Visual Effects Market Outlook:

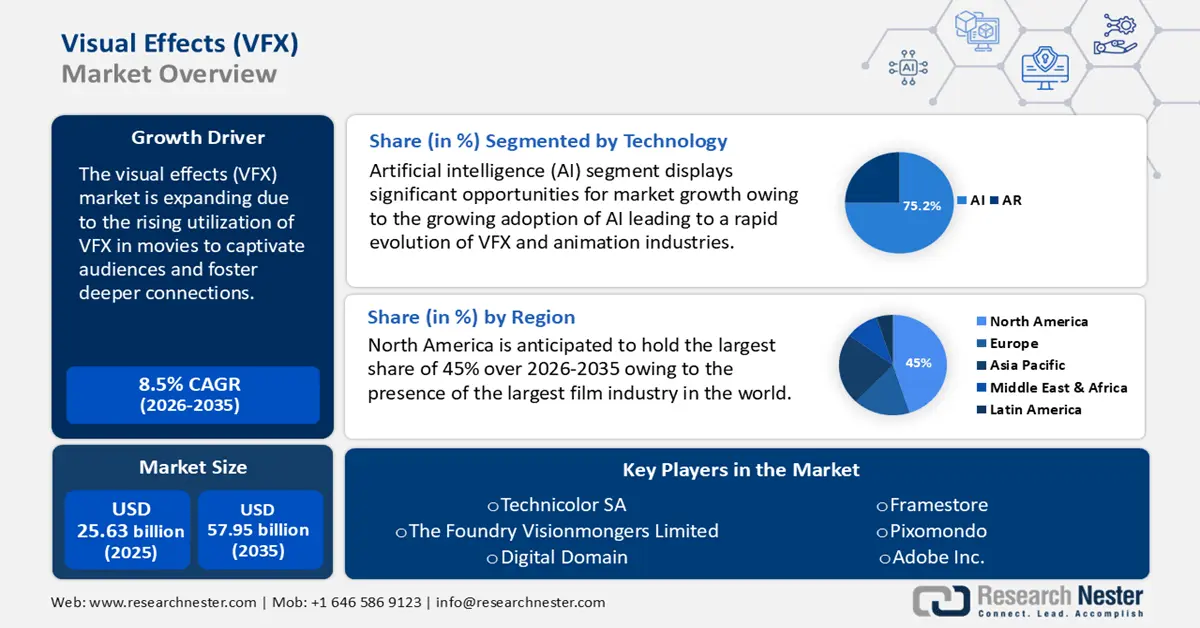

Visual Effects Market size was over USD 25.63 billion in 2025 and is projected to reach USD 57.95 billion by 2035, growing at around 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of visual effects is evaluated at USD 27.59 billion.

New digital technologies including VFX, blend virtual camera systems, 3D assets, and advanced motion capture and performance, with real-time render display technology, are facilitating filmmakers to create interactive digital scenes and breakthrough workflows. VFX has taken center stage in the production of feature films and game cinematics. Virtual production leverages computer graphics (CG) upstream and downstream technologies that allow stakeholders to guide technology to produce the desired creative outcome. Autodesk MotionBuilder is an example of a recently launched character animation tool with Pixar’s Universal Scene Description (USD) plugins.

Cloud-based storage of media is more popular than on-premise systems, owing to the robust security architecture offered by cloud-native platforms. Furthermore, such platforms eliminate the need to store assets on vendor sites, move or duplicate files between different vendors, and facilitate users to maintain sovereignty over assets. In 2022, Sony launched Ci Workflow, which gave production companies total control and visibility of their assets.

Key Visual Effects (VFX) Market Insights Summary:

Regional Highlights:

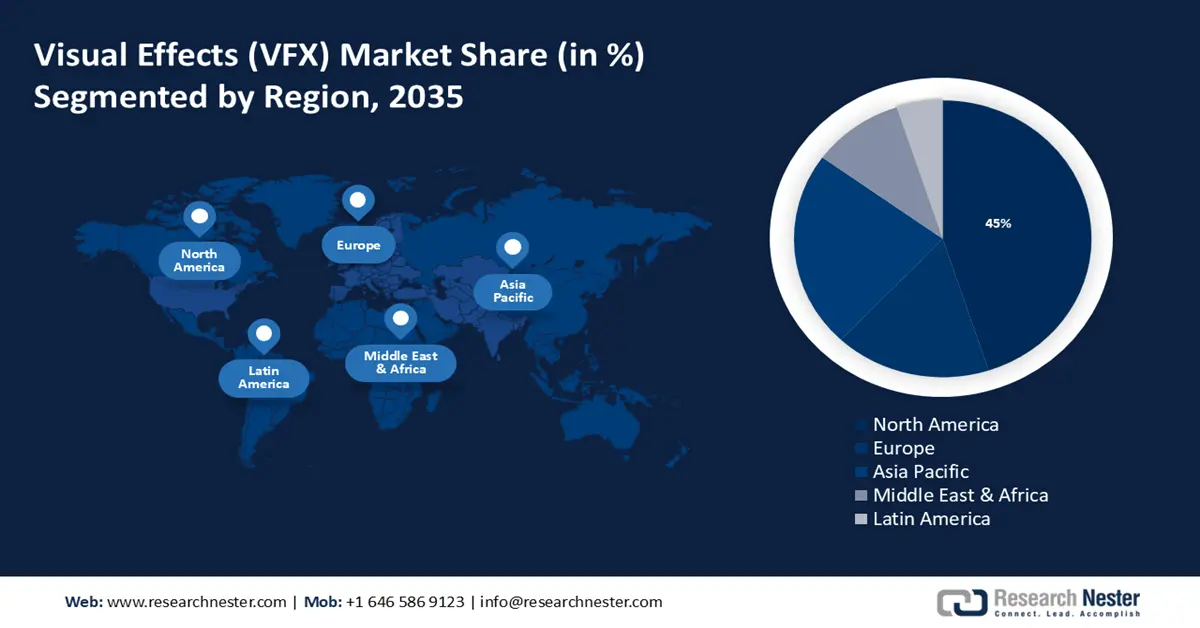

- North America’s visual effects (VFX) market will dominate around 45% share by 2035, driven by the presence of the largest film industry and adoption of new technologies like 3D printing.

Segment Insights:

- The ai segment segment in the visual effects market is projected to achieve a 75.20% share by 2035, driven by growing adoption of AI that boosts efficiency, creativity, and quality in VFX production.

- The movies segment in the visual effects market is projected to see significant growth till 2035, driven by surging global film production and increasing use of visual effects in movies and TV.

Key Growth Trends:

- Widening VFX capacity through innovations

- Increasing usage of streaming platforms

Major Challenges:

- Data management and budget constraints

Key Players: Technicolor SA, The Foundry Visionmongers Limited, Digital Domain, Framestore, Pixomondo, Adobe Inc., Animal Logic, Cinesite, Rodeo FX.

Global Visual Effects (VFX) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.63 billion

- 2026 Market Size: USD 27.59 billion

- Projected Market Size: USD 57.95 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Canada, Japan, China

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Visual Effects Market Growth Drivers and Challenges:

Growth Drivers

- Widening VFX capacity through innovations: Virtual moviemaking is a metamorphosis of digital technologies in filmmaking, enabling creative experimentation and transforming previously cumbersome, alienating, and complex processes into more interactive and immersive content. It has aided in bridging the gap between digital performers and set locations, with its extensive scope in previsualization to virtual cinematography.

In August 2023, Pixar, NVIDIA, Apple, Adobe, and Autodesk, together with the Joint Development Foundation (JDF), revealed the Alliance for OpenUSD (AOUSD). It is dedicated to promoting the development, standardization, and evolution of OpenUSD by advancing the platform’s 3D capabilities. AOUSD is aimed at supporting content creators and developers to simulate large-scale 3D projects and build a range of 3D-enabled services and products. OpenUSD caters to the components including cameras and lighting needed to build 3D worlds. It has become a de facto standard for VFX and animation using 3D modeling for other industries such as robotics, architecture, and manufacturing.

In June 2023, Southpaw launched a SaaS artist and resource management tool called TACTIC Resource for VFX studios to seamlessly plan, track costs, bid, and generate financial reports. This VFX project budget planning platform allows the comparison of bid rates and original cost rates, thus, providing necessary insights into project profitability. Furthermore, in April 2024 DNEG gained exclusive license to Ziva, a VFX toolset. This strategic investment is anticipated to enhance DNEG’s solution pipeline, in turn, supporting artists in animation projects. The technology will support the DNEG IXP division, rendering the creation of interactive digital humans for gaming, virtual concerts, and next-generation headsets including the Apple Vision Pro. - Increasing usage of streaming platforms: Customers are spending more time streaming digital content on platforms such as Netflix, Amazon Prime Video, and Disney+. There is an increasing demand for high-quality media, which has led content providers to use significant visual effects to enhance their storylines and create immersive experiences that are appealing to audiences from diverse linguistic and cultural backgrounds. The number of users in the media market's over-the-top video (OTT Video) segment worldwide was predicted to rise steadily between 2024 and 2029, reaching around 996 million users..

Challenges

- Data management and budget constraints: Managing quality, accuracy, and consistency of data is one of the VFX industry's toughest challenges. VFX production is frequently beset by constrained funding and timeframes since a production pipeline for visual effects (VFX) is intricate and involves numerous steps. Moreover, people with years of training and experience who have honed extremely precise talents are needed to create visual effects that can command a hefty price.

Visual Effects Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 25.63 billion |

|

Forecast Year Market Size (2035) |

USD 57.95 billion |

|

Regional Scope |

|

Visual Effects Market Segmentation:

Technology Segment Analysis

Artificial intelligence (AI) segment is poised to dominate around 75.2% visual effects (VFX) market share by the end of 2035. The segment growth can be attributed to the growing adoption of AI, which is providing artists with tools to push the envelope of efficiency and creativity. For instance, in 2023, over 77% of multinational corporations implemented AI to enhance their business processes. The integration of AI technology has led to a rapid evolution of visual effects (VFX) and animation industries.

AI is re-evaluating the role of humans in the film business, speeding up VFX processes, boosting character modeling and animation, and is being used to create intricate and realistic environments and special effects such as fire and explosions. AI in visual effects can help with rendering, and character animation, raising the VFX's quality and reducing post-production turnaround times. Artificial intelligence enables a more accurate representation of VFX elements, such as lighting, textures, and simulations in films, TV shows, and video games.

Product (Simulation FX, Animation, Modelling, Matte Painting, Compositing)

Throughout the projected timeframe, the simulation FX segment in the VFX market is expected to grow at the fastest rate on account of the application of simulation learning in the expanding field of education. Globally, the education market is expected to expand by over 9% between 2022 and 2027, reaching a market size of around USD 10 billion by that year. Several universities are implementing simulation-based curricula to improve the academic performance of students. Applications for teaching, training, and testing have seen a great deal of success and benefit from the adoption of simulation VFX.

Application Segment Analysis

The movies segment in the visual effects (VFX) market is assessed to generate significant revenue share by the end of 2035. The growth of the segment is set to be encouraged by surging film production across the globe. The global film production and distribution sector generated over USD 75 billion in income annually in 2022. The explosion of visual effects in nearly every film and television show in recent years has contributed to the VFX industry's expansion, which is also being aided by the general public's growing inclination toward watching these media. The movie industry has continuously relied on some form of visual effects, which are major revenue generators in the global visual effects (VFX) market. Animation and visual effects are becoming increasingly important as they are fundamentally redefining the cinematic landscape through the unrelenting explosion of visual effects.

Our in-depth analysis of the VFX market includes the following segments:

|

Component |

|

|

Product |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Visual Effects Market Regional Analysis:

North America Market Insights

North America industry is poised to hold largest revenue share of 45% by 2035. The market growth in the region is also projected owing to the presence of the largest film industry in the world. For instance, Hollywood one of the world's most lucrative and successful sectors, is more of a notion or a moniker for the American film business as a whole has an average of 400 films produced annually and more than 2 billion viewers globally. Major studios hire Hollywood Visual Effects to produce VFX fit for feature films, that allow filmmakers to enrich a narrative by bringing plausible settings, people, and stunts to life.

In addition, the U.S. and Canada VFX market is expanding due to the introduction of new technologies including 3D printing for its versatility and many uses in the creation of different parts. In the film industry, 3D printing is becoming increasingly common. It allows for the quick creation of props, and to produce a variety of objects, including equipment, weaponry, food, statues, and sculptures.

Europe Market Insights

The Europe visual effects (VFX) market is projected to register notable revenue by the end of 2035. This rise is poised to be propelled by the increasing number of VFX studios, leading to a higher demand for VFX, and animation. For instance, every year, Europe produces over 35 animated films. Moreover, the region has developed into a global leader in VFX led by the rapid growth of the animation industry and the expanding number of European-produced films that have drawn attention from around the world.

Germany VFX market is expanding and developing significantly since the country has the second-largest VR/AR ecosystem in Europe. This has impelled by the widespread adoption of these technologies across numerous industries and the creation of more sophisticated and reasonably priced devices. The Germany market for AR and VR is predicted to have around 50 million users by 2029.

Visual Effects Market Players:

- The Walt Disney Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Technicolor SA

- The Foundry Visionmongers Limited

- Digital Domain

- Framestore

- Pixomondo

- Adobe Inc.

- Animal Logic

- Cinesite

- Rodeo FX

The players are collaborating to aggressively introduce AI and deep learning-based tools and mark their presence in the competitive market. In January 2024, VAST Data and Lola Visual Effects (VFX) entered into a partnership to leverage the VAST Data Platform and launch VFX tools for data-intensive feature films. It is aimed at streamlining administration and reducing the data ratio for efficient project completion, allowing artists to access media assets with minimal latency, irrespective of their geographic location. Some of the prominent players in the visual effects (VFX) market include:

Recent Developments

- In February 2024, The Walt Disney Company announced a partnership with Epic Games to increase the audience for well-loved Disney tales and experiences and create a revolutionary new gaming and entertainment world by combining the immensely popular Fortnite game with Disney's cherished brands and properties.

- In March 2024, Technicolor SA declared the opening of Technicolor Creative Studios SA as the new holding entity for its operations, to accelerate its path to developing cutting-edge technologies in the creative sector, and intends to progressively advance under its new structure and ultimately change from a holding company consisting of VFX firms in games, film, advertising, and animation to a visual experiences company specializing in visual storytelling.

- Report ID: 6379

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Visual Effects (VFX) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.