Vertical Lift Module Market Outlook:

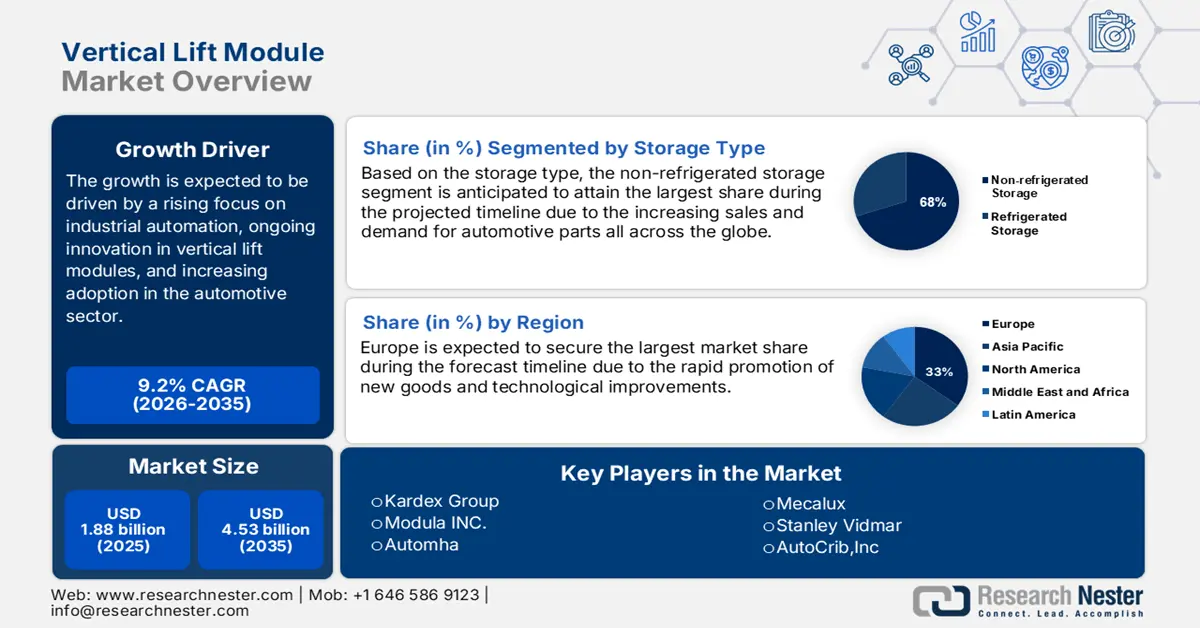

Vertical Lift Module Market size was valued at USD 1.88 billion in 2025 and is set to exceed USD 4.53 billion by 2035, expanding at over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vertical lift module is estimated at USD 2.04 billion.

The growth of VLMs will be fueled by the expansion of the retail industry. Warehouse services, which mainly rely on vertical lift modules, are growing along with retail. Ahold Delhaize USA and Americold will construct two fully automated frozen warehouses, it was announced in May 2020. The goal of the initiative is to boost cold-storage capacity by 24 million cubic feet, or 500,000 square feet, by constructing the two frozen facilities in collaboration with Americold. By 2020, e-commerce's percentage of retail sales is expected to jump from 16% to 19%, according to UNCTAD.

The strict government rules for improving workplace safety are also a significant component driving the market. Workers must wear safety fall protection, regardless of the fall distance, according to the Occupational Safety and Health Act's amended criteria. Because of this, worker safety—which deals with preventing any accidents or incidents—becomes crucial, which increases the use of vertical lift modules (VLM). According to ILO estimates, about 2.3 million men and women worldwide die from work-related illnesses or accidents each year, or more than 6000 people per day. Each year, there are over 160 million cases of work-related disease and 340 million occupational accidents worldwide.

Key Vertical Lift Module Market Insights Summary:

Regional Highlights:

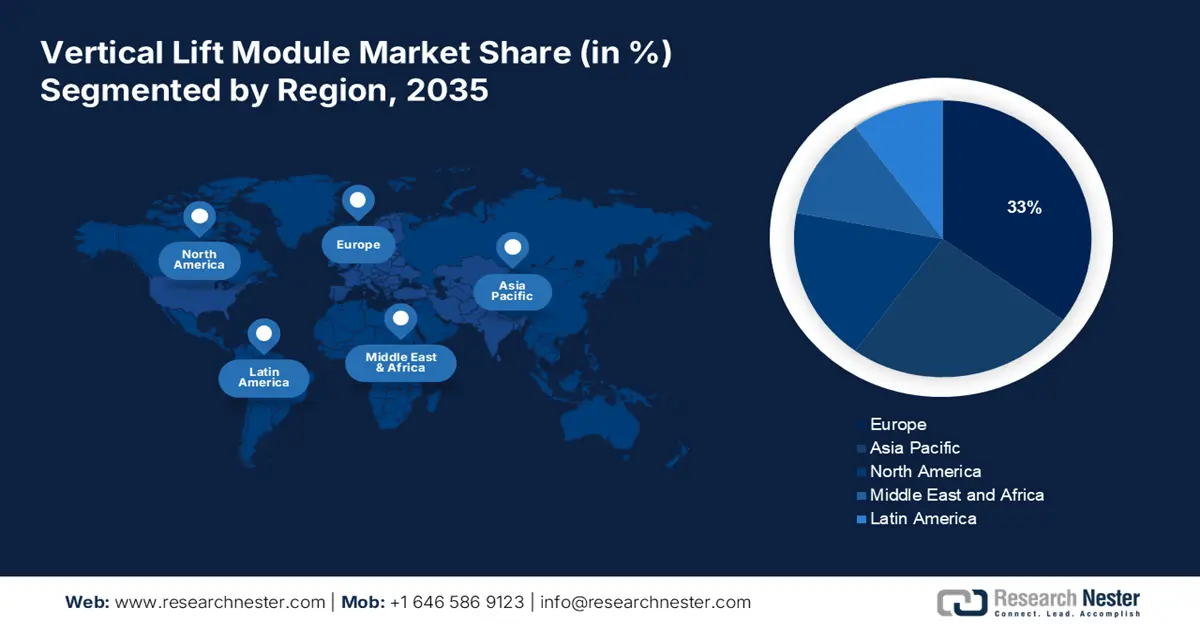

- The Europe vertical lift module market will hold over 33% share by 2035, fueled by new product promotion, technological improvements, and warehouse space optimization.

- The Asia Pacific market will secure 25% share by 2035, fueled by the booming semiconductor and electronics industries and demand for automated material handling systems.

Segment Insights:

- The non-refrigerated storage segment in the vertical lift module market is forecasted to capture a 68% share by 2035, driven by the need for storage without temperature control, especially in logistics.

- The single-level delivery segment in the vertical lift module market is anticipated to capture a 58% share by 2035, fueled by automotive sector growth and the need for faster, compact storage systems.

Key Growth Trends:

- Increasing Focus on Industrial Automation

- Continuous Innovation in Vertical Lift Modules

Major Challenges:

- Expensive Vertical Lift

- Lack of Qualified Personnel

Key Players: Modula INC., Automha, Mecalux, Stanley Vidmar, AutoCrib, Inc, Hanel, The Slate River Systems Inc. (SRSI), Ferretto Group S.p.a., Scahefer Systems International, Plc.

Global Vertical Lift Module Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.88 billion

- 2026 Market Size: USD 2.04 billion

- Projected Market Size: USD 4.53 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Vertical Lift Module Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Focus on Industrial Automation- During the predicted period, the growth of industry 4.0 has greatly accelerated the trend towards industrial automation. The sales of vertical lift modules have dramatically increased as a result worldwide. The market is expected to grow quickly over the next several years as a result of the benefits provided by vertical storage systems. The manufacturing sector will be most affected by automation, which has the potential to automate about 64% of all manufacturing processes worldwide. By automating 64% of manufacturing operations, the globe could save 749 billion working hours.

- Continuous Innovation in Vertical Lift Modules- Strict security and control procedures are typical in the automotive sector. To prevent theft and preserve privacy, some of the parts and tools need to be stored properly and securely, and priceless assets need to be guarded and kept in a secure location. A total of 38,90,114 passenger vehicles were sold overall, up from 30,69,523. In comparison to the prior year, sales of passenger cars climbed from 14,67,039 to 17,47,376, utility vehicles from 14,89,219 to 20,03,718 and Vans from 1,13,265 to 1,39,020 units in FY-2022–23 in India.

- Vertical Lift Modules Are Being Adopted Quickly in The Automotive Sector- Strict security and control procedures are typical in the automotive sector. To prevent theft and preserve privacy, some of the parts and tools need to be stored appropriately and securely, and significant assets need to be guarded and kept in a secure location. In 2022, the US auto sector is anticipated to sell 13.75 million cars and light trucks. In 2022, there were 290.8 million registered automobiles in the country.

Challenges

- Expensive Vertical Lift- Pricing patterns suggest that the high cost of vertical lift modules is limiting industry growth. Costs for vertical lift modules are very high, which drives up overall business costs. The acquisition of brand-new vertical lift modules would demand a very high starting cost.

- Lack of Qualified Personnel

- The Availability of Second-Hand or Used Vertical Elevators.

Vertical Lift Module Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 1.88 billion |

|

Forecast Year Market Size (2035) |

USD 4.53 billion |

|

Regional Scope |

|

Vertical Lift Module Market Segmentation:

Delivery Type Segment Analysis

The single-level delivery segment is expected to hold 58% of the vertical lift module market share owing to the increasing sales of automobiles and increasing demand for automotive parts, followed by the growing demand for quicker storage, and maximum storage space. As a result of the growing demand for single-level delivery systems, the vertical lift module market will expand the fastest. In 2021, 9.2 million US automobiles were made. In 2021, the US produced 9.2 million automobiles, up 4.5% from the previous year. Manufacturing of motor cars and their components employs 923,000 Americans, while auto dealers employ 1,251,600.

Storage Type Segment Analysis

Vertical lift module (VLM) market from the non-refrigerated storage segment is expected to hold 68% revenue share. The best option for the industrial industries is non-refrigerated vertical lift module storage. The effective handling and storage of goods without the need for a temperature-controlled environment is necessary for non-refrigerated vertical lift module storage. With the biggest concentration in Asia and the largest market share for third-party logistics, there were 681,000 warehouses worldwide in 2020.

Our in-depth analysis of the global market includes the following segments:

|

Delivery Type |

|

|

Storage Type |

|

|

Maximum Load Capacity |

|

|

Configuration |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vertical Lift Module Market Regional Analysis:

European Market Insights

Europe held the greatest portion of the vertical lift module market with a revenue share of around 33%. The promotion of new goods, technological improvements, and warehouse space optimization are the drivers that are fueling Europe's need for vertical lift modules. Europe is a market with enormous potential, and major industrial sectors like automotive and aviation have seen a surge in the number of vertical lift module installations in the region.

APAC Market Market Insights

The Asia Pacific is estimated to hold 25% share of the global vertical lift module (VLM) market. The growth of the vertical lift module storage market in the APAC region is being fuelled by important factors such as the booming semiconductor and electronics industries, the rising need for warehousing management solutions, and automated material handling systems. For instance, as of March 31, 2022, Japan had about 138.33 thousand battery electric passenger automobiles, up from over 125.86 thousand the year before.

Vertical Lift Module Market Players:

- Kardex Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Modula INC.

- Automha

- Mecalux

- Stanley Vidmar

- AutoCrib, Inc

- Hanel

- The Slate River Systems Inc. (SRSI)

- Ferretto Group S.p.a.

- Scahefer Systems International, Plc

Recent Developments

- Koenig & Bauer ordered SSI LOGIMAT Vertical Lift Modules from SSI SCHAEFER. Koenig & Bauer (AT) GmbH takes a step further towards automation with SSI SCHAEFER and modernizes the Maria Enzersdorf location. The printing press manufacturer commissioned SSI SCHAEFER to supply and install a semi-automated solution with 13 SSI LOGIMAT Vertical Lift Modules for small parts vertical and efficient item picking.

- SRSI (Slate River Systems, Inc.) announces their partnership with ICAM Intelligent Space Solutions. Known for their unique vertical lift module (VLM) systems, SRSI looks to use ICAM’s product for their integration solutions.

- Report ID: 5252

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vertical Lift Module Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.