Vendor Risk Management Market Outlook:

Vendor Risk Management Market size was over USD 10.18 billion in 2025 and is poised to exceed USD 40.47 billion by 2035, growing at over 14.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vendor risk management is estimated at USD 11.54 billion.

The expansion of this sector can be ascribed to the escalating number of third-party vendors in numerous enterprises, as they have found that their systems and processes relating to the VRM are not adequate from purely a business perspective. Therefore, it may lead to significant damage owing to an improper vendor risk management framework.

Furthermore, factors behind the growth of vendor risk management market for vendor risk management market consist of a surge in government initiatives and enforcement by agencies such as the Comptroller of the Currency (OCC), the Health Insurance Portability and Accountability Act (HIPAA), the Consumer Financial Protection Bureau (CFPB) to set up better vendor risk management framework.

Key Vendor Risk Management Market Insights Summary:

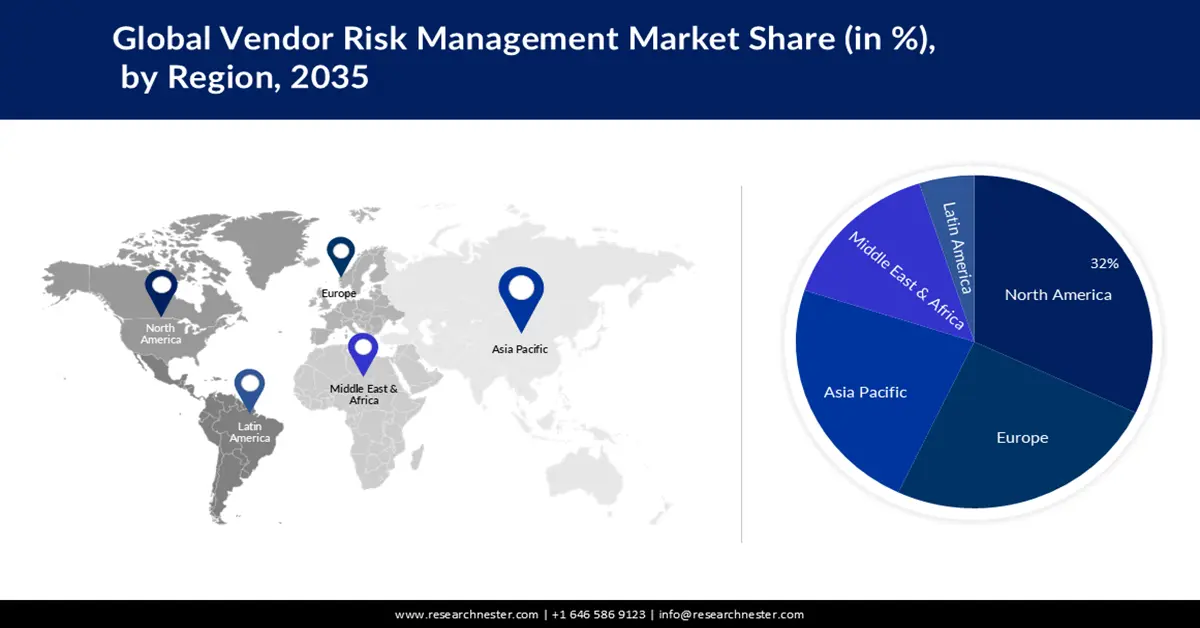

Regional Highlights:

- The North America vendor risk management market is projected to capture a 32% share by 2035, driven by increasing security breaches and need for supplier performance monitoring.

Segment Insights:

- The cloud segment in the vendor risk management market is projected to secure a 64% share by 2035, driven by the flexibility, scalability, and cost-effectiveness of cloud-based VRM solutions.

- The bfsi segment in the vendor risk management market is expected to experience significant growth over the forecast period 2026-2035, fueled by increased connectivity and cybersecurity needs in the BFSI sector.

Key Growth Trends:

- Leading Demand for VRM Solutions by SMBs

- Increased investment in vendor risk management solutions

Major Challenges:

- Wide Dependence of Organization on Manual Processes

- Lack of Outsourcing of VRM Solutions in Highly Strict Industries

Key Players: BitSight Technologies, Inc., Genpact, SAI Global, IBM Corporation, Rapid Ratings International Inc., ProcessUnity, Inc., LogicManager, Inc., Aravo Solutions, Inc., ACL Services Ltd.

Global Vendor Risk Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.18 billion

- 2026 Market Size: USD 11.54 billion

- Projected Market Size: USD 40.47 billion by 2035

- Growth Forecasts: 14.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, Japan, China

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Vendor Risk Management Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Efficient Management of Vendor Ecosystem — vendor risk management tools are useful when a company relies on several different suppliers because they help pinpoint the major problems present while buying goods and services. from outside snooker. A vendor risk management system makes it easier for the enterprise to evaluate risks and helps in improving productivity and reducing costs. In 2020, over 40% of businesses had cutting down their budget as their major agenda across the globe.

- Increasing Need to Streamline Vendor Risk Assessment Processing — To determine your business and its level of risk and exposure, one must understand the tools, methods, and procedures that a vendor employs, this is done through a special sort of vendor review called a vendor risk assessment. With supply chains becoming more complex, these third-party risks are expanding, hence the need to optimize and monitor vendor risk assessment processing, Globally, a high-impact third-party risk incident was reported by 17% of firms, up from 11% in the 2020 study.

- Leading Demand for VRM Solutions by SMBs – According to the latest annual data breach report, data breaches cost USD 3 million in India. SMBs are focusing on managing data security vendor risk by expanding the number of vendors and companies. This boom is projected to continue during the forecast period.

- Increased investment in vendor risk management solutions – According to data, 90% of investment institutions in the US, Canada, and the UK are considering investing in vendor risk management and security to free up internal staff and improve productivity.

Challenges

- Wide Dependence of Organization on Manual Processes – Many organizations still rely on manual processes to evaluate any risks associated with vendors and dependencies. The reluctance in accepting vendor risk management solution software is one of the major factors estimated to hamper the market expansion in the upcoming times.

- Lack of Outsourcing of VRM Solutions in Highly Strict Industries

- Unaware of the Significance of Vendor Risk

Vendor Risk Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.8% |

|

Base Year Market Size (2025) |

USD 10.18 billion |

|

Forecast Year Market Size (2035) |

USD 40.47 billion |

|

Regional Scope |

|

Vendor Risk Management Market Segmentation:

Deployment Mode Segment Analysis

The cloud segment in deployment mode segmentation is expected to capture the largest revenue share 64% in the vendor risk management market during the estimated period. Flexible, inexpensive, scalable, cloud-based VRM solution availability has helped the field flourish more. The outsourcing of information technology to the cloud has proliferated in both the private and public cloud, increasing the importance of VRM. Some companies outsource most of their work processes. This means businesses can no longer control the process and must rely on contractors to do the job right.

The effectiveness of cooperation decreased with IT sustainability through upgrades, quality control related to system management and maintenance are also important benefits of cloud computing. Many companies have recently started offering cloud-based VRM solutions, which are projected to drive the growth of the vendor risk management market in the coming years.

End User Segment Analysis

The BFSI segment is projected to grow significantly by the end of 2035. The BFSI industry is a highly connected sector due to the rapidly increasing number of third-party integrations, connected devices, internet banking, and demand for high-speed transactions. Increased connectivity raises further questions about cybersecurity. Vendor risk management and potential cybersecurity are in high demand in this industry as connected businesses are almost always connected with new entities. The Financial Services Information Sharing and Analysis Center predicts that cyberattacks targeting financial institutions will increase in 2022. The agency predicts that third-party risks, zero-day vulnerabilities, and ransomware will continue to be the top cyber threats facing financial institutions in 2022.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Deployment Mode |

|

|

Organization Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vendor Risk Management Market Regional Analysis:

North American Market Insights

North America industry is anticipated to dominate majority revenue share of 32% by 2035. The market's expansion can be attributed mostly to the increasing number of security breaches caused by the increased number of independent suppliers within smaller or larger organizations. For instance, research shows that at the largest banks in the U.S., approximately 1.5 million customers in June 2022 were affected by a major data breach. However, the revenue growth of the market in this region is expected to be supported by the increasing need to monitor and analyze the performance of the suppliers.

Europe Market Insights

The Europe vendor risk management market is set to grow significantly during the time period. There is an increased government regulatory framework adoption in multiple sectors in the region. For instance, on June 2022, Marsh, a global services firm introduced its Cyber Incident Management service, which will assist clients based in the UK and Europe in responding and recovering from cyberattacks, as well as increasing their cyber resilience.

Vendor Risk Management Market Players:

- BitSight Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Genpact

- SAI Global

- IBM Corporation

- Rapid Ratings International Inc.

- ProcessUnity, Inc.

- LogicManager, Inc.

- Aravo Solutions, Inc.

- ACL Services Ltd.

Recent Developments

- IBM Corporation recently signed an agreement with Siam Commercial Bank, a Thailand-based financial services provider, to improve the security of countless digital transactions on its platform and to provide better service to its customers. This collaboration aims to capitalize on IBM’s key expertise in providing a secure, resilient enterprise platform for mission-critical apps and data on hybrid multi-cloud to mitigate risks and reduce fraudulent activity in financial transactions.

- ProcessUnity, Inc. a U.S.-based software company released a statement announcing that Forrester has poisoned it as a leader in the Forrester Wave Third-Party Risk Management Platforms.

- Report ID: 4901

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vendor Risk Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.