Vinyl Acetate Monomer Market Outlook:

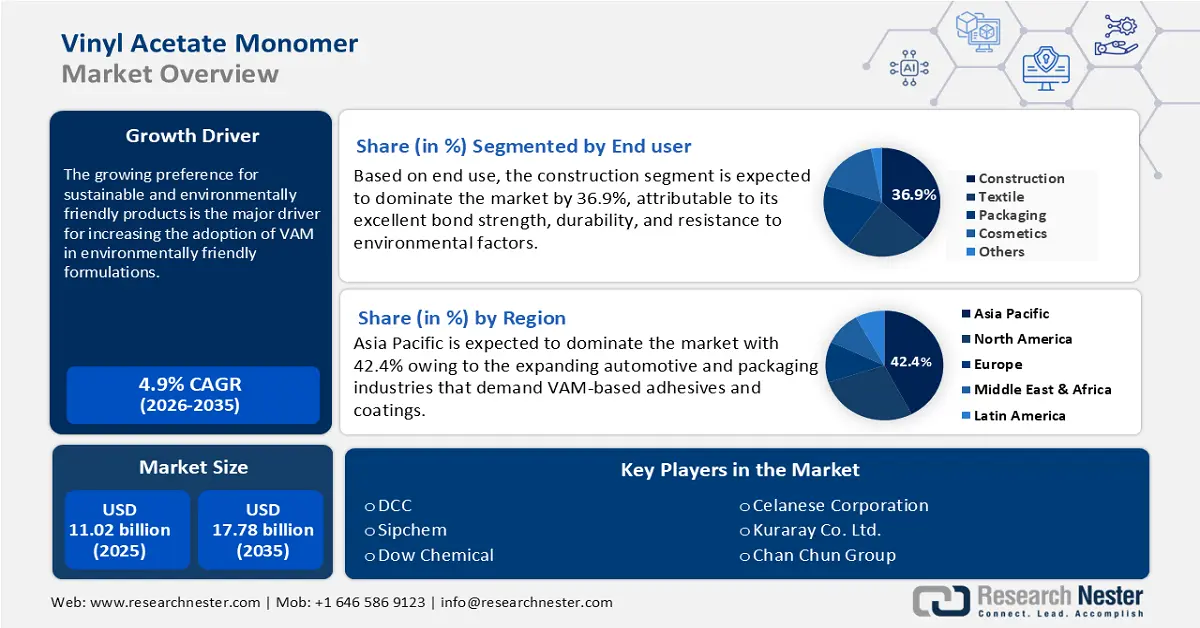

Vinyl Acetate Monomer Market size was over USD 11.02 billion in 2025 and is poised to exceed USD 17.78 billion by 2035, witnessing over 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vinyl acetate monomer is evaluated at USD 11.51 billion.

Industries are looking for alternatives to traditional materials that are contributing to carbon dioxide emissions and environmental pollution. Moreover, due to increasingly diversified consumer preference needs and particularly tough regulatory requirements, manufacturers develop new and advanced products.

Furthermore, continuous improvement within the companies through investing in research and development activities provides a boom in the market. For instance, in October 2022, Asian Paints announced the establishment of a new manufacturing facility for vinyl acetate-ethylene emulsion and vinyl acetate monomer for USD 248.7 million. This helped in rendering cost efficiency and mitigating import reliability by boosting domestic production. In addition, the application of technological innovations could help the industry differentiate its products and capture new market segments.

Key Vinyl Acetate Monomer Market Market Insights Summary:

Regional Highlights:

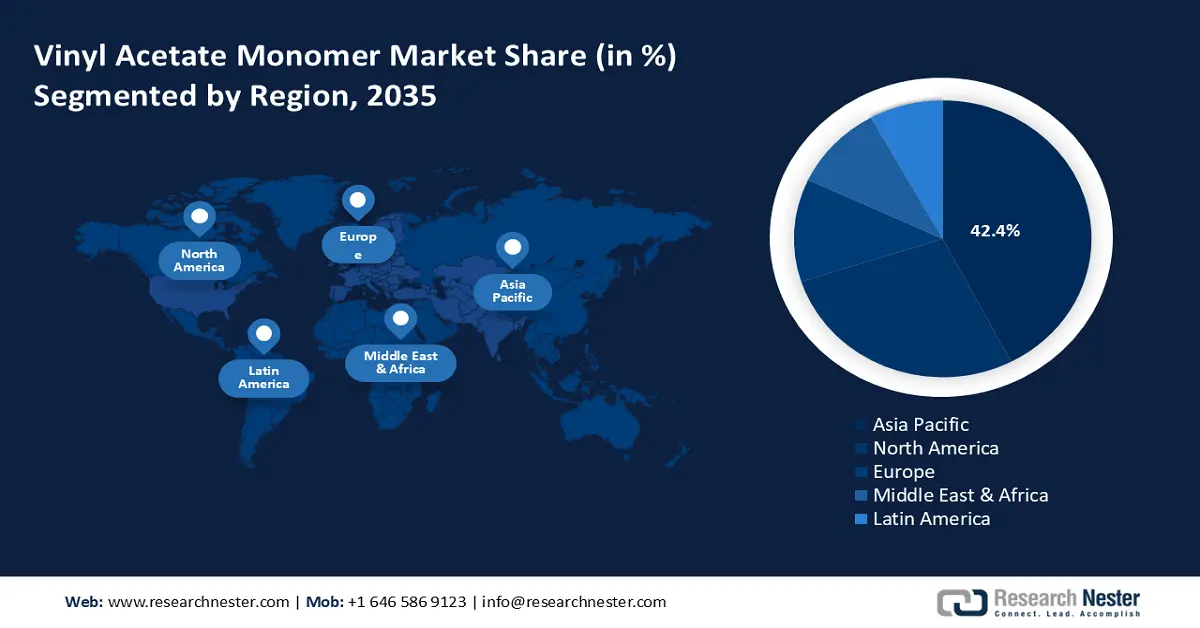

- Asia Pacific's 42.4% share in the Vinyl Acetate Monomer Market is driven by the high speed of industrialization and urbanization, ensuring strong growth prospects from 2026–2035.

- North America's vinyl acetate monomer market is expected to grow steadily through 2026–2035, driven by the increasing demand for environment-friendly and low-VOC adhesives in the construction and automotive sectors.

Segment Insights:

- The Construction segment is anticipated to achieve more than 36.9% market share by 2035, propelled by increased demand for high-performance adhesives and sealants in flooring, wall coverings, and insulation.

- Polyvinyl Acetate segment is anticipated to experience high growth from 2026-2035, driven by its universal application in adhesives, paints, and coatings.

Key Growth Trends:

- Rising consumer preferences for eco-friendly products

- Growing automotive industry

Major Challenges:

- Market saturation

- Hurdles in technological advancement integration

- Key Players: Sinopec, Sipchem, Exxon Mobil Corporation, Solventis, DowDuPont, and more.

Global Vinyl Acetate Monomer Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.02 billion

- 2026 Market Size: USD 11.51 billion

- Projected Market Size: USD 17.78 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 14 August, 2025

Vinyl Acetate Monomer Market Growth Drivers and Challenges:

Growth Drivers

- Rising consumer preferences for eco-friendly products: Rapidly increasing awareness about environmental sustainability and health issues related to old chemical products drives the demand. Manufacturers innovate and introduce VAM-based products that are aligned with the preferences of the eco-conscious consumer, marking higher market appeal and competitiveness. For instance, in February 2023, Celanese Corporation announced the expansion of its sustainable product portfolio within its acetyl chain. This comprised the development and integration of ECO-B products in response to the growing demand for sustainable solutions. In addition, it pushes the adoption in the vinyl acetate monomer market.

- Growing automotive industry: As one of the main growth impellers of the market, the automotive industry has witnessed growth over the years, mainly in demand for fuel-efficient and lightweight vehicles. Manufacturers are now looking for more advanced adhesive solutions to afford the bonding of lightweight materials such as composites and plastics. High-performance adhesives play a critical role in VAM in attaining durability and safety. This creates a trend of innovation in vehicle design and construction and thus propels the demand for VAM, making it an essential constituent in developing next-generation automotive products.

Challenges

- Market saturation: The market explosion leads to widespread products and technologies, which serve as catalysts for massive price competition, thereby militating against profit margins by manufacturers. This saturation makes it challenging for companies to differentiate their offers, hence forcing them to incur significant research and development costs to innovate and create unique value propositions. Additionally, the over-supplied VAM in specific regions leads to the accumulation of stock and reduced demand, which further complicates the market dynamics.

- Hurdles in technological advancement integration: Transitioning to advanced technologies would often involve significant capital investment in equipment and process re-engineering within the company. Furthermore, the installation of new technologies might cause inconvenience to existing operations, and personnel would have to navigate a steeper learning curve which hampers productivity. This financial and operational burden can discourage manufacturers, especially smaller-scale companies, from trying to achieve technological upgrades, which limits innovation in the market.

Vinyl Acetate Monomer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 11.02 billion |

|

Forecast Year Market Size (2035) |

USD 17.78 billion |

|

Regional Scope |

|

Vinyl Acetate Monomer Market Segmentation:

End user (Construction, Textile, Cosmetics, Packaging, Others)

Construction segment is predicted to account for vinyl acetate monomer market share of more than 36.9% by the end of 2035. This is mainly due to increased demand for high-performance adhesives and sealants used in applications such as flooring, wall coverings, and insulation. As urbanization and infrastructure develop rapidly worldwide, consumption of VAM in the construction industry expands due to increased demand for more effective bonding solutions and thus further solidifies market leadership. For instance, in February 2023, it was announced that to construct the new VAM plant in Ulsan, LOTTE INEOS Chemical has acquired additional land. It will boost the current 450,000-ton production capacity to 700,000-ton.

Application (Polyvinyl Alcohol, Polyvinyl Acetate, Ethylene-Vinyl Acetate, Vinyl Acetate Ethylene, Ethylene-Vinyl Alcohol, Others)

The polyvinyl acetate segment of the vinyl acetate monomer market is expected to be highly growing primarily due to its universal application in adhesives, paints, and coatings. PVA exhibits excellent adhesion properties, flexibility, and durability, which makes it a go-to product for many industrial applications like woodworking, construction, and packaging. For instance, in September 2022, Bioplastics International developed the first water-soluble PVA made from sugar cane alcohol. Bioplastics International has introduced a water-soluble, fossil fuel-free alternative to petroleum-based plastics to reduce the massive amount of plastic debris that is polluting our oceans. This versatility and capability in performance drive enormous demand for VAM in the production of polyvinyl alcohol.

Our in-depth analysis of the global market includes the following segments:

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vinyl Acetate Monomer Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific industry is estimated to account for largest revenue share of 42.4% by 2035, predominantly due to the high speed of industrialization and urbanization. In addition, the rising demand for vinyl acetate monomer in construction, automotive, and packaging applications reflects the region's expanding manufacturing capabilities and makes it the growing side of the global VAM market landscape.

In China, the market is growing rapidly owing to the substantial manufacturing sector and increased demand for it in most applications, including adhesives and coatings. For instance, in December 2023, Jiangsu Sopo Chemical planned a comprehensive VAM and EVA monomer project. The construction of a large-scale VAM production plant aims to accommodate an annual capacity of 330 thousand tons. This strategic move fulfills business goals of growth and improved production capacity. Furthermore, increasing VAM consumption and setting China ahead in this global VAM market.

In India, the market is developing at a great pace due to fast growth in the construction sector, which is driven by urbanization and infrastructure development initiatives. For instance, in March 2024, Asian Paints declared to have secured the required agreements with Gujarat Chemical Port (GCPL) to set up an ethylene handling and storage facility. More consumption of high-performance adhesives and sealants in residential and commercial projects assures VAM consumption in India, making it an important aspect while enhancing manufacturing capabilities in the market.

North America Market Analysis

The vinyl acetate monomer market in North America is expected to be one of the emerging regions in the future, driven by the increasing demand for environment-friendly and low-VOC adhesives in the construction and automotive sectors. Manufacturing of VAM-based products is increasingly adopted as the regulatory standards rise regarding environmental sustainability. Manufacturer presence has improved and introduced innovation in sustainable applications across the region.

Robust growth is registered in the U.S. market mainly due to surging demand for lightweight and durable materials to satisfy stricter regulatory requirements and consumer preferences. For instance, in March 2021, Celanese Corporation made an announcement to boost its VAM production at Clear Lake, Texas, by about 150,000 metric tons annually. By the end of 2023, this plant expansion will be finished, allowing Celanese to satisfy the growing demand for VAM in the Americas.

In Canada, the market has been steadily growing due to the increasing demand for sustainable building materials and adhesives. Furthermore, it is also driven by its focus on eco-friendly building practices and regulatory compliance for low-VOC adhesives and coatings where VAM is positioned to play a key role. This trend puts Canada among the emerging players in the market and fosters innovation and growth.

Key Vinyl Acetate Monomer Market Players:

- Sipchem

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Celanese Corporation

- Chang Chun Group

- DCC

- Dow Chemical

- DowDuPont

- Wacker Chemie AG

- Solventis

- Innospec

- Sinopec

- Arkema

- Exxon Mobil Corporation

- LyondellBasell Industries N.V.

Companies undertaking business in the vinyl acetate monomer market landscape highly operate with competitive and innovative forces through the efficient generation of demand for sustainable and high-performance products. For instance, in March 2023, WACKER’s Nanjing declared the successful capacity expansion for vinyl-acetate-ethylene copolymer (VAE) dispersions and VAE dispersible polymer powders. This move helped the company meet the increasing demand from customers for its premium binders, especially from China's thriving construction sector. Major players are taking considerable measures on research and development to upgrade VAM solutions to remain in the competitive edge in a fast-changing market.

Here's the list of some key players:

Recent Developments

- In September 2024, Henkel introduced a new, high-performing removable construction adhesive, Pattex No More Nails Stick & Peel addressing the demands of consumers by greatly increasing the possibilities for decoration and re-decoration. A new patented technology for the first debonding solution that is easily removable and has a high-strength hold.

- In May 2021, Celanese Corporation announced that it signed a MoU with Anhui Wanwei Group Co., Ltd. The agreement calls for Celanese to supply Wanwei with its ethylene-based vinyl acetate monomer (VAM), based on green technology, to support roughly half of the company's captive product needs in the production of chemicals, fibers, and new materials.

- Report ID: 6751

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vinyl Acetate Monomer Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.