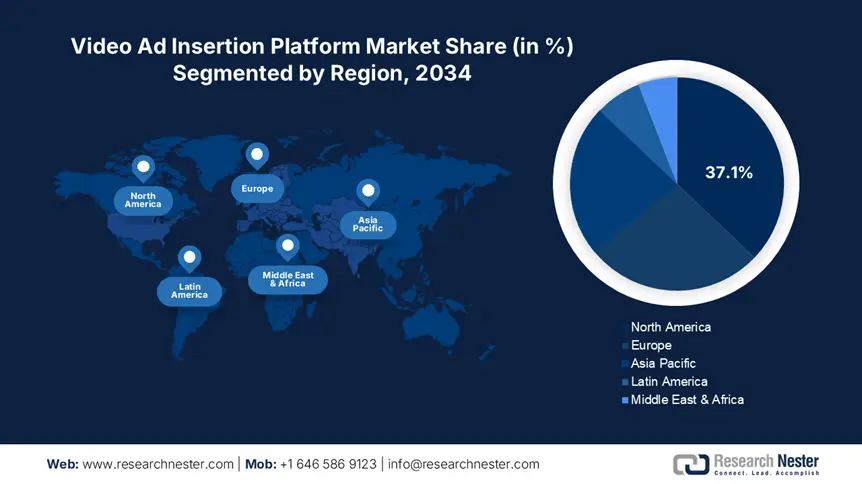

Video Ad Insertion Platform Market - Regional Analysis

North America Market Insights

The North America video ad insertion platform market is anticipated to hold 37.1% of the global revenue share by 2034. The mature digital advertising ecosystem and rapid connected TV (CTV) penetration are propelling the sales of video ad insertion platforms. The strong federal investment in broadband and cloud infrastructure is also contributing to the increasing demand for video ad insertion platforms.

In the U.S., the sales of video ad insertion platforms are driven by the presence of advanced broadband infrastructure and extensive federal investment in digital expansion. The growing shift towards connected TV is also expected to have a positive influence on the market growth. The FCC’s Affordable Connectivity Program and NTIA’s BEAD initiative are opening new delivery channels for video advertising. In 2023, more than 2.1 million U.S. households gained access to video platforms through federal broadband programs.

Europe Market Insights

The Europe rm market is projected to capture 26.5% of global revenue share throughout the study period. The regulatory alignment on digital ad standards and increasing reliance on programmatic advertising are propelling the sales of video ad insertion platforms. The robust digital shift is also accelerating the adoption of compliant ad tech solutions. The countries in the region are investing in AI-powered contextual targeting and server-side ad insertion (SSAI) as consumer behavior shifts to mobile and OTT platforms. Germany, France, and the Nordics are some of the key marketplaces for video ad insertion platform producers.

Germany is commanding the highest revenue share in the Europe market, owing to several structural and policy factors. Digital infrastructure investments exceeded €21.1 billion in 2023, contributing to the high production of video ad insertion solutions. Bitkom and the BMDV reveal that nearly 7.2% of the country’s ICT budget was spent on adtech solutions, especially video ad optimization, real-time targeting, and CTV integration. The rise in public-private investment partnerships is poised to double the revenues of key players in the years ahead.

Country-Specific Insights

|

Country |

2023 Budget Allocation to Video Ad Insertion |

2020 Allocation |

Current Market Demand (Est. €) |

|

United Kingdom |

6.6% of the digital infrastructure budget |

5.0% |

€1.2 billion |

|

Germany |

7.2% of the national ICT budget |

5.7% |

€1.3 billion |

|

France |

6.7% of ICT expenditure |

4.9% |

€940.5 million |

APAC Market Insights

The Asia Pacific market is foreseen to increase at a CAGR of 16.5% between 2025 and 2034, owing to mass digitization and rising OTT consumption. The extensive government investments in cloud, AI, and broadband infrastructure are also contributing to the increasing adoption of video ad insertion platforms. China, Japan, India, and South Korea are the most profitable marketplaces for video ad insertion platform producers. These countries are witnessing a surge in programmatic advertising and mobile video consumption.

The China market is driven by the massive ICT infrastructure and the fast-growing base of OTT viewers. The spending on video ad insertion platforms crossed USD 6.5 billion in 2023. Also, more than 5.3 million enterprises integrated video ad insertion platforms during the same year. The shift towards cloud infrastructure in both public and private sectors is expected to drive the overall market growth. The digital economy initiatives are also set to propel the sales of video ad insertion platforms in the coming years.

Country-Specific Insights

|

Country |

Gov. Budget to Video Ad Platforms (2024) |

Adoption (Businesses) |

|

Japan |

$2.9B (4.0% of ICT budget) |

1.5M+ platforms integrated |

|

India |

$1.7B (2023); +66% since 2015 |

4.8M businesses |

|

Malaysia |

$511M (2023); +90% since 2013 |

1.2M businesses |

|

South Korea |

$2.0B (2023) |

62.5% of digital campaigns |