Virtual Visor Market Outlook:

Virtual Visor Market size was valued at USD 430.93 million in 2025 and is set to exceed USD 3.76 billion by 2035, expanding at over 24.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of virtual visor is estimated at USD 524.79 million.

The virtual visor market is predicted to experience significant growth driven by the surging emphasis on driver safety. Major companies operating in the automotive sector are incorporating driver safety features while regulatory bodies worldwide are enforcing strict regulations to improve road safety conditions. The trends are favorable for an increase in the demand for virtual visors, as unlike traditional sun visors which tend to obstruct the driver’s view in changing light conditions, virtual visors can utilize transparent LEDs and LCDs to selectively block the sun’s glare without hindering visibility. The table below highlights the World Health Organization (WHO) report on road safety 2023 with the trends expected to usher further demands for virtual visors.

WHO Road Safety Report 2023

|

Particulars |

Details |

|

Estimated deaths due to road crashes worldwide |

More than 1 million |

|

Road crashes casualty comparison |

5% reduction in 2021 compared to 1.25 million deaths in 2010. |

Source: WHO

The United Nations Decade of Action for Road Safety 2021–2030 plans to halve deaths by 2030 by improving road safety initiatives globally. The action plan converges with the efforts to improve interior components of automobiles to improve driver safety. Furthermore, the growing calls for luxury and autonomous vehicles equipped with advanced safety features bode well for the market’s growth. The shifting consumer preferences indicate the rising emphasis on automobiles equipped with complete safety measures. Moreover, virtual visors provide convenience along with plugging the limitations of traditional visors.

The virtual visor market’s expansion is also supported by collaborations between automotive manufacturers and technology firms dedicated to developing cutting-edge solutions. For instance, in January 2025, Amazon and Qualcomm announced a collaboration for delivering and redefining AI-powered experiences in the car. The partnership is positioned to assist automakers and developers in delivering advanced in-car experiences while mitigating development time. With Robert Bosch GmbH, a leading player in the virtual visor market, releasing an AI-powered virtual visor in 2020, the recent collaborations are expected to further the AI-powered solutions for automobile safety which can boost the market’s growth.

Key Virtual Visor Market Insights Summary:

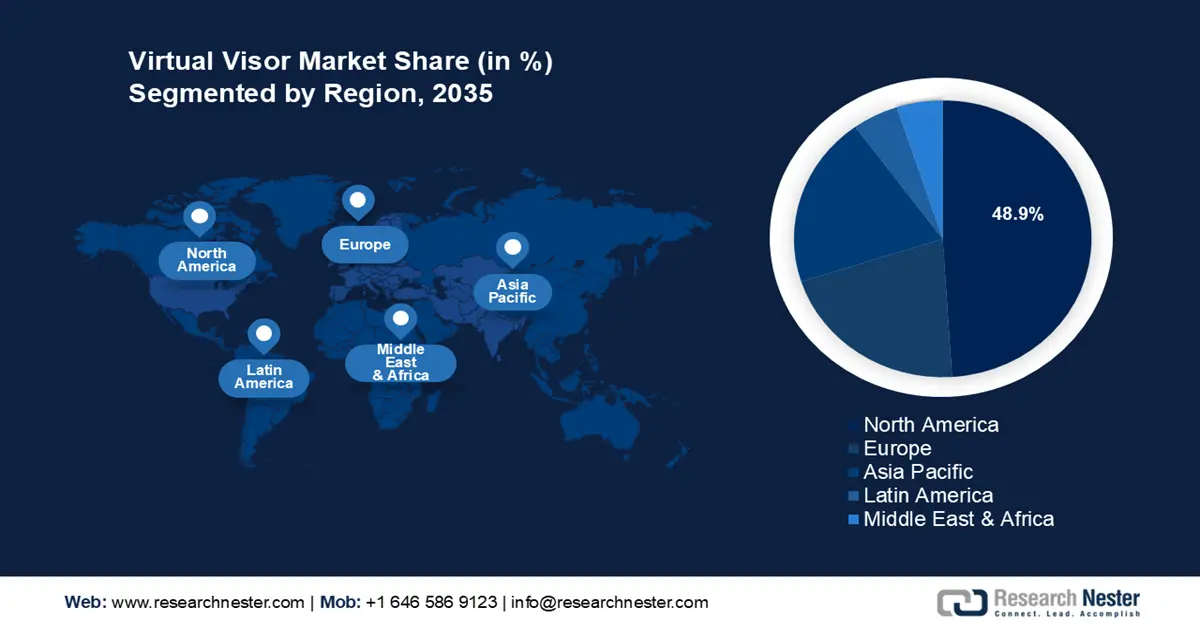

Regional Highlights:

- North America commands the Virtual Visor Market with a 48.9% share, fueled by rising adoption of advanced automotive tech and AI-integrated vehicle interior features, fostering growth through 2026–2035.

- Europe’s virtual visor market is projected to experience rapid growth by 2035, driven by stringent EU safety regulations and consumer demand for safer vehicles with enhanced comfort features.

Segment Insights:

- The Commercial Vehicle segment is estimated to expand significantly by 2035, driven by the growth in ride-sharing fleets and long-haul use cases benefiting from fatigue-reducing visors.

- The LED segment is anticipated to experience robust growth from 2026-2035, driven by its ability to dynamically adapt to changing light conditions without obstructing vision.

Key Growth Trends:

- Rapid adoption of smart automotive technologies

- Expansion of electric and autonomous vehicle markets

Major Challenges:

- Market penetration in emerging economies

- Limitation in aftermarket opportunities

- Key Players: Robert Bosch GmbH, Sunvisors Private Ltd., Irvine Automotive Products, Atlas Holdings, FOMPAK, Magna International Inc., Kasai Kygo Co., Ltd., Weetect.

Global Virtual Visor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 430.93 million

- 2026 Market Size: USD 524.79 million

- Projected Market Size: USD 3.76 billion by 2035

- Growth Forecasts: 24.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.9% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: Germany, UK, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Virtual Visor Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid adoption of smart automotive technologies: The virtual visor market is projected to expand by leveraging the increasing adoption of smart automotive technologies. The advent of Internet of Things (IoT) and artificial intelligence (AI) in vehicles to improve convenience underscores the lucrative opportunities for manufacturers to supply virtual visors to negate the use of traditional visors. Additionally, consumer preferences for vehicles with heightened security measures can provide opportunities for automotive companies to advertise virtual visors as the differentiating feature to boost sales.

Moreover, the growth of the ride-sharing economy is poised to provide burgeoning opportunities for manufacturers. For instance, in July 2025, Uber announced a partnership with NVIDIA to accelerate AI-powered autonomous mobility. The major partnership indicates the proliferation of generative AI in the automotive sector, which bodes well for the manufacturing of AI-powered virtual visor solutions for vehicle interiors. -

Expansion of electric and autonomous vehicle markets: The surge in EV production and the development of autonomous vehicles are estimated to assist the demand for innovative interior components such as virtual visors. The current trends in automobile manufacturing highlight user experience being prioritized, aligning with the rise in demand for virtual visors. The table below highlights the International Energy Agency's global EV outlook showcasing the increase in EV sales, and the advent of AI-powered visors are expected to facilitate greater adoption rates in EV interiors.

Global EV Outlook

|

EV Particulars |

EV Sales Data |

|

Total EVs on the road in 2023 |

40 million |

|

EV Sales in 2023 |

3.5% higher than 2022, and a 35% YoY increase |

|

Percentage of EVs in all cars sold |

18% of all cars sold in 2023, which is up from 14% in 2022 |

Source: IEA

-

Increasing demand for driver comfort: While driver safety is a major factor of the sector’s growth, the calls for heightened driver comfort is an emerging driver of the virtual visor market. The National Highway Traffic Safety Administration (NHTSA) estimated an increase in demand for driver assistance technologies to reduce motor vehicle crashes. In September 2024, MITRE Corporation highlighted that 10 out of 14 ADAS features had surpassed a 50% market penetration rate by 2023, with five of them exceeding 90% penetration. Moreover, the increasing integration of ADAS is favorable for the creation of a shared ecosystem where virtual visors can be integrated as a complementary technology.

Challenges

-

Market penetration in emerging economies: The virtual visor market faces challenges in market penetration in emerging economies where consumer awareness of the benefits of the product is limited. Moreover, the lack of affordability can cause challenges in regions with price-sensitive consumer bases. Furthermore, traditional visors have a strong foothold in the market and manufacturers must invest in raising awareness to expand their footprint.

-

Limitation in aftermarket opportunities: The virtual visor market is reliant on advanced technologies that are directly integrated into vehicle systems. The dependency makes it difficult to offer virtual visors as aftermarket products, restricting retrofitting capabilities in new vehicles equipped with traditional visors. The limitation can cause constraints in market penetration which can limit the scope of revenue expansion for major manufacturers.

Virtual Visor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.2% |

|

Base Year Market Size (2025) |

USD 430.93 million |

|

Forecast Year Market Size (2035) |

USD 3.76 billion |

|

Regional Scope |

|

Virtual Visor Market Segmentation:

Application (Passenger Vehicle, Commercial Vehicle)

In virtual visor market, passenger vehicle segment is set to capture revenue share of over 68% by 2035. The rapid proliferation of ADAS is a major factor of the segment’s expansion. Virtual visors utilizing AI-powered transparent LCDs address challenges such as sun glare and offers improved visibility to drivers. The growing demand for premium passenger vehicles coupled with the rising car rental services bode well to create opportunities for manufacturers to integrate virtual visors in the interiors. In March 2023, the Center for Automotive Research published a report underscoring that educating drivers on the benefits of ADAS and autonomous vehicles (AVs) to improve the consumer adoption rates. Moreover, partnerships between technology firms and global car manufacturers are driving mass production and cost-efficiencies, which in turn expands the scope of accessibility of virtual visors to diverse categories of passenger cars.

The commercial vehicle segment is estimated to expand during the forecast period. A major factor of the growth is the increasing number of commercial vehicles fueled by the advent of ride-sharing economies worldwide. The expansion of major ride hailing companies such as Uber, Lyft Inc., ANI Technologies Private Limited, Cabify Spain SLU, Ola etc. has heightened the number of commercial vehicles on the road. For instance, in November 2024, Lyft Inc., announced plans for multiple autonomous vehicle (AV) partnerships to connect the Lyft community with future AV rides in the Lyft app. The AV partnerships are predicted to create opportunities for the integration of AI-powered visors in the vehicles. Furthermore, virtual visors solve a critical pain point for long hauls by reducing fatigue and improving driver visibility.

Type (LED, LCD)

The LED segment in virtual visor market is set to exhibit robust growth during the stipulated timeframe owing to superior performance offered by LEDs in providing precise illumination control. LEDs are able to provide dynamic light adjustment, seamlessly adapting to changing sunlight conditions without obstructing the driver’s view. The benefits expand its scope of application in visors for driving in areas with fluctuating sunlight conditions. Additionally, the extensive R&D in LED manufacturing driven by the demand for ADAS benefits the growth. For instance, in January 2025, Aledia released a breakthrough microLED technology for the next generation of displays for vision applications at the backdrop of tech giants targeting commercial launches by 2027.

Our in-depth analysis of the global virtual visor market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Virtual Visor Market Regional Analysis:

North America Market Forecast:

The North America virtual visor market is predicted to account for a major revenue share of 48.9% throughout the forecast period. The rising adoption of advanced automotive technologies in the region, with a consumer base receptive to the proliferation of AI-integrated vehicle interior features, creates lucrative opportunities. Prominent manufacturers in the region such as Ford, General Motors, Tesla, etc., fosters innovation and improves the rate of integrating cutting-edge solutions such as virtual visors. The consumer demand for premium vehicle features is predicted to support the trend with driver comfort and safety prioritized in the manufacturing of the next generation of vehicles.

The U.S. virtual visor market is expected to represent a leading revenue share in North America. The sector’s expansion is propelled by the automotive industry’s commitment to integrating ADAS and improving vehicle safety features. The United States Department of Transportation National Roadway Safety Strategy (NRSS) is working on a long-term goal of zero roadway facilities, and a key objective in the strategy is the integration of safer vehicles in the market. Such objectives incentivize stakeholders in the automotive sector to invest in expanding the manufacturing of vehicles with robust safety features, which in turn benefits the integration opportunities for virtual visors. Additionally, the consumer demand for improved driving experiences which is a characteristic of the U.S. market is predicted to ensure sustained growth of the virtual visors sector.

The Canada virtual visor market is forecast to expand by the end of 2035. The rising emphasis on vehicle safety is expected to improve consumer awareness on the benefits of virtual visors. Moreover, the successful use cases of the integration of AI-powered virtual visors in mitigating the impact of glare and improving driver comfort is poised to create opportunities for the manufacturers. The International Trade Organization reported a 15% growth of the automotive industry in Canada in 2022, and with the country cementing its position among the top 12 producers of light vehicles, manufacturers are poised to find continuous opportunities to supply virtual visors to automakers.

Europe Market Forecast

The Europe virtual visor market is poised to exhibit the fastest growth during the forecast period. The stringent safety regulations imposed by the European Union (EU) remains a major cause of the market’s growth. Consumers in Europe are increasingly demanding safer vehicles with enhanced comfort features, propelling opportunities for the adoption of virtual visors. Additionally, the presence of leading automotive manufacturers in Europe fosters an innovation-centric ecosystem in the region, which can assist in improving end user awareness on the benefits of virtual visors over traditional visors. The Roadworthiness Certificate (RWC) and the Proof of Test (POT) models of countries in Europe augurs well for manufacturers to highlight virtual visors as a key component in vehicle safety.

The Germany virtual visor market is poised to expand during the stipulated timeframe. The dominant factor of the sector’s growth is the presence of a well-established automotive sector in the country with German manufactured cars renowned across the world. The consumer demand for vehicles manufactured in Germany creates an innovation-centric ecosystem where automakers can invest in improving the interior safety of vehicles. Furthermore, the integration of virtual visors can align with the country’s focus on precision engineering contributing to the sector’s continued growth.

The France virtual visor market is set to exhibit robust growth by the end of 2035. The consumer demand for safer vehicles, which is evident in global trends, has had an impact in the France market, with the calls for safer vehicles expected to increase during the virtual visor market’s estimated timeline. OECD’s Road Safety country profile of France in 2021 reported a 20% decrease in fatalities in the previous decade and a 20% increase in traffic. France expects to improve the numbers in the decade by heightening focus on road safety initiatives, which hold the potential of benefiting manufacturers of virtual visors.

Key Virtual Visor Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sunvisors Private Ltd.

- Irvine Automotive Products

- Atlas Holdings

- FOMPAK

- Magna International Inc.

- Kasai Kygo Co., Ltd.

- Weetect

The virtual visor market is poised to expand during the forecast period. The key players in the market are investing to improve product offering, by inculcating AI and adaptive transparency to improve driver safety. Partnerships between firms and automakers facilitates the seamless integration of virtual visors in new vehicle models. Additionally, targeted marketing campaigns to improve consumer awareness on the efficacies of virtual visors are expected to benefit the leading companies operating in the sector. Robert Bosch GmbH, a major player in the market, reported 14.1% profit before tax in the first quarter of 2024-2025 which is a 3.8% over the same quarter in 2023-2024.

Here are some key players in the virtual visor market:

Recent Developments

- In January 2025, NVIDIA announced announced that its autonomous vehicle (AV) platform, NVIDIA DRIVE AGX Hyperion passed industry-safety assessments by TÜV SÜD and TÜV Rheinland. This achievement raises the bar for AV safety.

- In December 2024, General Motors announced plans to realign its autonomous driving strategy. The strategy is poised to prioritize the development of advanced driver assistance systems on a path to fully autonomous personal vehicles.

- Report ID: 7112

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Virtual Visor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.