Vacuum Insulated Pipe Market Outlook:

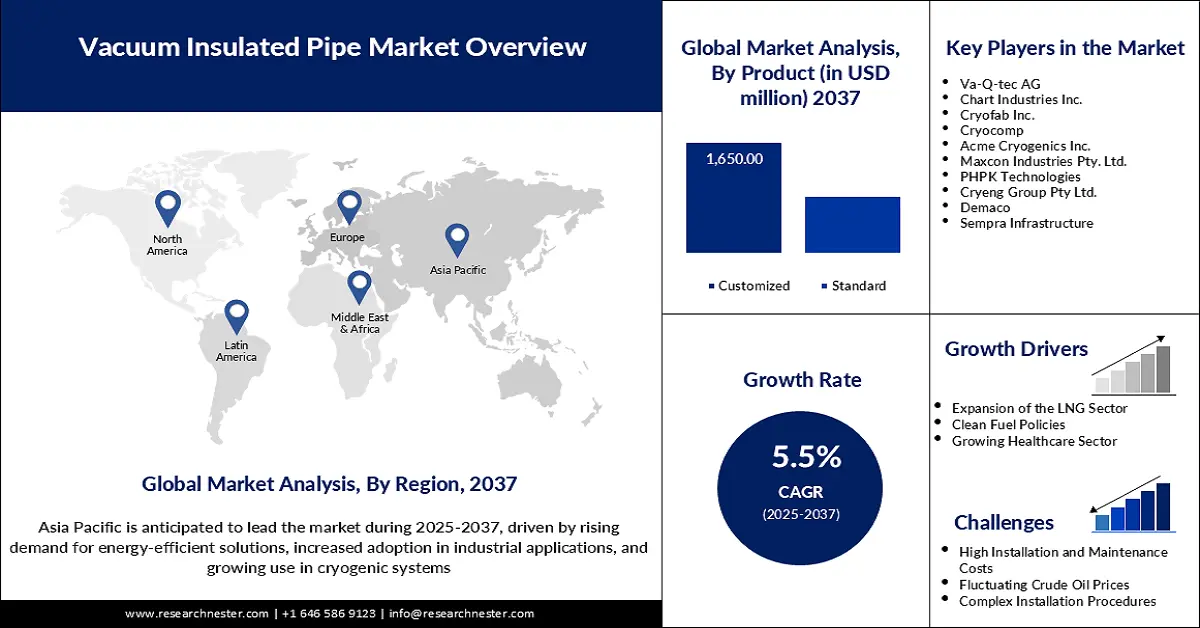

Vacuum Insulated Pipe Market size was valued at USD 1.2 billion in 2024 and is projected to reach a valuation of USD 2.4 billion by the end of 2037, rising at a CAGR of 5.5% during the forecast period, i.e., 2025-2037. In 2025, the industry size of vacuum insulated pipe is estimated at USD 1.3 billion.

The increased demand for sophisticated cryogenic transport solutions in various industrial areas is driving growth in the vacuum insulated pipe market. This expansion is owing to the increased need for the transportation of cryogenic liquids, including LNG, liquid nitrogen, and liquid hydrogen, with minimum heat transfer over long distances. The healthcare, aerospace, and food and beverage industries are looking towards VIP systems to maintain the low operating temperatures required for their operations. For example, the guidelines provided by the Asia Industrial Gases Association state that medical bulk oxygen supply systems within healthcare facilities operate based on cryogenic liquid that is stored in both stationary vessels and portable liquid cylinders, which are vacuum-insulated to ensure the safe maintenance of low operating temperatures that are required to facilitate the usage of medical-grade oxygen. These systems are to be sized depending on the facility demand and rate of delivery. The primary, secondary, and reserve sources are to be designed in such a way that there is never an interruption in supply; this fundamental dependency on the use of vacuum-insulated pipes in bulk medical oxygen delivery directly leads to their adoption and increase in the health sector.

Moreover, the increase in the LNG infrastructure and the current transformation to clean energy solutions are stimulating the demand for VIPs. For instance, the Hydrogen Strategy of British Columbia aims to create a hydrogen economy that is the best globally by 2050 by utilizing more than 98% of renewable electricity and low-carbon hydrogen production to cut down on emissions by 7.2 megatons per year, which is 11% of the yearly 2018 emissions across the province.

The strategy incorporates the development of hydrogen liquefaction, distribution, and transmission infrastructure, which in effect catalyzes the expansion of vacuum-insulated pipe systems vital in the safe transportation and storage of cryogenic liquid hydrogen at low temperatures. Government backing and regulation frameworks are playing a significant role in the development of the vacuum insulated pipe market. The Hydrogen Strategy Progress Report (May 2024) in Canada highlights the potential investment of well over 100 billion dollars in 80 low-carbon hydrogen projects, including hydrogen infrastructure development, which will, in turn, advance the development of vacuum-insulated pipe systems that are needed to safely and efficiently transport and store cryogenic hydrogen. The use of vacuum-insulated pipelines eases compliance with regulations and promotes investment in better transport networks. These initiatives demonstrate the increased appreciation of VIPs as important players in contemporary energy and industrial activities.

The vacuum-insulated pipes (VIPs) material supply chain is closely associated with grade stainless steel, specialty alloys, multilayer insulated foils, vacuum jackets, and precision welding assemblies. With the rise in the global demand for VIPs due to the increase in cryogenic storage, LNG infrastructure, and industrial gas usage, there has been an increase in pressure on the costs of the inputs. In the US, the Producer Price Index (PPI) of Fabricated Pipe and Pipe Fitting Manufacturing increased to 464.6 in August 2025, signifying an increase in producer prices of major materials and components used to manufacture VIP. This inflation of costs is in tandem with the augmented manufacturing process to serve the scaling VIP demand in the industries.