Vegan Food Market Outlook:

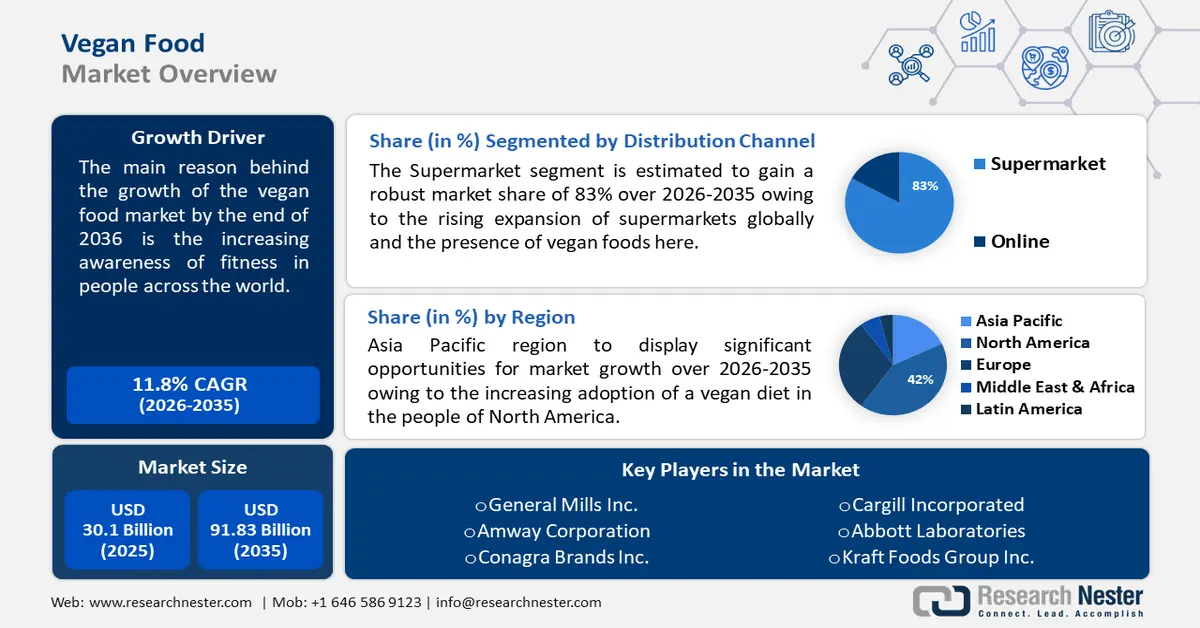

Vegan Food Market size was over USD 30.1 billion in 2025 and is projected to reach USD 91.83 billion by 2035, growing at around 11.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vegan food is evaluated at USD 33.3 billion.

The reason behind the growth is the increasing awareness of fitness in people across the world. According to the National Library of Medicine published in 2023, public health initiatives have been put into place to raise awareness of the recommendations and to inform the general public about the many advantages of physical exercise.

Key Vegan Food Market Insights Summary:

Regional Highlights:

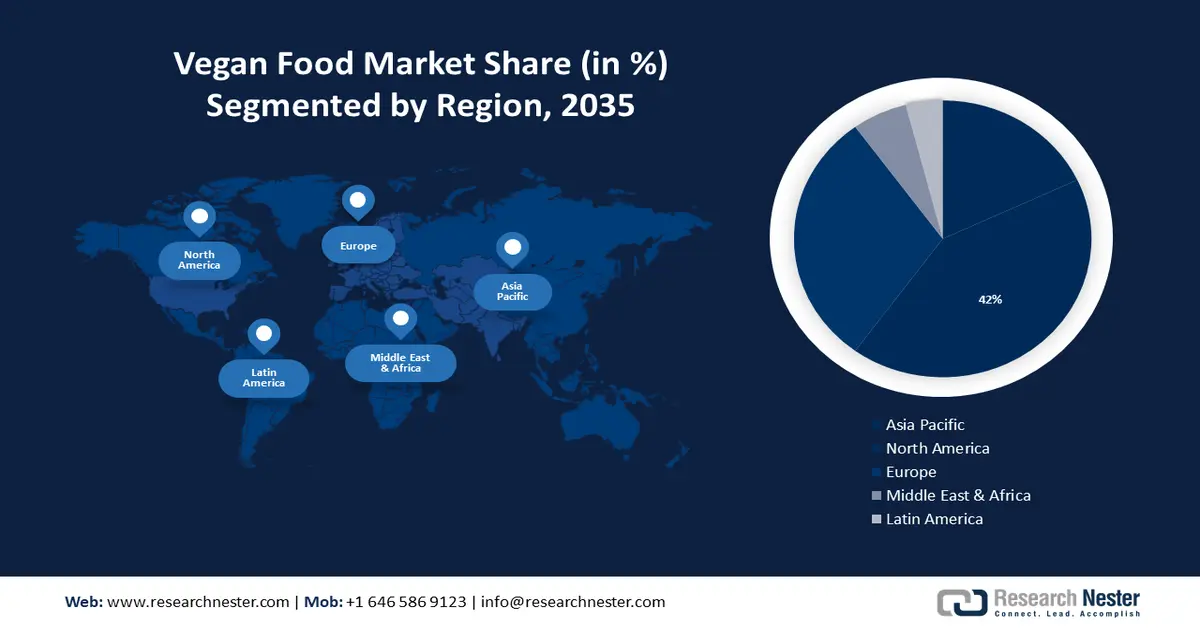

- North America vegan food market achieves a 42% share by 2035, driven by increasing adoption of vegan diets and lactose intolerance prevalence.

- Europe market will experience considerable CAGR during 2026-2035, driven by the increasing trendiness of veganism and product launches by popular brands.

Segment Insights:

- The supermarket segment in the vegan food market is anticipated to secure an 83% share by 2035, driven by the growing number of supermarkets globally and the rising popularity of vegan cuisine.

- The alternative dairy products segment in the vegan food market is expected to achieve significant growth till 2035, attributed to the popularity of soy and almond milk products and the rise in lactose sensitivity.

Key Growth Trends:

- Increasing physical inactivity in high-income countries

- Rising awareness of animal life in the food industry

Major Challenges:

- Excessive price of vegan food

- Limited research to support health benefits

Key Players: General Mills Inc., Amway Corporation, Conagra Brands Inc., Cargill Incorporated, Abbott Laboratories, Kraft Foods Group Inc., The Coca-Cola Company, PepsiCo Inc., Atkins Nutritionals Inc., Brunswick Corporation, NIPPN CORPORATION, Danone S.A, Beyond Meat, Eden Foods Inc., SunOpta.

Global Vegan Food Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.1 billion

- 2026 Market Size: USD 33.3 billion

- Projected Market Size: USD 91.83 billion by 2035

- Growth Forecasts: 11.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Vegan Food Market Growth Drivers and Challenges:

Growth Drivers

- Increasing physical inactivity in high-income countries - The unhealthy lifestyle and inactivity in the people of high-income countries increase the risks of chronic diseases in people. Moreover, according to the World Health Organization, surveyed in 2023, 27% of adults and more than 80% of adolescents globally do not engage in the required amounts of physical exercise.

As a result, people turn to the healthier option and become vegan. Moderate exercise and a healthy vegan diet have been shown to reduce body fat. This is linked to an increase in endurance due to an enhanced capacity to use oxygen to drive movement.

- Increasing number of people becoming vegan recently - In 2023, around 3% of German consumers aged 18 to 64 who responded to the survey ate a vegan diet. Approximately 2-4 % of respondents in the United States, Brazil, China, and Mexico followed a vegan diet. India is a notable exception since more than 10% of participants reported generally adhering to a vegan diet and alternative protein. Four quarterly rounds of the study were conducted among internet users.

In 2022, over 700,000 individuals from nearly every nation in the world signed up for the Veganuary campaign, which encourages people to eat vegan for the whole month of January. This campaign had record-breaking sign-ups.

- Rising awareness of animal life in the food industry - Customers are being encouraged to switch to plant-based food items as a result of growing knowledge of animal abuse and health issues in the food business. The vegan diet is becoming more and more popular in the US, Australia, New Zealand, the UK, Ireland, Israel, and Canada, among other countries.

Livestock and fish output are expected to rise by 14% between 2020 and 2030, according to estimates from the OECD and the Food and Agriculture Organization (FAO) of the United Nations. In order to satisfy sustainable production targets, a significant portion of this increase will need to be attained through increases in productivity in currently operating herds. Enhancing health management to lower livestock losses and boost productivity is a crucial component of this sustainable strategy.

Challenges

- Excessive price of vegan food - The vegan food business across the world will notice a setback due to the constantly increasing price of vegan products. Conventional food items are more readily available and hence more affordable, particularly in comparison to vegan meals. The price of finished goods that are made with vegan ingredients such as vegan milk and desserts is further raised.

- Limited research to support health benefits - The scant scientific evidence supporting the claims made for the vegan diet is foreseen to pose a threat to the worldwide vegan food market.

Multiple factors that show the side effects of taking vegan products over an expanded period on a person’s health have been documented worldwide. Additionally, it is recommended that pregnant women and anyone with certain health issues speak with medical specialists before beginning any kind of diet regimen.

Vegan Food Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.8% |

|

Base Year Market Size (2025) |

USD 30.1 billion |

|

Forecast Year Market Size (2035) |

USD 91.83 billion |

|

Regional Scope |

|

Vegan Food Market Segmentation:

Product Segment Analysis

Meat & seafood segment is predicted to account for vegan food market share of around 36% by 2035. Growing demand for plant-based meat in developed countries like the US and the UK will drive the global desire for vegan cooking.

For instance, the PLANeT Partnership, a joint venture between PepsiCo Inc. and Beyond Meat, a company that produces plant-based meat, was announced in 2021. Its goal is to develop, create, and sell novel snacks and beverages made from plant-based protein. PepsiCo will leverage Beyond Meat's technology, and Beyond Meat will benefit from PepsiCo's experience in the production and marketing of new products.

Substitution Type Segment Analysis

In vegan food market, alternative dairy products segment is estimated to capture revenue share of over 60% by 2035. This growth will be caused by the fashionability of bend-over soy and almond milk products as well as the rise in people's lactose sensitivity.

According to a significant study published in the Lancet Gastroenterology and Hepatology in 2023, there are huge global variations in the prevalence of lactose malabsorption—from 4 in Denmark to over 100 in China and among Native Americans.

Distribution Channel Segment Analysis

By 2035, supermarket segment is likely to hold vegan food market share of more than 83%, due to the growing number of supermarkets sprouting up throughout the world and the popularity of vegan cuisine. Moreover, even with the development of supermarkets, convenience stores, and other contemporary models, the average African consumer still purchases over 70% of their food, drinks, and personal hygiene items from the more than 2.5 million small, independent businesses on the continent.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Distribution Channel |

|

|

Source |

|

|

Substitution Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vegan Food Market Regional Analysis:

North American Market Insights

North America industry is predicted to hold largest revenue share of 42% by 2035. This increase will be noticed in large part because more people in North America are beginning to adopt a vegan diet. In the modern world, eating a diet centered around factories is still fashionable. The National Library of Medicine estimated the ten years’ data and found that between 2014 and 2024, the likelihood of insectivores in North America grew by 601.

Because more Americans are getting lactose intolerant, the request for vegan cookery has grown in the U.S. The American College of Gastroenterology reports that 20 percent of adult Caucasians and 90 percent of adult African Americans in the US are lactose intolerant, which has led to an increase in demand for vegan cooking.

Growing type II diabetes rates and increased desire for factory-grounded diets are the main reasons for the rise of vegan cooking in Canada. In a prospective 10-time case-cohort investigation performed in the year 2023 comprising over 400,000 individuals, the National Library of Medicine established an inverse association between the diurnal input of fruits and vegetables and the occurrence of type II diabetes mellitus.

European Market Insights

It is expected that vegan food market will grow considerably throughout Europe by 2035. The increasing trendiness of veganism is driving up the demand for vegan meals in this area. Actually, as vegan cuisine gains popularity, well-known coffee shops like Domino's and Starbucks have launched vegan menu options across the European Union.

For instance, consumers in European countries may now select between dairy substitutes made of almond, soy, and coconut. Throughout much of European countries, the Pumpkin Spiced Latte has frequently been offered as a vegan alternative. The soy-grounded Vegan Whipped Beating was introduced in 2021 as a factory-grounded whipped cream option for visitors.

In the UK, there is an increasing demand for vegan cooking due to the fact that fewer people are using animals as food. 46 British respondents, aged 16 to 75, stated in a 2022 Bean survey that they would think about ingesting smaller beast products.

Italy will see a sharp increase in the vegan food industry due to the increased demand for factory-grounded meat and factory-grounded meat created through 3D printing. In June 2021, a survey found that Italian customers preferred factory-grounded beef products such as burger galettes, with 41 percent saying they would be willing to purchase them from retailers.

The increasing popularity of vegan diets in Germany will lead to a flourishing vegan food scene. A study from the American Department of Agriculture in 2023 states that 1.58 million Germans are insectivores.

Vegan Food Market Players:

- General Mills Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amway Corporation

- Conagra Brands Inc.

- Cargill Incorporated

- Abbott Laboratories

- Kraft Foods Group Inc.

- The Coca-Cola Company

- PepsiCo Inc.

- Atkins Nutritionals Inc.

In order to create and launch new vegan product variations, businesses are investing in expanding their manufacturing and technological capacities. A few of the key players in the vegan food market are:

Recent Developments

- General Mills Inc. revealed on April 30, 2024, that it had successfully acquired Edgard & Cooper, a prominent independent premium pet food brand in Europe. Through this deal, the business expands on its Accelerate strategy, which prioritizes its core markets, international platforms, and regional jewel brands in order to generate long-term, profitable growth and superior shareholder returns.\

- Conagra Brands, Inc., one of the top manufacturers of branded foods in North America, is bringing a ton of snacks on a road trip to Indianapolis on May 13, 2024, to attend the National Confectioners Association's 2024 Sweets & Snacks Expo. Conagra boasts an incredible USD 3.2 billion snack portfolio that includes delicious salty nibbles, meaty fuel-ups, and delectable sweet sweets.

- Report ID: 6172

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vegan Food Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.