Vacuum Insulated Pipe Market

- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Regional Synopsis

- DROT

- Drivers

- Restraints

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Va-Q-tec AG

- Chart Industries Inc.

- Cryofab Inc.

- Cryocomp

- Acme Cryogenics Inc.

- Maxcon Industries Pty. Ltd.

- PHPK Technologies

- Cryeng Group Pty Ltd.

- Demaco

- Sempra Infrastructure

- Ongoing Technological Advancements

- SWOT Overview

- Analysis On Industrial Gases Used In Semiconductor Manufacturing

- Porter Five Forces Analysis

- Type Analysis

- North America Vacuum Insulated Pipe Market – Industry Breakdown

- North America Vacuum Insulated Pipe Market – Key Applications & Use Cases

- Industry-Specific Challenges & Solutions

- Strategic Initiatives Taken By Key Player

- Material Analysis

- PESTLE Analysis

- Recent Developments

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Global Segmentation (USD Million), 2019-2037, By

- Type, Value (USD Million)

- Vacuum Insulated pipe (Not jacketed) –Straight pipe

- Vacuum Insulated pipe (Not jacketed) –Flexible hose

- Vacuum Jacketed Pipe – Straight pipe

- Vacuum Jacketed Pipe – Flexible hose

- Product, Value (USD Million)

- Standard

- Customized

- Material, Value (USD Million)

- Stainless Steel

- Copper

- Aluminum

- Others

- End user, Value (USD Million)

- Cryogenic Industry

- Liquefied Natural Gas (LNG)

- Industrial Gases

- Healthcare & Research

- Food & Beverage Industry

- Cold Storage & Refrigeration

- Beverage Industry

- Cold Chain Logistics

- Aerospace Industry

- Cryogenic Fuel Storage & Transfer

- Aircraft Systems

- Satellite & Space Exploration

- Electronic & Semiconductor Manufacturing

- Semiconductor Fabrication

- Superconducting & Quantum Computing

- Precision Manufacturing

- Pharmaceutical Industry

- Biopharmaceuticals & Cryopreservation

- Pharmaceutical Manufacturing

- Cold Chain & Healthcare Logistics

- Others

- Cryogenic Industry

- Regional Synopsis (USD Million), 2019-2037

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Type, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Type, Value (USD Million)

- Vacuum Insulated pipe (Not jacketed) –Straight pipe

- Vacuum Insulated pipe (Not jacketed) –Flexible hose

- Vacuum Jacketed Pipe – Straight pipe

- Vacuum Jacketed Pipe – Flexible hose

- Product, Value (USD Million)

- Standard

- Customized

- Material, Value (USD Million)

- Stainless Steel

- Copper

- Aluminum

- Others

- End user, Value (USD Million)

- Cryogenic Industry

- Liquefied Natural Gas (LNG)

- Industrial Gases

- Healthcare & Research

- Food & Beverage Industry

- Cold Storage & Refrigeration

- Beverage Industry

- Cold Chain Logistics

- Aerospace Industry

- Cryogenic Fuel Storage & Transfer

- Aircraft Systems

- Satellite & Space Exploration

- Electronic & Semiconductor Manufacturing

- Semiconductor Fabrication

- Superconducting & Quantum Computing

- Precision Manufacturing

- Pharmaceutical Industry

- Biopharmaceuticals & Cryopreservation

- Pharmaceutical Manufacturing

- Cold Chain & Healthcare Logistics

- Others

- Cryogenic Industry

- Country Level Analysis

- U.S.

- Canada

- Mexico

- Type, Value (USD Million)

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Type, Value (USD Million)

- Vacuum Insulated pipe (Not jacketed) –Straight pipe

- Vacuum Insulated pipe (Not jacketed) –Flexible hose

- Vacuum Jacketed Pipe – Straight pipe

- Vacuum Jacketed Pipe – Flexible hose

- Product, Value (USD Million)

- Standard

- Customized

- Material, Value (USD Million)

- Stainless Steel

- Copper

- Aluminum

- Others

- End user, Value (USD Million)

- Cryogenic Industry

- Liquefied Natural Gas (LNG)

- Industrial Gases

- Healthcare & Research

- Food & Beverage Industry

- Cold Storage & Refrigeration

- Beverage Industry

- Cold Chain Logistics

- Aerospace Industry

- Cryogenic Fuel Storage & Transfer

- Aircraft Systems

- Satellite & Space Exploration

- Electronic & Semiconductor Manufacturing

- Semiconductor Fabrication

- Superconducting & Quantum Computing

- Precision Manufacturing

- Pharmaceutical Industry

- Biopharmaceuticals & Cryopreservation

- Pharmaceutical Manufacturing

- Cold Chain & Healthcare Logistics

- Others

- Cryogenic Industry

- Country Level Analysis

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Type, Value (USD Million)

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Type, Value (USD Million)

- Vacuum Insulated pipe (Not jacketed) –Straight pipe

- Vacuum Insulated pipe (Not jacketed) –Flexible hose

- Vacuum Jacketed Pipe – Straight pipe

- Vacuum Jacketed Pipe – Flexible hose

- Product, Value (USD Million)

- Standard

- Customized

- Material, Value (USD Million)

- Stainless Steel

- Copper

- Aluminum

- Others

- End user, Value (USD Million)

- Cryogenic Industry

- Liquefied Natural Gas (LNG)

- Industrial Gases

- Healthcare & Research

- Food & Beverage Industry

- Cold Storage & Refrigeration

- Beverage Industry

- Cold Chain Logistics

- Aerospace Industry

- Cryogenic Fuel Storage & Transfer

- Aircraft Systems

- Satellite & Space Exploration

- Electronic & Semiconductor Manufacturing

- Semiconductor Fabrication

- Superconducting & Quantum Computing

- Precision Manufacturing

- Pharmaceutical Industry

- Biopharmaceuticals & Cryopreservation

- Pharmaceutical Manufacturing

- Cold Chain & Healthcare Logistics

- Others

- Cryogenic Industry

- Country Level Analysis

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Taiwan

- Thailand

- Singapore

- Philippines

- Vietnam

- New Zealand

- Malaysia

- Rest of Asia Pacific

- Type, Value (USD Million)

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Type, Value (USD Million)

- Vacuum Insulated pipe (Not jacketed) –Straight pipe

- Vacuum Insulated pipe (Not jacketed) –Flexible hose

- Vacuum Jacketed Pipe – Straight pipe

- Vacuum Jacketed Pipe – Flexible hose

- Product, Value (USD Million)

- Standard

- Customized

- Material, Value (USD Million)

- Stainless Steel

- Copper

- Aluminum

- Others

- End user, Value (USD Million)

- Cryogenic Industry

- Liquefied Natural Gas (LNG)

- Industrial Gases

- Healthcare & Research

- Food & Beverage Industry

- Cold Storage & Refrigeration

- Beverage Industry

- Cold Chain Logistics

- Aerospace Industry

- Cryogenic Fuel Storage & Transfer

- Aircraft Systems

- Satellite & Space Exploration

- Electronic & Semiconductor Manufacturing

- Semiconductor Fabrication

- Superconducting & Quantum Computing

- Precision Manufacturing

- Pharmaceutical Industry

- Biopharmaceuticals & Cryopreservation

- Pharmaceutical Manufacturing

- Cold Chain & Healthcare Logistics

- Others

- Cryogenic Industry

- Country Level Analysis

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Type, Value (USD Million)

- Middle East and Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Type, Value (USD Million)

- Vacuum Insulated pipe (Not jacketed) –Straight pipe

- Vacuum Insulated pipe (Not jacketed) –Flexible hose

- Vacuum Jacketed Pipe – Straight pipe

- Vacuum Jacketed Pipe – Flexible hose

- Product, Value (USD Million)

- Standard

- Customized

- Material, Value (USD Million)

- Stainless Steel

- Copper

- Aluminum

- Others

- End user, Value (USD Million)

- Cryogenic Industry

- Liquefied Natural Gas (LNG)

- Industrial Gases

- Healthcare & Research

- Food & Beverage Industry

- Cold Storage & Refrigeration

- Beverage Industry

- Cold Chain Logistics

- Aerospace Industry

- Cryogenic Fuel Storage & Transfer

- Aircraft Systems

- Satellite & Space Exploration

- Electronic & Semiconductor Manufacturing

- Semiconductor Fabrication

- Superconducting & Quantum Computing

- Precision Manufacturing

- Pharmaceutical Industry

- Biopharmaceuticals & Cryopreservation

- Pharmaceutical Manufacturing

- Cold Chain & Healthcare Logistics

- Others

- Cryogenic Industry

- Country Level Analysis

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Type, Value (USD Million)

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

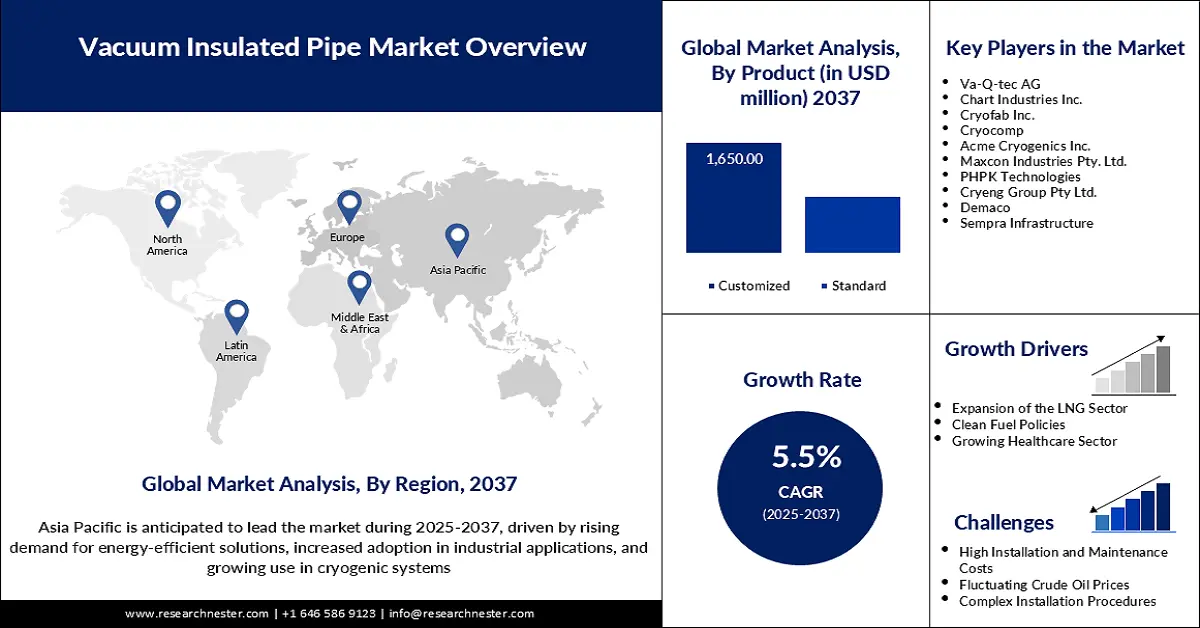

Vacuum Insulated Pipe Market Outlook:

Vacuum Insulated Pipe Market size was valued at USD 1.2 billion in 2024 and is projected to reach a valuation of USD 2.4 billion by the end of 2037, rising at a CAGR of 5.5% during the forecast period, i.e., 2025-2037. In 2025, the industry size of vacuum insulated pipe is estimated at USD 1.3 billion.

The increased demand for sophisticated cryogenic transport solutions in various industrial areas is driving growth in the vacuum insulated pipe market. This expansion is owing to the increased need for the transportation of cryogenic liquids, including LNG, liquid nitrogen, and liquid hydrogen, with minimum heat transfer over long distances. The healthcare, aerospace, and food and beverage industries are looking towards VIP systems to maintain the low operating temperatures required for their operations. For example, the guidelines provided by the Asia Industrial Gases Association state that medical bulk oxygen supply systems within healthcare facilities operate based on cryogenic liquid that is stored in both stationary vessels and portable liquid cylinders, which are vacuum-insulated to ensure the safe maintenance of low operating temperatures that are required to facilitate the usage of medical-grade oxygen. These systems are to be sized depending on the facility demand and rate of delivery. The primary, secondary, and reserve sources are to be designed in such a way that there is never an interruption in supply; this fundamental dependency on the use of vacuum-insulated pipes in bulk medical oxygen delivery directly leads to their adoption and increase in the health sector.

Moreover, the increase in the LNG infrastructure and the current transformation to clean energy solutions are stimulating the demand for VIPs. For instance, the Hydrogen Strategy of British Columbia aims to create a hydrogen economy that is the best globally by 2050 by utilizing more than 98% of renewable electricity and low-carbon hydrogen production to cut down on emissions by 7.2 megatons per year, which is 11% of the yearly 2018 emissions across the province.

The strategy incorporates the development of hydrogen liquefaction, distribution, and transmission infrastructure, which in effect catalyzes the expansion of vacuum-insulated pipe systems vital in the safe transportation and storage of cryogenic liquid hydrogen at low temperatures. Government backing and regulation frameworks are playing a significant role in the development of the vacuum insulated pipe market. The Hydrogen Strategy Progress Report (May 2024) in Canada highlights the potential investment of well over 100 billion dollars in 80 low-carbon hydrogen projects, including hydrogen infrastructure development, which will, in turn, advance the development of vacuum-insulated pipe systems that are needed to safely and efficiently transport and store cryogenic hydrogen. The use of vacuum-insulated pipelines eases compliance with regulations and promotes investment in better transport networks. These initiatives demonstrate the increased appreciation of VIPs as important players in contemporary energy and industrial activities.

The vacuum-insulated pipes (VIPs) material supply chain is closely associated with grade stainless steel, specialty alloys, multilayer insulated foils, vacuum jackets, and precision welding assemblies. With the rise in the global demand for VIPs due to the increase in cryogenic storage, LNG infrastructure, and industrial gas usage, there has been an increase in pressure on the costs of the inputs. In the US, the Producer Price Index (PPI) of Fabricated Pipe and Pipe Fitting Manufacturing increased to 464.6 in August 2025, signifying an increase in producer prices of major materials and components used to manufacture VIP. This inflation of costs is in tandem with the augmented manufacturing process to serve the scaling VIP demand in the industries.

Key Vacuum Insulated Pipe Market Insights Summary:

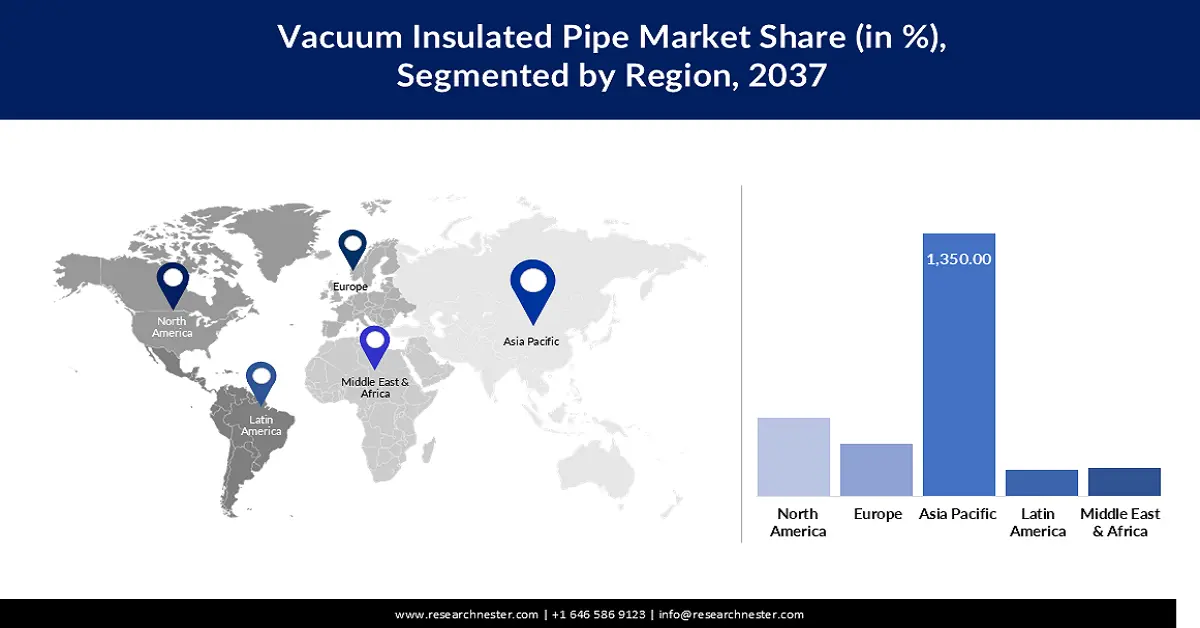

Regional Insights:

- Asia Pacific is projected to lead the vacuum insulated pipe market with a 37% revenue share during the forecast period 2025–2037, fueled by industrial growth and investments in LNG and hydrogen infrastructure.

- North America is expected to witness significant growth with a CAGR of 6.9% from 2025 to 2037, propelled by clean energy initiatives and extensive investments in energy infrastructure.

Segment Insights:

- Customized VIP segment is projected to account for approximately 65% of the vacuum insulated pipe market share during the forecast period 2026–2035, owing to their tailored designs meeting diverse spatial and technical demands in hydrogen delivery infrastructure.

- Stainless-steel segment is expected to hold a 48% share by 2037, driven by its superior mechanical strength, corrosion resistance, and insulating properties in harsh cryogenic environments.

Key Growth Trends:

- Expansion of LNG infrastructure

- Advancements in healthcare and biopharmaceuticals

Major Challenges:

- Technical complexity and maintenance

- Supply chain constraints

Key Players:Chart Industries, Inc., Cryofab, Inc., Demaco Holland BV, Senior Flexonics Inc., Cryotherm GmbH & Co. KG, Hager Industries GmbH, Technifab, Vacuum Barrier Corporation, Cryogas Equipment Pvt. Ltd., Cryogenic Specialty Manufacturing, Thames Cryogenics Ltd., Ability Engineering Technology, Cryocomp, DSI Dantech, Quest

Global Vacuum Insulated Pipe Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 1.2 billion

- 2025 Market Size: USD 1.3 billion

- Projected Market Size: USD 2.4 billion by 2037

- Growth Forecasts: 5.5% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2037)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, South Korea, China

- Emerging Countries: India, Brazil, Australia, Canada, United Arab Emirates

Last updated on : 6 October, 2025

Vacuum Insulated Pipe Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of LNG infrastructure: With the shift towards cleaner choices in global energy policies, there has been a significant increase in the financing of LNG infrastructure projects. The efficient transportation of LNG is dependent on VIPs for their capability to maintain a continuous low temperature and to reduce energy loss significantly during transit. High vacuum multilayer insulation is of great importance to reduce heat transfer and minimize the rate of LNG evaporation during transportation to ensure safe and efficient cryogenic storage. Experimental evidence indicates that LNG tanks with vacuum insulation have a low value of the daily rate of the static evaporation at 0.19% which implies their effectiveness in maintaining the integrity of the LNG. With the increase in LNG infrastructure around the world, the vacuum insulated pipes are also on the rise in terms of demand because of their necessity to keep the LNG at ultra-low temperatures and minimize the energy loss.

- Advancements in healthcare and biopharmaceuticals: The growing use of cryogenic solutions for handling biological products in the growing healthcare sector is increasing demand for VIPs. The Lawrence Berkeley National Laboratory safety manual highlights vacuum-insulated piping as critical to the upholding of the ultra-low temperatures needed to safely store and transport cryogenic gases such as liquid nitrogen, essential in preserving biological specimens and sophisticated therapies within the context of healthcare and biopharmaceuticals. With the expansion of these fields, sensitive biological products are being developed and used, which means that efficient cryogenic infrastructure, like vacuum-insulated pipes, is increasingly required to preserve product integrity and accommodate growing healthcare innovations.

- Growth in semiconductor manufacturing: The uptake of VIP systems is being driven by an increasing need for careful thermal management in semiconductor manufacturing. According to the Semiconductor Industry Association (SIA), the world semiconductor sales were at 179.7 billion in Q2 2025, which is an increase of 7.8% in Q1 2025, and major investments are still underway to increase the chip manufacturing capacity in the United States. This boom in semiconductor manufacturing has led to the usage of VIP systems in fabs, which has been the most accurate thermal control method in improving manufacturing efficiency and yield. The increase in the chip-making capacity, therefore, directly contributes to the escalating need in the semiconductor sector for VIP technology. VIP systems are essential in semiconductor production since they ensure that high-temperature standards are maintained for the production of high-performing chips.

Challenges

- Technical complexity and maintenance: The design of VIP systems is so advanced that only experienced technicians can install and maintain these systems. The complexity of these systems leads to the need for qualified labor and sophisticated diagnostic equipment, causing higher maintenance and operation costs. Furthermore, the fixing of issues in the vacuum insulation layer frequently requires advanced leak detection methods and can lead to machine downtime for a prolonged time. In addition, remediation of defects in the vacuum insulation layer may encounter sophisticated leak-detection techniques (e.g., helium mass spectrometry, acoustic imaging) and may take an extended period to repair. Harsh or remote conditions (offshore, Arctic, desert) cause additional strains on the frequency of integrity checks and maintenance requirements, leading to increased O&M burdens, and service logistics become a major limiting factor.

- Supply chain constraints: The fabrication of vacuum-insulated pipes requires the regular application of modern materials and parts such as high-quality stainless steel, vacuum pumps, and special insulation materials. The fluctuations in global supply and specialized manufacturers' capacity influence the speed at which these vital materials are made available. A dedicated supply chain infrastructure increases the threat of bottlenecks, as any delay in obtaining required components may halt production and influence the project timeline. Any disturbances in material flows, be it caused by logistical delays, geopolitical limitations, or undercapacity on the part of suppliers, can put the vacuum insulated pipe production on its knees and spread throughout the project schedule slippages. All these risks are enhanced due to the potential lack of a sufficient number of qualified vendors of high-vacuum, cryogenic, or specialty alloy-based parts, and the VIP supply chain is especially delicate.

Vacuum Insulated Pipe Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

5.5% |

|

Base Year Market Size (2024) |

USD 1.2 billion |

|

Forecast Year Market Size (2037) |

USD 2.4 billion |

|

Regional Scope |

|

Vacuum Insulated Pipe Market Segmentation:

Product Segment Analysis

The customized VIP segment is anticipated to garner approximately 65% of the vacuum insulated pipe market share during the forecast period. VIPs designed for specific standards enhance efficiency and performance in various sectors. These custom solutions make it easy to integrate into the existing infrastructure, and they meet specific spatial requirements. This ability for customization results in their extensive use in niche industries. According to the Hydrogen Delivery Roadmap published by the U.S. Department of Energy, there exists widespread hydrogen delivery infrastructure, such as pipelines, tube trailers, and cryogenic liquid trucks, that enable the efficient transportation of hydrogen. Having over 2,100 kilometers of dedicated high-pressure vacuum insulated pipes, high-pressure tube trailers, with the capacity to carry up to 600 kg of hydrogen, the infrastructure requires more customized vacuum insulated pipes to accommodate the diverse spatial and technical demands required by the expansion of the hydrogen-related industry, and the fueling of sophisticated energy applications.

Material Segment Analysis

The stainless-steel segment is expected to occupy 48% share of the vacuum insulated pipe market by 2037. The superior mechanical strength, corrosion resistance, and insulating properties of stainless steel make it the preferred material for VIPs in harsh environments. It provides durable performance and reduces maintenance in harsh conditions. The ability of stainless steel to withstand high degrees of temperature variation increases its importance in cryogenic transport. For instance, Brugg Pipes offers vacuum-insulated corrugated stainless-steel piping that is specifically used in cryogenic services. Their pipes are exceptionally durable and low-maintenance in the harsh conditions, with superior superinsulation and a pressure stability of up to 30 bars. These stainless-steel pipes maintain the safe and efficient transportation of cryogenic liquids like liquid hydrogen and LNG, and provide performance and reliability according to the strict requirements of the industry.

End User Segment Analysis

The cryogenic industry segment is expected to grow significantly over the forecast years by 2037, owing to the growing LNG trade, the growing hydrogen economy, and the growth in investments in aerospace, healthcare, and food and beverage. The U.S. National Hydrogen Strategy and Roadmap (June 2023) includes the vision of the extended hydrogen infrastructure development in the U.S., which focuses on mass hydrogen production, transportation, and storage. It aims at scalable delivery systems, such as cryogenic liquid hydrogen, which would necessitate the use of vacuum insulated pipes (VIP) that would be necessary to keep the temperatures low. The roadmap identifies objectives to expand hydrogen application to other sectors by 2030 and beyond to enable VIP growth in cryogenic storage and transport infrastructure needed to support clean energy transitions.

Our in-depth analysis of the vacuum insulated pipe market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Product |

|

|

Material |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vacuum Insulated Pipes Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific is projected to dominate the vacuum insulated pipe market with the largest revenue share of 37% during the forecast period from 2025 to 2037, attributed to the industrial growth and investments in LNG and hydrogen infrastructure. The growing demand for energy and increased focus on the reduction of emissions are enhancing market expansion. Technological advancement and a strong manufacturing industry are also key factors in the significant market share of the region. The ambitious green hydrogen vision of South Korea's goal is to grow hydrogen consumption from 130,000 tons per year to 5.26 million tons per year, with 420,000 jobs through investments of 43 trillion won. The number of hydrogen refuelling stations will grow as the government intends to install 1,200 hydrogen refuelling stations by 2040, compared to the current 24 in 2019, which will require the use of vacuum insulated pipes (VIPs), which could help sustain the transport and storage of cryogenic hydrogen.

The major conglomerate investment in hydrogen technologies in South Korea of $38 billion is boosting the growth of the Asia Pacific VIP market by enhancing hydrogen infrastructures. Moreover, CIMC Enric provides advanced hydrogen refueling stations, which could be safely, efficiently, and scaled to use in transportation that uses hydrogen as a fuel. There is the completion of the modular vacuum-insulated pipe (VIP) modules by the company, which have been installed in more than 100 hydrogen refueling stations around the country, indicating the roaring growth of the infrastructure. This massive application propels the need for VIPs necessary to store and transport cryogenic hydrogen, playing a key role in the development of the vacuum insulated pipe market in the Asia Pacific to facilitate a shift towards clean energy.

The vacuum insulated pipe market in China is predicted to lead the Asia Pacific region with a significant revenue share by 2037, owing to the rising attention to clean energy and industrial development in the country. The market is being propelled by significant investments in LNG terminals and hydrogen production capabilities. In 2024, China would import 78 million tonnes of LNG, up by 9% annually, driving infrastructure growth even as renewables compete. This investment will lead to the development of the market of vacuum-insulated pipes in China, as it will increase the capacity of LNG terminals with the ability to transport liquor in the cryogenic mode. In addition, China had an augmented production of hydrogen capacity of 80.800 tons in October 2023, which exemplifies a fast growth. This increased rate of hydrogen production stimulates the need for vacuum-insulated pipes in cryogenic hydrogen storage and transportation infrastructure in China. Furthermore, favourable government initiatives and commitment to innovative technologies are boosting market growth. For example, in April 2024, China designed ultra-large cryogenic refrigeration equipment with an operational temperature ranging from 20K (liquid hydrogen) to 2K (superfluid helium), to maintain its stable and continuous operation. The invention optimises the vacuum insulated pipe operation in LNG and hydrogen transportation, and fuels the VIP market in growing cryogenic energy infrastructure in China.

India’s vacuum insulated pipe market is expected to grow with the fastest CAGR over the projected years, due to the increasing energy needs of India and its infrastructure initiatives. The commitment of the government to develop natural gas infrastructure as well as to promote clean energy solutions is one of the driving forces behind the increasing adoption of VIPs. For example, India has added 24,623 km of natural gas pipeline to the existing 15,340 km in operation in 2014, and 10,860 km are currently being built. The capacity of LNG terminals increased to 47.7 MMTPA, increasing VIP demand in the cryogenic storage and transport infrastructure. Furthermore, the Indian National Gas Grid presently serves 307 Geographical Areas, which include 100 percent of the population, which is facilitated by pipeline expansion and city gas distribution networks. The vacuum insulated pipe market is powered by this massive expansion of the infrastructure that will make the Indian natural gas and LNG transport and storage safe and efficient by supporting cryogenic transportation and storage across India.

Additionally, increased investments in cryogenic gas use in the industrial and healthcare industries are enhancing the vacuum insulated pipe market growth. The Ministry of Petroleum and Natural Gas has ordered 80 Compressed Biogas plants and requires the use of CBG in the distribution of city gases between 1% and 5% by 202829. The development of pipeline infrastructure and the expansion of geographical coverage areas increase the VIP demand within the clean energy industry of India. This improvement to infrastructure represents an important step towards increasing India's cryogenic transportation infrastructure.

North America Market Insights

The North American market is projected to grow significantly with a CAGR of 6.9% from 2025 to 2037. The commitment of the region to clean energy and advanced manufacturing is increasing the demand for VIP systems. Government promotion and strong investment in the development of energy infrastructure play a key role in maintaining vacuum insulated pipe market growth. For instance, the national energy plan of Mexico envisions the rise in the production of natural gas to more than 5 Bcf/d, compared to 3.5 Bcf/d, by the early 2030s, with mega-projects of pipeline construction envisaged. The presence of infrastructure gaps threatens the growth in the industrial sphere, which would boost the need for VIPs to facilitate effective cryogenic transportation in the area. Moreover, the nation also spends USD 1.75 billion on local industrial content development with an emphasis on such areas as chemicals and petrochemicals, which are dependent on the hydrocarbons provided by PEMEX. It is also backed by investments in energy infrastructure, including renewable energy initiatives worth USD 22.4 billion, which contribute to efficient energy transport, which has a direct influence on market development in the region through the increase of the cryogenic and gas transport capacity. The market's upward trend is largely driven by major industry companies and constant technological advancements. Additionally, the FY 2024 ERCIP guidance details the DoD's interest in energy resiliency initiatives like microgrids and clean energy infrastructure, which facilitates the proliferation of vacuum insulated pipes (VIPs) in North America to support efficient cryogenic and thermal systems. This effort highlights the invaluable role VIPs occupy in essential healthcare and national defense services.

The U.S. vacuum insulated pipe market is anticipated to dominate the North American region with a notable share by 2037, attributed to a boom in investments concerning LNG and hydrogen infrastructure. Increased application of cryogenic technologies in various industries is fuelling growth. In addition, DOE is putting in place deployments across buildings, hydrogen, carbon management, grid, storage, and clean energy infrastructure more quickly, with more than $97 billion invested through the Bipartisan Infrastructure Law and Inflation Reduction Act. This highlights an increasing need for better systems, such as vacuum-insulated pipes, within energy networks. Furthermore, increased safety requirements are pushing the adoption of advanced VIP systems. For example, the PHMSA report of the Freeport LNG accident stated that the violation of safety measures, a vacuum-insulated pipe (VIP) with an 18-inch diameter, exploded, causing a catastrophe.

Part of VIP was contained within the LNG and became hot over a period of five days, raising the pressure from 37 psig to 1,313 psig before the rupture, discharging 10,000 pounds of flammable gas and creating a 450-foot fire that resulted in a 500-foot blast and eventual fire. The incident indicates how important the higher safety systems and monitoring of VIP infrastructure are. Furthermore, US CFR 49 §178.277 provides strict design, construction, and testing requirements on vacuum-insulated portable tanks, such as a pressure of at least 3 bar, triple shut-off valves, and enhanced insulation requirements. These standards promote safety, which promotes the use and expansion of vacuum-sealed pipes in the U.S. energy sector and their cryogenic transportation. These regulations and incentives are set to stimulate the high-speed implementation of VIP technology in energy use.

The market in Canada is likely to grow at a steady rate during the projected years, mainly due to the country’s commitment towards net-zero emissions by 2050, which is fueling the implementation of VIPs. Effective cryogenic transportation systems are needed for hydrogen corridors and LNG export expansion. For instance, the Hydrogen Strategy of Canada has seen projections of 4 MT of hydrogen production by the year 2030, which is expected to contribute to 6% of national power consumption, with more than USD 15 billion in investment and policy. Such expansion requires modernized cryogenic transportation infrastructure, such as vacuum-insulated pipes that allow the development of hydrogen corridors and the expansion of LNG export. Government initiatives and financial support are major contributors to the growth of VIP infrastructure across the country. The Canadian government initiated the Critical Minerals Infrastructure Fund, where the government contributed CAD 1.5 billion across seven years to deal with infrastructure deficiencies in the production of critical minerals.

The investment promotes clean energy and transportation initiatives, which contribute to the development of vacuum-insulated pipe infrastructure, which is vital in the transportation of cryogenic in the Canadian energy buildup. Moreover, the Energy Innovation Program, which involved the allocation of over CAD 319 million by Canada to carbon capture, utilization, and storage (CCUS) projects, such as improved underground CO2 transport and storage facilities. This governmental support helps to create high-tech cryogenic transport systems, such as vacuum-insulated pipes (VIP), which are essential to the expanding low-carbon energy industry in Canada. This initiative demonstrates how VIPs are taking a leading role in helping Canada shift toward clean energy.

Europe Market Insights

The European market is anticipated to expand significantly over the forecast years by 2037, owing to the strict energy efficiency directive of the EU, which aims at reducing final energy consumption by 11.7% by 2030, which will cause investments in energy-efficient infrastructure development, such as VIPs in the transportation of cryogenic gases. In addition, safety standards such as the Pressure Equipment Directive (PED) will ensure that the cryogenic vessels are highly and positively inspected to boost the VIPs uptake in industrial and healthcare sectors. Decarbonization, renewable energy growth, and hydrogen corridors are strategic EU policies that develop VIP demand that is supported by funding programs promoting the rapid transition to clean energy. Regular monitoring of the cryogenic vessels also promotes reliability and safety, and this is what is increasing the VIP market. In 2023, the EU attributed a level of 1,211 Mtoe of primary energy use, representing a 19.9% from the 2006 level and 3.9% lower than 2022, with a 32.5% efficiency goal by 2030. The efficiency development is driving the vacuum insulated pipes requirements in the transport of cryogenic energy in Europe. Additionally, to strengthen VIP infrastructure, the UK government has pledged to create regional hydrogen transportation and storage systems worth more than half a billion dollars by 2031. Moreover, the infrastructure fund of €500 billion in Germany is aimed at infrastructure transition initiatives, thus boosting the investment in VIP-based cryogenic pipelines.

Key Vacuum Insulated Pipe Market Players:

- Chart Industries, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cryofab, Inc.

- Demaco Holland BV

- Senior Flexonics Inc.

- Cryotherm GmbH & Co. KG

- Hager Industries GmbH

- Technifab

- Vacuum Barrier Corporation

- Cryogas Equipment Pvt. Ltd.

- Cryogenic Specialty Manufacturing

- Thames Cryogenics Ltd.

- Ability Engineering Technology

- Cryocomp

- DSI Dantech

- Quest

The vacuum insulated pipe market is highly competitive, with companies focusing on innovation and strategic alliances to improve their vacuum insulated pipe market position. Major players in the vacuum insulated pipe market include Chart Industries Inc., Cryofab Inc., Cryocomp, Acme Cryogenics Inc., Maxcon Industries Pty. Ltd., PHPK Technologies, Cryeng Group Pty Ltd., Demaco, and Sempra Infrastructure. To meet industry demands, these firms are investing in R&D to enhance their product lines. The key players in the vacuum insulated pipes market are focusing on technology to enhance their services. In May 2024, Chart Industries revealed an AI-enabled monitoring platform for VIP systems, which enables real-time monitoring of pressure, heat loss, and fluid movement. The integration of IoT into Chart’s systems enables predictive maintenance and makes the company the pioneer of digital cryogenic infrastructure, demonstrating the industry’s movement towards sophisticated and efficient technologies.

Top Global Vacuum Insulated Pipe Manufacturers:

Recent Developments

- In February 2025, Taylor-Wharton collaborated with GenH2 to provide zero-loss liquid hydrogen storage systems, which remove hydrogen boil-off losses during transfer, storage, and dispensing. Their system incorporates the Controlled Storage technology (developed by NASA) of GenH2 in TaylorWharton cryogenic tanks, allowing active refrigeration and heat extraction to eliminate the 20% to 30% hydrogen losses common to traditional LH2 handling. The combined solution is based on the concept of vacuum-insulated bulk storage facilities, where high-performance vacuum insulation is indispensable to the preservation of cryogenic conditions and the reduction of the heat inflow. Since vacuum insulation is a low-conductance barrier surrounding cryogenic piping and cryogenic tanks, their integration with active refrigeration and heat removal is important to attaining the so-called zero-loss target in the partnership.

- In February 2025, DNV gave HD KSOE an Approval in Principle (AiP) on its vacuum-insulated large-scale liquefied hydrogen (LH2) tank technology. This is a breakthrough in cryogenic storage since it is very difficult to keep very low heat ingress through vacuum insulation in large tanks. The design to be awarded is supposed to utilize the improved vacuum insulation methods that are also the precursors of vacuum-insulated pipes (VIP). This advancement increases confidence in the vacuum insulation of interconnected piping networks in hydrogen and chemical infrastructure by showing that it is viable at scale with LH2 storage. Using the same principles of vacuum insulation (e.g., multilayer insulation, getter systems, and high-vacuum jacket) to VIP systems can enable reduced thermal loss during long tank-to-process unit connections.

- Report ID: 5492

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vacuum Insulated Pipe Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.