Vehicle Telematics Market Outlook:

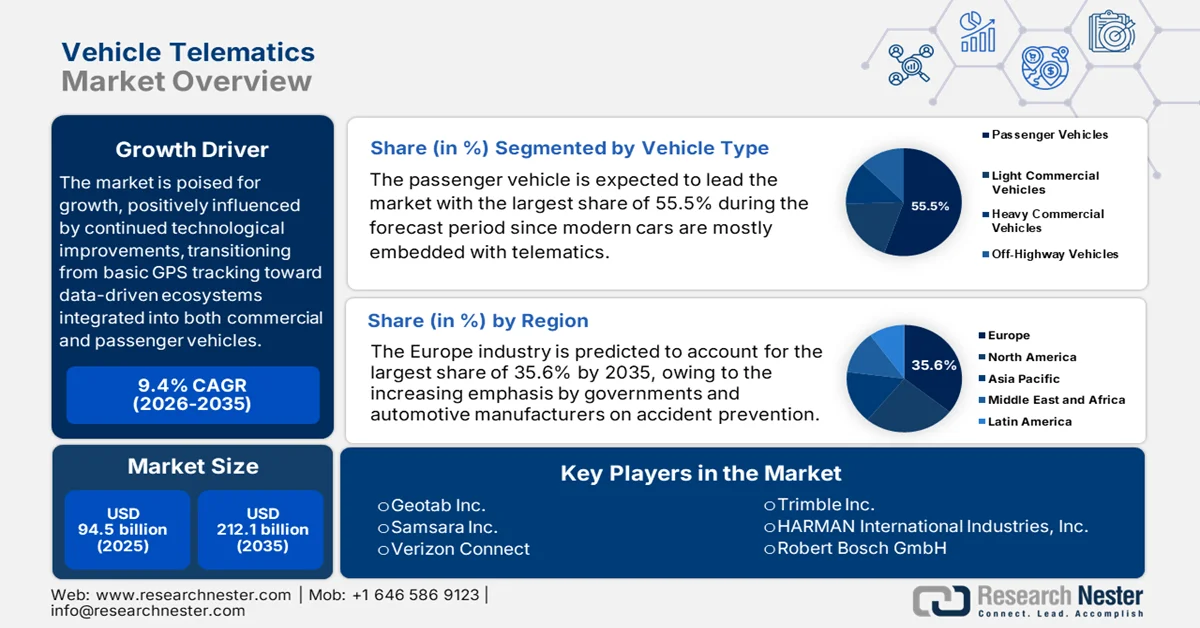

Vehicle Telematics Market size was valued at USD 94.5 billion in 2025 and is projected to reach USD 212.1 billion by the end of 2035, rising at a CAGR of 9.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of vehicle telematics is evaluated at USD 103.3 billion.

The international market is poised for extensive growth, positively influenced by continued technological improvements, transitioning from basic GPS tracking toward data-driven ecosystems integrated into both commercial and passenger vehicles. The rapid digitalization of logistics, increasing demand for enhanced safety and security through advanced driver-assistance systems (ADAS), and the urgent need for fuel efficiency are the major driving factors for market expansion. Based on the industry validated analysis published by CRS in July 2024, telematics systems enable wireless transmission of vehicle data to OEM data centers, supporting various functions, whereas OEM telematics systems operate as closed networks, allowing manufacturers to offer subscription-based services. Independent repair shops and consumers advocate for access to vehicle data under right-to-repair laws, as access is highly critical for maintenance, diagnostics, and competition in the aftermarket. It also stated that the regulatory developments, such as Massachusetts’ 2020 law and Maine’s 2023 law, along with the proposed REPAIR Act (H.R. 906), also influence the structure and competitiveness of the market.

Key Statistics on Vehicle Telematics and Aftermarket Impacts

|

Category |

Data |

|

U.S. Household Expenditure (2023) |

USD 768 billion on motor vehicles and parts (4.2% of total consumer spending) |

|

ADAS Repair Cost Impact |

Up to 37.6% increase in repair costs after minor collisions |

|

Telematics Functions |

GPS navigation, hands-free devices, ADAS, remote diagnostics |

Source: Congress.gov

Furthermore, the regulatory landscape, through right-to-repair laws such as Maine’s, is expanding independent access to vehicle telematics data, fostering innovation in the market and aftermarket services. In this context Maine Legislature officially reported that its 2023 Right-to-Repair law (Title 29‑A, §§1810–1811) requires vehicle manufacturers to provide standardized access to on-board diagnostic, repair for owners and independent repair facilities without proprietary authorization, overseen by an independent entity designated by the Attorney General. It also notes that the law applies to all vehicles, including heavy-duty commercial models, and mandates that manufacturers offer the same diagnostic tools, software, parts, and telematics data to independent shops as to their own dealers. Moreover, for newer vehicles (2018 and later), access must be through off-the-shelf computers and nonproprietary interfaces, including mobile applications, allowing repair commands and telematics-based data sharing where necessary, hence increasing the growth potential of the market.

Key Vehicle Telematics Market Insights Summary:

Regional Highlights:

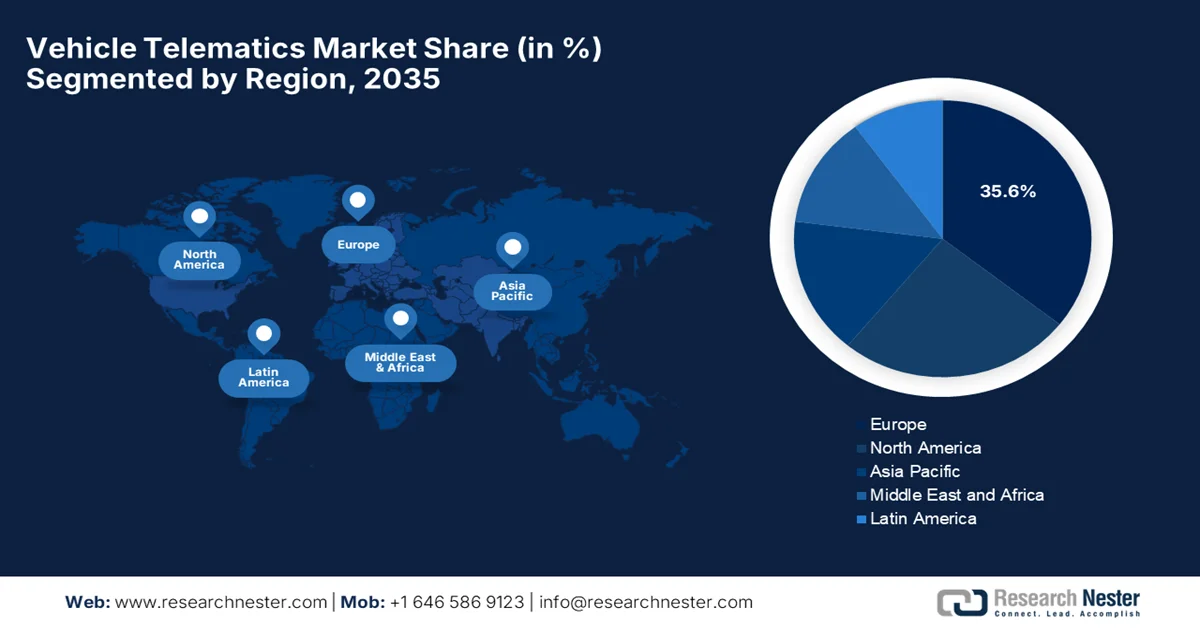

- Europe is projected to secure nearly a 35.6% revenue share of the vehicle telematics market by 2035, reinforced by stringent safety priorities, accident prevention initiatives, and expanding public–private fleet telematics deployments emphasizing data-driven mobility management.

- Asia Pacific is expected to experience accelerated expansion through 2035, energized by rapid digital transformation, rising automotive production, and government-led smart mobility programs encouraging large-scale adoption of connected vehicle and fleet telematics solutions.

Segment Insights:

- The passenger vehicle subtype is anticipated to dominate the vehicle telematics market with a 55.5% share by 2035, supported by the standardization of telematics-enabled navigation, safety, diagnostics, and infotainment features alongside growing demand for real-time vehicle tracking and connectivity services.

- Embedded telematics systems are projected to command a substantial technology share by 2035, strengthened by OEM-level integration that enables over-the-air updates, predictive maintenance, and advanced connected vehicle functionalities aligned with rising consumer demand for seamless digital automotive experiences.

Key Growth Trends:

- Fleet management & operational efficiency

- Government regulations & safety mandates

Major Challenges:

- Data privacy and security concern

- Regulatory and compliance challenges

Key Players: Geotab Inc. (Canada), Samsara Inc. (U.S.), Verizon Connect (U.S.), Trimble Inc. (U.S.), HARMAN International Industries, Inc. (U.S.), Robert Bosch GmbH (Germany), Continental AG (Germany), TomTom International B.V. (Netherlands), Denso Corporation (Japan), Hyundai Mobis Co., Ltd. (South Korea), Airbiquity, Inc. (U.S.), Visteon Corporation (U.S.), Octo Telematics S.p.A. (Italy), Targa Telematics S.p.A. (Italy), WirelessCar AB (Sweden), Otonomo Technologies Ltd. (Israel), MiX Telematics (South Africa), Queclink Wireless Solutions Co., Ltd. (Malaysia), Trak N Tell (India)

Global Vehicle Telematics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 94.5 billion

- 2026 Market Size: USD 103.3 billion

- Projected Market Size: USD 212.1 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Indonesia, Vietnam, Brazil, Mexico

Last updated on : 5 February, 2026

Vehicle Telematics Market - Growth Drivers and Challenges

Growth Drivers

- Fleet management & operational efficiency: Businesses, especially in logistics and transportation, are adopting telematics with a prime focus on enhancing productivity and cutting operational costs. Based on the government data from the U.S. General Services Administration (GSA) in May 2023, the agency has launched the electric vehicle suitability assessment tool, using federal fleet telematics data to identify which vehicles can be replaced with electric alternatives based on driving patterns, range, and cost-of-ownership. It also stated that the tool supports agencies in making data-driven decisions to improve operational efficiency while also advancing the Biden-Harris Administration’s goal of transitioning to a zero-emission federal fleet by the end of 2027 for light-duty vehicles. In addition, GSA leverages telematics and predictive analytics and aims to save time and resources for fleet managers and optimize vehicle utilization across government operations, hence creating an optimistic opportunity for pioneers in the market.

- Government regulations & safety mandates: Safety and compliance regulations across the globe, and national vehicle tracking policies are requiring telematics systems in many vehicles, driving adoption. Simultaneously, the regulatory focus on reporting of emissions and road safety is also accelerating demand in the market. As per the October 2025 Government of Meghalaya data, the Ministry of Road Transport & Highways India (MoRTH), mandated under G.S.R 1095(E) and Rule 125H, reported that all public transport vehicles need to be fitted with AIS‑140-compliant vehicle location tracking devices and emergency buttons to enhance both safety and monitoring. It also noted that the VLTD captures real-time GPS/IRNSS location, speed, and alerts, and transmits data through embedded e-SIMs to backend servers, even operating on an internal battery if vehicle power is disconnected. In addition, the state transport departments are responsible for implementing these systems across all public service vehicles, ensuring proper compliance and effective emergency alert management.

- Electric vehicle adoption: There has been a major shift towards electric vehicles, increasing the demand for telematics, which supports battery monitoring, charging management, range optimization, and integration with smart charging networks. In this context, the U.S. Department of Energy in 2026 revealed that its Federal Energy Management Program (DOE FEMP) provides guidance for federal agencies to properly measure and report electricity use in zero-emission vehicles (ZEVs), including BEVs and PHEVs. Therefore, agencies are encouraged to use vehicle telematics devices to track charging sessions, which include date, location, state of charge, and kilowatt-hours added, enabling precise reporting and fleet management. Hence, this telematics-based approach supports battery monitoring, charging management, and operational optimization across federal EV fleets, ensuring efficient use of energy and compliance, thereby increasing adoption in the vehicle telematics market across different nations.

Global Electric Vehicle Sales & Market Share (2020-2025)

|

Year |

Global EV Sales (million) |

Year-on-Year Growth |

Share of Global Car Sales |

Notes |

|

2020 |

3.5 |

- |

- |

Total EVs sold worldwide in 2020 |

|

2022 |

- |

- |

- |

- |

|

2023 |

14 |

- |

18% of new cars |

Strong growth, improved range & performance |

|

2024 |

17 |

+3.5 million |

>20% |

Record-breaking year, affordability improves |

|

2025 |

>20 |

- |

>25% |

Projected, +35% YoY in Q1 2025 |

Source: IEA

Challenges

- Data privacy and security concern: One of the foremost challenges in the market is ensuring data privacy and cybersecurity. Telematics systems mostly collect sensitive information, which includes vehicle location, driver behavior, and operational metrics. Therefore, this makes it sensitive to aspects such as hacking, unauthorized access, or misuse that, in turn raises concerns among fleet operators, drivers, and regulatory bodies. To address this, telemetry providers operating across different nations need to implement proper encryption, secure cloud infrastructure, and strict access controls to protect data integrity. Furthermore, failure to address these concerns can erode customer trust, result in legal liabilities, and hinder widespread adoption of connected vehicle technologies.

- Regulatory and compliance challenges: The vehicle telematics market witnesses high-end scrutiny, which keeps varying across countries, affecting data collection, driver privacy, insurance reporting, and vehicle safety. Also, the compliance requirements differ for fleet telematics, connected cars, and autonomous vehicle initiatives, requiring telematics providers to adapt hardware and software solutions to meet local standards. For instance, regulations may dictate how GPS tracking data can be stored, processed, or shared, whereas the telematics-based driver monitoring must align with labor laws. On the other hand, non-compliance can result in fines and legal disputes, making administrative compliance a major hurdle. Therefore, staying abreast of changing policies and harmonizing solutions globally is challenging, particularly for multinational telematics providers.

Vehicle Telematics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 94.5 billion |

|

Forecast Year Market Size (2035) |

USD 212.1 billion |

|

Regional Scope |

|

Vehicle Telematics Market Segmentation:

Vehicle Type Segment Analysis

The passenger vehicle subtype, which is a part of vehicle type, is expected to lead the market with the largest share of 55.5% during the forecast period. Modern cars are mostly embedded with telematics for navigation, safety, diagnostics, and connectivity functions, making telematics a standard expectation for consumers and OEMs alike. On the other hand, real-time vehicle tracking and infotainment features are major drivers for this demand. Testifying, FRED reported that in March 2022, India registered around 167,309 passenger cars in retail trade, according to seasonally adjusted monthly data for car registrations. This study reflects the consistent demand for passenger vehicles amongst consumers, and it is considered to be one of the world’s largest automotive sectors, which directly supports sustained growth in telematics for real-time analysis, hence denoting a wider segment scope.

Technology Segment Analysis

Embedded telematics systems are expected to capture a significant technology share owing to factors such as OEM-installed units being more reliable, integrated, and compliant with modern safety standards than aftermarket devices. This, in turn, drives long-term subscription revenue and data services, whereas the OEM integration also facilitates over-the-air updates and advanced connected car functions. In addition, these embedded systems provide proper real-time diagnostics and predictive maintenance alerts, significantly improving vehicle uptime and reducing repair costs. They also enable integration with smart city infrastructure and fleet management platforms, enhancing the overall traffic efficiency and safety. Furthermore, the heightened consumer demand for connected services, such as remote vehicle control and personalized infotainment, boosts increased adoption in the vehicle telematics market.

Application Segment Analysis

The fleet management services are expected to grow at a considerable rate by 2035 since the commercial operators rely on routing optimization, driver behavior monitoring, and operational analytics to lower costs and improve safety. Also, these services are fundamental in the logistics and transportation sectors, making telematics a critical infrastructure. As of the September 2025 data from the U.S. General Services Administration, it provides all leased vehicles with integrated, FedRAMP-authorized telematics without necessitating any additional cost, with a collective goal of supporting operational efficiency, automated mileage reporting, and OEM integration. It also stated that these telematics systems track vehicle diagnostics, GPS data, and driver behavior, thereby enabling better fleet management. Furthermore, GSA enhances decision-making, reduces costs through shared services, and ensures compliance with federal cybersecurity, thus benefiting the vehicle telematics market.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Vehicle Type |

|

|

Technology |

|

|

Application |

|

|

Sales Channel |

|

|

Connectivity Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vehicle Telematics Market - Regional Analysis

Europe Market Insights

The vehicle telematics market in Europe is forecast to capture nearly 35.6% of the overall revenue share by the conclusion of 2035. The market’s development in this region is mainly propelled by the increasing emphasis by governments and automotive manufacturers on accident prevention and the safety and security of drivers and passengers. In addition, the strategic partnerships among industry players to enhance their market presence accelerate the region’s growth in this field. In this context, in July 2024, Donegal County Council in Ireland published an EU tender for fleet telematics services, looking for a system to monitor and manage its vehicles, which includes tracking, engine diagnostics, and operational reporting. It also notes that the contract was valued at around €700,000 (approximately USD 760,000) and is aimed at improving fleet efficiency, safety, and data-driven decision-making. Hence, such instances boost consistent growth by creating demand, validating technology, and encouraging wider adoption across public and private fleets.

Historic Official Statistics on Death by Accidents in the EU and Selected Countries: Government-Reported Data for 2021

|

Country |

Number of Deaths (number) |

|

|

Total |

|

EU |

164,039 |

|

Belgium |

4,508 |

|

Bulgaria |

1,502 |

|

Czechia |

3,413 |

|

Denmark |

1,423 |

|

Germany |

30,374 |

|

Estonia |

694 |

|

Ireland |

1,114 |

|

Greece |

3,691 |

|

Spain |

12,052 |

|

France |

29,033 |

|

Croatia |

1,903 |

|

Italy |

20,882 |

|

Cyprus |

244 |

|

Latvia |

1,035 |

|

Lithuania |

1,584 |

|

Luxembourg |

173 |

|

Hungary |

3,304 |

|

Malta |

113 |

|

Netherlands |

7,290 |

|

Austria |

2,909 |

|

Poland |

14,547 |

|

Portugal |

3,763 |

|

Romania |

9,938 |

|

Slovenia |

1,332 |

|

Slovakia |

1,450 |

|

Finland |

2,442 |

|

Sweden |

3,326 |

|

Iceland |

114 |

|

Liechtenstein |

6 |

|

Norway |

1,931 |

|

Switzerland |

2,753 |

|

Serbia |

1,501 |

|

Türkiye |

13,090 |

Source: Eurostat

The vehicle telematics market in Germany is gaining increasing traction, owing to the strong focus on advanced telematics integration within automotive manufacturing and fleet systems supports sophisticated OEM solutions. This also includes over-the-air updates and predictive diagnostics, thereby aligning with the country’s strong automotive R&D ecosystem and industrial digitization strategies. Rosenberger Telematics GmbH, in August 2025, announced that it has partnered with Volkswagen Group Info Services AG to integrate fleet vehicle data from six brands, enabling services such as maintenance management, EV monitoring, and corporate car sharing without extra hardware. The company also stated that the OEM Sync integration ensures secure, GDPR-compliant access to mileage, fuel, warning messages, and other telematics data, hence supporting safer, more sustainable mobility across Europe.

In the UK, the vehicle telematics market is readily progressing on account of a mature insurance telematics adoption and regulatory support for connected and autonomous vehicle trials. The country is witnessing increasing utilization of telematics in terms of fleet safety monitoring, usage-based insurance products, and telematics-enabled services that enhance operational insights for commercial and corporate vehicle operators. Kent County Council in March 2023 announced that it has launched a tender for vehicle telematics and associated services with an estimated value totaling £10 million (approximately 12.4 million) by covering hardware, software, fleet tracking, geofencing, data analytics, and emissions monitoring. The contract was open to all industries and accessible to public bodies across the country, and operates under a 48-month framework agreement to improve fleet safety, driver behavior, and operational efficiency.

APAC Market Insights

The Asia Pacific vehicle telematics market is set to witness rapid growth through the discussed tenure owing to factors such as rapid digital transformation, expanding automotive production, and government smart mobility initiatives. Also, there has been an increasing fleet & passenger telematics adoption in countries such as China, India, and South Korea, providing encouraging opportunities for both national and international pioneers. In March 2024, HERE Technologies and Netstar together reported that they expanded their 16-year partnership to enhance fleet management and asset tracking for commercial and heavy vehicles across the Asia-Pacific. Besides this collaboration leverages HERE Location Services and the HERE SDK Navigate to provide vehicle tracking, optimized routing, and thereby supporting operational efficiency and driver safety. Hence, with the presence of such developments in the region, the market is rapidly growing and expanding.

The vehicle telematics market in China is mainly driven by its large automotive manufacturing base and national policies, which are efficiently promoting digital mobility and vehicle connectivity. Simultaneously, the integration with national smart transport initiatives is efficiently driving adoption in the country. In July 2023, China’s Ministry of Industry and Information Technology and the State Administration for Standardization officially released the National Guidelines for the Construction of the Standard System for the Internet of Vehicles Industry (Intelligent Connected Vehicles) 2023 edition, updating the 2018 edition. Also, the guidelines establish a proper and coordinated framework for vehicle telematics by covering fundamentals, technologies, products, testing standards, and V2X applications, while also addressing functional safety, cybersecurity, and industrial regulation. It also stated that by the conclusion of 2025, over 100 standards will support combined driving assistance and autonomous driving, and by 2030, more than 130 standards will enable integrated single-vehicle intelligence and networked capabilities.

China’s Automobile Exports and Telematics Security Plan (2023)

|

Metric |

Value |

|

China auto exports (January - August 2023) |

3 million vehicles |

|

Year-on-year export growth |

61.9% |

|

Projected total exports 2023 |

>4 million vehicles |

|

China EV global ranking |

1 in exports |

|

Tesla vehicles are manufactured in Shanghai |

>50% of total Tesla EVs |

|

Number of telematics standards planned by 2030 |

>140 |

Source: Jamestown Organization

In India vehicle telematics market is growing, fueled by the presence of regulatory standards such as automotive industry standard 140 (AIS 140) mandate installation of vehicle tracking devices in terms of public transport vehicles. This efficiently boosts telematics adoption for compliance, route monitoring, and safety in commercial vehicle fleets, wherein the government enforcement is driving telematics uptake. In this context Ministry of Road Transport & Highways, in February 2022, issued a draft notification proposing that all goods vehicles that are carrying hazardous materials, including gases such as Argon, Nitrogen, and Oxygen, must be equipped with vehicle tracking system devices compliant with AIS‑140 standards. Besides, this measure’s prime focus is to enhance the safety and monitoring of hazardous goods transport across the country. The presence of such mandates efficiently drives demand for telematics devices and services, boosting the country’s fleet management and connected vehicle sector.

North America Market Insights

The North America vehicle telematics market is primarily shaped by widespread deployment of advanced fleet connectivity, which includes GPS tracking and performance analytics across commercial and public fleets. This, in turn, is supported by mature digital infrastructure and early adoption of connected vehicle technologies. Simultaneously, the government initiatives are proactively promoting smart transportation and fleet safety, which has accelerated telematics adoption. Besides, the Integration with AI and IoT enables predictive maintenance, route optimization, and fuel efficiency improvements, encouraging increased adoption in this field. In addition, the heightened demand for insurance telematics and usage-based insurance models is driving market growth. Furthermore, the collaboration between automotive OEMs and telematics providers is expanding the availability of connected vehicle solutions across both private and commercial segments in the region.

The U.S. vehicle telematics market is growing continuously, owing to the strict regulatory compliance and the integration of telematics in logistics and last-mile delivery networks, which reinforce its prominent position. The country is witnessing adoption in terms of commercial, rental, and freight sectors with extensive use of telematics data for real-time performance visibility and operational insights. In July 2025, Teletrac Navman announced that it had launched OEM Telematics, thereby allowing its TN360 fleet management platform to connect directly with factory-installed telematics hardware from multiple vehicle manufacturers. This integration provides fleet managers with real-time access to critical data, i.e., vehicle location, usage patterns, speed, fuel levels, and EV battery state, without the need for aftermarket devices. Therefore, with such continued developments, the country’s vehicle telematics industry is expected to witness unprecedented growth over the years ahead.

There is a huge opportunity for Canada vehicle telematics market owing to the rising utilization for long-haul trucking and utility sector fleets, where real-time vehicle and driver data improves compliance with safety standards. As per the article published by Accident Analysis & Prevention in May 2024, the systematic review observes that in-vehicle telematics research is largely driven by insurance applications, particularly for claims prediction and driver risk classification. The review analyzed 45 studies, most of which used large insurer-provided datasets, including a dataset of 50,301 insured vehicles from Canada. It also mentioned that machine learning was the most commonly used analytical method, with speed, braking, and acceleration identified as the most influential driving behavior variables. Furthermore, telematics is widely used for risk assessment; the evidence on its effectiveness in improving driving behavior is limited, highlighting the need for research using demographic data and multi-level models that account for trip- and driver-level differences.

Key Vehicle Telematics Market Players:

- Geotab Inc. (Canada)

- Samsara Inc. (U.S.)

- Verizon Connect (U.S.)

- Trimble Inc. (U.S.)

- HARMAN International Industries, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- TomTom International B.V. (Netherlands)

- Denso Corporation (Japan)

- Hyundai Mobis Co., Ltd. (South Korea)

- Airbiquity, Inc. (U.S.)

- Visteon Corporation (U.S.)

- Octo Telematics S.p.A. (Italy)

- Targa Telematics S.p.A. (Italy)

- WirelessCar AB (Sweden)

- Otonomo Technologies Ltd. (Israel)

- MiX Telematics (South Africa)

- Queclink Wireless Solutions Co., Ltd. (Malaysia)

- Trak N Tell (India)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Geotab Inc. has registered itself as one of the largest vehicle telematics providers, with a strong focus on fleet management, data analytics, and open-platform ecosystems. The company leverages a scalable cloud-based architecture and a vast marketplace of third-party integrations, which differentiates it from other national and international competitors.

- Samsara Inc. is based in the U.S. and is best known for its intuitive, software-first approach. The company combines vehicle telematics with video-based safety, IoT sensors, and real-time analytics to serve logistics, construction, and service fleets. In addition, Samsara’s competitive strategy centers on continued innovation, subscription-based SaaS models, and cross-selling connected solutions that improve productivity and driver safety across physical operations.

- Verizon Connect is yet another dominant force in this field that leverages Verizon’s global telecommunications infrastructure to deliver efficient fleet and asset tracking solutions. The firm’s strength lies in reliable connectivity, large enterprise relationships, and end-to-end telematics platforms by covering routing, fuel management, and driver behavior monitoring.

- Continental AG is one of the major automotive technology suppliers that has a very strong presence in terms of embedded telematics and OEM-integrated solutions. The company’s telematics strategy aligns closely with connected, autonomous, and software-defined vehicle roadmaps. Furthermore, Continental makes investments in control units, cybersecurity, and V2X communication, positioning itself as a long-term technology partner to worldwide automakers.

- Hyundai Mobis is a key player in OEM-grade telematics, which is focused on advanced connectivity solutions for autonomous and software-defined vehicles. The company is proactively transitioning from 4G to 5G-based telematics control units, enabling high-precision mapping, remote control, and advanced connected services.

Below is the list of some prominent players operating in the global market:

The vehicle telematics market is highly competitive with the presence of international automotive suppliers, telecom-backed platforms, and specialized telematics providers. Leading pioneers in this field are mainly focusing on 5G connectivity, cloud-native platforms, AI-based analytics, and software-defined vehicle integration to differentiate their product offerings. OEM partnerships, platform integrations, acquisitions, and geographic expansion are the primary strategies opted for by these key players to secure their market positions. On the other hand, fleet-focused firms leverage automation, safety, and cost optimization. In October 2025, Geotab announced that it had acquired Verizon Connect’s international commercial telematics operations across Europe and Australia, significantly expanding its global footprint and market presence. Hence, the deal strengthens the company’s position in the limited-to mid-sized fleet segment, enhancing access to AI-based telematics insights, domestic support, and scalable fleet solutions.

Corporate Landscape of the Vehicle Telematics Market:

Recent Developments

- In January 2026, RentalMatics announced an API integration with Renteon, which enables rental operators to combine real-time telematics data with rental management workflows in a single platform. The partnership enhances fleet utilization, security, damage detection, automation, and revenue optimization through live tracking, alerts, and global connectivity.

- In January 2026, Hyundai Mobis announced that it is developing a 5G wireless, antenna-integrated telematics solution to support autonomous driving and software-defined vehicles. It also stated that the 5G-based technology enables advanced services such as high-precision maps, remote control, and ultra-high-definition streaming.

- In November 2025, Targa Telematics and Conneqtech together reported that they have entered into an alliance to deliver advanced connected mobility solutions across Central Europe by enabling fleet, leasing, and rental companies to optimize operations through real-time data, predictive maintenance, and keyless vehicle access.

- In January 2025, Cambridge Mobile Telematics reported that it is expanding its telematics solutions in Germany, Austria, and Switzerland to help insurers reduce road risk, improve claims efficiency, and combat rising motor insurance costs.

- Report ID: 4462

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vehicle Telematics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.