Vehicle Networking Market Outlook:

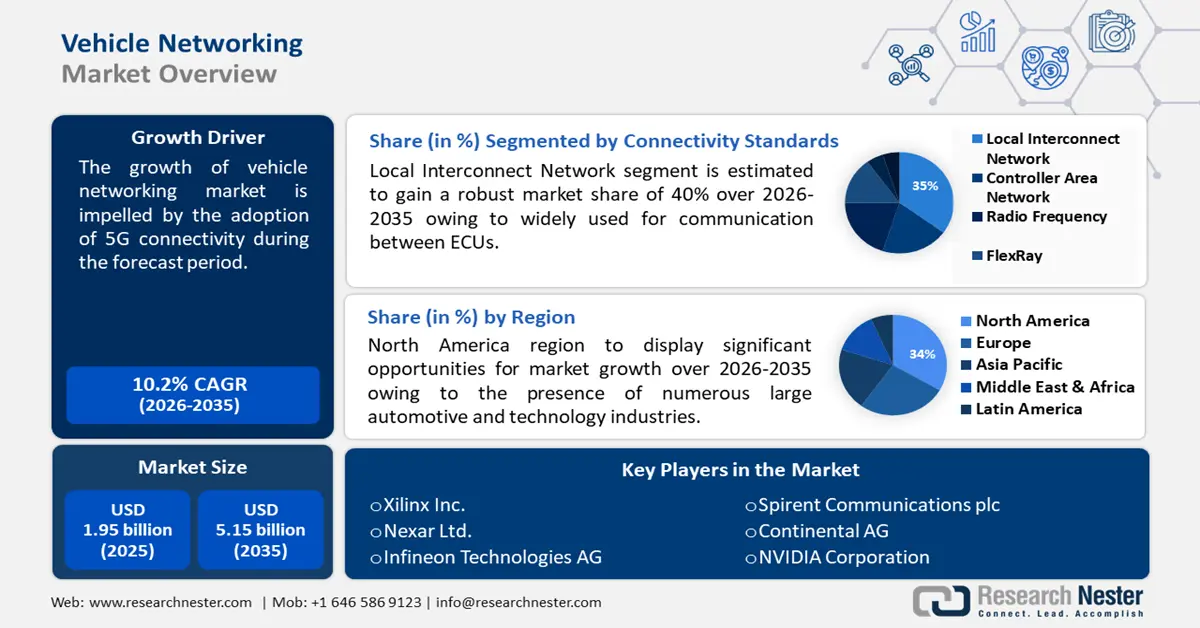

Vehicle Networking Market size was over USD 1.95 billion in 2025 and is poised to exceed USD 5.15 billion by 2035, growing at over 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vehicle networking is estimated at USD 2.13 billion.

The industry growth of vehicle networking is impelled by the adoption of 5G connectivity during the forecast period. There are already 296 commercial 5G networks in the world. By 2025, this number is estimated to rise to 438, indicating substantial global investments in 5G infrastructure.

In addition to this, factors that are believed to fuel the vehicle networking market growth include companies that manufacture semiconductors have been investing a lot of money in R&D to create goods with cutting-edge technologies. For instance, between 2020 and 2021, Analog Devices boosted their research & development spending from USD 1.05 million to USD 1.29 million. Automakers have also been investing more in automotive in-vehicle networking industries, offering lucrative prospects, in an effort to enhance vehicle design.

Key Vehicle Networking Market Insights Summary:

Regional Highlights:

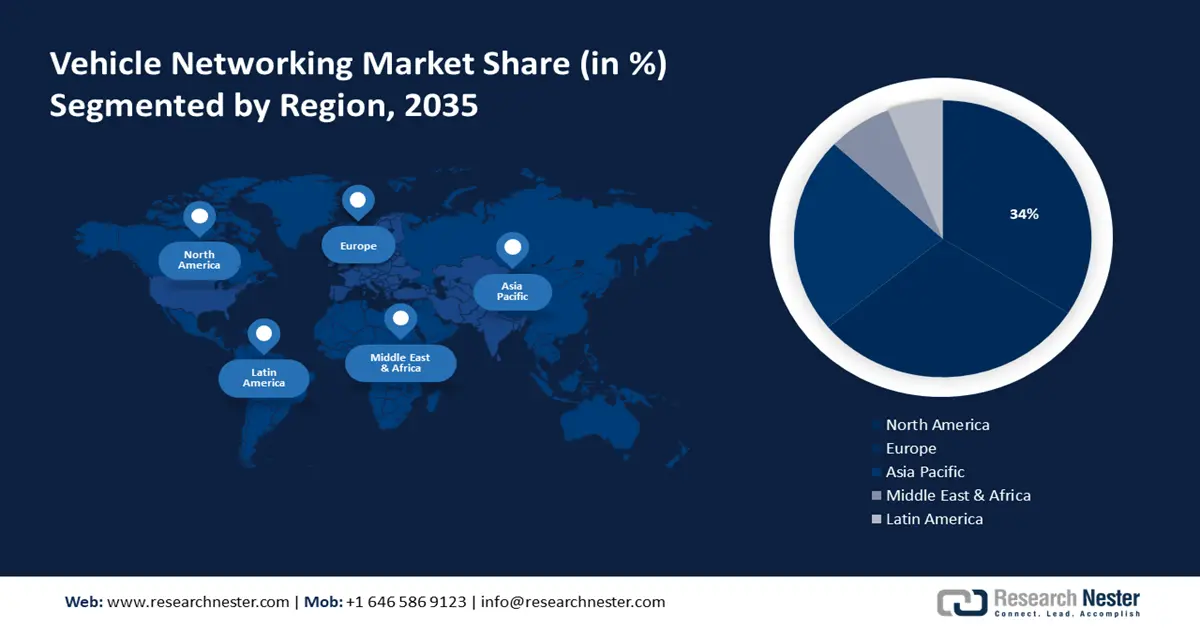

- North America vehicle networking market is expected to capture 34% share by 2035, attributed to a strong automotive and technology base, rising adoption of ADAS and EVs, and demand for connected auto technologies.

- Europe market will exhibit enormous CAGR during 2026-2035, fueled by increased funding for vehicle electrification and decarbonization, strong industrial presence, and advanced automotive manufacturing capabilities.

Segment Insights:

- The local interconnect network segment in the vehicle networking market is projected to hold a 35% share by 2035, driven by its cost-effectiveness, low power usage, and wide use in non-critical automotive systems.

- The passenger vehicles segment in the vehicle networking market is expected to capture a 30% share by 2035, fueled by demand for in-car entertainment, ADAS, and increasing popularity of connected vehicles.

Key Growth Trends:

- Surge in automobile production

- Increase in demand for autonomous vehicles

Major Challenges:

- Absence of infrastructure for autonomous mobility to hamper industry expansion

- Growth in the market may be hampered by electric vehicles' rising semiconductor usage.

Key Players: Xilinx Inc., Nexar Ltd., Infineon Technologies AG, STMicroelectronics N.V., Spirent Communications plc, Continental AG, NVIDIA Corporation, Aptiv plc, Intel Corporation.

Global Vehicle Networking Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.95 billion

- 2026 Market Size: USD 2.13 billion

- Projected Market Size: USD 5.15 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Vehicle Networking Market Growth Drivers and Challenges:

Growth Drivers

-

Surge in automobile production - The vehicle networking market is anticipated to grow as a result of the rise in auto production. The process of creating automobiles, including cars, buses, trucks, and other motor vehicles, is known as automobile manufacture. The more cars that are produced, the more opportunities there are to add cutting-edge connection features to cars. Vehicle networking encompasses a variety of technologies, including infotainment systems, telematics, and vehicle-to-vehicle (V2V) communication. For instance, 79.1 million motor cars were produced globally in 2021, a rise of 1.3%, according to the European Automobile Manufacturers Association, the primary standards-setting and lobbying organization for the automotive industry, which is headquartered in Belgium. Furthermore, from April 2021 to March 2022, the Indian automobile industry produced a total of 22.93 million vehicles, including passenger cars, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, according to Invest India, a national agency for the promotion and facilitation of investment in India.

- Increase in demand for autonomous vehicles - The vehicle networking market is expanding due to the rising need for autonomous vehicles. Self-driving cars, or autonomous cars, are automobiles that can navigate and function without the need for human help. In the market, autonomous cars are becoming more and more popular since they may increase efficiency, convenience, and safety for both drivers and passengers.

- Developments in vehicle networking technology - One major trend that is becoming more and more popular in the market is technological developments. Large market players usually concentrate on technology developments in order to stay competitive by implementing new technologies. Autonomous driving is made possible by the new Ethernet device, which also introduces the next generation of automotive architectures and standardizes in-car video distribution across a range of domains. This includes an inventive portfolio of data infrastructure semiconductor solutions that cover computing, networking, security, and storage.

Challenges

-

Absence of infrastructure for autonomous mobility to hamper industry expansion - Autonomous and connected vehicles make extensive use of vehicle networking components. Upgrading the current infrastructure consistently is necessary for the introduction of autonomous vehicles. Particularly in emerging and impoverished nations, the absence of infrastructure for autonomous mobility may impede the growth of the vehicle networking market. Additionally, the integration of car networking technologies may be delayed by problems with inadequate government financing and bad road infrastructure.

- Growth in the market may be hampered by electric vehicles' rising semiconductor usage.

- The high initial cost of vehicle networking systems is the main factor reducing the revenue of the market.

Vehicle Networking Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 1.95 billion |

|

Forecast Year Market Size (2035) |

USD 5.15 billion |

|

Regional Scope |

|

Vehicle Networking Market Segmentation:

Connectivity Standards

The local interconnect network in the vehicle networking market is estimated to gain the largest revenue share of about 35% in the year 2035. The segment growth can be credited to because local interconnect network is intended to be a single wire bus with flexibility, affordability, and tolerance, it may be implemented with less complexity and expense. At least 12 local interconnect network nodes for power windows and other car components are found in the majority of new cars. Moreover, local interconnect network is widely used for communication between ECUs in less important automotive systems such as window control, seat control, and interior illumination. Its cost, low power consumption, and ease of use make it suitable for entry-level and mid-range cars.

Further, the increased customer desire for luxury amenities, comfort, and convenience in their automobiles is expected to drive up demand for local interconnect network-based networks for in-cabin systems driving the market. In 2021, there was a 3% year-over-year growth in the production of motor cars, with around 80 million vehicles produced worldwide.

Vehicle Type

The passenger vehicle networking market projected to gain the largest revenue share of about 30% in the year 2035. The growth of segment is owing to consumer demand for entertainment systems, networking features, and advanced driver assistance systems (ADAS) in passenger cars increases, vehicle networking is becoming more and more common. Besides this, the integration of smartphones, tablets, and other smart devices for entertainment, communication, and navigation into in-car networks is also contributing to the growth of this market. As consumers' desires for cutting-edge automotive technologies grow and connected cars gain popularity, there will likely be a greater need for in-vehicle networks in passenger automobiles.

Our in-depth analysis of the vehicle networking market includes the following segments:

|

Vehicle Type |

|

|

Connectivity Standards |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vehicle Networking Market Regional Analysis:

North America Market Insights

North America industry is expected to account for largest revenue share of 34% by 2035. The market growth in the region is also expected owing to the region being home to numerous large automotive and technology industries, which increases vehicle networking market’s demand. The market for vehicle networking is projected to be driven by the region's growing adoption of advanced driver assistance systems (ADAS), electric vehicles (EVs), and connected auto technologies. In 2023, there were almost 1.6 million electric vehicles sold in the United States, a 60% increase over the 1 million sold in 2022.

European Market Insights

The Europe region will also encounter enormous growth for the vehicle networking market during the forecast period and will hold the second position. This is owing to the increasing financing to support the electrification and decarbonization of vehicles in this region. Further influencing the adoption of vehicle network communication solutions will be the strong industrial presence in the region, which includes, among others, Melexis AG and Infineon Technologies. Moreover, the region is well known for its advanced automotive manufacturing abilities and has a sizable market for luxury and high-end automobiles.

Vehicle Networking Market Players:

- NXP Semiconductors

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Xilinx Inc.

- Nexar Ltd.

- Infineon Technologies AG

- STMicroelectronics N.V.

- Spirent Communications plc

- Continental AG

- NVIDIA Corporation

- Aptiv plc

- Intel Corporation

Recent Developments

- Nexar Ltd. completed the acquisition of Veniam, a software startup with headquarters in the US that offers car networking services. Through this acquisition, Nexar hopes to provide OEMs with an improved platform that will hasten the adoption of mobility applications that are rich in data.

- NXP Semiconductors has introduced the S32G GoldVIP to assist in addressing real-time and application development issues of software-defined vehicles. This innovative architecture for vehicle integration offers several benefits for software development, quick prototyping, and S32G processor evaluation. S32G performance is available right out of the box with resource monitoring and real-time use cases.

- Report ID: 6010

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vehicle Networking Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.