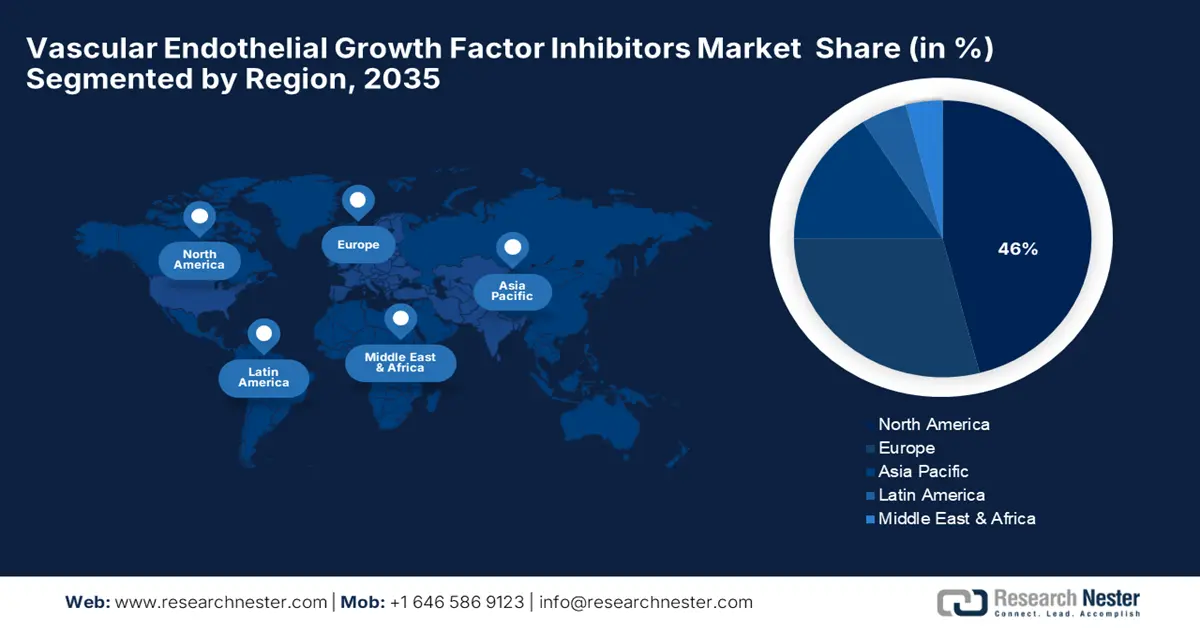

Vascular Endothelial Growth Factor Inhibitors Market - Regional Analysis

North America Market Insight

The vascular endothelial growth factor (VEGF) inhibitors market in North America is expected to hold the highest market share of 46% within the forecast period due to the high prevalence of cancer and retinal disorders, and strong availability of FDA-approved biologics. The region also benefits from a highly advanced healthcare infrastructure and hefty R&D investments. Government initiatives, such as NIH funding for anti-VEGF therapies, continue to promote innovation, particularly in research on cancers and vision. Through public-private partnerships, the development of biosimilars and clinical trials comes faster. Also, newer VEGF inhibitors are hitting the market with the FDA quicker due to fast-track designation and regulatory flexibility.

The market in the U.S. is growing due to broad insurance coverage, high diagnosis rates, and early adoption of biosimilars. Leading pharma players and frequent product approvals also drive market expansion. As per a report by NCI May 2025, the cancer death rate (cancer mortality) is 145.4 per 100,000 men and women per year in the U.S. This alarming incidence fuels demand for anti-angiogenic treatments such as bevacizumab and ramucirumab, which are standard therapies for several solid tumors. Additionally, significant investments by institutions in oncology research are accelerating the development of next-generation VEGF-targeted therapies.

The inhibitors market in Canada is growing due to continued innovation in biologics and biosimilars and a growing elderly population. Additionally, favorable reimbursement and clinical trial activities support growth. As per a report by Statistics of Canada in April 2022, in the last five years, about 861,000 individuals aged 85 and above have been enumerated in Canada. Being on the older side of the population curve, such patients are more vulnerable to age-related diseases such as macular degeneration and other cancers, conditions that are mainly treated using VEGF inhibitors. As the government healthcare programs provide access to these therapies to a broad population, they create larger adoption rates.

Asia Pacific Market Insight

The vascular endothelial growth factor inhibitors market in the Asia Pacific is expected to hold the fastest-growing market within the forecast period due to the rising incidence of diabetes-related eye disorders and cancer. There are increases in regional growth due to the expansion of healthcare access and generic drug manufacturing. During recent years, the biosimilar VEGF inhibitors have seen increasing approvals in the region, thus enhancing affordability and availability. The key markets, China, India, and South Korea, are pouring investments into clinical trials and local production facilities. Moreover, numerous collaborations exist between multinational pharmaceutical companies and local manufacturers, which are augmenting the pace of market expansion.

The market in China is growing due to government expenditure on oncology and ophthalmology treatment, and increasing approvals of biosimilars. The manufacturing capacity is also reducing the cost of drugs. According to a report by NLM in September 2024, in China, increasing numbers of oncology drugs manifested annually, accounting for 49.2% of all early-phase clinical trials in 2022. Endocrine and hematologic trials also increased consistently, accounting for about 8.5% and 5.3% of all early-phase clinical trials in 2022. Additionally, government support for biotech innovation has driven a boom in domestic development of VEGF inhibitors, with it being one of the fastest-growing markets in the Asia-Pacific region.

The market in India is growing due to a huge number of diabetics susceptible to retinopathy and growing demand for affordable biologics. Growing upscaling of specialty hospitals and public health programs also propels adoption. As per a report by NLM, 2025 May, the prevalence of diabetes in adults in India has been estimated at 6.5%. NCDs account for approximately 60% of India's overall mortality, with diabetes, hypertension, and obesity being particularly prevalent. Increased government initiatives to increase the availability of diabetes care and rising awareness about diabetic eye disease are further driving market development. Moreover, the launch of cost-effective biosimilars is improving access to a broader patient base.

Export and Import of Ophthalmic Instruments and Appliances (2023):

|

Country |

Exports |

Imports |

|

Japan |

498 million |

249 million |

|

Singapore |

197 million |

88.8 million |

|

China |

182 million |

962 million |

|

Israel |

102 million |

31.2 million |

|

South Korea |

89.7 million |

106 million |

Source: OEC, 2023

Europe Market Insight

The vascular endothelial growth factor (VEGF) inhibitors market in Europe is expected to grow steadily within the forecast period due to a mature regulatory framework, strong presence of biosimilar producers, and aging demographics. Public health policy and research drive access and innovation. Public health policy and research mandates access and innovation. The European Medicines Agency (EMA) approved several biosimilar versions of bevacizumab, increasing treatment and affordability across the region. Germany and the UK also experienced a steady rise in anti-VEGF therapy prescriptions due to increasing use in oncology and ophthalmology. The developed healthcare infrastructure enables widespread use of VEGF inhibitors.

The vascular endothelial growth factor inhibitors market in the UK is growing due to a well-developed NHS system, allowing for broad adoption of anti-VEGF therapies. Additional impetus to market penetration is also offered by early access programs and clinical trials. According to a report by the Government of the UK, May 2023, a £5.4 billion (USD 6.7 billion) funding deal up to March 2022, of which £1 billion (1.24 billion) is elective activity, focusing on cancer treatment, had been made. £500 million (USD 620 million) billion in capital investment was also made for upgrading hospital infrastructure and facilities for more sophisticated treatments such as VEGF inhibitors. The early adoption of biosimilars and the NHS systematic cancer care pathway also further increases market penetration.

The market in Germany is growing due to high healthcare expenditure, extensive ophthalmology and oncology infrastructure, and favorable reimbursement models. Diseases such as colorectal cancer, lung cancer, and age-related macular degeneration are carefully monitored through national health databases. As per a report by NLM April 2023, statistical analyses include the mean and standard deviation of age at primary diagnosis, 5-year overall survival rates with 95% confidence intervals, and the percentage of female patients as an indicator of gender distribution and an estimator for cohort coverage. This level of stratification ensures precision in treatment planning, supports the evaluation of therapeutic outcomes, and informs regulatory and reimbursement decisions.