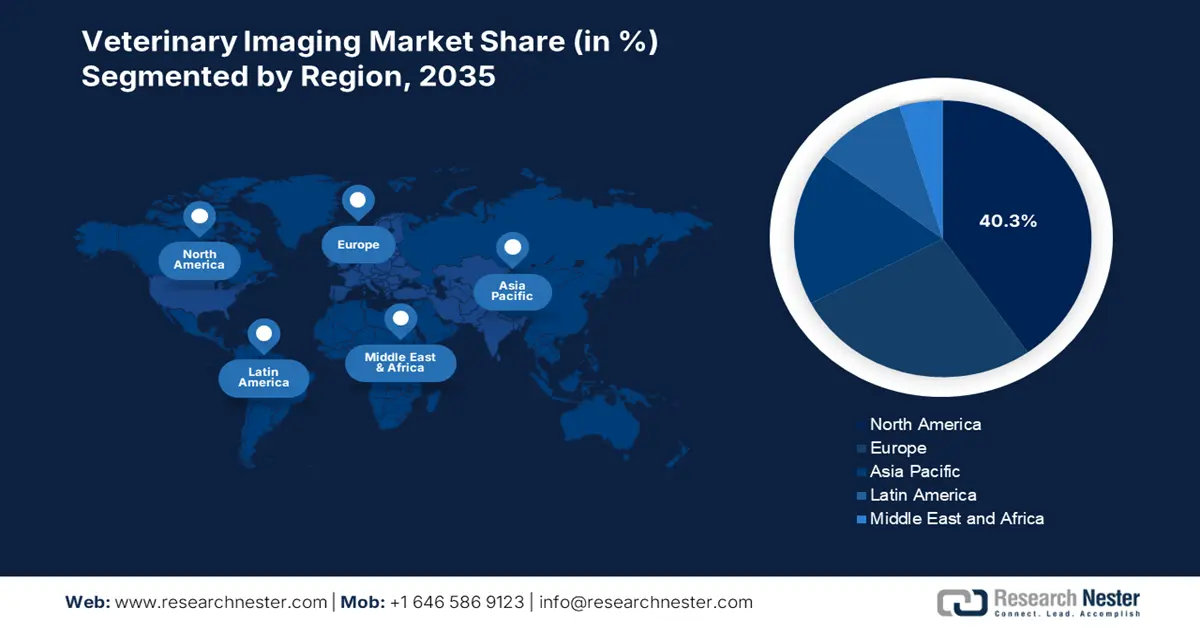

Veterinary Imaging Market - Regional Analysis

North America Market Insights

North America is predicted to hold the largest share of 40.3% in the global veterinary imaging market by the end of 2035. The region’s dominance in this sector is primarily attributed to the advanced animal health infrastructure, massive consumption of livestock, and government-backed financial support. In this regard, in May 2024, the U.S. Department of Agriculture’s (USDA) Animal and Plant Health Inspection Service (APHIS) allocated $22.2 million to enhance prevention, preparedness, early detection, and rapid response to the most damaging diseases, threatening the liability and capacity of livestock. Such an influx of capital, coupled with the ongoing technological innovations, is consolidating the region’s strong presence in this sector.

According to the 2025 APPA National Pet Owners Survey, approximately 94 million U.S. households own a pet. Additionally, the sale value of vet care and products in the country accounted for $41.4 billion in the same year. This establishes the nation as both the epicenter of consumer base and revenue generation for the regional landscape. On the other hand, a 2023 OEC database revealed that the net export and import of animal produts in the U.S. were valued at $35.3 billion and $41.9 billion, respectively. These figures testifies to the growing significance of the country in this field.

Canada is a considerable landscape in the North America veterinary imaging market on account of its robust livestock industry and growing demand for animal health diagnostics. As of January 2023, the country consisted of an inventory filled with 11.3 million head of cattle, 13.9 million hogs, 809 million chickens & turkeys, and 854,400 sheep & lambs across more than 76.7 thousand farms. Besides, in 2022, Canada recorded $35 billion in retail sales of meat, poultry, and dairy products, as per the Canadian Agri-Food Policy Institute. This portrays the nation's strong emphasis on this sector, which is gained through an enlarging consumer base.

APAC Market Insights

Asia Pacific is anticipated to become the fastest-growing region in the global veterinary imaging market during the analyzed tenure. The region’s propagation in this sector is fastening under the influence of its globally leading production capacity and government initiatives to implement optimum measures for early disease prevention. These dynamics are portrayed through the enlarging dairy industry in emerging economies, such as India, Malaysia, and China. Such a business environment is further influencing domestic pioneers to invest more in innovations, which can be exemplified by the launch of MyVet CT Plus by WOORIEN in October 2024. The advanced veterinary imaging solution lowered CT barriers and improved diagnostic quality with the use of spiral-Linear Technology.

The China veterinary imaging market is expanding rapidly alongside rising pet ownership, livestock health awareness, and government support for modern animal health services. The presence of a massive demography can be displayed through the population of dogs and cats as pets in the country, which collectively accounted for 141 million in 2022, as per the Global Animal Health Association. Furthermore, the emergence of advanced imaging modalities, such as digital X-ray and video endoscopy, is also fueling the country’s augmentation in this sector.

India is one of the emerging landscapes in the APAC veterinary imaging market, which is primarily supported by the rising impact of animal-transmitted diseases on human health. As evidence, till 2022, more than 20 thousand cases of rabies transmission to humans from dogs were registered from across the country, making it the most affected country in this category, according to a report from the Global Animal Health Association. As a result, both public and private healthcare authorities are actively promoting the use of early detection and prevention to combat the widespread.

Country-wise Favorable Provinces and Statistics

|

Country |

Segment |

Key Point |

Year of Impact |

|

Australia |

Animal health practices in the livestock industry |

National Action Plan for Production Animal Health |

2022 to 2027 |

|

South Korea |

Regulatory and bio-science testing |

Scientific use of animals reached around 5 million |

2012-2022 |

|

Indonesia |

Livestock biomass

|

The value of livestock crossed USD 54 billion |

2021 |

Source: Australian Government, MAFRA, and ScienceDirect

Europe Market Insights

Europe is expected to maintain its position as the second-largest shareholder in the global veterinary imaging market between 2026 and 2035. The region’s persistent performance in this sector is attributable to the enlarging pet population and livestock demand base. Testifying to the same, in 2022 alone, Europe consists of 92 million and 113 million of dog and cat pets, as recorded by the Global Animal Health Association. In this landscape, the dominance of small clinics is evidently portrayed through 67% of veterinarians practicing in these institutions till 2022. Besides, strong veterinary education standards and regional cooperation in animal health regulation are also supporting growth in this sector.

Germany, as the leading regional economy, represents a predominant share in the Europe veterinary imaging market. The country’s position is consolidated by a strong demand for X-ray diagnosis, which is further complemented by the accelerated adoption of video endoscopy. The country’s leadership can also be testified by the import and export values of animal products in 2023, which accounted for $25.5 billion and $25.7 billion, respectively, as per the OEC report. This signifies the large volume of livestock production and consumption in Germany, benefiting the wide expansion of the merchandise.

According to the OEC, the Netherlands ranked 1st among the global exporters of live animals in 2023, totaling $183 million. As a result, both the governing bodies and small clinics of the country heavily invest in the veterinary imaging market to cultivate high-throughput diagnostic capabilities locally. Besides, the presence of an established ecosystem for sample preparation and reagent utilization during ultrasound assessments creates new opportunities for the suppliers and innovators operating in this field.

Country-wise Population of Pets (2022)

|

Country |

Dogs (Million) |

Cats (Million) |

|

Spain |

6.7 |

3.7 |

|

France |

7.6 |

14.2 |

|

Russia |

17.1 |

22.7 |

Source: Global Animal Health Association