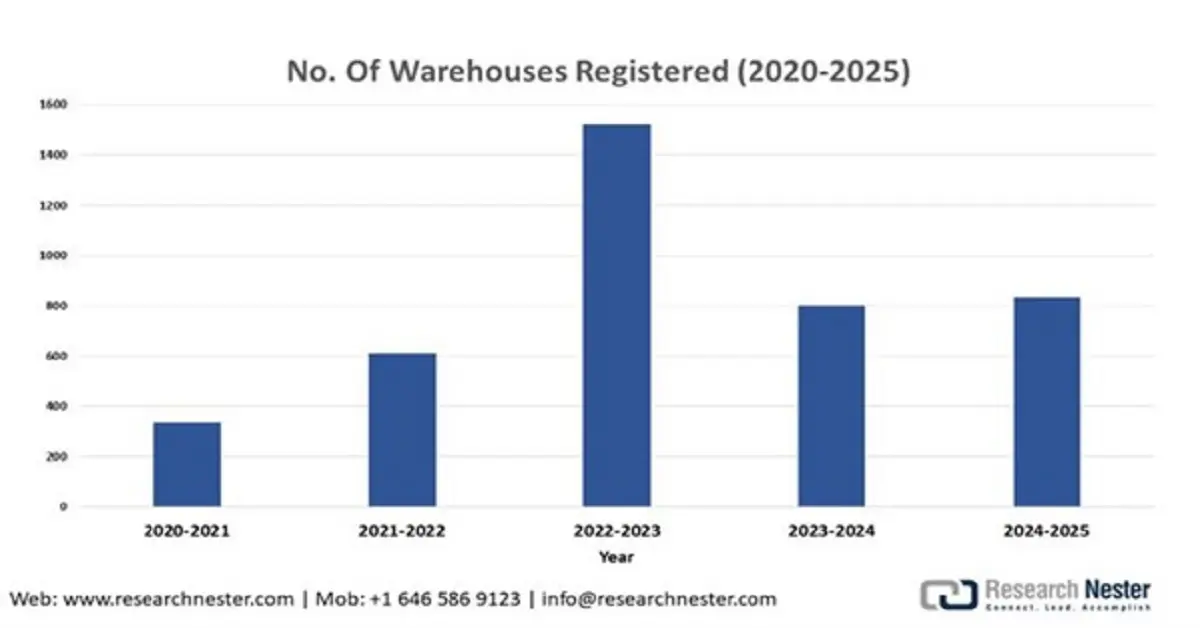

- Rising number of warehouses: The rising number of warehouses across several industries is accelerating the need for precise warehouse management. Such establishments are taking place across the globe, especially in developing economies like India. For instance, as reported by the Department of Food and Public Distribution in June 2025, the Central Warehouse Corporation in India was contemporarily managing a wide network of 469 warehouses across the country. The warehouses account for a capacity of 115 lakh MT.

Source: DFPD

Rapid Advancements in AI and ML

The rapid advancements in AI and ML technology are driving the market by providing the opportunity to deploy more intelligent and proactive warehouse execution systems. AI-incorporated warehouse execution systems are likely to benefit organizations with improved productivity, increased accuracy, and operational agility in warehouse management. Organizations across different industries have started to adopt AI-powered WES. One such example is the adoption of the Porter AMR autonomous pallet-moving robot by Ocado in March 2025. The company integrated the technology with its fulfillment centers and benefited from automated picking, packing, and organization of product stock from the grid directly.

|

Company |

Core AI / ML functions in Warehousing |

Product / Platform |

|

Blue Yonder |

Predictive demand & replenishment, real-time orchestration, ML-driven scenario planning, and dynamic execution adjustments |

Luminate (AI/ML services used across planning - execution / WES/WMS integration) |

|

Manhattan Associates |

AI-driven order allocation, intelligent task prioritization, generative-AI assistant for configuration and exception resolution (warehouse assist) |

Manhattan Active (WMS + embedded WES features; Manhattan Assist) |

|

Dematic |

Intelligent orchestration of automation + workforce, ML for autonomous decisions, predictive performance/throughput optimization in WES |

Dematic iQ (iQ Optimize / iQ platform - WES/WMS orchestration) |

|

GreyOrange |

Real-time AI for robot routing, task allocation, and continual learning to improve throughput and pathing |

GreyMatter (robotics orchestration/warehouse decision engine) |

|

Honeywell Intelligrated |

ML-driven workload balancing, real-time decisioning for order release, integration/optimization across conveyors, AS/RS, and robots |

Momentum WES (cloud-enabled WES with ML optimization) |

|

Locus Robotics |

Fleet-level AI for AMR pathing, prescriptive analytics, predictive & prescriptive BI for throughput and utilization |

LocusOne / LocusHub (AI business-intelligence and fleet orchestration) |

Source: Blue Yonder, Manhattan Associates, Honeywell

Challenges

- The need for high initial investments: The deployment of warehouse execution systems is costly, which is an area of challenge for businesses with limited revenue streams. High costs for the deployment of the WES are influenced by the high expenses required for the purchase of sophisticated software, scanners, robotics, and performing data migration, customization, and many more. Autonomous mobile robots are increasingly being adopted in warehouses due to the changing landscape of relevant technology. This encourages organizations to adopt automation-enabled warehouse execution systems, and the production of such systems is likely to be higher in terms of costs.

- Cybersecurity threats: Cybersecurity attacks in the form of infiltration of operating systems, destruction of crucial warehouse information with the use of malicious code, extortion, and others, impose challenges in the execution of warehouse execution systems. This raises concerns among organizations to deploy warehouse execution systems and influence them to take measures and ensure the mitigation of all cybersecurity risks in the use of systems. Thus, the need for initiating more expenses arises for businesses, which is likely to hinder the adoption of WES.

Wearable Pregnancy Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2030 |

|

CAGR |

11.4% |

|

Base Year Market Size (2025) |

USD 3,269.1 million |

|

Forecast Year Market Size (2035) |

USD 5,600 million |

|

Regional Scope |

|

Warehouse Execution Systems Market Segmentation:

Deployment Segment Analysis

The cloud-based segment is expected to account for 71% of market share by the end of 2030, owing to the capability to offer scalability, flexibility, and seamless integration with other organizational information systems. This is helping organizations meet the customer expectations in the fast-paced and ever-evolving 21st-century business world. Companies associated with different industries are also adopting cloud-based WES for seamless warehouse management. For instance, in March 2025, Honeywell revealed the availability of its warehouse execution software as a cloud-based platform that can be accessed by consumers. The cloud-based systems can help businesses to reduce upfront expenses for IT infrastructure and facilitate processes for the maintenance and adjustments of the warehouse execution software according to the business's needs.

Component Segment Analysis

The software segment is anticipated to acquire a revenue share of 66.9% by 2030, due to the rapid expansion of the e-commerce industry, leading to surging demand for increasingly efficient and automated warehouse operations. With the expansion of e-commerce, the volumes of orders and picking processes are increasing. The integration of suitable WES in organizations enables effective high volumes of order management, picking, and warehouse operational efficiency.

Type Segment Analysis

The centralized WES (cWES) is expected to acquire 64.3% revenue share by the end of 2030, as a consequence of the growing demand for automation, and rising need for access to real-time operational data, and improved visibility of the processes in the organizational inventory. Organizations are taking significant measures, including the initiation of strategic partnerships, to make their warehouse execution systems centralized. For instance, in October 2023, the largest pure-play contract logistics provider globally, GXO Logistics, unveiled its strategic partnership with a leader in intelligent supply chain software, Blue Yonder. The initiative was taken for the deployment of a new end-to-end supply chain software solution with the motive of powering GXO Direct, the shared warehousing solution, in the U.S.

Our in-depth analysis of the warehouse execution systems market includes the following segments:

|

Segments |

Subsegments |

|

Deployment |

|

|

Component |

|

|

Application |

|

|

Industry vertical |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Warehouse Execution Systems Market - Regional Analysis

North America Market Insights

North America is expected to account for a remarkable warehouse execution systems market share by the end of 2030, owing to a persistent shortage of labor. As reported by the U.S. Chamber of Commerce in November 2023, workforce engagement remained lower compared to pre-pandemic levels. Compared to February 2020, a shortage of around 1.7 million workers exists in the U.S. in November 2023. This factor is likely to lead organizations to adopt software like WES to avoid the issue of workforce shortage in warehouse operations. The demand for resilience in the organizational supply chain in businesses is another factor fueling the market growth.

The U.S. is expected to emerge as a rapidly expanding warehouse execution systems market at a CAGR of 11.9% during the forecast period, as a consequence of a persistent shortage of labor and surging demand for supply chain resilience. Companies based in the U.S. are also involved in the development of WES. For instance, at ProMat 2023 in March 2023, DCS unveiled a new proprietary WES, DATM. The system is capable of facilitating multiple warehouse tasks, ranging from order to planning to task synchronization to reprioritization of tasks for the establishment of optimal warehouse workflow.

The warehouse execution systems market in Canada is anticipated to witness steady growth throughout the forecast period, due to rising property costs. This factor is increasing the need to adopt advanced warehouse execution systems in organizations by leading them to improve efficiency in their existing warehouses to meet the market demands. A surge in e-commerce sales across Canada is also fueling the need for WES in organizations. As reported by the National Statistical Office in Canada in August 2025, retail sales through e-commerce platforms increased by 1.7% to USD 4.2 billion in June of the current financial year.

Europe Market Insights

The warehouse execution systems market in Europe is poised to account for a robust revenue share by the end of 2030, owing to stringent environmental regulations. For example, in September 2023, the European Parliament and the Council announced the new, recast Energy Efficiency Directive (EU) 2023/1791. The new directive is focused on increasing energy efficiency through the reduction of consumption of the same by 11.7% by 2030 across Europe. To comply with the new directive and contribute to reducing energy consumption, companies operating in Europe are likely to initiate the integration of WES in their warehouse management. Growing industrialization across the region is another factor, fueling the demand for warehouse execution systems.

Germany warehouse execution systems market is anticipated to experience a rapid expansion at a CAGR of 11.4% during the forecast period, due to rising online shopping, fueling the need for organizations to adopt WES. As reported by the International Trade Administration in August 2025, the number of e-commerce users in Germany is expected to reach 47.68 million by 2029. Retailers based in Germany are consistently adopting the omnichannel strategy, which is also fueling the demand for WES.

The WES market in the UK is expected to witness a steady expansion throughout the forecast period, as a consequence of the rapid penetration of e-commerce. Technological advancements, including the advancement of AI, ML, robotics, and cloud-based solutions, are fueling the market growth by providing the opportunity to incorporate more advanced solutions into WES. Organizations that need advanced WES are initiating strategic collaborations with relevant technology organizations. For instance, in May 2023, Made5net announced its acquisition by Ingka Group. This led the company to the Ikea software rollout.

Asia Pacific Market Insights

By 2030, the WES market in the Asia Pacific is anticipated to register rapid growth, owing to support from the government for organizations to modernize their supply chain. As reported by the Ministry of Trade, Industry and Energy (MOTIE) of the Republic of Korea in December 2024, the government announced the First Supply Chain Stabilization Basic Plan, which was enforced in June of the same business year. Adhering to the plan, the government is keen to invest USD 39.5 billion to expand production, diversify imports, improve public stockpiling, and protect key technologies. Such government support is encouraging organizations to adopt WES to streamline their supply chain procedures.

The WES market in China is anticipated to expand steadily at a CAGR of 12.0% during the forecast period, on account of the implementation of national strategies promoting advanced manufacturing. The deployment of digital and advanced supply chain models, fueling the adoption of WES. Technology companies based in China are also fueling the market growth by initiating strategic collaborations with organizations that need advancements in their WES. For instance, in January 2024, Honeywell unveiled its plan to collaborate with Hai Robotics with the motive of delivering flexible, high-density solutions for storage and retrieval to the distribution centers. In the collaboration, Honeywell’s Momentum Warehouse Execution Software was integrated with the innovative robotics technology of Hai Robotics, resulting in enhanced cybersecurity abilities of the WES.

Japan is expected to emerge as a steadily growing WES market during the forecast period, as a consequence of an aging population. An aging population has led to a workforce shortage and is fueling the demand for WES for effective warehouse maintenance in organizations. Japan's 2024 logistics problem, which refers to the prohibition of truck drivers working overtime, fuels the market growth. The issues in the logistics in Japan force companies to invest in the adoption of WES to reduce the duty times of drivers, since WES optimizes workflow in warehouses and minimizes dwell time for drivers.

Key Warehouse Execution Systems Market Players:

- Blue Yonder

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dematic

- Infor

- Generix Group

- Softeon

- Bastian Solutions

- Honeywell Intelligrated, Inc.

- Oracle WMS

- Korber AG

- Swisslog Holding AG

- Ehrhardt Partner Group

- Invata Intralogistics

- Made4net

- Logiwa

- Toshiba Infrastructure Systems & Solutions Corporation

The association of a vast range of key players makes the market highly competitive. The market is fragmented at the same time due to the acquisition of the majority of revenue shares by the large players. The majority of the key players in the market have become active to take advantage of the development of AI, machine learning, and other technologies to develop WES in ways that can perform warehouse operational tasks in more streamlined ways. The motive behind such development of WES is to enable real-time visualization and access to real-time data.

Below is the list of the key players associated with the global market:

Recent Developments

- In March 2025, a leading supplier of warehouse management software, Körber Supply Chain Software, rebranded itself as Infios. It is a joint venture between Körber AG and KKR, involved in integrating order management, transportation, warehousing, and fulfillment management into a comprehensive suite of software solutions.

- In March 2024, Kardex announced the launch of its FulfillX solution at the MODEX 2024, the trade show on international supply chain held in Atlanta. Automation engineers designed the WES with the motive of maximizing the performance of the AutoStore robotic cube storage systems, along with the delivery of the fastest systems of order fulfillment per square foot.

- In January 2024, Fujitsu revealed its agreement with YE Digital to serve businesses with WES-enabled distribution centers. The motive was to contribute to eliminating shortages of labor and strengthening supply chain sustainability in Japan.

- Report ID: 8133

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Warehouse Execution Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.