Veterinary Anesthesia Equipment Market Outlook:

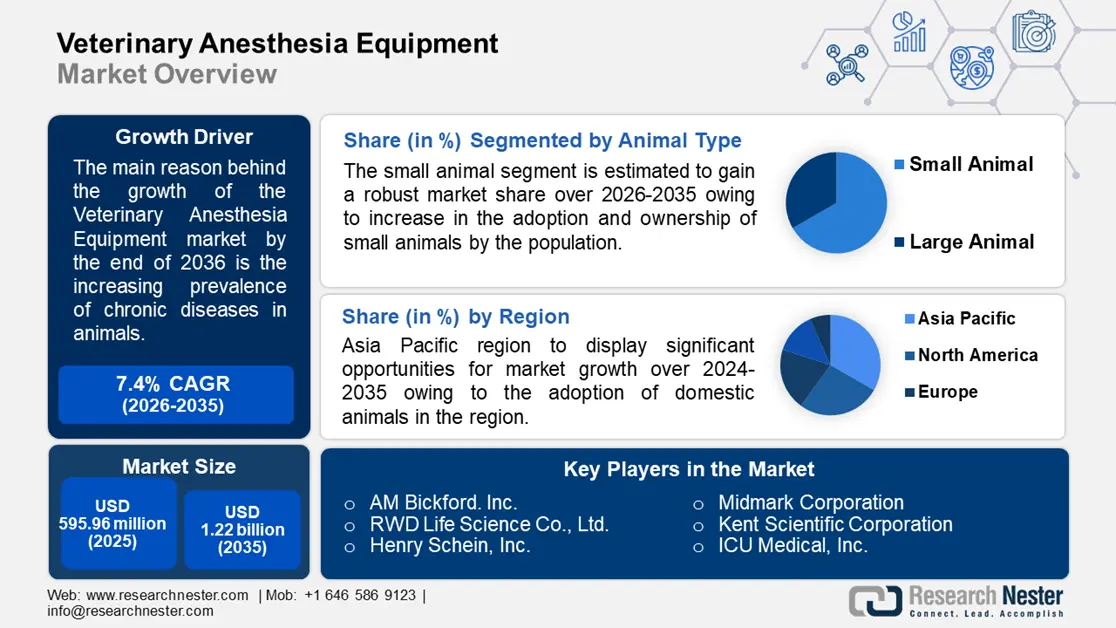

Veterinary Anesthesia Equipment Market size was over USD 595.96 million in 2025 and is projected to reach USD 1.22 billion by 2035, witnessing around 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of veterinary anesthesia equipment is evaluated at USD 635.65 million.

The growth of the market can be attributed to the increasing prevalence of chronic diseases in animals. The rising animal diseases are expected to increase the adoption rate of veterinary anesthesia equipment for treating them comfortably. Veterinary anesthesia equipment is helpful in treating incidences of veterinary chronic diseases such as hepatitis, skin allergies, chronic diseases, and diabetes mellitus. Canine atopic dermatitis, or atopy is defined as a skin hypersensitivity condition in animals caused by allergies to environmental substances known as allergens. As per a recent report from 2020, it is stated that at least 10% of the global dog population is affected by this skin allergy condition.

Veterinary anesthesia equipment is very useful in numerous veterinary procedures such as dental operations, imaging, urinary cauterization, surgical actions, and others. Moreover, the adoption rate of veterinary anesthesia equipment is expected to increase in the forecast period, considering that it is important for diagnosing and treating veterinary chronic diseases such as emphysema in the horses, leukemia in cats and cattle, muscular dystrophies in chickens and mice, atherosclerosis in pigs and pigeons, blood-coagulation disorders, and nephritis in dogs. Another factor that is anticipated to create a positive outlook for market growth is the rising trend of adopting pets in households. Companion animals are considered to bring positive health benefits. They have proven to reduce cardiac arrhythmias and anxiety, and also normalize blood pressure. Hence, the boost in the adoption rate of animals is expected to fuel the growth of the market owing to an increase in veterinary visits, rising awareness about pets’ health, and growth in expenditure on animal healthcare systems. Every year, almost 4.1 million animals in shelters are adopted out of which 2 million are dogs and 2.1 million are cats.

Key Veterinary Anesthesia Equipment Market Insights Summary:

Regional Highlights:

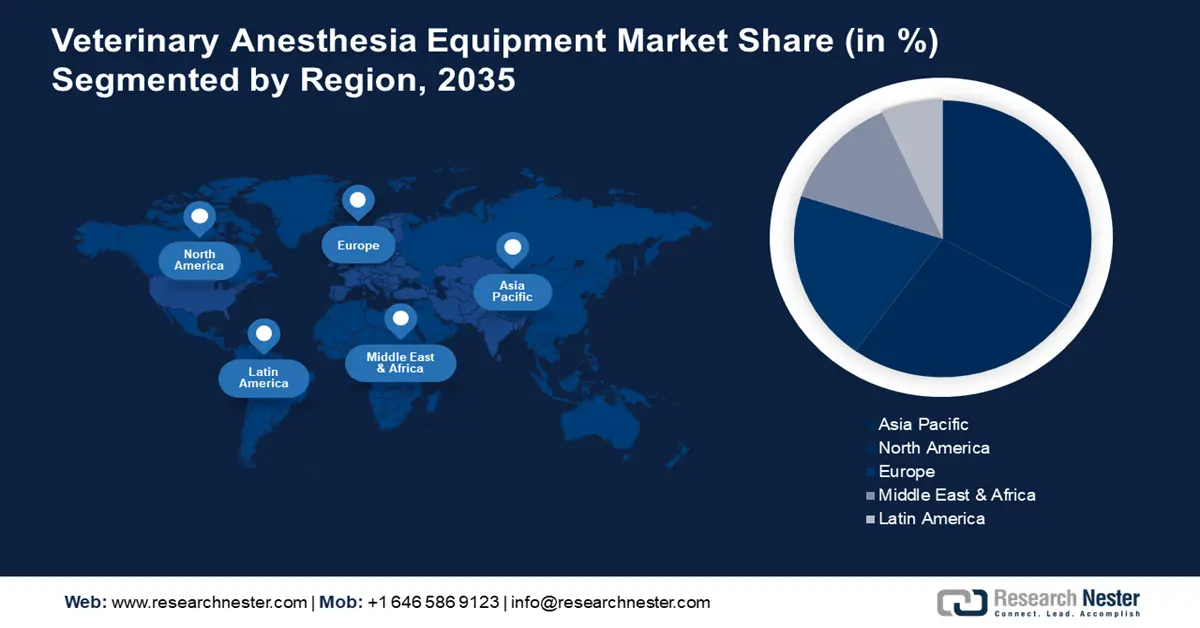

- Asia Pacific veterinary anesthesia equipment market, the largest share by 2035, is driven by the rising adoption of domestic animals, increased awareness of animal care, and the improvement of healthcare infrastructure in Asian economies.

Segment Insights:

- The veterinary hospitals segment in the veterinary anesthesia equipment market is forecasted to hold the highest market share by 2035, fueled by the high adoption of veterinary anesthesia equipment in hospitals with advanced infrastructure.

- The small animal segment in the veterinary anesthesia equipment market will command the highest market share, propelled by the rising adoption of small animals and their susceptibility to diseases, forecast year 2035.

Key Growth Trends:

- Growing Pet Population

- Growing Cases of Accidental Injuries in Animals

Major Challenges:

- Growing Pet Population

- Growing Cases of Accidental Injuries in Animals

Key Players: Midmark Corporation, Kent Scientific Corporation, ICU Medical, Inc., Hallowell EMC, Soar Medical-Tech. Co., Ltd., Miden Medical, AM Bickford. Inc., RWD Life Science Co., Ltd., Henry Schein, Inc.

Global Veterinary Anesthesia Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 595.96 million

- 2026 Market Size: USD 635.65 million

- Projected Market Size: USD 1.22 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Veterinary Anesthesia Equipment Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Pet Population - As the pet population has increased, the demand for quality veterinary services is also increasing. People have become more concerned about their pet’s health. Hence, owing to this, the utilization rate of veterinary anesthesia equipment is expected to grow considerably in the forecast period. In 2018, the population of pet dogs in India was estimated to be around 18 million. By the end of 2023, it was anticipated that the population will exceed 30 million.

-

Growing Cases of Accidental Injuries in Animals – Approximately 11,900 stray animals, including dogs, cats, cattle, and goats, suffered injuries in traffic incidents in India from 2011–12 to July 2019.

-

Rapid Urbanization & Increase in Disposable Income - In the last ten years, China's urbanization rate has increased significantly, from 32.93% in 2007 to 60.6% in 2019 and 65.5% in 2025, respectively.

-

Growing Expenditure on Pet Health Insurance - The adoption rate of pet health insurance in the United States is 2.3% for dogs and 0.4% for cats, according to the North American Pet Health Insurance Association (NAPHIA).

-

Surge in Number of Veterinary Established - In India, there were close to 10,000 veterinary facilities and polyclinics during the fiscal year 2021.

Challenges

-

High Cost of Veterinary Products - Veterinary products usually carry huge prices hence making it difficult for people to afford them. Also, their distribution in rural is less owing to a low level of awareness about its advantages. Hence, owing to these factors the growth of the global veterinary anesthesia equipment market is expected to hinder.

-

Lack of Awareness

-

Low Adoption Rate of Veterinary Infrastructure in Rural Part

Veterinary Anesthesia Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 595.96 million |

|

Forecast Year Market Size (2035) |

USD 1.22 billion |

|

Regional Scope |

|

Veterinary Anesthesia Equipment Market Segmentation:

Animal Type

The global veterinary anesthesia equipment market is segmented and analyzed for demand and supply by animal type into small animals, and large animals. Out of these, the small animal segment is anticipated to garner the highest revenue by the end of 2035, backed by the increase in the adoption of small animals by the population. Recent studies and statistics stated that there are many health benefits for a human such as reduced blood pressure, enhanced psychosocial stability, and lower anxiety attacks owing to a pet in a household. Moreover, the smaller animals are prone to both acute and chronic diseases owing to weaker metabolism and delicate immune system. As a result, more veterinary anesthesia equipment is being used to treat small animals. In the United States, approximately 70 million dogs and about 84 million cats are reportedly adopted. In addition, the increased awareness and concerns related to animal health, along with the high expenditure for diagnosing and treating diseases in pets is projected to generate favorable opportunities for market growth in the upcoming years.

End-user

The global veterinary anesthesia equipment market is also segmented and analyzed for demand and supply by end-user in veterinary hospitals and veterinary clinics. Out of these two segments, the veterinary hospitals’ segment is attributed to garner the highest share by the end of the assessment period owing to the high rate of adoption of veterinary anesthesia equipment in veterinary hospitals. In veterinary hospitals, several medical procedures are being carried out daily, such as examinations, diagnosis, prophylaxis, surgeries, and treatment, which require veterinary anesthesia equipment to carry out these facilities. Moreover, the settings found in veterinary hospitals have advanced infrastructure with technologically advanced equipment that is maintained on a regular basis, and high-quality facilities to carry out surgeries are expected to raise the demand for veterinary anesthesia equipment in veterinary hospitals.

Our in-depth analysis of the global market includes the following segments:

|

By Animal Type |

|

|

By Product |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Veterinary Anesthesia Equipment Market Regional Analysis:

APAC Market Insights

The Asia Pacific industry is likely to hold largest revenue share by 2035, as rise in the adoption of domestic animals in the region will increase the usage of veterinary anesthesia equipment for treatment and other medical processes. Around 61 million urban Chinese people kept cats or dogs as pets in 2020, up from about 60 million the year before. Further, an increase in awareness regarding animal care, along with the rising focus on pet care and the development of better treatment facilities, is also expected to boost the growth of the market in this region. In addition to the other growth factors, the recent improvement in the healthcare infrastructure in Asian economies for animals is also considered to drive market growth in the region. Moreover, the rising government policies to protect the animals and provide carem along with the high investment made in the research and development sector to introduce new veterinary anesthesia equipment for better treatment options are also forecasted to adopt veterinary anesthesia equipment in the next few years.

Veterinary Anesthesia Equipment Market Players:

-

JD Medical

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Midmark Corporation

- Kent Scientific Corporation

- ICU Medical, Inc.

- Hallowell EMC

- Soar Medical-Tech. Co., Ltd.

- Miden Medical

- AM Bickford. Inc.

- RWD Life Science Co., Ltd.

- Henry Schein, Inc.

Recent Developments

-

Veterinary practitioners now have access to in-clinic anesthetic simulation training owing to Midmark Corporation, a top provider of animal health solutions with an emphasis on clinical environment design to enhance care delivery.

-

JD Medical has latest technology known as VT-110-X in order to deliver anesthesia for the veterinary professional.

- Report ID: 4530

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.