Video Production Cameras Market Outlook:

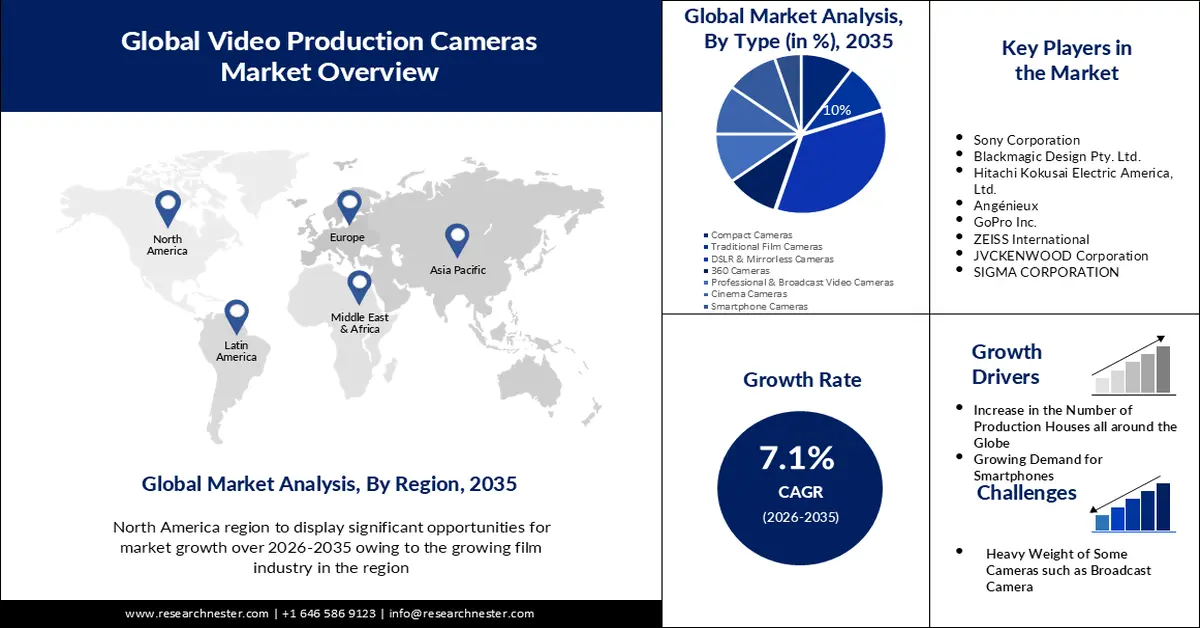

Video Production Cameras Market size was over USD 63.75 billion in 2025 and is projected to reach USD 126.58 billion by 2035, growing at around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of video production cameras is evaluated at USD 67.82 billion.

The reason behind the growth is due to the growing entertainment industry across the globe driven by growing discretionary incomes, technological advancements, a boom in the purchasing of consumer durables, and the widespread availability of inexpensive high-speed internet. For instance, in 2022, the total global revenue from entertainment and media (E&M) increased by more than 5% to reach around USD 2 trillion.

The growing technological advancements in video production are believed to fuel the market growth. For instance, AI-generated video production streamlines automates, and produces content quickly, with less human involvement aids in cutting down on the time and expense of producing videos. It allows to complete production of videos more quickly and effectively and may optimize several aspects of the video to produce a more visually appealing and interesting final output, to raise the quality of the finished product.

Key Video Production Cameras Market Insights Summary:

Regional Highlights:

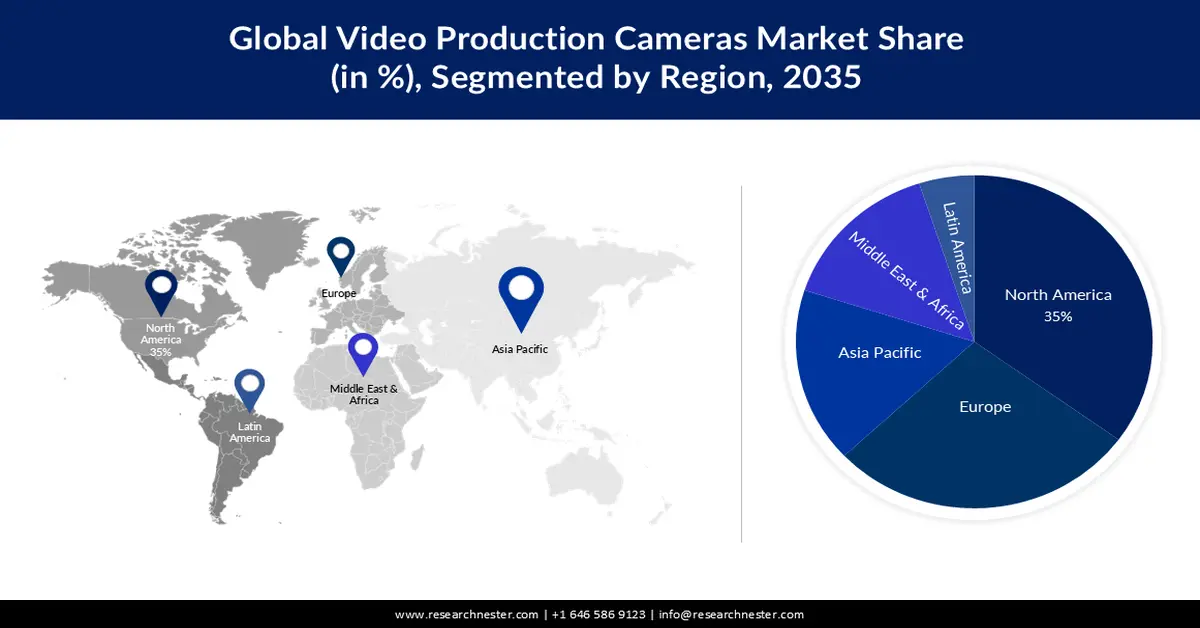

- North America is poised to command a 35% share by 2035 in the video production cameras market, underpinned by the region’s strong film industry and expanding creative economy.

- Europe is anticipated to hold the second-largest share by 2035, bolstered by accelerating urbanization that is elevating content creation activity.

Segment Insights:

- The DSLR & mirrorless cameras segment is projected to secure a 35% share by 2035 in the video production cameras market, propelled by rising sports event coverage and growing preference for high-performance imaging tools.

- The studio & broadcasting segment is expected to capture a notable share by 2035, supported by expanding production activities across television, film, and multimedia environments.

Key Growth Trends:

- Increase in the Number of Production Houses all around the Globe

- Growing Demand for Smartphones

Major Challenges:

- Heavy Weight of Some Cameras such as Broadcast Camera

- High Cost of Video Production Camera

Key Players: Sony Corporation, Blackmagic Design Pty. Ltd., Hitachi Kokusai Electric America, Ltd., Angénieux, GoPro Inc., ZEISS International, JVCKENWOOD Corporation, SIGMA CORPORATION, IMPERX.

Global Video Production Cameras Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 63.75 billion

- 2026 Market Size: USD 67.82 billion

- Projected Market Size: USD 126.58 billion by 2035

- Growth Forecasts: 7.1%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, United Kingdom, Germany

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 24 November, 2025

Video Production Cameras Market - Growth Drivers and Challenges

Growth Drivers

- Increase in the Number of Production Houses all around the Globe - Constant demand of people for better quality films and TV content is encouraging entertainment industries to adopt advanced cameras. For instance, the Canon C700 FF, Sony broadcast cameras, the Panasonic AU-EVA1, and other RED cameras have all been added to Netflix's list of authorized cameras. Additionally, Netflix continued to use the conventional (and perplexing) RED camera names, which have subsequently been replaced by the DSMC2 BRAIN with specific sensors.

- Growing Demand for Smartphones - Nowadays, featured smartphones consist of advanced cameras that enable users to shoot quality videos and upload them on social media.

According to estimates, the number of global smartphone users is expected to reach approximately 6 billion in 2022, representing an about 4% annual rise.

- Rapid Penetration of Social Media- Video streaming is now a key component in keeping viewers interested and promoting brands therefore, more and more individuals are extensively exploring the realm of expert social media video creation and learning the techniques for making powerful films.

- According to the most recent statistics, approximately 4 billion people are estimated to be using social media globally in 2022, a rise of about 7% from the previous year.

Challenges

- Heavy Weight of Some Cameras such as Broadcast Camera - When creating content including TV shows, broadcast television cameras are equipped with large broadcast television lenses which are the cause of their weight therefore, these cameras are heavy, which makes them challenging to operate.

- High Cost of Video Production Camera- Few cameras are utilized to record 4K footage in addition to other formats may cost tens of thousands of dollars as the price tends to increase in direct proportion to the desired level of quality for the video, and also owing to the usage of cutting-edge technology and premium materials that went into its construction. Moreover, DSLR cameras are generally expensive since their sensors and processors are made of pricey materials the creation of which involves a substantial amount of technological research and development.

- Continuous New Production

Video Production Cameras Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 63.75 billion |

|

Forecast Year Market Size (2035) |

USD 126.58 billion |

|

Regional Scope |

|

Video Production Cameras Market Segmentation:

Type Segment Analysis

The DSLR & mirrorless cameras segment in the video production cameras market is estimated to gain a robust revenue share of 35% in the coming years owing to the increase in several events and the majority of people watching sports on television. On broadcast TV, sports programming is the most watched genre since the majority of sports enthusiasts prefer to watch live events and matches on streaming services as big-screen TV offers a more immersive viewing experience and is also far more convenient with superior audio-visual quality. Moreover, continuous autofocus and a quick burst rate are necessary when taking sports shots which necessitates the use of a DSLR for taking sports videos and is considered the best camera for professional-style filming and photojournalism owing to its qualities including incredible autofocus system, high-speed shooting capabilities, and exceptional low-light performance.

Additionally, compared to DSLRs, mirrorless cameras can offer significantly greater coverage across the frame since they acquire focus directly from the sensor, and have also started to use intelligent algorithms, which enables getting the player's eyes in focus which is often the aim when photographing sports, thus this can be quite useful.

According to a survey conducted in 2023, it was found that more than 12% of American adults watched live sports on television practically every day.

End-user Segment Anlysis

The studio & broadcasting segment in the video production cameras market is set to garner a notable share shortly. The planning and production of television shows, radio programs, movies, plays, and other media is the area of expertise for broadcasting, studio, and theater services, which can include instructional videos, product demos, music performances, and training DVDs. This has led to a higher demand for studio cameras as they enable complex camera movements on an articulated arm with a large reach.

The highest-quality video cameras are called studio cameras that offer the best image quality and are top-notch, expert video cameras made for use in film and television production, events, news and sports broadcasts, music videos, and more. They are specifically designed to fulfill the demands of high-quality video production.

Our in-depth analysis of the global video production cameras market includes the following segments:

|

Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Video Production Cameras Market - Regional Analysis

North American Market Insights

North America industry is likely to account for largest revenue share of 35% by 2035. For instance, in 2022, the U.S. film business had a valuation of more than USD 94 billion which encouraged a thriving creative economy in the region. The American film business, sometimes known as Hollywood, is thought to be the oldest in the world and is known to produce almost all of the movies that are shown in theaters and earn over 75% of the money from those that are shown overseas.

European Market Insights

The Europe video production cameras market is estimated to be the second largest, during the forecast timeframe led by rapid urbanization. For instance, by 2050, Europe's urbanization rate is projected to reach over 82%. As a result, there will be a significant rise in content creation which will contribute to the market growth in the region.

Video Production Cameras Market Players:

- Blackmagic Design Pty. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hitachi Kokusai Electric America, Ltd.

- Angénieux

- GoPro Inc.

- ZEISS International

- JVCKENWOOD Corporation

- SIGMA CORPORATION

- IMPERX

Recent Developments

- Nikon India Private Ltd., an entirely owned subsidiary of Nikon Corporation Tokyo, introduces the latest Nikon Z 9, a revolutionary full-frame (Nikon FX-format) Z series mirrorless camera built to outperform expectations with unrivaled performance and innovative capabilities that are firsts in the mirrorless category and for Nikon.

- Hitachi Kokusai Electric America, Ltd. introduced the Z-HD6500 HD camera to provide customers with exceptional HD visual quality and superior cost/performance value with a smooth triax-to-fiber conversion, to cut expenses and reduce broadcasters' system complexity.

- Report ID: 4353

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Video Production Cameras Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.