Veterinary Pharmacovigilance Market Outlook:

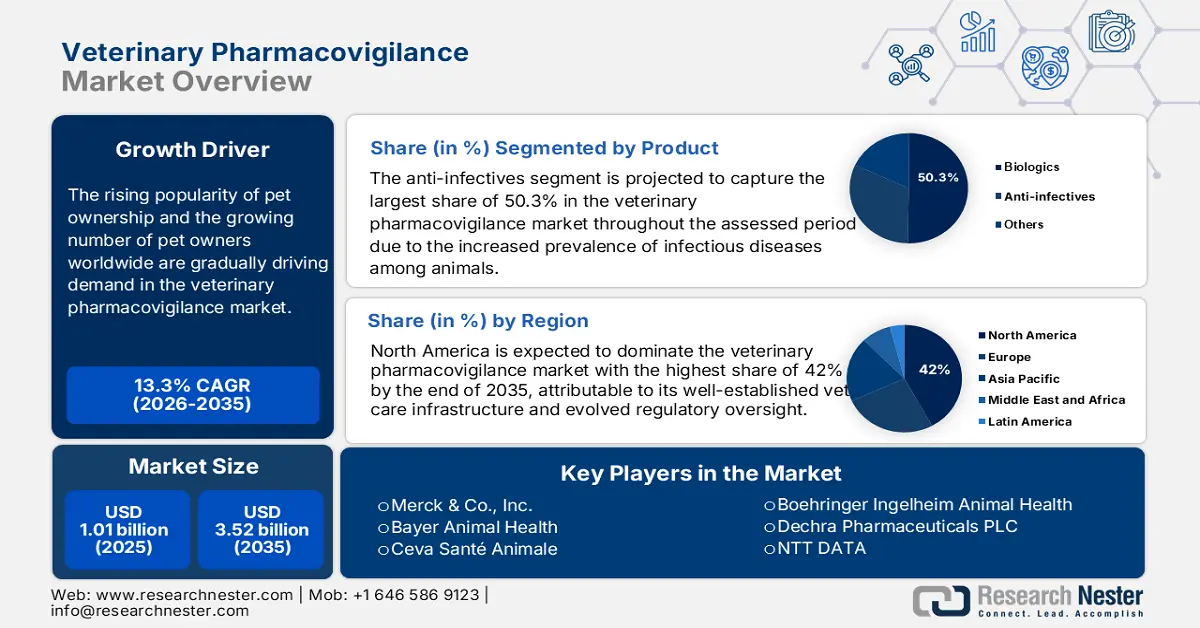

Veterinary Pharmacovigilance Market size was over USD 1.01 billion in 2025 and is projected to reach USD 3.52 billion by 2035, witnessing around 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of veterinary pharmacovigilance is evaluated at USD 1.13 billion.

The rising popularity of pet ownership and the growing number of pet owners worldwide are gradually driving demand in the veterinary pharmacovigilance market. According to a report from the Global Animal Health Association, published in September 2022, over 50.0% of the global population owned an animal companion at home. The report further predicted the number of families from the U.S., Brazil, Europe, and China to have more than 500.0 million dogs and cats. As more people become aware of maintaining animal health, the need for drug safety assurance rises. In addition, the recent widespread of zoonotic diseases has drawn the attention of regulatory frameworks in verifying the functionality and probable side effects of these medicines. Thus, the requirement for vigilant monitoring services is inflating.

With the growing expenditure on animal products and services, the rise in enrollments in the veterinary pharmacovigilance market is becoming more evident. However, the significant hike in payer’s pricing from the last decade, particularly in high-income countries is pushing the pharma community to establish a fair standard of value-based strategic retailing practices. This helped them improve accessibility and profit margins at the same time. According to a study on associated economics, conducted from 2022 to 2023/2024, a 2-24% increment in median prices of cat and dog gonadectomy (GDY) was noticed over a year in European countries. It also highlighted a 64.0% and 27.0% growth for the same aspect in equine GDY (per sedation and local analgaesia) and pyometra surgery respectively in Sweden.

Median payer’s pricing of GDY in European countries (till October 2023)

|

Animal Type |

Gender |

Country |

Payer’s Pricing (USD) |

|

Dog |

Male |

Sweden |

404.3 |

|

Dog |

Male |

Denmark |

620.9 |

|

Dog |

Female |

The UK |

477.9 |

|

Dog |

Female |

Denmark |

1052.2 |

|

Cat |

Male |

Sweden |

74.6 |

|

Cat |

Male |

Denmark |

238.4 |

|

Cat |

Female |

Sweden |

134.7 |

|

Cat |

Female |

Denmark |

374.2 |

Key Veterinary Pharmacovigilance Market Insights Summary:

Regional Highlights:

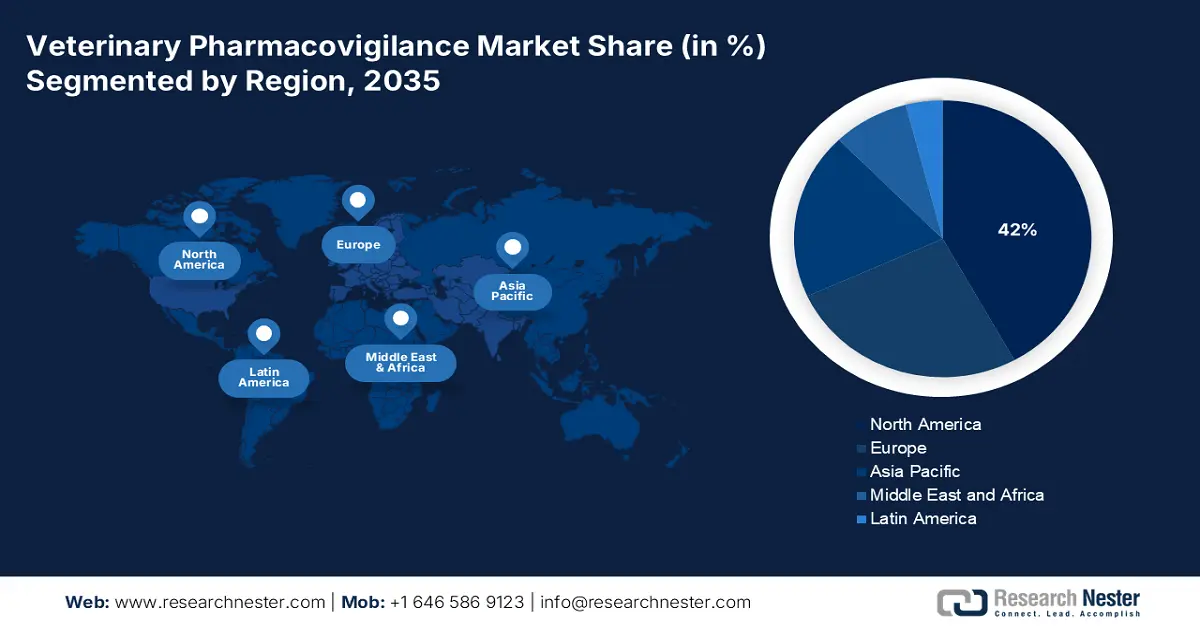

- North America leads the Veterinary Pharmacovigilance Market with a 42% share, driven by well-established vet care infrastructure and stringent regulatory oversight, ensuring robust growth by 2035.

- Asia Pacific’s veterinary pharmacovigilance market is forecasted to see rapid growth by 2035, driven by increased spending on animal healthcare and an enlarging bioeconomy in developing countries.

Segment Insights:

- The anti-infectives segment is projected to command a 50.3% share by 2035 in the veterinary pharmacovigilance market, driven by the growing prevalence of infectious diseases among animals.

- The Dogs segment of the Veterinary Pharmacovigilance Market is expected to expand through 2035, fueled by high adoption rates and frequent veterinary visits for dogs.

Key Growth Trends:

- Improved efficacy of veterinary biologics

- Rising need for assistance in acquiring compliance

Major Challenges:

- The presence of in-house equipped laboratories

- Shortage of adequate resources and skilled professionals

Key Players: Ceva Santé Animale, Boehringer Ingelheim Animal Health, Merck & Co., Inc., Zoetis Inc., Dechra Pharmaceuticals PLC.

Global Veterinary Pharmacovigilance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.01 billion

- 2026 Market Size: USD 1.13 billion

- Projected Market Size: USD 3.52 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Veterinary Pharmacovigilance Market Growth Drivers and Challenges:

Growth Drivers

-

Improved efficacy of veterinary biologics: Innovations in medicine pipelines are one of the major growth drivers in the veterinary pharmacovigilance market. The trend of incorporating biologics through advancing in formulations, vaccines, and other treatment modalities is gaining traction through rigorous R&D activities. It revolutionized the product range of pet healthcare by delivering specificity and accuracy, encouraging owners to invest more and securing great revenues. For instance, in June 2024, Merck Animal Health commercially launched a first-of-its-kind line of vaccines, NOBIVAC NXT Rabies portfolio in Canada. The NOBIVAC NXT Feline-3 Rabies and NOBIVAC NXT Canine-3 Rabies are designed to prevent rabies in cats and dogs.

-

Rising need for assistance in acquiring compliance: The penetration of clinical research into the animal drugs segment is a prominent contributor to the veterinary pharmacovigilance market. The continuously evolving regulations have mandated certain standard practices for veterinary therapeutics, which need expertise to attain compliance. For instance, in March 2023, the specialized divisions of the U.S. EPA and FDA collaboratively modernized the approach toward new animal-regulated commodities. In addition, the trend of globalization in pharma leaders' capturing a larger consumer base outside their local territory requires reliable support to complete various formalities of different regional regulations, magnifying demand.

Challenges

-

The presence of in-house equipped laboratories: Most of the global medicine pioneers have in-built laboratory facilities to evaluate the safety and efficacy of their offerings before launching. This shrinks the consumer base of the veterinary pharmacovigilance market. In addition, adverse reactions in animals are less frequent than in humans, which dilutes the interest or motive of investing in additional services or tools. Moreover, drug developers often build region-specific workshops, which eliminates the need for these specialized systems.

-

Shortage of adequate resources and skilled professionals: Many research centers, particularly in rural or budget-constrained areas, lack sufficient infrastructure, resources, and expertise which may impact the quality of offerings from the veterinary pharmacovigilance market. Engaging in proper vigilance activities requires efficient monitoring and accurate detection. But in resource-limited regions, it is hard to maintain proficiency due to the absence of trained professionals and lab partners, restricting the optimum expansion of this sector.

Veterinary Pharmacovigilance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 1.01 billion |

|

Forecast Year Market Size (2035) |

USD 3.52 billion |

|

Regional Scope |

|

Veterinary Pharmacovigilance Market Segmentation:

Product (Biologics, Anti-infectives)

Anti-infectives segment is expected to account for veterinary pharmacovigilance market share of around 50.3% by 2035. The increased prevalence of infectious diseases among animals is propelling the urge for this type of therapeutics, which needs to be monitored while being developed. The crucial role of pharmacovigilance in identifying possible risks of antibiotic resistance and adverse reactions in residents makes it a necessary element in mitigating these issues. Thus, the expansion of such antimicrobial therapies in this field is a direct indication of this segment’s progress.

Animal Type (Dogs, Cats)

In terms of animal type, the dogs segment is anticipated to dominate the veterinary pharmacovigilance market during the forecast period, 2026-2035. The faithful behavior and close emotional attachment with humans have made this kind of pets the mostly adopted ones. According to a report from the Global Animal Health Association, published in September 2022, the total population of dog pets in major marketplaces including Europe, China, and the U.S. was predicted to be 251.0 million, higher than the cat residents. The report also stated that dogs are present in every 1 in 3 homes globally. This implies greater spending on dogs in comparison to cats. Moreover, a higher rate of registered appointments to vet clinics and hospitals for this species is the pivotal driver behind the inflation in this segment.

Our in-depth analysis of the global veterinary pharmacovigilance market includes the following segments:

|

Product |

|

|

Solution |

|

|

Type |

|

|

Animal Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Veterinary Pharmacovigilance Market Regional Analysis:

North America Market Analysis

North America veterinary pharmacovigilance market is expected to capture revenue share of over 42% by 2035. The region is driven by several growth factors which accumulatively contribute to a larger revenue portion. The well-established vet care infrastructure and evolved regulatory oversight of this trading zone are a few of the primary drivers of this sector. The enforced regulations, mandating real-time reporting and post-production surveillance, made North America a lucrative business prefecture, attracting global leaders to participate. For instance, in August 2024, The Ministry of Agriculture and Rural Development in Mexico launched a new veterinary pharmacovigilance system to fill the gap in efficacy and side effects in pet medicines.

The growing population of pet owners is fueling the U.S. veterinary pharmacovigilance market. The Global Animal Health Association database revealed that over 70.0% of the total households in this country owned pets in 2021. The number of dogs and cats further reached 85.0 million and 65.0 million respectively in 2022. Thus, the requirement for monitoring services and systems to track the safety of associated anti-infectives and other therapeutic agents is exceptionally high in this country. In addition, the promotional activities from different academic organizations are notably contributing to its extension. For instance, in January 2022, Kansas State University Olathe launched its animal health professional development series, promoting pharmacovigilance.

Canada is augmenting the veterinary pharmacovigilance market with a focus on accelerating R&D in these medications. The country’s government is playing a crucial role in spreading awareness about early detection of emerging resistance patterns and associated risks with overuse. Their efforts to train and educate professionals to overcome the shortage of skilled operators are also bringing innovation in this category. For instance, in April 2024, the Government of Saskatchewan allocated USD 13.2 million to the Western College of Veterinary Medicine (WCVM) in 2024-25 to enact state-of-the-art education. The fund also intended to offer subsidies to 25 training vacancies for Saskatchewan students, covering rural or mixed practices.

APAC Market Statistics

The Asia Pacific veterinary pharmacovigilance market is poised to witness the fastest growth over the forecast timeline. The increased spending on animal healthcare and the enlarging bioeconomy of developing countries such as China and India are presenting opportunities for securing a good profit margin. In addition, the advances in the biologics industry, particularly vaccines for both humans and their companions, are attracting more pharma pioneers to be involved in this genre. For instance, Vetnation Pharma announced its plans to launch its new subsidiary, oriented around veterinary healthcare and the associated range of commodities including medicines, in 2024. The new venture is set to offer vaccines, antibiotics, nutritional supplements, parasiticides, and other therapies.

India is propagating the veterinary pharmacovigilance market with its emphasis on the pharmaceutical and animal healthcare industry. For instance, a report was released by the consortium of the Department of Drug Regulatory Affairs and Management, Manipal College of Pharmaceutical Sciences, and Manipal Academy of Higher Education in June 2023 on this topic. The statistics mentioned in this research paper revealed that the veterinary healthcare merchandise of India achieved USD 1.1 billion in 2023, which is anticipated to be valued at USD 1.8 billion in the upcoming years. This is a clear indication of the rising need for pharmacovigilance (PV) to safeguard recipients from adverse events of medications.

China is one of the biggest potential stakeholders in the veterinary pharmacovigilance market due to the heightening volume of pet habitats. A report estimated the population of dogs and cats in this country to be 74.0 million and 67.0 million respectively in 2022. In addition, the government’s influence on prioritizing animal health is also contributing to the growth of this field. Being an in-house revenue generator of the pharma industry, this marketplace has become a lucrative option for both domestic and foreign forces. PV works as the perfect solution for these participants to attain compliance from strict regulatory bodies such as the Ministry of Agriculture and Rural Affairs (MARA) in China, rising need in this category.

Key Veterinary Pharmacovigilance Market Players:

- Zoetis Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co., Inc. (Merck Animal Health)

- Boehringer Ingelheim Animal Health

- Elanco Animal Health

- Virbac

- Bayer Animal Health

- Ceva Santé Animale

- Vetoquinol

- IDEXX Laboratories, Inc.

- Covetrus

- Norbrook Laboratories

- Dechra Pharmaceuticals PLC

- Merial (now part of Boehringer Ingelheim)

- Huvepharma

- Biovet JSC

- Invetx Inc.

- Ethos Discovery

Amalgamating each other’s expertise and resources is the current trend in the veterinary pharmacovigilance market. Key players in this field are deliberately forming strategic partnerships and research collaborations to expand their portfolio. For instance, in October 2023, MWI Animal Health unveiled the integration of the practice information management software from Shepherd into its AllyDVM client engagement platform. This move was aimed at possessing the robust client communications, retention, and analytics tools for day-to-day operations in animal health-related developments. In addition, they are utilizing the impact of humanization on the economy, which brings a favorable amount of investment as a financial cushion, supporting further progress. Such key players are:

Recent Developments

- In January 2025, Ethos Discovery partnered with Chou2 Pharma to start a joint study on a newly developed animal drug formulation, treating idiopathic epilepsy in dogs. The collaboration was intended to evaluate the efficacy and safety of the drug by testing its pharmacokinetics.

- In July 2024, Dechra Pharmaceuticals acquired Invetx in a transaction of USD 520.0 million on a cash-free and debt-free basis. The acquisition aimed at strengthening the pipeline of monoclonal antibody therapeutics for Invetx, empowering and expanding the company’s animal health portfolio.

- Report ID: 7172

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Veterinary Pharmacovigilance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.