- An outline of the Global Video Streaming Infrastructure Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Opportunities

- Growth Drivers

- Major Roadblocks

- Trends

- Government Regulation

- Comparative Analysis of the Current Technology Trends

- Up-Coming Technologies

- Growth Outlook

- Risk Analysis

- Analysis on the Parts/Hardware Utilized in Manufacturing of Humanoid Robots

- Pricing Benchmarking

- SWOT

- Patent Analysis

- Supply Chain

- Root Cause Analysis

- Regional Demand

- Recent News

- Strategic Initiatives

- Customer Requirements

- Value Chain Analysis

- Parts/Hardware and Their Future Trends

- Factors Enhancing the Potential of the Video Streaming Infrastructure Market

- Verification of Change Points – Market

- Required Technology Hypotheses

- Verification of Change Points – Technology

- Technology Trends

- Current Applications of Humanoid Robots with a Focus on Factory Automation

- Customized Analysis: Opportunities for Expansion into the Video Streaming Infrastructure Market

- Strategic Recommendation Analysis for Panasonic in the Humanoid Robots Market

- Integration of the Latest Technology in the Video Streaming Infrastructure Market

- Industry Vertical Analysis

- Comparative Positioning

- Competitive Landscape

- Competitive Model

- Market Share of Major Companies Profiled, 2023

- Business Profile of Key Enterprise

- Microsoft Corporation

- Alphabet Inc.

- Akamai Technologies, Inc.

- Edgio, Inc.

- Cloudflare, Inc.

- Fastly, Inc.

- CDNetworks, Inc.

- Zyao Group, LLC

- Lumen Technologies, Inc.

- RoboGarage

- Xiaomi

- Apptronik

- Global Video Streaming Infrastructure Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Global Video Streaming Infrastructure Market Segmentation Analysis (2024-2037)

- By Type

- By Hardware

- Switches, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoders, Market Value (USD Million), and CAGR, 2024-2037F

- Amplifiers, Market Value (USD Million), and CAGR, 2024-2037F

- Servers, Market Value (USD Million), and CAGR, 2024-2037F

- Set-top Box, Market Value (USD Million), and CAGR, 2024-2037F

- Codec Unit, Market Value (USD Million), and CAGR, 2024-2037F

- By Software

- Video Management, Market Value (USD Million), and CAGR, 2024-2037F

- Video Security, Market Value (USD Million), and CAGR, 2024-2037F

- Video Analytics, Market Value (USD Million), and CAGR, 2024-2037F

- Video Deliver & Distribution, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoding & Processing, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- Services

- By Type

- Managed Services

- Professional Services

- Integration & Deployment

- Training and Support Services

- Consulting

39.1.2 By Video Streaming Type

- On-Demand, Market Value (USD Million), and CAGR, 2024-2037F

- Live, Market Value (USD Million), and CAGR, 2024-2037F

- End use

- Broadcast, Operator and Media, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Gaming & Entertainment, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Government, Market Value (USD Million), and CAGR, 2024-2037F

39.1.4 By Region

- North America, Market Value (USD Million), and CAGR, 2024-2037F

- Europe Market Value (USD Million) and CAGR, 2024-2037F

- Asia Pacific Market Value (USD Million) and CAGR, 2024-2037F

- Latin America Market Value (USD Million) and CAGR, 2024-2037F

- Middle East and Africa Market Value (USD Million) and CAGR, 2024-2037F

39.1.5 Cross Analysis of Hardware W.R.T. Application (USD Million), 2024-2037

40) North America Video Streaming Infrastructure Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Predictions and Trend Analysis for Humanoid Robots

- Regional Competitors and Market Positioning

- North America Video Streaming Infrastructure Market Segmentation Analysis (2024-2037)

- By Type

- By Hardware

- Switches, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoders, Market Value (USD Million), and CAGR, 2024-2037F

- Amplifiers, Market Value (USD Million), and CAGR, 2024-2037F

- Servers, Market Value (USD Million), and CAGR, 2024-2037F

- Set-top Box, Market Value (USD Million), and CAGR, 2024-2037F

- Codec Unit, Market Value (USD Million), and CAGR, 2024-2037F

- By Software

- Video Management, Market Value (USD Million), and CAGR, 2024-2037F

- Video Security, Market Value (USD Million), and CAGR, 2024-2037F

- Video Analytics, Market Value (USD Million), and CAGR, 2024-2037F

- Video Deliver & Distribution, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoding & Processing, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- Services

- By Type

- Managed Services

- Professional Services

- Integration & Deployment

- Training and Support Services

- Consulting

40.1.2 By Video Streaming Type

- On-Demand, Market Value (USD Million), and CAGR, 2024-2037F

- Live, Market Value (USD Million), and CAGR, 2024-2037F

40.1.3 End use

- Broadcast, Operator and Media, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Gaming & Entertainment, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Government, Market Value (USD Million), and CAGR, 2024-2037F

40.1.4 By Country

- US, Market Value (USD Million), and CAGR, 2024-2037F

- Canada Market Value (USD Million) and CAGR, 2024-2037F

40.1.5 Cross Analysis of Hardware W.R.T. Application (USD Million), 2024-2037

41) Europe Video Streaming Infrastructure Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Predictions and Trend Analysis for Humanoid Robots

- Regional Competitors and Market Positioning

- Europe Video Streaming Infrastructure Market Segmentation Analysis (2024-2037)

- By Type

- By Hardware

- Switches, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoders, Market Value (USD Million), and CAGR, 2024-2037F

- Amplifiers, Market Value (USD Million), and CAGR, 2024-2037F

- Servers, Market Value (USD Million), and CAGR, 2024-2037F

- Set-top Box, Market Value (USD Million), and CAGR, 2024-2037F

- Codec Unit, Market Value (USD Million), and CAGR, 2024-2037F

- By Software

- Video Management, Market Value (USD Million), and CAGR, 2024-2037F

- Video Security, Market Value (USD Million), and CAGR, 2024-2037F

- Video Analytics, Market Value (USD Million), and CAGR, 2024-2037F

- Video Deliver & Distribution, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoding & Processing, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- Services

- By Type

- Managed Services

- Professional Services

- Integration & Deployment

- Training and Support Services

- Consulting

41.1.2 By Video Streaming Type

- On-Demand, Market Value (USD Million), and CAGR, 2024-2037F

- Live, Market Value (USD Million), and CAGR, 2024-2037F

41.1.3 End use

- Broadcast, Operator and Media, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Gaming & Entertainment, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Government, Market Value (USD Million), and CAGR, 2024-2037F

41.1.4 By Country

- UK, Market Value (USD Million) and CAGR, 2024-2037F

- Germany, Market Value (USD Million) and CAGR, 2024-2037F

- France, Market Value (USD Million) and CAGR, 2024-2037F

- Italy, Market Value (USD Million) and CAGR, 2024-2037F

- Spain, Market Value (USD Million) and CAGR, 2024-2037F

- BENELUX , Market Value (USD Million) and CAGR, 2024-2037F

- Poland, Market Value (USD Million) and CAGR, 2024-2037F

- Russia, Market Value (USD Million) and CAGR, 2024-2037F

- Rest of Europe, Market Value (USD Million) and CAGR, 2024-2037F

41.1.5 Cross Analysis of Hardware W.R.T. Application (USD Million), 2024-2037

42) Asia Pacific Video Streaming Infrastructure Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Predictions and Trend Analysis for Humanoid Robots

- Regional Competitors and Market Positioning

- Asia Pacific Video Streaming Infrastructure Market Segmentation Analysis (2024-2037)

- By Type

- By Hardware

- Switches, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoders, Market Value (USD Million), and CAGR, 2024-2037F

- Amplifiers, Market Value (USD Million), and CAGR, 2024-2037F

- Servers, Market Value (USD Million), and CAGR, 2024-2037F

- Set-top Box, Market Value (USD Million), and CAGR, 2024-2037F

- Codec Unit, Market Value (USD Million), and CAGR, 2024-2037F

- By Software

- Video Management, Market Value (USD Million), and CAGR, 2024-2037F

- Video Security, Market Value (USD Million), and CAGR, 2024-2037F

- Video Analytics, Market Value (USD Million), and CAGR, 2024-2037F

- Video Deliver & Distribution, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoding & Processing, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- Services

- By Type

- Managed Services

- Professional Services

- Integration & Deployment

- Training and Support Services

- Consulting

42.1.2 By Video Streaming Type

- On-Demand, Market Value (USD Million), and CAGR, 2024-2037F

- Live, Market Value (USD Million), and CAGR, 2024-2037F

42.1.3 End use

- Broadcast, Operator and Media, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Gaming & Entertainment, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Government, Market Value (USD Million), and CAGR, 2024-2037F

42.1.4 By Country

- China, Market Value (USD Million) and CAGR, 2024-2037F

- India, Market Value (USD Million) and CAGR, 2024-2037F

- Indonesia, Market Value (USD Million) and CAGR, 2024-2037F

- South Korea, Market Value (USD Million) and CAGR, 2024-2037F

- Malaysia, Market Value (USD Million) and CAGR, 2024-2037F

- Australia, Market Value (USD Million) and CAGR, 2024-2037F

- Singapore, Market Value (USD Million) and CAGR, 2024-2037F

- Vietnam, Market Value (USD Million) and CAGR, 2024-2037F

- Thailand, Market Value (USD Million) and CAGR, 2024-2037F

- New Zealand, Market Value (USD Million) and CAGR, 2024-2037F

- Rest of Asia Pacific excluding Japan, Market Value (USD Million), and CAGR, 2024-2037F

42.1.5 Cross Analysis of Hardware W.R.T. Application (USD Million), 2024-2037

43) Latin America Video Streaming Infrastructure Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Predictions and Trend Analysis for Humanoid Robots

- Regional Competitors and Market Positioning

- Latin America Video Streaming Infrastructure Market Segmentation Analysis (2024-2037)

- By Type

- By Hardware

- Switches, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoders, Market Value (USD Million), and CAGR, 2024-2037F

- Amplifiers, Market Value (USD Million), and CAGR, 2024-2037F

- Servers, Market Value (USD Million), and CAGR, 2024-2037F

- Set-top Box, Market Value (USD Million), and CAGR, 2024-2037F

- Codec Unit, Market Value (USD Million), and CAGR, 2024-2037F

- By Software

- Video Management, Market Value (USD Million), and CAGR, 2024-2037F

- Video Security, Market Value (USD Million), and CAGR, 2024-2037F

- Video Analytics, Market Value (USD Million), and CAGR, 2024-2037F

- Video Deliver & Distribution, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoding & Processing, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- Services

- By Type

- Managed Services

- Professional Services

- Integration & Deployment

- Training and Support Services

- Consulting

43.1.2 By Video Streaming Type

- On-Demand, Market Value (USD Million), and CAGR, 2024-2037F

- Live, Market Value (USD Million), and CAGR, 2024-2037F

43.1.3 End use

- Broadcast, Operator and Media, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Gaming & Entertainment, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Government, Market Value (USD Million), and CAGR, 2024-2037F

43.1.4 By Country

- Brazil, Market Value (USD Million) and CAGR, 2024-2037F

- Argentina, Market Value (USD Million) and CAGR, 2024-2037F

- Mexico, Market Value (USD Million) and CAGR, 2024-2037F

- Rest of Latin America, Market Value (USD Million) and CAGR, 2024-2037F

43.1.5 Cross Analysis of Hardware W.R.T. Application (USD Million), 2024-2037

44) Middle East & Africa Video Streaming Infrastructure Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Predictions and Trend Analysis for Humanoid Robots

- Regional Competitors and Market Positioning

- Middle East & Africa Video Streaming Infrastructure Market Segmentation Analysis (2024-2037)

- By Type

- By Hardware

- Switches, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoders, Market Value (USD Million), and CAGR, 2024-2037F

- Amplifiers, Market Value (USD Million), and CAGR, 2024-2037F

- Servers, Market Value (USD Million), and CAGR, 2024-2037F

- Set-top Box, Market Value (USD Million), and CAGR, 2024-2037F

- Codec Unit, Market Value (USD Million), and CAGR, 2024-2037F

- By Software

- Video Management, Market Value (USD Million), and CAGR, 2024-2037F

- Video Security, Market Value (USD Million), and CAGR, 2024-2037F

- Video Analytics, Market Value (USD Million), and CAGR, 2024-2037F

- Video Deliver & Distribution, Market Value (USD Million), and CAGR, 2024-2037F

- Transcoding & Processing, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- Services

- By Type

- Managed Services

- Professional Services

- Integration & Deployment

- Training and Support Services

- Consulting

44.1.2 By Video Streaming Type

- On-Demand, Market Value (USD Million), and CAGR, 2024-2037F

- Live, Market Value (USD Million), and CAGR, 2024-2037F

44.1.3 End use

- Broadcast, Operator and Media, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Gaming & Entertainment, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Government, Market Value (USD Million), and CAGR, 2024-2037F

44.1.4 By Country

- GCC, Market Value (USD Million) and CAGR, 2024-2037F

- Israel, Market Value (USD Million) and CAGR, 2024-2037F

- South Africa, Market Value (USD Million) and CAGR, 2024-2037F

- Rest of Middle East & Africa, Market Value (USD Million) and CAGR, 2024-2037F

44.1.5 Cross Analysis of Hardware W.R.T. Application (USD Million), 2024-2037

45 Global Economic Scenario

46 About Research Nester

Video Streaming Infrastructure Market Outlook:

Video Streaming Infrastructure Market size was over USD 47.2 billion in 2025 and is anticipated to cross USD 114.85 billion by 2035, growing at more than 9.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of video streaming infrastructure is assessed at USD 51.15 billion.

The growing popularity of various over-the-top (OTT) platforms globally is one of the key factors expected to drive the video streaming infrastructure market during the forecast period. There has been a drastic shift from traditional TV to streaming services with the rise of OTT platforms such as Netflix, Amazon Prime, Zee5, Disney+, and YouTube amidst the COVID-19 pandemic. According to a recent survey by Research Nester, the number of OTT users is expected to reach 4.9 billion globally by 2029. Thus, the growing demand for high-quality, on-demand content is increasing the need for robust infrastructure to deliver seamless video experiences.

Adopting several cloud services has made it easier for streaming platforms to scale their infrastructure. Cloud providers such as Amazon Web Services (AWS), IBM Cloud Video, Google Cloud, and Microsoft Azure offer advanced, scalable, and flexible solutions for OTT platforms to operate seamlessly in traffic and ensure global content delivery. For instance, features such as auto-scaling in AWS or Azure automatically adjust computing resources in response to user demand. Moreover, these providers have data centers worldwide that help OTT platforms host region-specific content. This is expected to fuel global video streaming infrastructure market growth going ahead.

Key Video Streaming Infrastructure Market Insights Summary:

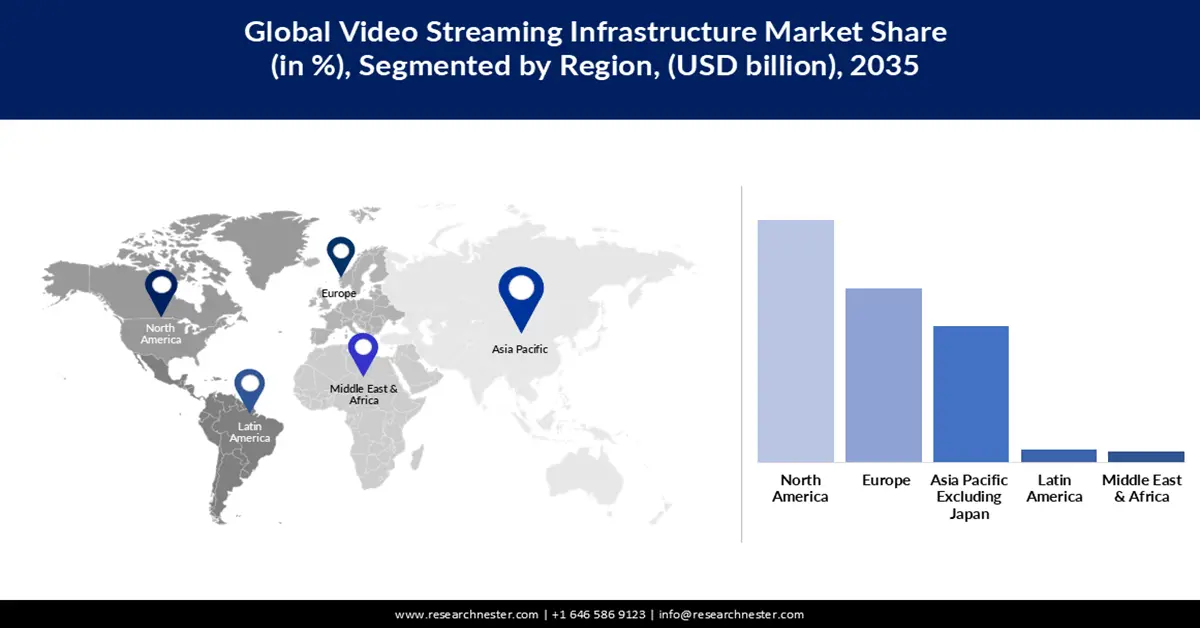

Regional Highlights:

- By 2035, North America in the video streaming infrastructure market is projected to command the largest revenue share, underpinned by rapid advancements in video streaming technology.

- Asia Pacific is anticipated to post a rapid revenue CAGR by 2035, supported by rising integration of AI and blockchain technologies.

Segment Insights:

- The on-demand segment in the video streaming infrastructure market is forecast to achieve a robust revenue CAGR through 2026–2035, propelled by rising adoption of AI and other advanced technologies to improve the video streaming infrastructure.

- The gaming and entertainment segment is set to capture the largest revenue share by 2035, fueled by the rising popularity of multiplayer online games and esports tournaments.

Key Growth Trends:

- Increasing integration of 5G network

- Rising demand for advertising video on demand (AVOD) platforms

Major Challenges:

- Rising concerns about data privacy and security

- High cost required for infrastructure development

Key Players: Amazon Web Series, Inc., Microsoft Corporation, Alphabet Inc., Akamai Technologies, Inc., Edgio, Inc., Cloudflare, Inc., Fastly, Inc., CDNetworks, Inc., Zyao Group, LLC and Lumen Technologies, Inc.

Global Video Streaming Infrastructure Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 47.2 billion

- 2026 Market Size: USD 51.15 billion

- Projected Market Size: USD 114.85 billion by 2035

- Growth Forecasts: 9.3%

Key Regional Dynamics:

- Largest Region: North America (Largest Revenue Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, South Korea, Brazil, Indonesia, United Arab Emirates

Last updated on : 19 November, 2025

Video Streaming Infrastructure Market - Growth Drivers and Challenges

Growth Drivers

- Increasing integration of 5G network: The recent rollout of 5G networks is significantly enhancing the capabilities of video streaming services. One of the most impressive features of 5G is that it supports simultaneous users without compromising the overall streaming experience. It also helps in reducing buffering and latency issues. The high bandwidth and higher speeds compared to its prior versions allow users to stream HD, 4K, and 8K content, driving the need for upgraded infrastructure. One of the recent developments is the launch of DragonFly V 5G by Vislink in December 2024. DragonFly V 5G is a bonded cellular miniature transmitter with combined 5G connectivity and HD video streaming capabilities.

- Rising demand for advertising video on demand (AVOD) platforms: Rising popularity of AVOD platforms such as YouTube, MX player, Roku Channel, and Peacock has resulted in a growing need for robust, secure, and scalable infrastructure capable of handling complex customer management, data analytics, and content delivery. To deliver seamless experiences along with ad-support content, AVOD platforms mostly rely on specialized infrastructure components such as Ad insertion technologies, Content Delivery Networks (CDNs), and data analytics.

Challenges

- Rising concerns about data privacy and security: Video streaming platforms use sensitive consumer data such as payment information, viewing habits, and personal preferences. Thus, rising incidences of data privacy and security thefts raise questions among viewers and consumers, leading to lower adoption of video streaming platforms. Ensuring the security of data while complying with regulations like GDPR is extremely crucial. However, this may add to the overall expenses, hampering video streaming infrastructure market growth to a certain extent.

- High cost required for infrastructure development: the development and maintenance of necessary video streaming infrastructure, including network servers, storage systems, and cloud services can be costly. This can be a major roadblock for small players and startups due to budget constraints, limiting the growth of the video streaming infrastructure market during the forecast period.

Video Streaming Infrastructure Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 47.2 billion |

|

Forecast Year Market Size (2035) |

USD 114.85 billion |

|

Regional Scope |

|

Video Streaming Infrastructure Market Segmentation:

Video Streaming Type Segment Analysis

The on-demand segment in video streaming infrastructure market is expected to register a robust revenue CAGR during the forecast period owing to growing popularity of OTT platforms, availability of high-quality content on platforms such as Netflix, Amazon Prime, and Disney+, rising penetration of high-speed internet, and rising adoption of AI and other advanced technologies to improve the video streaming infrastructure. These on-demand platforms have significantly expanded amidst the COVID-19 pandemic. The on-demand video streaming providers are focused on expanding the regional content across borders, supported by subtitles and dubbing. This is expected to support segment growth during the forecast period.

End user Segment Analysis

Among the end users, the gaming and entertainment segment in video streaming infrastructure market is expected to account for the largest revenue share during the forecast period. This growth can be significantly driven by rising popularity of multiplayer online games and esports tournaments, increasing adoption of AR/VR technologies in gaming and entertainment, and the need for scalable and resilient streaming infrastructure for seamless gameplay. In addition, entertainment social media platforms such as TikTok, YouTube, and Instagram require robust infrastructure for real-time seamless streaming. Thus, to cater to this demand, several industry giants are upgrading their services and products.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Video Streaming Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Video Streaming Infrastructure Market - Regional Analysis

North America Market Insights

The video streaming infrastructure market in North America is expected to account for the largest revenue share during the forecast period owing to rapid advancements in video streaming technology, increasing popularity of video-on-demand (VoD), and livestreaming services and platforms such as Netflix, Amazon Prime, and Disney+.

In the U.S., the number of digital media users has drastically increased due to the growing popularity of various video streaming platforms and services. According to a recent study, VoD revenue reached nearly USD 70 billion in 2023 and is expected to increase even more during the forecast period. Other factors such as high penetration of over-the-top (OTT) platforms and growing investments in developing robust and scalable infrastructure to support expanding user bases are expected to boost market growth in the country.

The Canada video streaming infrastructure market is likely to expand at a steady pace during the forecast period owing to high penetration of subscription-based OTT platforms across, the presence of high-quality broadband and fiber optic networks, and rising investments in developing advanced solutions.

Asia Pacific Market Insights

Asia Pacific video streaming infrastructure market is expected to register a rapid revenue CAGR throughout the forecast period due to rising integration of AI and blockchain technologies in enhancing the video quality and overall user experience, high penetration of smartphones, and rapid shift towards OTT platforms across the region.

India is one of the leading markets for video streaming infrastructure and solutions owing to the presence of a large consumer base, rapid adoption of various OTT platforms post-COVID-19 pandemic, and increasing investments and partnerships from industry giants. According to the latest survey by Research Nester, the number of video streaming users in India is rapidly increasing and is likely to reach 115 million by 2029. In addition, rising demand for content in vernacular languages and robust investments by streaming platforms in original and localized content are projected to drive India market going ahead.

The video streaming infrastructure market in China is rapidly expanding, driven by cultural shift towards digitalization, growing preference for mobile-based streaming and advancements in 5G technology. Local streaming platforms like Tencent Video or YouKu are widely used by consumers for their Chinese language content and exclusive productions. Moreover, rising livestreaming across various sectors such as entertainment, education, and e-commerce and high usage of mobiles for video streaming are expected to fuel video streaming infrastructure market growth in China.

Video Streaming Infrastructure Market Players:

- Amazon Web Series, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Alphabet Inc.

- Akamai Technologies, Inc.

- Edgio, Inc.

- Cloudflare, Inc.

- Fastly, Inc.

- CDNetworks, Inc.

- Zyao Group, LLC

- Lumen Technologies, Inc.

The competitive landscape of the global video streaming infrastructure involves key players providing platforms, software, and hardware to enable efficient delivery of video content globally. The market is driven by increasing demand for high-quality video streaming, lower latency, and scalability. These key players are focused on adopting several strategies such as mergers and acquisitions, product launches, joint ventures, and license agreements to enhance their product base and sustain their market position. Here is a list of key players operating in the global video streaming infrastructure market:

Recent Developments

In the News

- In May 2024, VdoCipher announced the launch of advanced live-streaming services that can integrate seamlessly into existing video hosting solutions for businesses, educators, and content creators.

- In April 2024, Accedo, Brightcove, and JUMP announced their collaboration with AI Sharqiya Group in order to enhance its 1001 OTT streaming service with the launch of Iraq’s first Subscription Video On-Demand (SVOD) platforms, along with other live linear channels.

- In July 2023, Kalutra’s Cloud TV and Streaming Platform announced its plans to enhance its services for its TV operators and media customers to enhance user experience and boost revenue with personalized add-ons.

- Report ID: 2784

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.