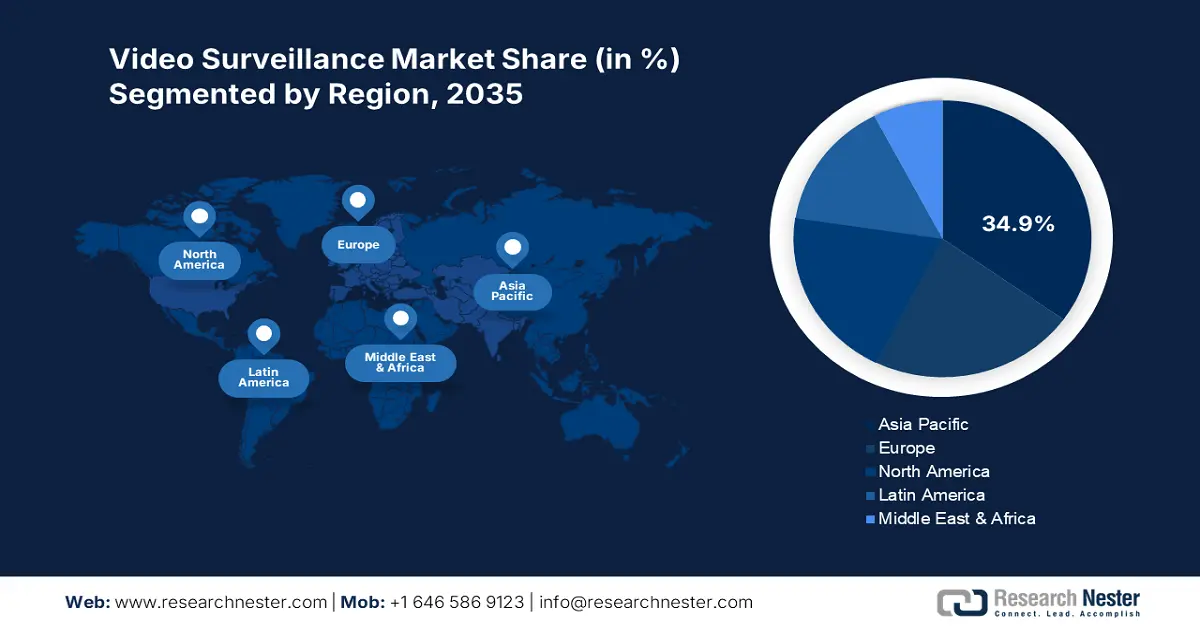

Video Surveillance Market - Regional Analysis

APAC Market Insights

The Asia Pacific video surveillance market is projected to hold 34.9% of the global revenue share through 2035, owing to robust public infrastructure programs and national security upgrades. The increasing investments in the smart city projects are also estimated to propel the sales of video surveillance systems. China, India, Japan, and South Korea are the most promising marketplaces for video surveillance companies. The swift rise in digitalization and growing demand from both the public and private sectors is accelerating the production and commercialization of advanced video surveillance systems. In addition, the government-backed ICT frameworks and crime prevention mandates are further promoting the demand for advanced surveillance solutions.

China leads the sales of video surveillance technologies, due to its massive investment in urban surveillance infrastructure and AI integration. The smart city initiatives are driving high demand for traffic management solutions, which is directly increasing the deployment of video surveillance solutions. The expansion of 5G-powered surveillance and edge AI analytics is further expected to drive the sales of next-gen camera systems. In February 2025, the government introduced rules to manage public security video systems. These rules aim to keep people safe while protecting their privacy and personal information rights. The evolving regulations are likely to promote the sales of advanced video surveillance systems.

India video surveillance market is expected to grow at a robust pace during the forecast period, attributed to the rising need for secure CCTVs across commercial, residential, and industrial settings and increasing government initiatives, including the Smart Cities Mission and Safe City Projects. Moreover, the rising incidence of thefts, terrorism concerns, and public safety demands is likely to increase the sales of different types of video surveillance systems in the coming years.

North America Market Insights

The North America video surveillance market is expected to increase at a CAGR of 9.9% from 2026 to 2035, owing to the aggressive public safety initiatives and smart city deployments. The expanding industrial automation is also contributing to the growing sales of video surveillance technologies. Government bodies in the U.S. and Canada are increasing ICT-related investments, especially in surveillance infrastructure, cybersecurity, and 5G rollouts.

The U.S. Federal Communications Commission’s (FCC) Broadband Equity, Access, and Deployment (BEAD) Program and Canada's Universal Broadband Fund are some of the key boosters for the production and commercialization of video surveillance systems. The Innovation, Science and Economic Development (ISED) agency’s commitment of CAD 3.225 billion under the Universal Broadband Fund (UBF) to connect remote regions by 2027 is expected to boost the sales of expected to scale cloud-based and edge surveillance systems. Furthermore, the Smart Surveillance Directive, aimed at stricter encryption and access standards for public-facing video systems, is likely to accelerate their deployment in municipal and healthcare sectors.

The U.S. is likely to hold a dominant share of the North America market throughout the projected period, due to the hefty federal ICT investments, AI integration, and infrastructure modernization initiatives. The Broadband Equity Access and Deployment Program of the National Telecommunications and Information Administration grants nearly USD 42.5 billion to connect every American to high-speed internet by investing in infrastructure partnerships. This highlights that the expansion of high-connectivity networks is likely to increase the deployment of advanced video surveillance systems in the years ahead.

Europe Market Insights

The Europe video surveillance is anticipated to account for 22.5% of the global revenue share throughout the study period. The digitization initiatives, data security reforms, and investments in smart infrastructure are prime growth drivers fueling the sales of advanced video surveillance systems. In February 2022, the European Commission announced a €3.2 billion investment plan to fund 21 projects in the Western Balkans. These projects are focused on enhancing transportation, digital technology, climate efforts, and energy connections. Such moves are emerging as lucrative opportunities for advanced video surveillance manufacturers.

The sales of video surveillance systems in Germany are poised to be driven by its manufacturing-focused economy and the increasing expansion of smart infrastructure projects. The high public spending on national security advancements is also expected to fuel the demand for advanced video surveillance solutions. The Federal Ministry for Digital and Transport (BMDV) is focused on smart transportation systems, which include the expansion of city-wide networks of AI-powered cameras, especially in Berlin and Munich, to improve traffic management and safety. Such initiatives are likely to boost the revenues of key players. The strong presence of high-tech companies is further contributing to the increasing adoption of video surveillance systems.

In France, the market is expected to register rapid growth during the forecast period owing to rising concerns about thefts, vandalism, and increasing safety pressures from public authorities and private organizations. For instance, in 2024, the average number of residential burglaries was about 5.87 per 1,000 homes in France. This has resulted in increasing demand for advanced video surveillance systems in the residential sector. Moreover, local governments in the country are increasingly embracing smart city initiatives that require well-equipped surveillance systems to manage traffic, crowd and enhance public safety.