VPX SBC Market Outlook:

VPX SBC Market size was over USD 276.6 million in 2025 and is poised to exceed USD 964.16 million by 2035, witnessing over 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of VPX SBC is estimated at USD 309.71 million.

The increasing demand for high-performance embedded computing is driving the VPX SBC market. This demand is particularly strong in aerospace, defense, and telecommunications industries, where applications like radar systems, electronic warfare, and advanced signal processing require modular and powerful computing solutions. Additionally, the focus on size, weight, and power (SWaP) optimization further propels the adoption of VPX SBCs due to their ability to deliver high performance in compact form factors.

Rising geopolitical tensions and defense modernization programs are driving investments in drones for surveillance, reconnaissance, and combat. Applications in logistics, agriculture, and mapping are also expanding. These systems require lightweight, compact, and high-performance computing solutions, making VPX SBCs an ideal choice. Governments and private players are heavily investing in satellite programs, reusable rockets, and space exploration missions. The harsh environments of space require ruggedized, reliable computing platforms capable of handling extreme conditions, which is a key aspect of VBX SBCs.

Key VPX SBC Market Insights Summary:

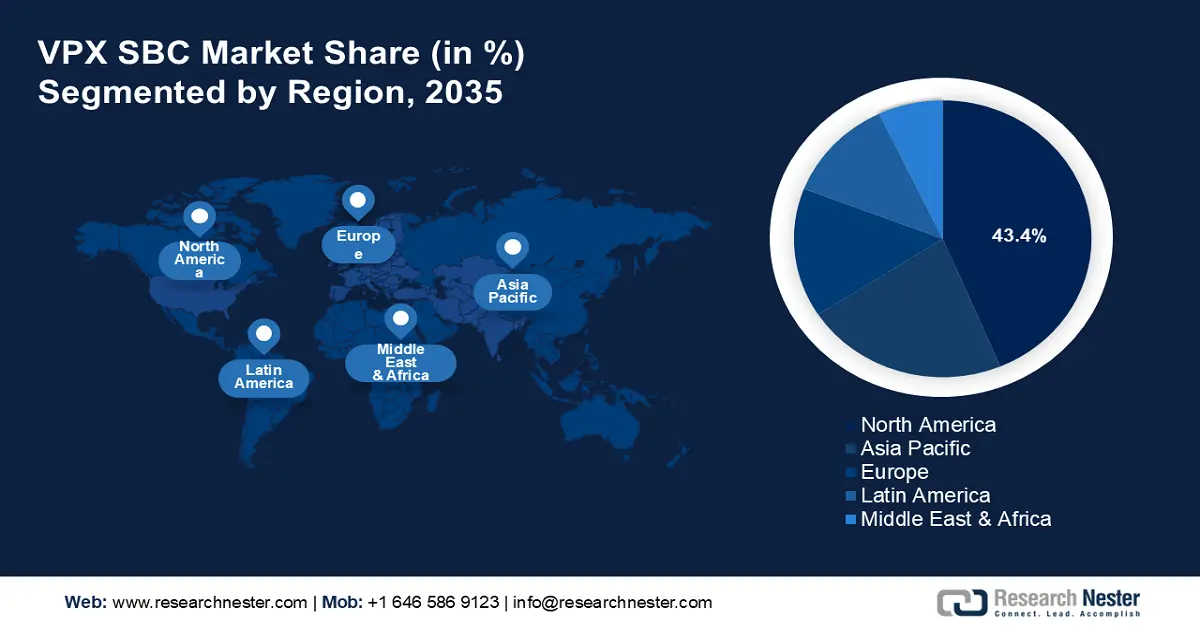

Regional Highlights:

- North America leads the VPX SBC Market with a 43.4% share, driven by technological advancements and defense investments, positioning it for significant growth through 2035.

- The Asia Pacific region is anticipated to witness significant growth in the VPX SBC Market from 2026 to 2035, driven by increased adoption of rugged computing solutions in defense.

Segment Insights:

- The Intel segment is anticipated to capture a significant share by 2035, driven by high-performance processors ideal for demanding VPX SBC applications.

- The 3U segment of the VPX SBC Market is projected to achieve a 67.70% share from 2026 to 2035, driven by its compact design and scalability suited for rugged and space-constrained applications.

Key Growth Trends:

- Rising demand in defense and aerospace

- Integration of artificial intelligence (AI) and machine learning (ML)

Major Challenges:

- High development and manufacturing costs

- Complex integration and compatibility issues

- Key Players: Extreme Engineering Solutions, Inc., Connect Tech Inc., Kontron, ADLINK Technology Inc., Mistral Solutions Pvt. Ltd., Curtiss-Wright Organization.

Global VPX SBC Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 276.6 million

- 2026 Market Size: USD 309.71 million

- Projected Market Size: USD 964.16 million by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 13 August, 2025

VPX SBC Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand in defense and aerospace: Modern defense applications, such as radar systems, electronic warfare, and unmanned vehicles, require real-time processing of large volumes of data. VPX SBCs provide the computational power and speed necessary for these critical tasks. Aircraft systems, including avionics, mission computing, and navigation, depend on high-performance embedded solutions like VPX SBCs to process and analyze data efficiently.

Many key players in the embedded computing industry are actively launching VPX SBCs tailored for defense and aerospace applications to meet the growing demand for high-performance, rugged, and reliable computing systems. The Logic Fruit Technologies' Kritin iXD 6U VPX SBC is a powerful single-board computer designed for aerospace and defense. It has a 10-core Intel Xeon D-1700 processor with Intel AVX-512 to handle demanding activities such as radar processing. The board features an AMD Xilinx FPGA, twin memory channels with 32 GB of DDR4-2667, and supports 100/40G Ethernet and PCIe Gen4, making it perfect for compute-intensive applications.

VPX SBCs are designed to withstand extreme conditions such as high altitudes, temperature variations, and shocks, making them ideal for defense and aerospace applications. These boards are built for long-term reliability, a key requirement in mission-critical systems. Moreover, the defense and aerospace sectors favor VPX SBCs because they adhere to open standards like VITA 46 and VITA 48, ensuring interoperability and future-proofing systems. These standards allow manufacturers to tailor VPX SBCs for specific defense and aerospace applications. - Integration of artificial intelligence (AI) and machine learning (ML): VPX SBCs are increasingly used in AI-powered systems for applications such as autonomous drones, predictive maintenance, and intelligent surveillance. With high-performance processors and GPUs, VPX SBCs efficiently handle AI and ML algorithms, making them ideal for next-generation military and aerospace systems.

The use of VPX SBCs in Internet of Things (IoT) applications is growing, especially in smart defense systems and aerospace monitoring platforms. VPX SBCs enable the processing of large volumes of data collected from advanced sensors in real-time. To address the increasing demand for connected and smart applications across industries key players are launching IoT-powered SBCs. These SBCs are designed to support IoT functionalities, including edge computing, real-time analytics, and high-speed communication. Anders Electronics PLC's SBC-IOT-iMX8-Plus is a powerful single-board computer based on the NXP i.MX8M-Plus. It supports high-performance graphics and images for a variety of applications, including industrial control and monitoring, medical, IoT, digital signage, and professional audio-visual devices.

Challenges

- High development and manufacturing costs: VPX SBCs are designed for high-performance and rugged applications, requiring advanced materials, sophisticated manufacturing processes, and stringent quality control. The high costs limit adoption, particularly in price-sensitive markets like small-scale industrial and commercial sectors. Industries with tight budgets may prefer alternative SBC solutions such as CompactPCI or COM Express.

- Complex integration and compatibility issues: VPX SBCs often need to integrate with other systems, which can lead to compatibility challenges, especially in legacy systems. The need for custom solutions increases development time and costs, potentially discouraging adoption. Non-compliance with older VME-based systems may require additional investment in redesign or adapters.

VPX SBC Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 276.6 million |

|

Forecast Year Market Size (2035) |

USD 964.16 million |

|

Regional Scope |

|

VPX SBC Market Segmentation:

Processor (NXP Power Architecture, Intel, and ARM)

By 2035, Intel segment is set to capture VPX SBC market share of over 48.2%. Intel’s advanced processors provide high-performance computing capabilities, making them ideal for the demanding applications of VPX SBCs in industries such as defense, aerospace, telecommunications, and industrial automation. Intel Xeon and Core processors offer multi-core architectures and high clock speeds, enabling VPX SBCs to handle complex tasks such as AI workloads, real-time data analytics, and edge computing. The powerful VPX3-1260 of Curtiss-Wright Corporation uses Intel's first-ever six-core CPU to provide 50% more processing power than prior four-core designs. The VPX3-1260 is Intel's first SBC to support 10G and 40G Ethernet connectivity, giving customers quicker data transmission and more network productivity than ever before, as well as maximum flexibility to fulfill a variety of integration requirements. Furthermore, its local NVMe SSD storage outperforms typical SATA SSD interfaces by 3-5 times and has up to 16 times the capacity.

Intel processors are optimized for power efficiency, crucial for VPX SBCs operating in rugged and mission-critical environments. Advanced thermal design ensures reliable performance in extreme conditions, such as high temperatures or vibrations. Moreover, Intel processors support a broad range of software tools and platforms, simplifying the development of VPX SBCs. Compatibility with Intel’s ecosystem, including oneAPI, enhances development efficiency and system integration.

Rack Unit (3U and 6U)

The 3U segment is set to capture over 67.7% VPX SBC market share by 2035. The 3U rack unit balances size, performance, and scalability. Its compact design and versatility make it ideal for demanding applications across defense, aerospace, telecommunications, and industrial sectors. The 3U VPX form factor is smaller and lighter compared to the 6U form factor, making it suitable for space-constrained environments such as unmanned aerial vehicles (UAVs), submarines, and mobile platforms. The Extreme Engineering Solutions, Inc. (X-ES) integrated 3U VPX SBCs are powered by cutting-edge Intel Core i7, Intel Atom, Intel Xeon D, or NXP (previously Freescale) QorIQ processors, providing unrivaled performance. X-ES 3U VPX SBCs offer integrated FPGAs, SecureCOTS technology for data protection, reliable processing in extreme environments, and industry-leading, U.S.-based support, making them ideal for commercial and defense applications.

Our in-depth analysis of the global VPX SBC market includes the following segments:

|

Processor |

|

|

Rack Unit |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

VPX SBC Market Regional Analysis:

North America Market Statistics

North America in VPX SBC market is set to capture over 43.4% revenue share by 2035. The market growth is attributed to its technological advancements, substantial investments in defense and aerospace, and the presence of key industry players. The region’s focus on adopting advanced technologies and maintaining a strong defense infrastructure supports the sustained growth of the VPX SBC market.

The U.S. leads in defense expenditure, driving the adoption of VPX SBCs for mission-critical applications. Moreover, the country’s strong industrial automation and telecommunications sectors contribute to the demand for VPX SBCs, as these industries require robust and reliable computing solutions. Additionally, the VPX SBC market is influenced by several key players offering advanced and rugged computing solutions across various sectors. For instance, Mercury Systems, Inc., delivers BuiltSAFE VPX SBCs focused on safety-critical applications in defense and aerospace industries.

In Canada, manufacturers such as Connect Tech Inc. offer products like the GraphiteVPX/CPU, a VITA 65 compliant 3U single board computer based on the Intel Atom E3845 Quad Core processor. This highlights the presence of domestic manufacturers contributing to the market.

APAC Market Analysis

Asia Pacific VPX SBC market is expected to hold a significant share in the forecast period. The growth of the market is attributed to the increasing adoption of rugged computing solutions in the defense sector, advancements in aerospace technologies, and the rising demand for high-speed data processing in industrial applications. The region’s focus on technological innovation and research further propels the VPX SBC market, with significant investments in defense and space programs by countries like China, India, Japan, and South Korea.

In China, the government’s focus on enhancing military capabilities led to increased demand for advanced computing systems, including VPX SBCs, for applications such as surveillance, communication, and weapon control. Rapid growth in both commercial and military aviation sectors has spurred the adoption of VPX SBCs for flight control, communication, and navigation systems, owing to their compact size and lower power consumption. According to the China Civil Aviation annual report, in 2019, China's civil transport airports witnessed 11.661 million movements, up 5.2% year on year. Commercial flights accounted for 9.868 million movements, a 5.3% rise.

India’s focus on modernizing its defense capabilities has led to increased investments in advanced technologies, including VPX SBCs. Government initiatives like Make in India and Atmanirbhar Bharat are encouraging domestic production of defense equipment, boosting the local VPX SBC market. the need for compact, efficient, and rugged computing solutions in military applications is driving the adoption of VPX SBCs.

Key VPX SBC Market Players:

- Abaco Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Extreme Engineering Solutions, Inc.

- Connect Tech Inc.

- Kontron

- ADLINK Technology Inc.

- Mistral Solutions Pvt. Ltd.

- Curtiss-Wright Organization

- Mercury Systems, Inc.

- iWave Systems Technologies Pvt. Ltd

- Concurrent Technologies Inc.

- Elma Electronic Inc.

Global key players in the VPX SBC market are driving its growth through several strategic actions, including technological advancements, market expansion, and forming key partnerships. These companies are contributing to the overall development of the VPX SBC industry across sectors like defense, aerospace, communications, and industrial applications.

Recent Developments

- In October 2024, Elma Electronic introduced the portable FlexVNX+ development chassis that facilitates the creation and testing of VNX+ plugin cards (PICs) compatible with both VITA 90 and The Open Group SOSA™ Technical Standards.

- In June 2024, AMETEK Abaco Systems, a leader in rugged embedded electronics and open architecture computing solutions, announced the debut of the SBC3901, a 3U VPX single-board computer (SBC) designed to provide unrivaled performance for autonomous and embedded edge computing systems.

- Report ID: 7025

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

VPX SBC Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.