Voting System Market Outlook:

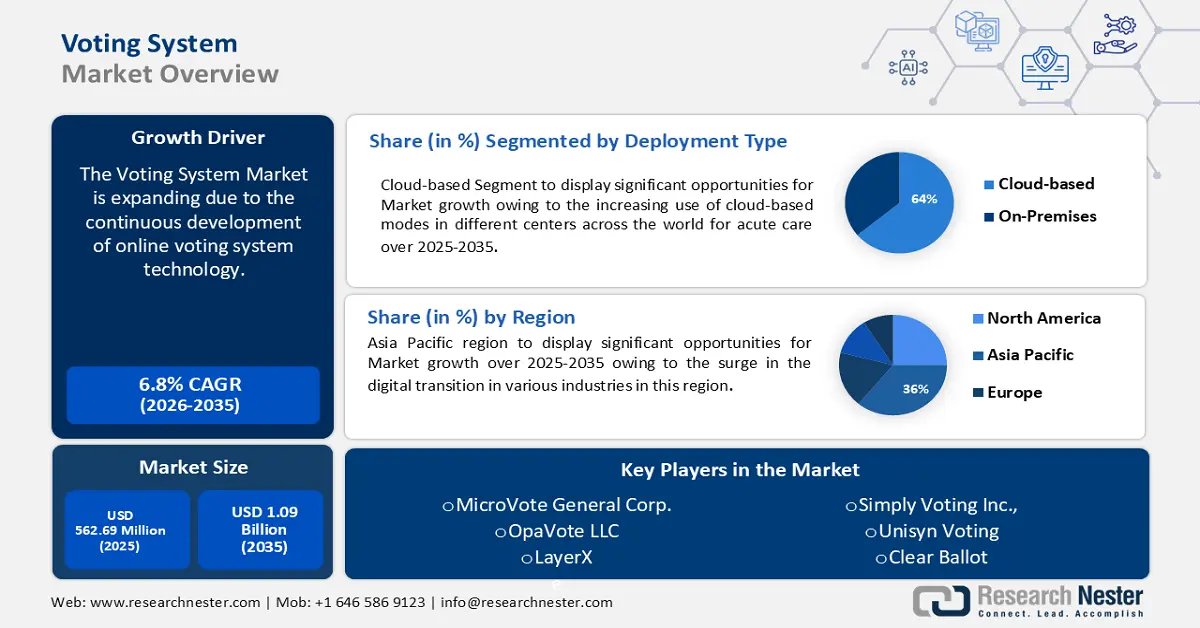

Voting System Market size was over USD 562.69 million in 2025 and is anticipated to cross USD 1.09 billion by 2035, growing at more than 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of voting system is assessed at USD 597.13 million.

The reason behind this growth is impelled by the growth in mobile technology, as people in advanced economies are more likely to have mobiles and smartphones, to use social media and the internet than people in emerging economies. The development of such media technologies has created a new application that will make the voting process very proficient and straightforward. For instance, in October 2021, the Telangana State Election Commission (TSEC) announced that it had developed India's first smartphone-based e-voting solution in the face of the COVID-19 pandemic that had rushed the world into all-digital operations.

Furthermore, with the continuous development of online voting system technology and the increase in government parties along with industrial organizations globally, the demand for solutions in the voting system market is at a surge. The number of unrecognized registered political parties has increased twice between 2010 and 2018. From 1094 in 2010, the number has reached 2095 as per the latest order of the Election Commission of India (ECI). The number increased by over 17% between 2013 & 2014, and now between 2017 & 2018, it has already increased by over 11%.

Key Voting System Market Insights Summary:

Regional Insights:

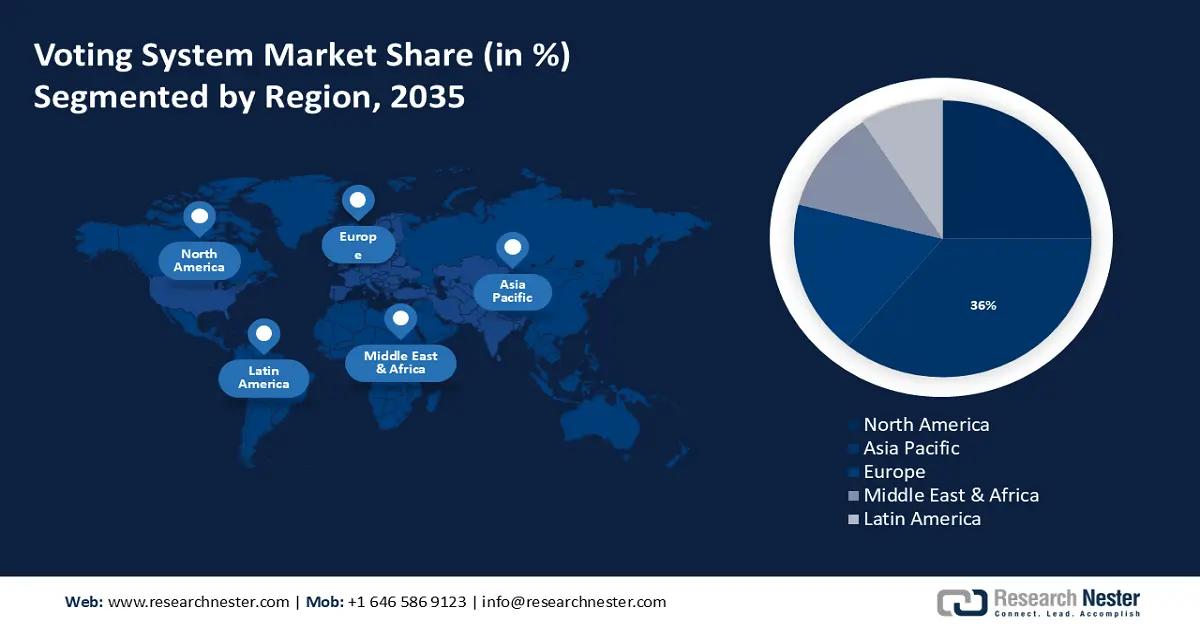

- Asia Pacific is projected to command a 36% share of the Voting System Market by 2035, impelled by the accelerating digital transition across governance frameworks.

- North America is anticipated to secure the second-largest position by 2035, supported by the rising adoption of online voting across corporate, political, and academic sectors.

Segment Insights:

- The cloud-based segment is expected to capture a 64% share by 2035 in the Voting System Market, propelled by the heightened need for scalable, secure, and remotely managed voting infrastructures.

- The control unit segment is set to hold a notable share by 2035, underpinned by its ability to enhance hardware-based security and expedite vote-counting processes.

Key Growth Trends:

- Increased Integration with Other Platforms and Technologies

- Advanced Analytics for Better Insights into Voting Patterns and Preferences

Major Challenges:

- Limited Accessibility

- Lack of Public Trust

Key Players: Clear Ballot, MicroVote General Corp., Avante International Technology, Inc., Election Systems & Software LLC, OpaVote LLC, Hart InterCivic Inc., Simply Voting Inc.

Global Voting System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 562.69 million

- 2026 Market Size: USD 597.13 million

- Projected Market Size: USD 1.09 billion by 2035

- Growth Forecasts: 6.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: Brazil, Indonesia, Mexico, South Korea, United Arab Emirates

Last updated on : 19 November, 2025

Voting System Market - Growth Drivers and Challenges

Growth Drivers

-

Increased Integration with Other Platforms and Technologies - The integration of e-voting platforms, such as mobile, digital, and blockchain-based voting apps, is expected to create more efficient and accurate voting systems along with the integration of electronic ID systems, such as biometric and digital IDs is expected to increase security and integrity of the voting system. According to a report, by the Swiss Broadcasting Corp., Swiss Abroad wants to use e-ID laws as a base on which to build electronic voting.

- Advanced Analytics for Better Insights into Voting Patterns and Preferences- Analytics can provide valuable insights into voter dynamics, including the impact of different political and social issues on voter behavior, patterns, and preferences. It can also help in enabling organizations to better engage with voters and tailor their campaigns and massaging to the specific needs and profiles of voters. These analytics can also be used to monitor and manage potential voting fraud.

Challenges

-

Limited Accessibility: Voting systems may face challenges in terms of accessibility for those without access to technology. This is expected to change over the next few years, with growing efforts to enable online voting.

-

Lack of Public Trust: Trust in the voting system remains a persistent challenge, and is expected to grow in the future.

-

Lack of Awareness: The awareness of new technologies and their benefits is currently limited, and is expected to grow in the short term.

Voting System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 562.69 million |

|

Forecast Year Market Size (2035) |

USD 1.09 billion |

|

Regional Scope |

|

Voting System Market Segmentation:

Development Type Segment Anallysis

The cloud-based segment in the voting system market is estimated to gain a robust revenue share of 64% during the forecast period. as it allows for data storage and processing on remote servers which enables more efficient and reliable management of voter data and data-driven decision-making. The cloud-based infrastructure also allows for easy access and scalability of voting systems that provide great flexibility along with high security. According to a recent survey, more than 1,000 new young and diverse people registered in time (depending on deadlines in each state) for them to participate before the US 2020 elections.

Component Segment Anallysis

The control unit segment is set to garner a notable share shortly and is likely to remain the largest segment in the component of the voting system market as this provides a level of hardware-based security for the voting systems, helping to protect against outside interference and unauthorized access to voting data. This also speeds up the processing time of voting systems, allowing for a faster and more efficient counting of votes.

End-users Segment Anallysis

The government segment is estimated to hold a noteworthy share as they can provide financial incentives to facilitate the adoption of voting systems, including reimbursement or grants. This can also support the development of new technologies and innovations in the voting system market using their regulatory frameworks that can enable or hinder the successful adoption of voting systems.

Our in-depth analysis of the global market includes the following segments:

|

Development Type |

|

|

Component |

|

|

End-Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Voting System Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 36% by 2035, impelled by the rise in digital transition in several industries such as governance. This market was primarily driven by nations such as India, the Philippines, and Nepal, out of which India was the highest. This was to modernize the election procedures; the governments are also expected to use online voting systems. There is a high voter turnout in this region as over 9 in every 10 people turn out to vote in parliamentary elections in Papua New Guinea, Vietnam, and many more.

North American Market Insights

The North America voting system market is estimated to the second largest, during the forecast period. led by the higher adoption rate of online voting in corporate, political, and academic sectors. According to the Congressional Research Service (CRS), the US Congress suggests altering House and Senate rules allowing floor votes to be cast remotely so that all members would be present virtually rather than physically.

Voting System Market Players:

- Unisyn Voting

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Clear Ballot

- MicroVote General Corp.

- Avante International Technology, Inc.

- Election Systems & Software LLC

- OpaVote LLC

- Hart InterCivic Inc.

- Simply Voting Inc.

Recent Developments

- Civix, expanded its election platform with new capabilities. Civix and DemTech recently announced a new partnership that will provide election officials with an end-to-end election management system. The partnership provides an expanded platform that will increase end-to-end processes, fully integrated systems, and transparency across the election spectrum, including voter registration, absentee and mail-in voting, election results reporting, and election validation.

- POLYAS, a market leader in online elections, sent out electronic ballot documents using Retarus' Transactional Email. The Munich-based enterprise cloud service provider ensures that the authentication via email for digital voting meets the strict security requirements of the German electoral law.

- Report ID: 2518

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Voting System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.