Vehicle Telematics Market Outlook:

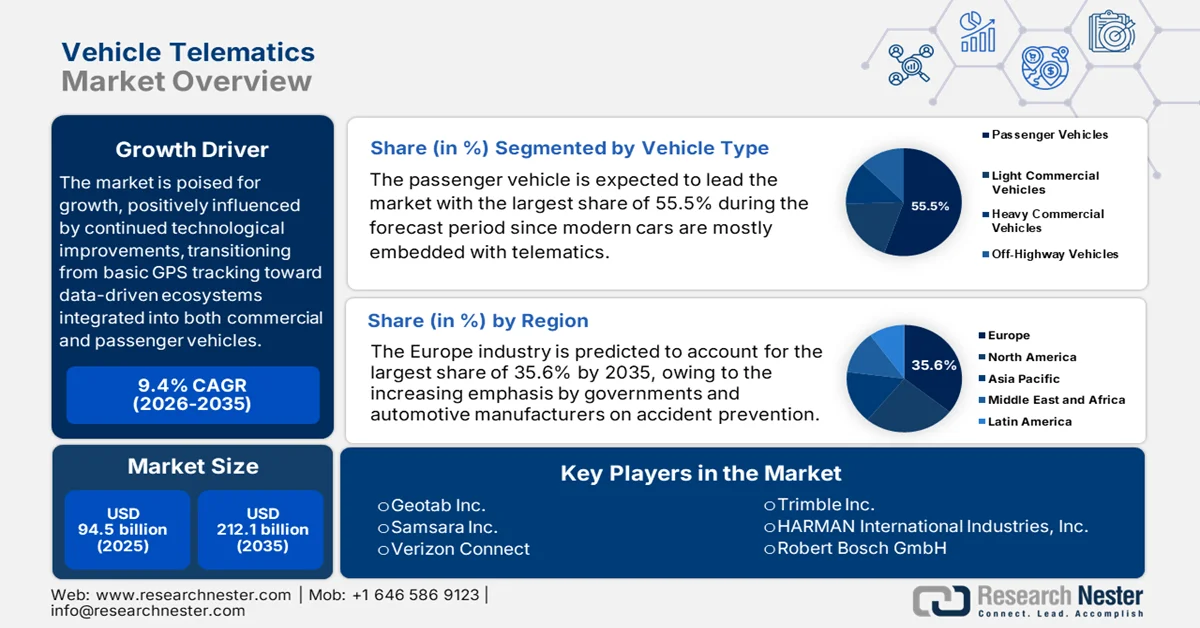

Vehicle Telematics Market size was valued at USD 94.5 billion in 2025 and is projected to reach USD 212.1 billion by the end of 2035, rising at a CAGR of 9.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of vehicle telematics is evaluated at USD 103.3 billion.

The international market is poised for extensive growth, positively influenced by continued technological improvements, transitioning from basic GPS tracking toward data-driven ecosystems integrated into both commercial and passenger vehicles. The rapid digitalization of logistics, increasing demand for enhanced safety and security through advanced driver-assistance systems (ADAS), and the urgent need for fuel efficiency are the major driving factors for market expansion. Based on the industry validated analysis published by CRS in July 2024, telematics systems enable wireless transmission of vehicle data to OEM data centers, supporting various functions, whereas OEM telematics systems operate as closed networks, allowing manufacturers to offer subscription-based services. Independent repair shops and consumers advocate for access to vehicle data under right-to-repair laws, as access is highly critical for maintenance, diagnostics, and competition in the aftermarket. It also stated that the regulatory developments, such as Massachusetts’ 2020 law and Maine’s 2023 law, along with the proposed REPAIR Act (H.R. 906), also influence the structure and competitiveness of the market.

Key Statistics on Vehicle Telematics and Aftermarket Impacts

|

Category |

Data |

|

U.S. Household Expenditure (2023) |

USD 768 billion on motor vehicles and parts (4.2% of total consumer spending) |

|

ADAS Repair Cost Impact |

Up to 37.6% increase in repair costs after minor collisions |

|

Telematics Functions |

GPS navigation, hands-free devices, ADAS, remote diagnostics |

Source: Congress.gov

Furthermore, the regulatory landscape, through right-to-repair laws such as Maine’s, is expanding independent access to vehicle telematics data, fostering innovation in the market and aftermarket services. In this context Maine Legislature officially reported that its 2023 Right-to-Repair law (Title 29‑A, §§1810–1811) requires vehicle manufacturers to provide standardized access to on-board diagnostic, repair for owners and independent repair facilities without proprietary authorization, overseen by an independent entity designated by the Attorney General. It also notes that the law applies to all vehicles, including heavy-duty commercial models, and mandates that manufacturers offer the same diagnostic tools, software, parts, and telematics data to independent shops as to their own dealers. Moreover, for newer vehicles (2018 and later), access must be through off-the-shelf computers and nonproprietary interfaces, including mobile applications, allowing repair commands and telematics-based data sharing where necessary, hence increasing the growth potential of the market.