Viscosity Index Improvers Market Outlook:

Viscosity Index Improvers Market size was over USD 230.91 million in 2025 and is poised to exceed USD 421.39 million by 2035, growing at over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of viscosity index improvers is estimated at USD 243.79 million.

The increasing demand for high-performance lubricants drives viscosity index improvers market expansion, particularly in the automotive and industrial sectors. The rise in vehicle production and the need for lubricants that can perform efficiently across a wide range of temperatures have significantly boosted the demand for VIIs in the automotive industry. These additives enhance the viscosity-temperature characteristics of lubricants, ensuring optimal performance in both high and low-temperature conditions.

Viscosity index improvers are additives that help maintain oil viscosity under varying temperatures, ensuring smooth engine performance. Since modern engines require high-performance lubricants, engine oil producers rely heavily on VIIs to meet industry standards. New blending plants and refinery upgrades are boosting the use of viscosity index improvers. Major lubricant manufacturers like Shell, ExxonMobil, Chevron, and TotalEnergies are expanding their engine oil production facilities, increasing VII demand. For instance, ExxonMobil is one of the world's largest refiners, with almost 5 million barrels per day of distillation capacity across 21 refineries.

Moreover, in 2023, Chevron's upstream business produced 3.1 million oil-equivalent barrels daily, with over USD 13 billion in capital expenditures. The company added 980 million barrels of net oil-equivalent proved reserves, accounting for nearly 86% of net oil-equivalent production for the year.

Key Viscosity Index Improvers Market Insights Summary:

Regional Highlights:

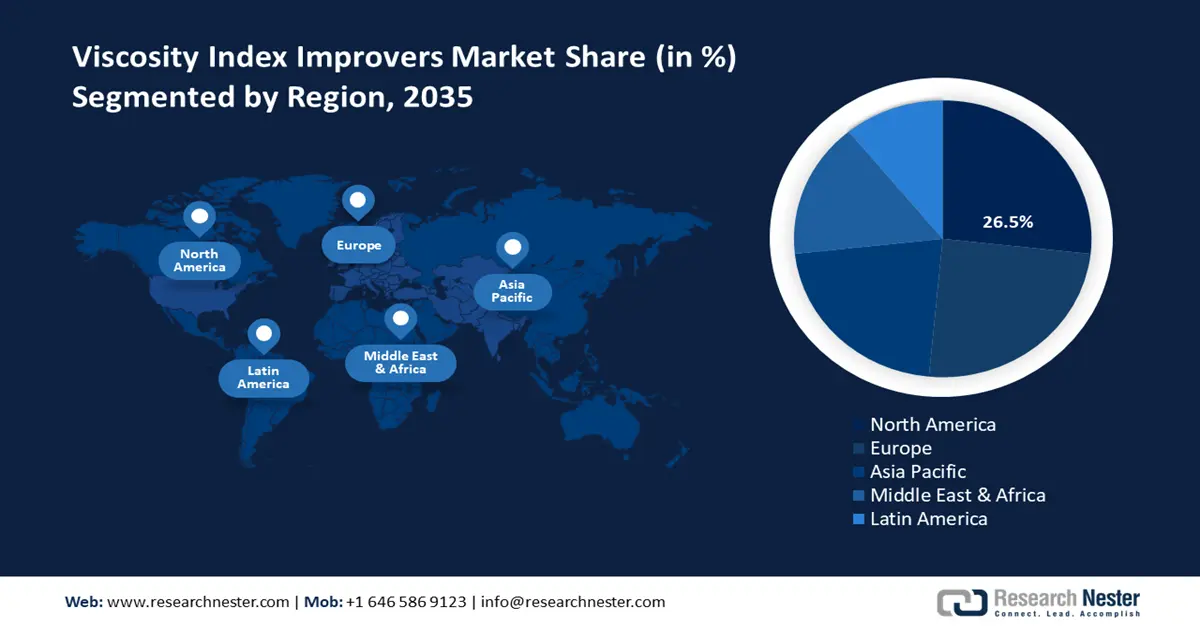

- North America leads the Viscosity Index Improvers Market with a 26.5% share, propelled by increasing demand for high-performance lubricants and advancements in automotive technology, driving sustained growth through 2035.

- Europe's viscosity index improvers market is poised for significant share growth by 2035, attributed to EU regulations aimed at reducing carbon emissions and improving energy efficiency.

Segment Insights:

- The Olefin Copolymer segment is projected to capture around 26.5% market share by 2035, fueled by its versatility and performance in lubricants across industries.

- Manufacturing segment is anticipated to achieve a notable share by 2035, driven by rising manufacturing activities and demand for stable lubricants.

Key Growth Trends:

- Rapid expansion of electric vehicles (EVs)

- Global trade in crude oil and refined petroleum products

Major Challenges:

- Volatility in the global oil and gas industry

- Dependence on a few major manufacturers

- Key Players: Lubrizol Corporation, Chevron Oronite Company LLC, Afton Chemical Corporation, Infineum International Limited, Bariyan Oil & Lubricants Pvt. Ltd., BPT Chemicals Co, Ltd.

Global Viscosity Index Improvers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 230.91 million

- 2026 Market Size: USD 243.79 million

- Projected Market Size: USD 421.39 million by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (26.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Viscosity Index Improvers Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid expansion of electric vehicles (EVs): EVs require specialized lubricants for components like electric motors, transmissions, battery cooling systems, and drivetrains. These lubricants must perform under high temperatures and electrical loads, necessitating VIIs to enhance thermal stability and viscosity consistency. Moreover, automakers are shifting towards low-viscosity lubricants to reduce friction and improve efficiency in EVs. VIIs help maintain optimal viscosity across varying temperatures, ensuring longer lubricant life and improved vehicle performance.

EVs rely on e-fluids such as dielectric coolants and transmission fluids to manage heat generated by high-voltage batteries. A recently published report on Thermal Management for Electric Vehicles 2025-2035: Materials, Markets, and Technologies, projects that approximately 880 million liters of coolant fluids will be required for electric cars by 2035, combining water-glycol, oils, and refrigerants. VIIs enhance the thermal and shear stability of these e-fluids, improving battery cooling efficiency and system longevity. New-generation polymer-based VIIs offer better shear stability, oxidation resistance, and compatibility with e-fluids. Smart viscosity modifiers that adjust to temperature variations are developed for EV-specific lubrication needs.

Additionally, increasing investment in EV fleets (taxis, buses, and delivery vehicles) drives demand for high-performance lubricants. VIIs help optimize lubricant performance in fleet applications, where vehicles operate under continuous high-load conditions. Government policies are propelling EV fleet investments through tax credits and policies. The U.S. Department of Energy (DOE) claims that through the Inflation Reduction Act of 2022 administered by the Internal Revenue Service (IRS), federal tax credits are available until 2032 to consumers, fleets, businesses, and tax-exempt entities that invest in new, used, and commercial clean vehicles, including fuel cell EVs, plug-in hybrid EVs, and all-electric vehicles (EVs), as well as EV charging infrastructure.

To guarantee that owners of EVs can benefit from these tax credits, manufacturers of these vehicles and the dealerships who sell them need to work together with the IRS. Taxpayers who purchase an eligible vehicle may qualify for a tax credit of up to USD 4,000 for qualified pre-owned vehicles and up to USD 7,500 for approved new, certified plug-in EVs, or fuel cell electric vehicles (FCV). -

Global trade in crude oil and refined petroleum products: As countries around the world import and export crude oil and refined petroleum products, there is a growing demand for high-quality lubricants to ensure the smooth operation of machinery in industries such as automotive, manufacturing, and energy. The refining process of crude oil produces a range of petroleum products, such as gasoline, diesel, and synthetic oils, which require additives like VIIs to meet the performance criteria for automotive, industrial, and marine lubricants.

Thus, the global trade in crude oil supports the growth of refining industries in emerging economies, leading to a rise in demand for VIIs in these regions. The Observatory of Economic Complexity (OEC) reports that in 2022, crude petroleum was the world’s most traded product, with a total trade of USD 1.45 trillion, representing a 46.1% growth from USD 993 billion in 2021.

Top exporters and importers of crude petroleum in 2022

|

Country |

Export (in USD billion) |

Country |

Import (in USD billion) |

|

Saudi Arabia |

236 |

China |

287 |

|

Russia |

133 |

U.S. |

199 |

|

Canada |

123 |

India |

170 |

|

U.S. |

118 |

South Korea |

89.1 |

|

Iraq |

111 |

Japan |

86.7 |

Source: OEC

Challenges

-

Volatility in the global oil and gas industry: The global oil and gas industry is highly susceptible to price fluctuations, geopolitical instability, and supply-demand imbalances. Any disruptions in the supply chain for crude oil or refined products can impact the production of lubricants and additives. The instability of oil prices and the ongoing transition to alternative energy sources can reduce the demand for traditional lubricants, and consequently, VIIs. Furthermore, the shift toward diminishing reliance on fossil fuels may reduce the importance of products like VIIs in industries such as automotive and marine, which have traditionally driven demand for lubricants.

-

Dependence on a few major manufacturers: The viscosity index improvers market is dominated by a few large companies with substantial control over the supply of additives. This creates barriers for smaller players to enter the market, potentially limiting the diversity of products available and reducing market competition. Supply chain disruptions caused by any operational or logistical challenges in these dominant companies can have a significant impact on the availability and pricing of VIIs.

Viscosity Index Improvers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 230.91 million |

|

Forecast Year Market Size (2035) |

USD 421.39 million |

|

Regional Scope |

|

Viscosity Index Improvers Market Segmentation:

Type (Polymethacrylate, Olefin Copolymer, and Polyisobutylene)

Olefin copolymer (OCP) segment is expected to capture around 26.5% viscosity index improvers market share by the end of 2035. major driver of the market owing to its versatility, superior performance, and widespread adoption in automotive, industrial, and EV applications. The growing demand for high-performance lubricants, increasing regulatory requirements, and advancements in synthetic oils continue to fuel the growth of OCP-based VIIs. Olefin copolymers (OCP) are a key type of polymer used in VII. These oil-soluble copolymers consist of ethylene and propylene, and may also include a nonconjugated diene as a third monomer. The grade of olefin copolymer utilized as VIIs has low propylene concentration (40-60 mol%).

Olefin copolymers are versatile polymers with medium to high molecular weight, ideal for medium to low shear applications. These applications include engine or crankcase oil, tractor fluids, hydraulic fluids, pneumatic oils, greases, rust preventatives, and general-purpose industrial lubricants. OCPs are a cost-effective alternative to heavy petroleum oils, offering better low-temperature fluidity and increased high-temperature viscosity. Functional Products Inc., a chemical manufacturer specializing in lubricant additives, provides material in both liquid and solid form. The fastest and easiest approach to add viscosity modifiers to a batch is to first dissolve high-quality OCP in highly refined petroleum oil. Whereas, OCP in bale (block), pellet, or flake form has the best economics, but it takes time and energy to process.

End user (Manufacturing, Food Processing, Mining, Construction, and Power Generation)

The manufacturing segment in viscosity index improvers market will garner a notable share in the forecast period. The rapid expansion of manufacturing activities, particularly in emerging economies like China, India, and Southeast Asia is increasing the demand for industrial lubricants. VIIs help maintain the efficiency and longevity of lubricants used in heavy machinery, hydraulic systems, and metalworking applications.

Metalworking processes, such as cutting, grinding, stamping, and forging, rely on metalworking fluids that need stable viscosity across temperature variations. VIIs enhance the performance of metalworking lubricants, improving cooling, friction reduction, and tool life extension. Moreover, the rising adoption of advanced manufacturing technologies such as automation, robotics, and Industry 4.0 has increased the need for specialized lubricants with viscosity stability. Advanced CNC machines, robotic arms, and precision machining tools require lubricants enhanced with VIIs to ensure smooth operation and reduced wear.

Our in-depth analysis of the viscosity index improvers market includes the following segments:

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Viscosity Index Improvers Market Regional Analysis:

North America Market Statistics

North America viscosity index improvers market is poised to capture revenue share of around 26.5% by the end of 2035. The region is witnessing steady growth due to increasing demand for high-performance lubricants, advancements in automotive technology, and expanding industrial sectors. The region led by the U.S., Canada, and Mexico, plays a crucial role in the global lubricant additives industry, with VIIs comprising an essential component.

Stringent environmental regulations such as the U.S. Environmental Protection Agency (EPA) and the Canadian Environmental Protection Act (CEPA) push for low-emission and fuel-efficient lubricants. VIIs are essential in developing low-viscosity, energy-efficient engine oils that help meet stringent fuel economy and emission reduction targets.

In the U.S. the expansion of crude oil distillation capacity is expected to be a significant driver of the viscosity index improvers market as it ensures a steady supply of base oils for automotive, industrial, and synthetic lubricant production. According to the Annual Refinery Capacity report by the U.S. Energy Information Administration (EIA), the primary measure of refinery capacity, operable atmospheric crude oil distillation capacity, was 18.4 million barrels per calendar day (b/cd) at the start of 2024, a 2% increase from the start of 2023.

|

U.S. Manufacturers |

Total crude oil distillation capacity in 2024 (in b/cd) |

|

ExxonMobil |

609,000 |

|

Valero Energy Corp |

360,000 |

|

Motiva’s |

626,000 |

|

Galveston Bay Refinery |

631,000 |

Source: EIA

Further, Canada’s stringent fuel efficiency standards have led to increased demand for engine oils and transmission fluids that provide improved fuel economy. VIIs are essential in achieving the low-viscosity and high-performance lubrication required for modern vehicles. As EV adoption rises in the country, demand for specialized lubricants is also increasing. These lubricants often require advanced VIIs for enhanced thermal stability and viscosity control.

Europe Market Analysis

Europe viscosity index improvers market is expected to hold a significant share in the forecast period. EU regulations aimed at reducing carbon emissions and improving energy efficiency are pushing the development and demand for advanced lubricants. VIIs play a critical role in meeting these performance standards, as they help lubricants maintain their viscosity and function effectively under both high and low temperatures.

The UK and Germany both are leaders in the transition to renewable energy. However, their oil and gas industries still require high-viscosity lubricants for turbines, compressors, and other equipment, driving the demand for VIIs in these applications. Germany being home to several global automotive giants like Volkswagen, BMW, and Mercedes-Benz, sees a high demand for high-performance lubricants that require VIIs.

Key Viscosity Index Improvers Market Players:

- Evonik Industries

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lubrizol Corporation

- Chevron Oronite Company LLC

- Afton Chemical Corporation

- Infineum International Limited

- Bariyan Oil & Lubricants Pvt. Ltd.

- BPT Chemicals Co, Ltd

- Brad-Chem Ltd

- Chetas Biochem

Leading players are driving the growth of the viscosity index improvers market through strategic innovation, expansion, and partnerships. Their focus on sustainability, high-performance lubricants, and adaptation to the rise of electric vehicles is enabling them to meet the evolving demands of the automotive, industrial, and energy sectors. With increasing market demand and technological advancements, these players are set to continue the future of the viscosity index improvers market.

Recent Developments

- In December 2024, Chevron U.S.A., Inc. (CUSA), a wholly owned subsidiary of Chevron Corporation, completed a retrofit of its refinery in Pasadena, Texas, which is expected to increase product flexibility and expand the processing capacity of lighter crudes by nearly 15 percent to 125,000 barrels per day.

- In March 2022, Afton Chemical Corporation, a global leader in the lubricant and fuel additive market, completed its phase 3 expansion to add Gasoline Performance Additives (GPA) blending capabilities at its Singapore Chemical Additive Manufacturing Facility.

- Report ID: 7076

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Viscosity Index Improvers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.