Vitiligo Treatment Market Outlook:

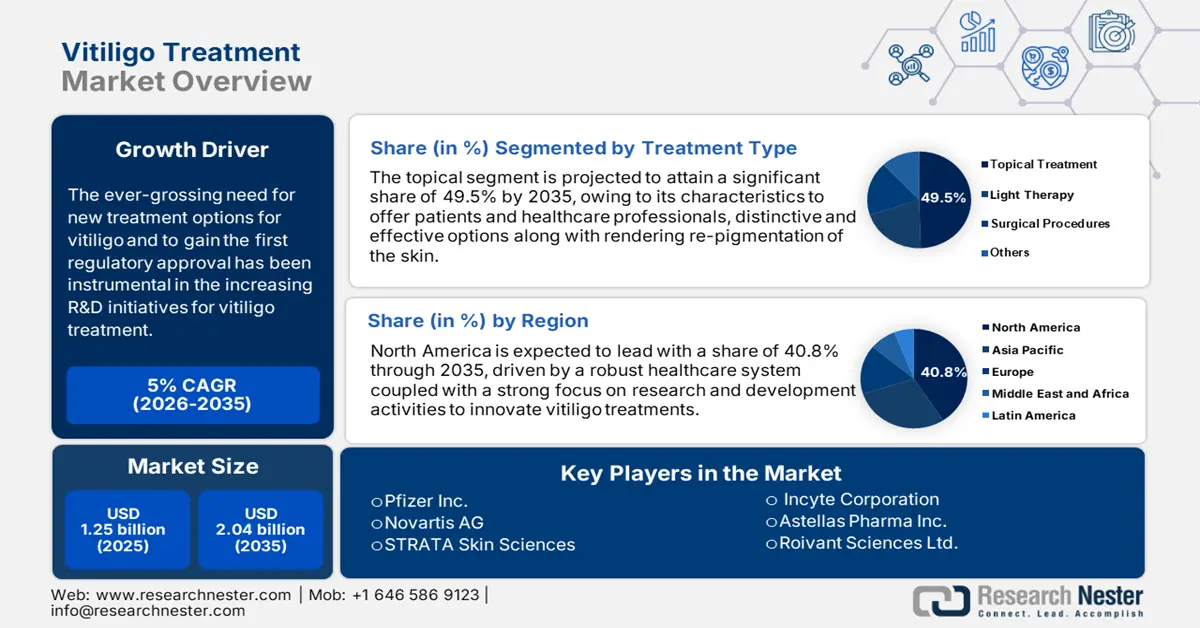

Vitiligo Treatment Market size was valued at USD 1.25 billion in 2025 and is expected to reach USD 2.04 billion by 2035, registering around 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vitiligo treatment is assessed at USD 1.31 billion.

Technological developments are significantly boosting the growth of the vitiligo treatment market, by presenting innovative therapies that improve accessibility and efficacy. Traditional treatments such as light therapy, corticosteroid creams, and skin grafting usually present limitations such as side effects, inconsistent outcomes, and high costs. Technological advancements in regenerative medicine, biologics, and gene therapies are expanding treatment options while addressing the growing demand for more effective and safer solutions.

Technological development of Janus Kinase (JAK) inhibitors which have shown some positive results in restoring pigmentation for vitiligo patients. For instance, in September 2021, the U.S. Food and Drug Administration (FDA) approved ruxolitinib (Opzelura) cream 1.5% for the treatment of nonsegmental vitiligo in patients aged 12 and older. This tropical JAK inhibitor works by inhibiting pathways that lead to immune system attacks on melanocytes, the cells that are responsible for pigmentation. Such targeted therapies are shifting the vitiligo treatment market by addressing the underlying causes of vitiligo rather than merely managing symptoms.

Key Vitiligo Treatment Market Insights Summary:

Regional Highlights:

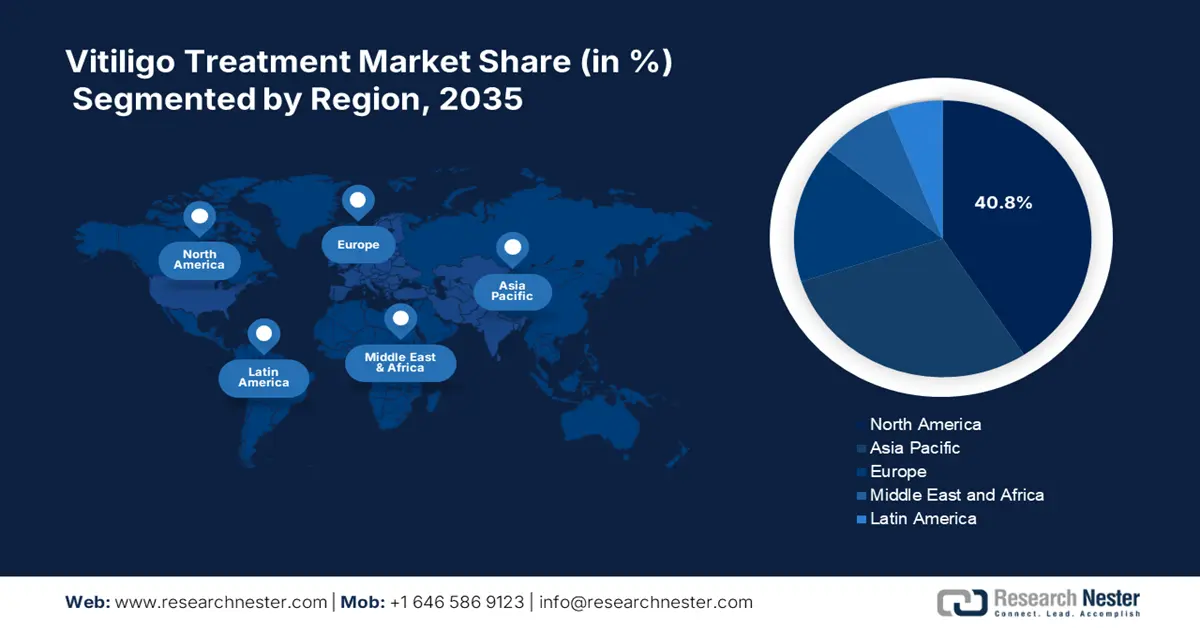

- North America dominates the Vitiligo Treatment Market with a 40.8% share, attributed to developed healthcare infrastructure, R&D investment, and rising awareness levels, fostering strong growth through 2026–2035.

- The Asia Pacific Vitiligo Treatment Market is projected to experience significant growth by 2035, driven by rising awareness of skin disorders and increasing demand for dermatological treatments.

Segment Insights:

- Topical Treatment segment is expected to hold around 49.5% of the market by 2035, propelled by its non-invasive nature and affordability.

- The Non-Segmental Vitiligo segment is projected to hold a significant share by 2035, driven by the rising prevalence of non-segmental vitiligo and increased awareness about treatment options.

Key Growth Trends:

- Aesthetic appeal and rising awareness of appearance

- Increasing number of clinical trials

Major Challenges:

- Lack of trained professionals

- Viable treatment response

- Key Players: Pfizer Inc., Novartis AG, Incyte Corporation, Dr. Reddy’s Laboratories Ltd., and STRATA Skin Sciences.

Global Vitiligo Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.25 billion

- 2026 Market Size: USD 1.31 billion

- Projected Market Size: USD 2.04 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Vitiligo Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Aesthetic appeal and rising awareness of appearance: The rising emphasis on aesthetic appeal and increased awareness of appearance-related issues have become important drivers in the vitiligo treatment market. Consumer awareness and demand for treatment options are increasing due to social media's role in advocacy and support for those dealing with vitiligo. Organizations and influencers are raising awareness and helping to decrease the stigma while also making people more aware of available treatment options.

As societal focus on physical appearance is primarily fueled by the influence of social media, pharmaceutical companies are ramping up their RD and gaining necessary government approvals to launch their products in the mainstream vitiligo treatment market. For example, in July 2022, Incyte Corporation received U.S. FDA approval for its product Opzelura (ruxolitinib) cream as the first tropical treatment for repigmentation in non-segmental vitiligo. This approval marks an important milestone as it addresses both cosmetics and clinical needs of patients. - Increasing number of clinical trials: The increasing number of clinical trials in vitiligo treatment research has become a significant driver leading vitiligo treatment market growth. These trials are critical to determining and confirming new as well as effective treatments for the condition. Some developments in clinical trials have innovated the vitiligo treatment landscape. With a greater scientific understanding of the condition and innovation in biotechnology, various pharmaceutical companies are investing in clinical trials to test new combinations and approaches to therapies.

For instance, in October 2022, Incyte declared that data from the pivotal Phase 3 TRuE-V clinical trial program evaluating ruxolitinib cream (Opzelura) 1.5% in patients 12 years of age and above with nonsegmental vitiligo have been available in The New England Journal of Medicine (NEJM). In the trials (TRuE-V1 and TRuE-V2), application of ruxolitinib cream resulted in significant facial and total body repigmentation versus vehicle control as shown by greater proportions of patients attaining the facial and total body vitiligo area scoring index (F-VASI and T-VASI, respectively) endpoints at Week 24 vs. vehicle, with a higher proportion of patients responding at Week 521.

Challenges

- Lack of trained professionals: The lack of trained healthcare professionals and dermatologists specializing in vitiligo presents an important challenge in effectively treating and managing the condition. The worldwide ratio of dermatologists to the general population is less. For example, according to the National Library of Medicine, in May 2020, there was approximately one dermatologist per 130,000 population in India, which highlights a significant gap in specialized care. This scarcity is further exacerbated in underserved and rural areas where access to specialized dermatologist services is non-existent or limited.

Overcoming this challenge requires concentrated efforts to upsurge the number of trained dermatologists and improve education on vitiligo management between healthcare providers. Leveraging digital health platforms and implementing telemedicine services can also bridge the gap while providing patients in distant areas with access to specialized care. Moreover, ongoing training programs and professional growth are important to equip healthcare providers with the skills and knowledge that are necessary to deliver effective vitiligo treatments, thereby improving patient satisfaction and outcomes. - Viable treatment response: The heterogeneity in treatment outcomes can be attributed to various factors including extent of depigmentation, disease duration, and individual patient characteristics. This variability complicates the development of standardized treatment protocols and poses challenges for clinicians in managing patient expectations. Additionally, the psychological impact of inconsistent treatment responses can affect patients’ quality of life and adherence to therapy.

Ongoing research into the pathogenesis of vitiligo and the growth of biomarkers to predict treatment response are key steps toward improving therapeutic outcomes. Moreover, support and patient education play an important role in handling expectations and improving adherence to treatment regimens which eventually contribute to better clinical results.

Vitiligo Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 1.25 billion |

|

Forecast Year Market Size (2035) |

USD 2.04 billion |

|

Regional Scope |

|

Vitiligo Treatment Market Segmentation:

Type (Segmental Vitiligo, Non-Segmental Vitiligo)

The non-segmental vitiligo segment is predicted to have a significant vitiligo treatment market share during the forecast period of 2025-2035. This dominance is due to the increase in patients diagnosed with non-segmental vitiligo, worldwide. When the skin color starts fading, the most common kind of vitiligo causes skin patches to arise all over the body. Non-segmental vitiligo is generally present when white spots on a person's body are symmetrical apart from asymmetrical. Nevertheless, therapies for non-segmental vitiligo may differ significantly depending on the patient's preferences and the severity of their disease. As a result, the increase in awareness about vitiligo symptoms, causes, and improved treatment alternatives provide lucrative growth opportunities for the segment.

For example, in April 2023, Incyte announced the European Commission (EC) approval of opzelura (ruxolitinib) cream for the treatment of non-segmental vitiligo with facial involvement in adults and adolescents. Opzelura is the first and only permitted treatment in the European Union (EU) to provide support for repigmentation in eligible patients with non-segmental vitiligo, a chronic autoimmune disease featuring depigmentation of skin and decreased quality of life.

Treatment Type (Topical Treatment, Light Therapy, Surgical Procedures, Others)

Topical treatment segment is anticipated to dominate around 49.5% vitiligo treatment market share by the end of 2035. Topical treatments such as calcineurin inhibitors, corticosteroids, and many new options similar to Janus kinase (JAK) inhibitors are preferred due to their ease of affordability, application, and non-invasive nature. These treatments are mainly effective in managing decreasing inflammation, localized vertigo, and promoting repigmentation while making them a unique choice among patients and healthcare providers.

For instance, according to Vitiligo Research Foundation, in September 2024, Aclaris Therapeutics' lead drug applicant ATI-50002 Topical Solution 0.46% for vitiligo is a JAK1/JAK3 inhibitor. Phase II clinical trials were completed in 2020 with no further development. In January 2024 company declared top-line results from its Phase 2b study of ATI-1777, an investigational topical soft JAK 1/3 inhibitor, in patients with mild to severe atopic dermatitis, with an eye for vitiligo down the road.

Our in-depth analysis of the global vitiligo treatment market includes the following segments:

|

Type |

|

|

Drug Class Type |

|

|

Treatment Type |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vitiligo Treatment Market Regional Analysis:

North America Market Analysis

North America in vitiligo treatment market is likely to account for around 40.8% revenue share by 2035, owing to developed healthcare infrastructure, significant investment in research and development, and rising awareness levels. Increasing healthcare spending, coupled with the presence of key market players, is further propelling market growth. The U.S. and Canada are projected to contribute the major share of the North America vitiligo treatment market.

The increasing prevalence of vitiligo in the United States, the emerging healthcare industry, the growing adoption of modern technologies, and rising innovative surgery procedures by key players are the factors driving the U.S. market throughout the forecast period. According to the American Academy of Dermatology (AAD), in June 2022, vitiligo affects around one in four persons in the U.S. This huge vitiligo patient pool, along with growing demand for enhanced therapeutic approaches, is driving up demand for the market in the region.

Canada is experiencing growth in the vitiligo treatment market due to advancements in treatment options, increasing awareness, and a supportive healthcare system. For instance, in October 2024, Incyte Biosciences Canada declared that Health Canada has approved a Notice of Compliance for OPZELURA (ruxolitinib (as ruxolitinib phosphate)) cream 1.5%, a non-steroidal topical JAK inhibitor, for the topical treatment of mild to moderate atopic dermatitis in adult and pediatric patients 12 years of age and more whose disease is not effectively controlled with conventional topical prescription therapies or when those therapies are not advisable.

Asia Pacific Market Analysis

Asia Pacific is expected to experience significant growth during the forecast period due to rising awareness of skin disorders, increasing patient population, and growing healthcare expenditure. The countries in the Asia Pacific dealing with vitiligo have resulted in the demand for improved treatment alternatives for vitiligo. The rise in knowledge of vitiligo, as well as initiatives to minimalize related stigma, are encouraging more people to seek treatment in the Asia Pacific. Moreover, the rising prevalence of vitiligo and the increasing demand for cosmetic and dermatological treatments are important drivers.

The China vitiligo treatment market is witnessing prominent growth in the country owing to the ongoing research and development activities and innovations in the available treatments to cater to the rising vitiligo cases. In September 2023, Huahai Institute of Vitiligo Research expanded its operations in Shanghai, to bring TCM-based vitiligo treatment to local patients, thus, improving accessibility to high-caliber traditional Chinese medicines. Furthermore, in April 2024, China Medical System Holdings Limited and Incyte entered into a partnership and license agreement to develop and commercialize povorcitinib in Mainland China, Macao, Hong Kong, and Taiwan.

Japan has a significantly high demand for dermatological and cosmetic treatments. Also, the penetration of global players in the country has improved vitiligo treatments. In 2023, Merck initiated the clinical trial for MK-6194 in several countries including Japan, catering to non-segmental vitiligo patients.

Key Vitiligo Treatment Market Players:

- Incyte Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- Novartis AG

- Incyte Corporation

- Dr. Reddy’s Laboratories Ltd.

- STRATA Skin Sciences

The competitive landscape of the vitiligo treatment market is well-defined by dynamic innovation and strategic activities targeted at meeting the unmet necessities of a wide range of patients. A robust emphasis on research and development is noticeable, with several businesses investing in new therapies and treatment modalities such as light therapy, topical treatments, and surgical possibilities. Here are some leading players in the vitiligo treatment market:

Recent Developments

- In January 2022, STRATA Skin Sciences, Inc., declared the commercial launch of its next-generation excimer laser system, XTRAC Momentum 1.0, with the first installation in the United States.

- In October 2021, the Uniza Group announced a new Vitiligo management solution. Vitellus is a new combination of Greyverse, Melitane, GL 200, and EUK-134 that offers an advanced new-age solution for Vitiligo management.

- Report ID: 6784

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vitiligo Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.