Vehicle Telematics Market - Regional Analysis

Europe Market Insights

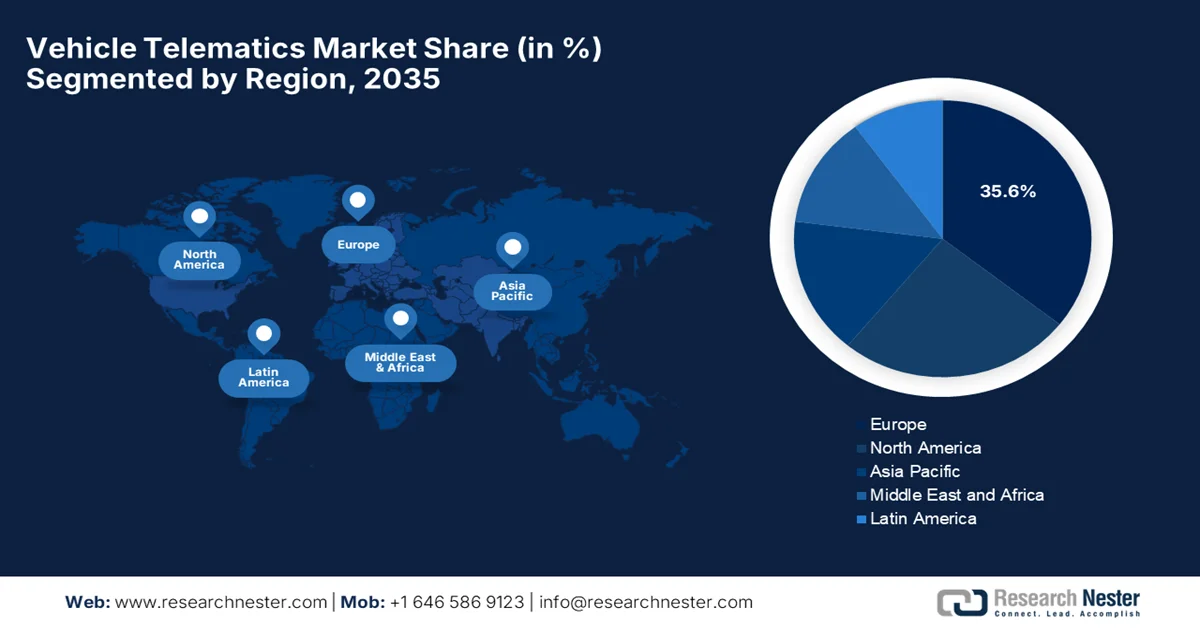

The vehicle telematics market in Europe is forecast to capture nearly 35.6% of the overall revenue share by the conclusion of 2035. The market’s development in this region is mainly propelled by the increasing emphasis by governments and automotive manufacturers on accident prevention and the safety and security of drivers and passengers. In addition, the strategic partnerships among industry players to enhance their market presence accelerate the region’s growth in this field. In this context, in July 2024, Donegal County Council in Ireland published an EU tender for fleet telematics services, looking for a system to monitor and manage its vehicles, which includes tracking, engine diagnostics, and operational reporting. It also notes that the contract was valued at around €700,000 (approximately USD 760,000) and is aimed at improving fleet efficiency, safety, and data-driven decision-making. Hence, such instances boost consistent growth by creating demand, validating technology, and encouraging wider adoption across public and private fleets.

Historic Official Statistics on Death by Accidents in the EU and Selected Countries: Government-Reported Data for 2021

|

Country |

Number of Deaths (number) |

|

|

Total |

|

EU |

164,039 |

|

Belgium |

4,508 |

|

Bulgaria |

1,502 |

|

Czechia |

3,413 |

|

Denmark |

1,423 |

|

Germany |

30,374 |

|

Estonia |

694 |

|

Ireland |

1,114 |

|

Greece |

3,691 |

|

Spain |

12,052 |

|

France |

29,033 |

|

Croatia |

1,903 |

|

Italy |

20,882 |

|

Cyprus |

244 |

|

Latvia |

1,035 |

|

Lithuania |

1,584 |

|

Luxembourg |

173 |

|

Hungary |

3,304 |

|

Malta |

113 |

|

Netherlands |

7,290 |

|

Austria |

2,909 |

|

Poland |

14,547 |

|

Portugal |

3,763 |

|

Romania |

9,938 |

|

Slovenia |

1,332 |

|

Slovakia |

1,450 |

|

Finland |

2,442 |

|

Sweden |

3,326 |

|

Iceland |

114 |

|

Liechtenstein |

6 |

|

Norway |

1,931 |

|

Switzerland |

2,753 |

|

Serbia |

1,501 |

|

Türkiye |

13,090 |

Source: Eurostat

The vehicle telematics market in Germany is gaining increasing traction, owing to the strong focus on advanced telematics integration within automotive manufacturing and fleet systems supports sophisticated OEM solutions. This also includes over-the-air updates and predictive diagnostics, thereby aligning with the country’s strong automotive R&D ecosystem and industrial digitization strategies. Rosenberger Telematics GmbH, in August 2025, announced that it has partnered with Volkswagen Group Info Services AG to integrate fleet vehicle data from six brands, enabling services such as maintenance management, EV monitoring, and corporate car sharing without extra hardware. The company also stated that the OEM Sync integration ensures secure, GDPR-compliant access to mileage, fuel, warning messages, and other telematics data, hence supporting safer, more sustainable mobility across Europe.

In the UK, the vehicle telematics market is readily progressing on account of a mature insurance telematics adoption and regulatory support for connected and autonomous vehicle trials. The country is witnessing increasing utilization of telematics in terms of fleet safety monitoring, usage-based insurance products, and telematics-enabled services that enhance operational insights for commercial and corporate vehicle operators. Kent County Council in March 2023 announced that it has launched a tender for vehicle telematics and associated services with an estimated value totaling £10 million (approximately 12.4 million) by covering hardware, software, fleet tracking, geofencing, data analytics, and emissions monitoring. The contract was open to all industries and accessible to public bodies across the country, and operates under a 48-month framework agreement to improve fleet safety, driver behavior, and operational efficiency.

APAC Market Insights

The Asia Pacific vehicle telematics market is set to witness rapid growth through the discussed tenure owing to factors such as rapid digital transformation, expanding automotive production, and government smart mobility initiatives. Also, there has been an increasing fleet & passenger telematics adoption in countries such as China, India, and South Korea, providing encouraging opportunities for both national and international pioneers. In March 2024, HERE Technologies and Netstar together reported that they expanded their 16-year partnership to enhance fleet management and asset tracking for commercial and heavy vehicles across the Asia-Pacific. Besides this collaboration leverages HERE Location Services and the HERE SDK Navigate to provide vehicle tracking, optimized routing, and thereby supporting operational efficiency and driver safety. Hence, with the presence of such developments in the region, the market is rapidly growing and expanding.

The vehicle telematics market in China is mainly driven by its large automotive manufacturing base and national policies, which are efficiently promoting digital mobility and vehicle connectivity. Simultaneously, the integration with national smart transport initiatives is efficiently driving adoption in the country. In July 2023, China’s Ministry of Industry and Information Technology and the State Administration for Standardization officially released the National Guidelines for the Construction of the Standard System for the Internet of Vehicles Industry (Intelligent Connected Vehicles) 2023 edition, updating the 2018 edition. Also, the guidelines establish a proper and coordinated framework for vehicle telematics by covering fundamentals, technologies, products, testing standards, and V2X applications, while also addressing functional safety, cybersecurity, and industrial regulation. It also stated that by the conclusion of 2025, over 100 standards will support combined driving assistance and autonomous driving, and by 2030, more than 130 standards will enable integrated single-vehicle intelligence and networked capabilities.

China’s Automobile Exports and Telematics Security Plan (2023)

|

Metric |

Value |

|

China auto exports (January - August 2023) |

3 million vehicles |

|

Year-on-year export growth |

61.9% |

|

Projected total exports 2023 |

>4 million vehicles |

|

China EV global ranking |

1 in exports |

|

Tesla vehicles are manufactured in Shanghai |

>50% of total Tesla EVs |

|

Number of telematics standards planned by 2030 |

>140 |

Source: Jamestown Organization

In India vehicle telematics market is growing, fueled by the presence of regulatory standards such as automotive industry standard 140 (AIS 140) mandate installation of vehicle tracking devices in terms of public transport vehicles. This efficiently boosts telematics adoption for compliance, route monitoring, and safety in commercial vehicle fleets, wherein the government enforcement is driving telematics uptake. In this context Ministry of Road Transport & Highways, in February 2022, issued a draft notification proposing that all goods vehicles that are carrying hazardous materials, including gases such as Argon, Nitrogen, and Oxygen, must be equipped with vehicle tracking system devices compliant with AIS‑140 standards. Besides, this measure’s prime focus is to enhance the safety and monitoring of hazardous goods transport across the country. The presence of such mandates efficiently drives demand for telematics devices and services, boosting the country’s fleet management and connected vehicle sector.

North America Market Insights

The North America vehicle telematics market is primarily shaped by widespread deployment of advanced fleet connectivity, which includes GPS tracking and performance analytics across commercial and public fleets. This, in turn, is supported by mature digital infrastructure and early adoption of connected vehicle technologies. Simultaneously, the government initiatives are proactively promoting smart transportation and fleet safety, which has accelerated telematics adoption. Besides, the Integration with AI and IoT enables predictive maintenance, route optimization, and fuel efficiency improvements, encouraging increased adoption in this field. In addition, the heightened demand for insurance telematics and usage-based insurance models is driving market growth. Furthermore, the collaboration between automotive OEMs and telematics providers is expanding the availability of connected vehicle solutions across both private and commercial segments in the region.

The U.S. vehicle telematics market is growing continuously, owing to the strict regulatory compliance and the integration of telematics in logistics and last-mile delivery networks, which reinforce its prominent position. The country is witnessing adoption in terms of commercial, rental, and freight sectors with extensive use of telematics data for real-time performance visibility and operational insights. In July 2025, Teletrac Navman announced that it had launched OEM Telematics, thereby allowing its TN360 fleet management platform to connect directly with factory-installed telematics hardware from multiple vehicle manufacturers. This integration provides fleet managers with real-time access to critical data, i.e., vehicle location, usage patterns, speed, fuel levels, and EV battery state, without the need for aftermarket devices. Therefore, with such continued developments, the country’s vehicle telematics industry is expected to witness unprecedented growth over the years ahead.

There is a huge opportunity for Canada vehicle telematics market owing to the rising utilization for long-haul trucking and utility sector fleets, where real-time vehicle and driver data improves compliance with safety standards. As per the article published by Accident Analysis & Prevention in May 2024, the systematic review observes that in-vehicle telematics research is largely driven by insurance applications, particularly for claims prediction and driver risk classification. The review analyzed 45 studies, most of which used large insurer-provided datasets, including a dataset of 50,301 insured vehicles from Canada. It also mentioned that machine learning was the most commonly used analytical method, with speed, braking, and acceleration identified as the most influential driving behavior variables. Furthermore, telematics is widely used for risk assessment; the evidence on its effectiveness in improving driving behavior is limited, highlighting the need for research using demographic data and multi-level models that account for trip- and driver-level differences.