Virtual Sports Market Outlook:

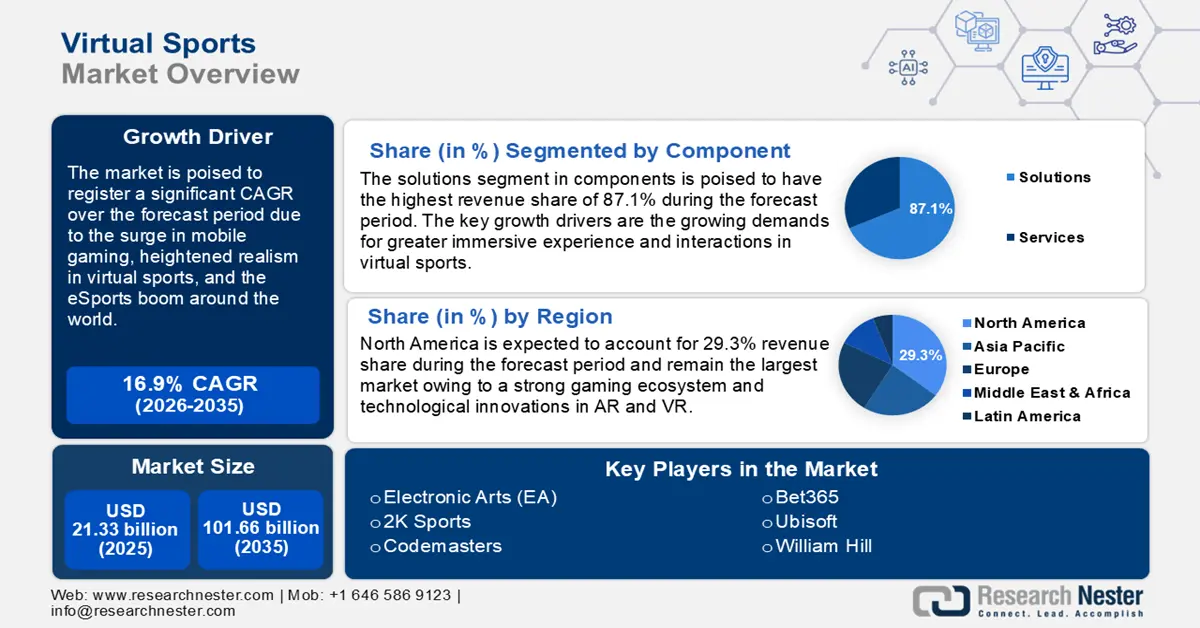

Virtual Sports Market size was over USD 21.33 billion in 2025 and is projected to reach USD 101.66 billion by 2035, growing at around 16.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of virtual sports is evaluated at USD 24.57 billion.

The COVID-19 pandemic has played a key role in increasing the number of users engaged in virtual sports. As per TwitchTracker, Twitch saw a 60% increase in viewership for e-sports during the first half of the pandemic. The Economics Times reported in 2020, that the Texas Motor Speedway simulation racing game became the highest-viewed e-sports event ever during the pandemic with 1.3 million viewers.

The significant growth of the virtual sports market is attributed to the rise in mobile gaming. The easy availability of smartphones has made virtual sports accessible globally leading to impressive market growth. Gaming on portable devices such as smartphones and tablets appeals to casual and hardcore gamers alike and has boosted the demand for virtual sports games. Due to the rise in technological innovations, virtual sports offer immersive experiences to users. For instance, Electronics Arts (EA) Sports released the UEFA Euro 2024 mode for EA Sports FC Mobile in June 2024 which has 500 million downloads on the Play Store. EA’s annual report in 2021 revealed that it made USD 1.6 billion from April 2020 to March 2021.

Key Virtual Sports Market Insights Summary:

Regional Highlights:

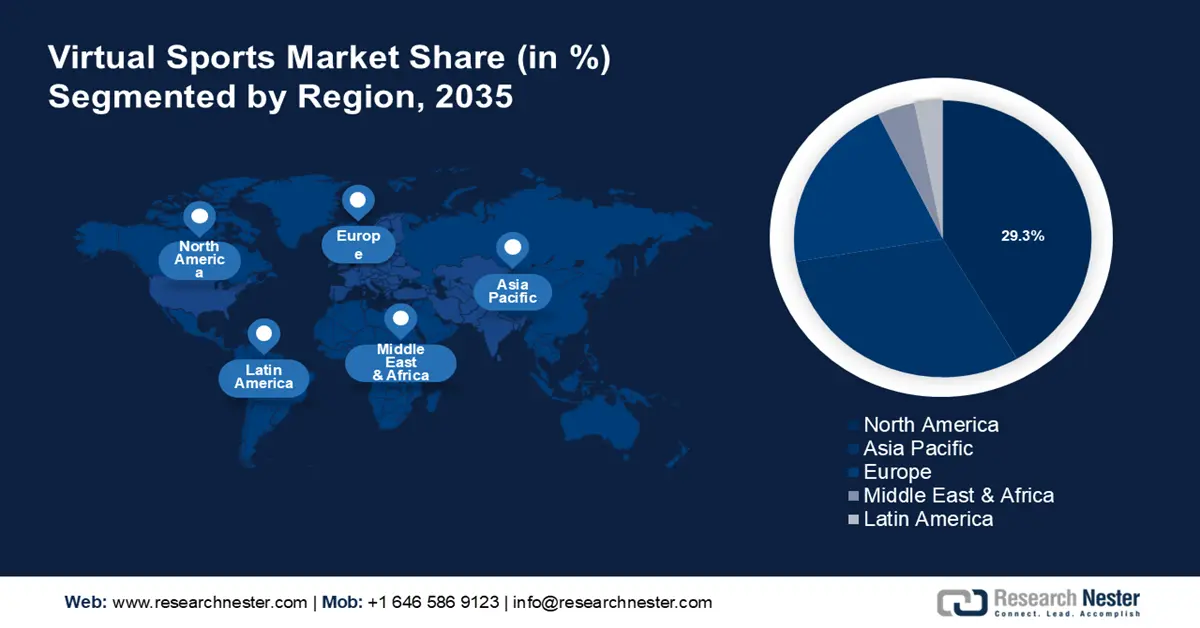

- North America’s virtual sports market will account for 29.3% share by 2035, driven by a strong gaming culture, regulatory support, and immersive technology adoption.

- Asia Pacific market will command a lucrative share by 2035, driven by large population, growing esports ecosystem, and increasing internet penetration.

Segment Insights:

- The solutions segment in the virtual sports market is expected to capture an 87.10% share by 2035, driven by rising demand for innovative virtual sports solutions and immersive user experiences.

- The football (soccer) game segment in the virtual sports market is set to maintain the largest market share by 2035, attributed to football's global popularity and the rise of virtual football esports.

Key Growth Trends:

- Heightened realism in virtual sports

- Rising popularity of Esports

Major Challenges:

- Navigating regulatory hurdles

- Lack of mainstream penetration

Key Players: Electronic Arts (EA), 2K Sports, Codemasters, Bet365, William Hill, DraftKings, Ubisoft, Dovetail Games, Cyanide Studio, Netmarble, HB Studios.

Global Virtual Sports Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.33 billion

- 2026 Market Size: USD 24.57 billion

- Projected Market Size: USD 101.66 billion by 2035

- Growth Forecasts: 16.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (29.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, China, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Virtual Sports Market Growth Drivers and Challenges:

Growth Drivers

-

Heightened realism in virtual sports: Technological innovations have been a significant driver for the boost in market growth. Virtual sports have seamlessly integrated virtual reality (VR) and augmented reality (AR) to make the user experience immersive. For instance, Golf+ VR, released in 2020, allows users to experience realistic Golf gameplay with friends and family. Players can calculate the wind and distance to a hole before taking a shot reiterating the hyperrealism of the game. In 2023, Ryan Eagle, the CEO of Golf+ predicted in a tweet that the user base will increase by 20 million to 300 million in 5 to 10 years.

Moreover, virtual and traditional sports have converged and opened avenues for engagement. Tennis allows VR streaming options for major tournaments such as the US Open, increasing fan engagement. The continuously evolving virtual sports sector is poised to answer the demands for greater interactive experiences for users which bodes well for the future of the market. - Rising popularity of Esports: Electronic Sports (Esports) has a massive popularity spike globally boosted by the pandemic shutdowns of traditional sports events. Esports tournaments have high prize pools and garner millions of viewers, thereby generating significant interest in virtual sports. For instance, Madden NFL 24 Ultimate Bowl tournament conducted in January 2024, saw a record 101.7 million viewers across platforms. Esports popularity has also boosted merchandise sales and sponsorship deals. For instance, Faze Clan signed a multimillion-dollar deal with Rollbit in 2024.

- Betting integration in virtual sports: The legalization of online betting created a significant growth curve for the virtual sports market. For instance, Kansas legalized sports betting in 2022. Previously, the option for sports to bet on was limited but not anymore as a multitude of sports such as Darts, Ice Hockey, Football, Greyhound Racing, Soccer, etc. are on the menu of sports betting websites.

Betting in virtual sports has an advantage as bets can be placed at any time without being impeded by real-life conditions such as weather. The diverse betting opportunities and in-play betting attract more users. In 2023, a leading player in the market DraftKings Inc. reported an annual revenue of USD 3.67 billion worldwide which is a 63.8% increase from their revenue in 2022.

Challenges

-

Navigating regulatory hurdles: The legal framework for virtual sports betting can be complex and vary between different jurisdictions. Countries such as Singapore, Japan, and the United Arab Emirates have banned sports betting. Additionally, there can be disputes over intellectual property rights between real-world sports brands and logos used in virtual sports games. Integration of betting and gambling in virtual sports also raises ethical concerns, making the jurisdictions reticent in relaxing regulatory hurdles.

-

Lack of mainstream penetration: The competition with traditional modes of sports creates restraints in virtual sports breaking into the mainstream. Virtual sports do not share the luxury of stemming cultural significance of traditional sports such as soccer, basketball, and cricket. Virtual sports still remain a niche experience and can be a constraint for market growth. The lack of physical connection in virtual sports also proves as a deterrent as many users fail to build the camaraderie that traditional sports offer.

Virtual Sports Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.9% |

|

Base Year Market Size (2025) |

USD 21.33 billion |

|

Forecast Year Market Size (2035) |

USD 101.66 billion |

|

Regional Scope |

|

Virtual Sports Market Segmentation:

Component Segment Analysis

The solutions segment will dominate the virtual sports market with a substantial 87.1% of revenue share by 2035. The need for innovative solutions rises as users seek immersive experiences and new ways to interact with virtual sports. Platforms like GeForce NOW by Nvidia allow users to stream high-quality games without supporting hardware. In 2022, GeForce NOW reported 20 million active users. The growing interest in esports is a key driver in this segment’s rise as evident from the surge in users in streaming platforms such as Facebook Gaming. In 2021, Worldmetrics.org reported that Facebook Gaming reached 500 million active users. With new cutting-edge innovations improving the virtual sports experience, this segment is expected to hold its dominant market share during the forecast period.

Game Segment Analysis

The football (soccer) held the most revenue share and is expected to continue its dominance during the forecast period owing to the immense popularity of football across the globe. Virtual sports games such as EA Sports FC Mobile, Top Eleven, and Football Manager provide immersive experiences to the users from being a manager to playing against opponents in real-time. The rise in virtual football esports will be a significant driver of this segment. For instance, in September 2024, FIFAe World Cup was conducted for the game Football Manager with the International Federation of Association Football planning new Esports events in the future.

Our in-depth analysis of the virtual sports market includes the following segments:

|

Component |

|

|

Game |

|

|

Demographics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Virtual Sports Market Regional Analysis:

North America Market Insights

North America industry is set to dominate majority revenue share of 29.3% by 2035, due to a strong technological ecosystem, prevalent gaming culture, and rising user interest in immersive virtual experiences.

U.S. is poised to remain a market leader in the virtual sports market in lieu of a robust culture of gaming which has created a dedicated user base and communities for various titles. As per EA, Madden NFL 2024 saw a record increase of 6% in booking and a surge in weekly users. The robust technological infrastructure of the U.S. enables the development of premier virtual sports experiences for users. Another significant driver for growth is the relaxation of regulatory hurdles, as virtual sports betting has been made legal in several states of the country. Additionally, with the Esports scene continuing to thrive in U.S., the country is set to maintain the growth curve in the market.

In Canada, the relaxed regulatory framework along with a strong gaming culture drives the market forward. In 2021, the government legalized single-game sports betting which has boosted the market growth. A robust Esports and gaming ecosystem in the country, with rising disposable income among the population, will continue to assist the market growth.

APAC Market Insights

Asia Pacific is poised for a lucrative market share during the forecast period owing to the considerably large section of the population, robust gaming ecosystem, and increasing internet penetration.

India has seen significant growth in the virtual sports market. The country saw the highest surge during the pandemic with a mammoth rise in esports and virtual sports betting. The largest sports betting platform Dream 11 reported more than 200 million active users in October 2023. Platforms such as Loco and Rooter have been established to capitalize on the rising esports and virtual sports streaming in the country. In 2022, Loco reported more than 100 million views in a live Esports event for Battlegrounds India Mobile. Virtual sports like football are becoming increasingly popular in Esports scenarios in India.

China has a strong gaming ecosystem with PC and mobile games sharing the popularity. In 2024, the South China Morning Post reported that gamers in China increased to 668 million from 666 million in 2022. As per the report, gamers in China spent USD 303 billion on games. Another significant driver is the esports boom in the country with China having the most active Esports players in the world along with the highest game revenues. These factors make China a lucrative market for virtual sports.

Virtual Sports Market Players:

- Electronic Arts (EA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 2K Sports

- Codemasters

- Bet365

- William Hill

- DraftKings

- Ubisoft

- Dovetail Games

- Cyanide Studio

- Netmarble

- HB Studios

Recent Developments

- In September 2024, EA Sports announced licensing and marketing partnerships with AS Roma and SSC Napoli. EA SPORTS FC 25 is expected to be the most hyper-realistic football game as per EA.

- In August 2024, JetSynthesys Nautilus Mobile announced a partnership with the Indian Premier League (IPL) team, Mumbai Indians. The partnership allows Nautilus Mobile’s Real Cricket 24 to incorporate more hyper-realism into the cricket game.

- In January 2023, Esports was officially recognized in India by the government. Esports was brought under the aegis of India’s Ministry of Youth Affairs and Sports while the broader gaming industry was brought under India’s Ministry of Electronics & Information Technology.

- In April 2021, the International Olympic Committee (IOC) announced the Olympic Virtual Series (OVC) that will connect physical sports in the Olympics with the virtual sports community.

- Report ID: 6408

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Virtual Sports Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.