Vulnerability Management Market Outlook:

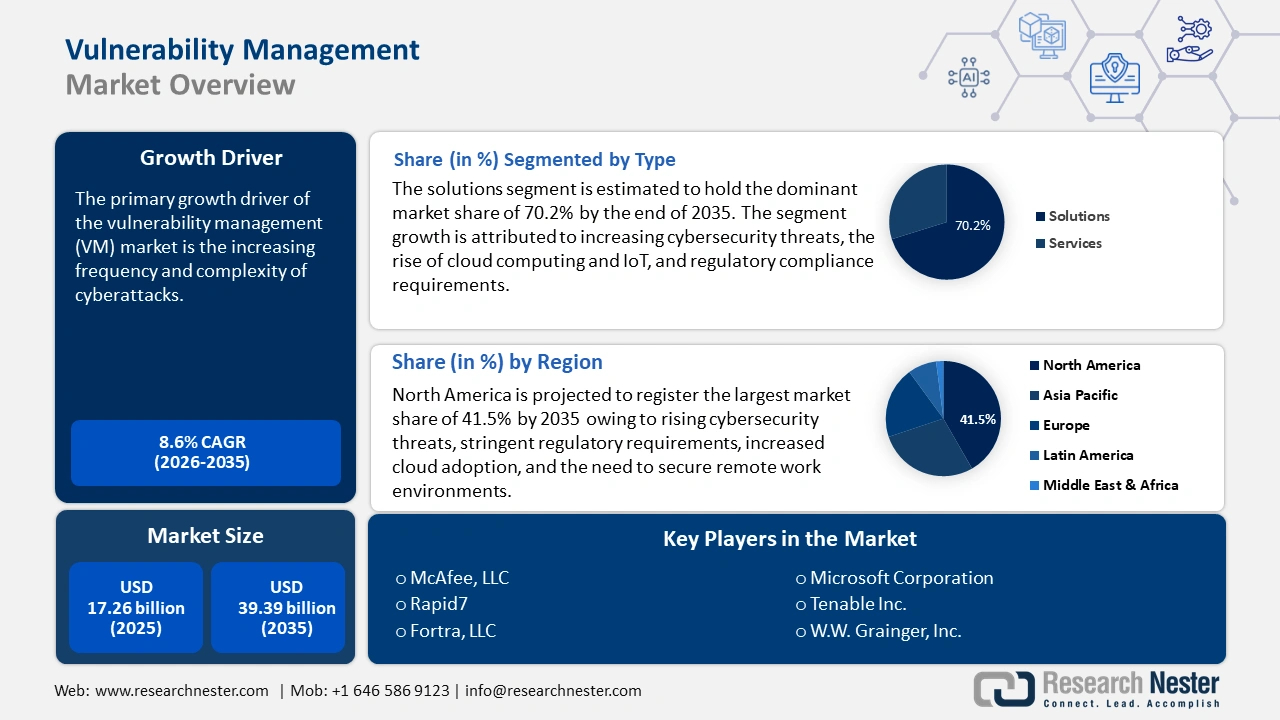

Vulnerability Management Market size was valued at USD 17.26 billion in 2025 and is likely to cross USD 39.39 billion by 2035, registering more than 8.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vulnerability management is assessed at USD 18.6 billion.

The primary growth driver of the VM market is the increasing frequency and complexity of cyberattacks. The number of cyberattacks worldwide increased by 30% year over year in Q2 2024, reaching 1,636 attacks per organization weekly. Education/Research (3,341 attacks per week), Government/Military (2,084 attacks per week), and Healthcare (1,999 attacks per week) were the top three most attacked industries. Organizations experiencing targeted and advanced threats are forced to prioritize identifying, assessing, and mitigating vulnerabilities in their IT systems.

Many industries are governed by strict regulations that require robust vulnerability management processes to protect sensitive data and ensure business continuity. Regulatory frameworks such as GDPR, HIPAA, and PCI-DSS demand strong security postures, driving organizations to invest in vulnerability management solutions. For instance, over 26% of businesses in the U.S. spent more than half a million dollars to become GDPR compliant, while 38% of enterprises saw good returns on their privacy investments.

Key Vulnerability Management Market Insights Summary:

Regional Highlights:

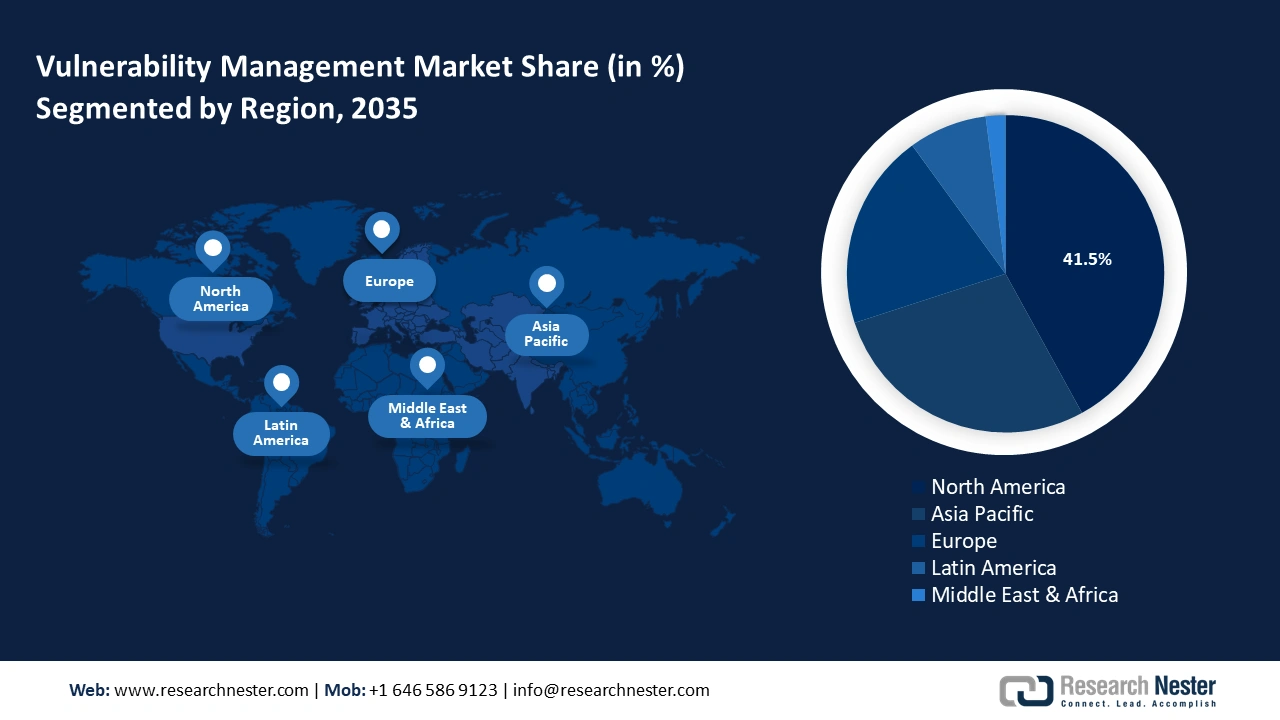

- North America vulnerability management market will account for 41.50% share by 2035, driven by rising cybersecurity threats, stringent regulatory requirements, increased cloud adoption, and the need to secure remote work environments.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, attributed to the rising number of cybersecurity attacks and BYOD data breaches in the region.

Segment Insights:

- The solutions segment in the vulnerability management market is expected to grow significantly by 2035, fueled by increasing cybersecurity threats and adoption of AI-driven vulnerability management solutions.

- The large enterprises segment (vulnerability management market) segment in the vulnerability management market is expected to secure a 64% share by 2035, driven by large enterprises' need for advanced risk management amid rising cyberattack exposure.

Key Growth Trends:

- Growth of cloud adoption and IoT

- Remote work and BYOD policies

Major Challenges:

- High implementation and maintenance costs

- Shortage of skilled cybersecurity professionals

Key Players: McAfee, LLC, Microsoft Corporation, Rapid7, Tenable Inc., Fortra, LLC, Qualys, Inc., IBM Corporation, NortonLifeLock Inc..

Global Vulnerability Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.26 billion

- 2026 Market Size: USD 18.6 billion

- Projected Market Size: USD 39.39 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 18 September, 2025

Vulnerability Management Market Growth Drivers and Challenges:

Growth Drivers

- Growth of cloud adoption and IoT: The rapid adoption of cloud technologies and the proliferation of IoT devices have created a more complex and diverse threat landscape. Many enterprises are adopting hybrid or multi-cloud strategies, integrating both on-premise and cloud-based resources. This creates complex environments that demand sophisticated vulnerability management to ensure security across all platforms. Also, the adoption of DevOps and continuous integration/continuous deployment (CI/CD) practices in cloud environments accelerates the software release. As of 2024, 77% of enterprises deploy software using DevOps. Vulnerability management solutions are critical for ensuring that security is maintained throughout rapid development cycles.

The rise of IoT devices, which often lack robust security measures, has made them prime targets for botnets. A botnet is a sizable set of devices that are taken over by a single attacker or group of attackers. Botnet attacks such as ad fraud have shown how easily IoT devices can be infected and used to launch massive Distributed Denial of Service (DDoS) attacks. About 31% of iOS app and 25% of Android app installs are fraudulent. The total cost of ad fraud in 2022 was around USD 80 billion with Asia Pacific being the most affected region. Vulnerability management tools are essential for monitoring and securing IoT environments, and detecting weak points that can be exploited by botnets. - Remote work and BYOD policies: A larger portion of the workforce is operating from remote locations and employees are accessing corporate networks from outside the secure perimeter of the office environment. This increases the risk of exposure to vulnerabilities, as employees may connect through unsecured networks or unpatched devices. As of 2024, 12.7% of full-time employees work from home, demonstrating the rising use of remote work environments. Simultaneously, 28.2% of employees have adopted a hybrid work model.

Additionally, Bring Your Own Device (BYOD) policies allow employees to use their personal devices for work purposes, including accessing sensitive corporate data and systems. These devices are often less secure than company-issued ones and also have limited IT control. This exposes a way for potential vulnerabilities, such as outdated software or weak configuration, that attackers can exploit. Vulnerability management solutions are critical for detecting, assessing, and remediating these vulnerabilities, helping organizations secure their distributed workforces and reduce exposure to cyber risks. - Advanced threat detection and remediation: Cyberattacks are growing in complexity, with threats such as zero-day exploits, fileless malware, advanced persistent threats (APTs), and ransomware becoming more common. For instance, fileless attacks sometimes referred to as memory-only malware, non-malware, and zero-footprint attacks, have become far more common over recent years. They now make up over 90% of ransomware samples and are used in more than 50% of successful data breaches. Fileless attacks surged by 1400% in 2022 alone, and due to their evasive nature, they will continue to appear in greater numbers in the coming years. These advanced threats often bypass traditional security measures, making it essential for organizations to adopt vulnerability management solutions that offer real-time, advanced detection and remediation capabilities.

Challenges

- High implementation and maintenance costs: Implementing a comprehensive vulnerability management system can be expensive, especially for small and medium-sized businesses. The costs associated with purchasing software licenses, training staff, and integrating tools into existing systems can be prohibitive. Moreover, vulnerability management requires continuous monitoring, regular patching, and updates. For many organizations, the costs of ongoing maintenance, especially for cloud or hybrid environments, can be a significant burden.

- Shortage of skilled cybersecurity professionals: The cybersecurity industry is facing a global shortage of skilled professionals, making it difficult for organizations to implement and manage effective vulnerability management programs. Even with vulnerability management solutions in place, businesses need cybersecurity experts to interpret data, assess risks, and prioritize remediation efforts. This shortage of professionals can hinder the full utilization of advanced vulnerability management systems.

Vulnerability Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 17.26 billion |

|

Forecast Year Market Size (2035) |

USD 39.39 billion |

|

Regional Scope |

|

Vulnerability Management Market Segmentation:

Component Segment Analysis

The solutions segment is likely to capture vulnerability management market share of over 70.2% by 2035. The solutions segment is playing a critical role in driving the growth of the vulnerability management market. Factors such as increasing cybersecurity threats, the rise of cloud computing and IoT, regulatory compliance requirements, and the need for integrated security platforms are driving organizations to adopt advanced vulnerability management solutions.

With innovations in AI, machine learning, and automation, the demand for vulnerability management solutions is expected to continue rising. Automated vulnerability management solutions using AI and machine learning are expected to witness significant growth in the coming years, as businesses seek more efficient ways to manage the increasing number of vulnerabilities. AI-powered tools can reduce the time needed for detection and prioritization, driving their adoption. The number of enterprises implementing AI-driven vulnerability management solutions has increased by 40%, resulting in a 30% decrease in vulnerabilities.

Organization Size Segment Analysis

The large enterprises segment share in the vulnerability management market is expected to reach 64% by 2035. Large enterprises face unique cybersecurity challenges due to their complex infrastructures, vast amounts of sensitive data, and greater exposure to cyberattacks. Cybercriminals often target these organizations for intellectual property, financial information, and customer data. In April 2021, Facebook, one of the biggest corporations in the world, experienced one of its biggest data breaches, exposing the names, phone numbers, account names, and passwords of more than 530 million individuals to the public. Facebook identified the problem in the platform’s tool to sync contacts, citing hackers exploiting a vulnerability to scrape user profiles for customer data.

Additionally, large enterprises prioritize risk management as part of their overall business strategy, and cybersecurity is a vital component. Vulnerability management solutions help large enterprises identify, assess, and mitigate security risks, ensuring business continuity and protecting financial losses.

Our in-depth analysis of the vulnerability management market includes the following segments:

|

Component |

|

|

Organization |

|

|

Deployment Model |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vulnerability Management Market Regional Analysis:

North America Market Insights

North America industry is likely to account for largest revenue share of 41.5% by 2035. The region is set to experience strong growth, driven by rising cybersecurity threats, stringent regulatory requirements, increased cloud adoption, and the need to secure remote work environments. Large enterprises, government institutions, and highly regulated sectors such as healthcare and finance are leading the demand for advanced vulnerability management solutions.

The U.S. healthcare organizations are facing increasing cyberattacks, particularly ransomware. For instance, a 2021 report published by the Department of Justice, Federal Bureau of Investigation (FBI), Cyber Division, stated that at least 16 Conti ransomware attacks targeting U.S. healthcare and first responder networks, including law enforcement agencies, emergency medical services, 9-1-1 dispatch centers, and municipalities were identified in 2020. Conti has targeted over 400 institutions worldwide, including healthcare and first responder networks, with over 290 nationwide.

Moreover, the Cybersecurity and Infrastructure Security Agency (CISA) and other federal entities are pushing for improved vulnerability assessments and continuous monitoring to secure national infrastructure. This has led to greater adoption of vulnerability management tools in sectors such as defense, energy, and telecommunications.

The Government of Canada has made significant investments in cybersecurity to secure critical infrastructure. Grants and funding are often provided to help small and medium-sized enterprises improve their cybersecurity posture, indirectly boosting demand for vulnerability management tools and services. The local government enforces regulations and standards that organizations must follow to protect their digital infrastructure. Some key regulatory bodies include the Canadian Center for Cyber Security, the Personal Information Protection and Electronic Documents Act (PIPEDA), and the Canadian National Cyber Security Strategy.

APAC Market Insights

Asia Pacific in vulnerability management market is poised to register the fastest growth by the end of the forecast period. The number of cybersecurity attacks and BYOD data breaches in the region is gradually increasing. As a result, the region is conducive to the development and use of security and vulnerability management solutions. According to an ESET Enterprise survey, approximately one in every five business organizations in this region has had at least six security breaches in recent years. Due to the rising number of cyberattacks in this field, the key industry participants are focusing on strengthening their defensive capabilities. This has also continuously drawn the interest of the governments of the nations in this region. Countries with extensive and up-to-date cybersecurity strategies include Australia, Indonesia, Japan, Malaysia, the Philippines, Singapore, Sri Lanka, and Thailand.

In Australia, the rising government and regulatory initiatives to increase security are expected to drive the usage of vendor solutions during the forecast period. For instance, in March 2022, in response to an increasing cyber threat scenario throughout the world, Australia's Federal Government announced its 2022-23 federal budget, allocating USD 6.39 billion to boost cybersecurity and intelligence capabilities. The USD 6.46 billion will be spent on a program known as REDSPICE, which stands for Resilience, Effects, Defence, Space, Intelligence, Cyber, and Enabler.

The Cyber Security Agency (CSA) of Singapore has reported an increase in cybercrimes such as phishing, ransomware, and scams in recent years. The most prevalent forms of scams in the country are phishing, employment, and e-commerce. E-commerce scams were the fastest-rising type of cyber fraud in 2022, accounting for USD 16.2 million in total losses. This in turn drives demand for vulnerability management tools and services across public and private sectors in the country.

Vulnerability Management Market Players:

- Ivanti

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- McAfee, LLC

- Microsoft Corporation

- Rapid7

- Tenable Inc.

- Fortra, LLC

- Qualys, Inc.

- IBM Corporation

- NortonLifeLock Inc.

- Proofpoint Inc.

The vulnerability management market key players drive market growth by focusing on innovation, expanding their solutions to cover emerging technologies, and assisting organizations in meeting complex compliance requirements. Moreover, mergers, acquisitions, and partnerships allow major players to expand their capabilities and vulnerability management market reach.

Recent Developments

- In October 2024, Tenable, the exposure management company, introduced new data security posture management (DSPM) and artificial intelligence security posture management (AI-SPM) features for Tenable Cloud Security, the proactive cloud security solution.

- In October 2020, McAfee Corp., a device-to-cloud cybersecurity business, introduced the MVISION Cloud Native Application Protection Platform (CNAPP), the industry's first integrated architecture for securing the cloud-native application ecosystem. MVISION CNAPP provides consistent data protection, threat prevention, governance, and compliance across the whole cloud-native application lifecycle, including container and OS-based workloads.

- Report ID: 6581

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vulnerability Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.