Vaccine Contract Manufacturing Market Outlook:

Vaccine Contract Manufacturing Market size was over USD 2.79 billion in 2025 and is projected to reach USD 6.54 billion by 2035, growing at around 8.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vaccine contract manufacturing is evaluated at USD 3.01 billion.

The intensity of life-threatening pandemics and endemics worldwide is inflating the demand for vaccines to combat widespread, creating a surge in the vaccine contract manufacturing market. As the ongoing public health challenges result in massive economic and commercial loss and disparities, the need for mass production of preventive therapeutics leverages. On this note, a clinical study from the Global Health Journal, published in December 2024, revealed that Africa utilizes 25.0% of the total global vaccine resources, whereas its domestic production is only 1.0% (less than 12.0 million). This is evidence of a rising urge for contract services, encompassing all aspects from development to distribution, to fight infectious outbreaks in such regions with high mortality rates and fewer accommodations.

The cost-effectiveness of individual products in this category is crucial to acquire optimum adoption. Thus, many biopharma companies are opting for services from the vaccine contract manufacturing market, based on its reliability and scalability. The offerings help them optimize their payers’ pricing by reducing their operational and production costs. This attracts more pioneers to invest and engage their resources in this field. For instance, in February 2022, BioNTech unveiled its plans to promote scalable vaccine production in Africa by installing a modular mRNA manufacturing facility. In collaboration with the local governing bodies, the company aimed to establish a strong and end-to-end network by offering turnkey services to its partners. In addition, the enlargement of the global business also highlights this field’s significance.

Moreover, the enlargement of the global business also highlights this field’s significance. According to the OEC report, France and Ireland were among the top exporters of human vaccines with the values of USD 4.6 billion and USD 12.3 billion respectively in 2023. The report also mentioned the emerging marketplaces such as China and Japan with significant import values of USD 8.3 billion and USD 2.5 billion respectively in the same year.

Country-wise Import-Export Data for Human Vaccines (2023)

|

Country |

Export (USD, million) |

Import (USD, million) |

|

Belgium |

15,300 |

13,200 |

|

Germany |

3,210 |

4,470 |

|

U.S. |

8,590 |

5,320 |

Key Vaccine Contract Manufacturing Market Insights Summary:

Regional Highlights:

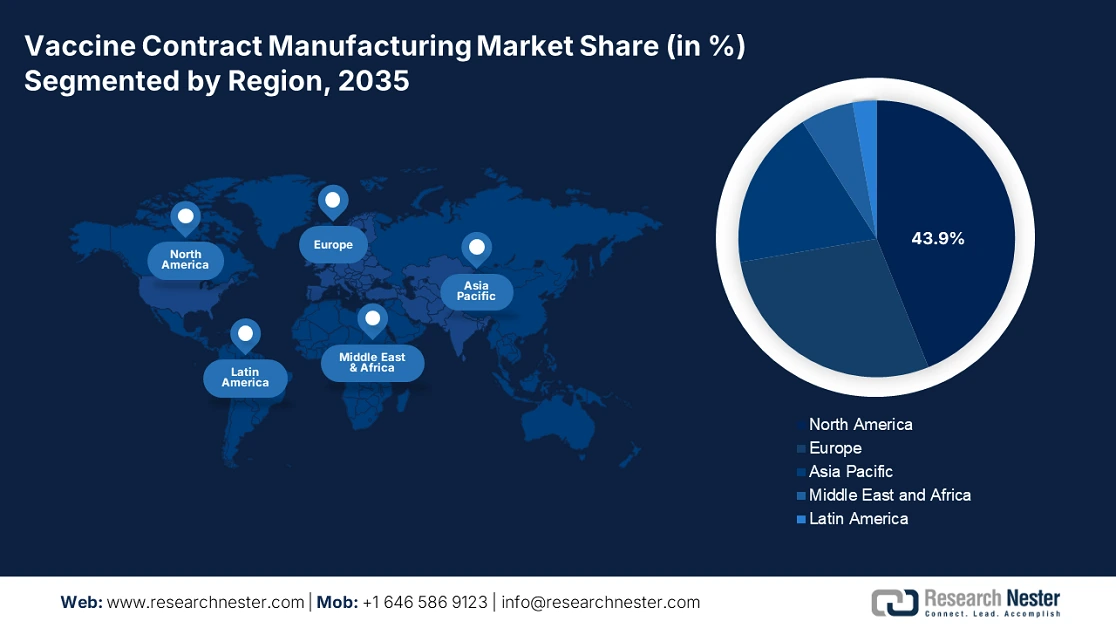

- North America dominates the Vaccine Contract Manufacturing Market with a 43.9% share, fueled by excellence in biologics innovations and cultivation, alongside rising demand in the veterinary segment, supporting growth through 2035.

- Asia Pacific’s vaccine contract manufacturing market anticipates rapid growth by 2035, fueled by the existing culture of large-scale pharmaceutical fabrication in the region.

Segment Insights:

- The attenuated vaccine type segment is projected to capture over 30.1% market share by 2035, driven by its long-acting efficacy and rapid fabrication for various viral infections.

Key Growth Trends:

- Impact of COVID-19 on the boom in biologics

- Inspirational achievements of global leaders

Major Challenges:

- Complexity and volatility in manufacturing

- Disruptions in hiring and sourcing essentials

- Key Players: Lonza, Merck KgaA, ICON plc., FUJIFILM Diosynth Biotechnologies, Inc., Moderna, Inc..

Global Vaccine Contract Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.79 billion

- 2026 Market Size: USD 3.01 billion

- Projected Market Size: USD 6.54 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Singapore, South Korea, Brazil

Last updated on : 13 August, 2025

Vaccine Contract Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

-

Impact of COVID-19 on the boom in biologics: The recent pandemic has pointed out the importance of the availability and accessibility of these biological products. People and governments around the globe are now more aware of taking preventive measures to restrict the spread. For instance, in June 2024, WACKER inaugurated a new competence center for large-scale manufacturing of APIs for mRNA COVID-19 vaccines with an investment of USD 104.7 million.

- Inspirational achievements of global leaders: Key players in the vaccine contract manufacturing market are inspiring other pharma producers to participate by securing a good profit margin. For instance, ICON Inc., which is a global contract development and manufacturing organization (CDMO) for biologics, revealed its complete 2024 revenue to be USD 8.2 billion, with a 2.0% annual increment. The company also celebrated a quarterly GAAP net income of USD 260.0 million in FY24, showcasing a significant 21.5% escalation from the same timeframe in 2023. As these figures magnify, replicating the wide spectrum of opportunities lying in this field, the tendency to expand their drugs and components fabrication and supplying capacity inflates.

Challenges

-

Complexity and volatility in manufacturing: Producing effective products in a budget and time-constraint scenario may still be a hurdle for the vaccine contract manufacturing market. In many cases, the process faces disparities in regulatory approvals and bioavailability, which may complicate the business terms for both service providers and consumers. This is also often from a dispute over intellectual property and confidentiality concerns. Thus, the combined forces are a major challenge for maintaining steady growth in this sector.

- Disruptions in hiring and sourcing essentials: The complexity of operations in the vaccine contract manufacturing market also brings an issue, revolving around the shortage of skilled lab operators. Finding the right personnel with sufficient knowledge and laboratory experience may become hard for employers, as this field is still under development. In addition, this market frequently witnesses consequences of disruptions in the raw material supply chain, which may slow production and delay delivery, loosening consumer faith and interest.

Vaccine Contract Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 2.79 billion |

|

Forecast Year Market Size (2035) |

USD 6.54 billion |

|

Regional Scope |

|

Vaccine Contract Manufacturing Market Segmentation:

Vaccine Type (Attenuated, Inactivated, Subunit-based, Toxoid-based, DNA-based)

Attenuated segment is set to capture over 30.1% vaccine contract manufacturing market share by 2035. The long-acting efficacy and fast fabrication abilities are attractive for leaders, as this form of immunization features utility in various viral infections. Further, the frequent appearance of these endemics is boosting the usage of attenuated antidotes. Additionally, the severity of these outbreaks also forces public and private investors to prioritize this segment. For instance, in June 2024, the vaccine alliance, Gavi, launched a subsidiary scheme, the African Vaccine Manufacturing Accelerator (AVMA). This is intended to accumulate up to USD 1.2 billion for manufacturers over ten years, prioritizing measles-rubella, hexavalent, yellow fever, Ebola, rotavirus, and others.

Application (Human Use, Veterinary)

Based on applications, the human use segment is poised to dominate the vaccine contract manufacturing market during the assessed period. The leadership in worldwide business and heightened demand are a few of the primary driving factors in this segment. The global exports of antidotes for humans accounted for USD 58.0 billion in 2023, with top traders being large marketplaces such as Belgium, the U.S., China, Germany, France, and Ireland: OEC. The growing population of the human species is also a propeller in this field. According to the estimations by the United Nations, the human population around the globe is predicted to be 8.5 billion by 2030, 9.7 billion by 2050, and 10.4 billion by 2100. As the impact and incidence of endemics and pandemics among this species become more prominent, this segment is growing.

Our in-depth analysis of the global vaccine contract manufacturing market includes the following segments:

|

Vaccine Type |

|

|

Workflow |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vaccine Contract Manufacturing Market Regional Analysis:

North America Market Analysis

North America in vaccine contract manufacturing market is predicted to dominate over 43.9% revenue share by 2035. The region is augmenting its proprietorship with its excellence in biologics innovations and cultivation. It is also enriched by the rapid emergence of the veterinary segment. Well-developed countries such as the U.S. and Canada are witnessing significant growth in pet ownership and expenditure on their healthcare, including vaccination. This is further testified by the large-scale domestic production and consumption. According to OEC, the U.S. held the 1st position in exporting veterinary antidotes with a value of USD 1.0 billion in 2023. Thus, the region’s strong emphasis on every genre of this field is evidence of the rising need for CDMO solutions.

The governing bodies in the U.S. are notable contributors to the vaccine contract manufacturing market. These authorities are aimed at strengthening the medical infrastructure by accommodating sufficient pharmaceutical supplies to retain their reputation for delivering quality care to every individual. For instance, in August 2023, the U.S. Department of Health and Human Services appointed Bavarian Nordic A/S to fill the stocks of its medical inventory with smallpox and mpox vaccines. This contract of bulk manufacturing was valued at a total of USD 120.0 million, ensuring the company’s long-term business relationship with such big and reliable clients. This fosters a beneficial trade culture for other CDMO leaders.

Canada is extending local production capacity with notable incentives and funds, garnering lucrative deals for manufacturers in the vaccine contract manufacturing market. After the pandemic strikes, the country has become more aware of enabling a wide network of antidote supply channels. For instance, in March 2023, the Ministry of Innovation, Science and Industry in Canada invested USD 23.8 million to empower the USD 108.3 million biomanufacturing project of Jubilant HollisterStier. This fund was a continuation of the government’s effort to increase local production of a wide range of immunization solutions including mRNA. Such steady capital influx is providing a financial cushion for this sector.

APAC Market Statistics

Asia Pacific is predicted to witness the fastest growth in the vaccine contract manufacturing market. The existing culture of large-scale pharmaceutical fabrication is widening the scope for globalization of this landscape. In March 2023, Pfizer, a leading mRNA antidote producer, chose Samsung Biologics for manufacturing its desired therapeutic, in a transaction of USD 183.0 million, till 2029.

India is reaching milestones in the vaccine contract manufacturing market through its emphasized biopharmaceutical and biotechnology industry. According to IBEF, the biotech industry of this nation is estimated to attain USD 150.0 billion by 2025 and USD 300.0 billion by 2030. As the country drew attention to domestic fabrication, the need for CDMOs is rising to support the cohort. In addition, the presence of strong academic expertise across the country is fostering the scope of future investments in this landscape. For instance, in December 2024, Bavarian Nordic A/S opted for Serum Institute of India Pvt. Ltd. to acquire a viable source of manufacturing and marketing its MVA-BN mpox vaccine in India.

The China vaccine contract manufacturing market encompasses exceptional capabilities in manufacturing and distribution. With ambitious goals and subsidiary policies of governing bodies, the country is embarking on opportunities for both domestic and international contributors. It is utilizing its pharmaceutical USPs such as mass production, clinical excellence, and reservoirs of raw materials to cultivate a local supply channel to cope with upcoming outbreak threats. For instance, in September 2023, WuXi Vaccines unveiled CDMO services in China by founding a new site with drug substance (DS) and small-to-medium sterile drug product (DP). The facility holds a reserved capacity of 2,000 L for DS and automated operation for DP.

Key Vaccine Contract Manufacturing Market Players:

- Lonza

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KgaA

- Cytovance Biologics

- Catalent, Inc.

- IDT Biologika GmbH

- Albany Molecular Research, Inc.

- PRA Health Sciences

- ICON plc.

- Pharmaceutical Product Development, LLC

- Cobra Bio

- Paragon Bioservices, Inc.

- Valneva

- Biovian

- 3P Biopharmaceuticals

Key players in the vaccine contract manufacturing market are now focusing on leveraging their capacities and capabilities. They are even forming partnerships and collaborations to optimize operational values and efficiencies. For instance, in October 2023, Lonza teamed with Vaxcyte, Inc. to globalize its vaccine manufacturing business. The companies allied to possess each other’s abilities and expertise to create a broad range of services for various pneumococcal conjugate vaccines (PCVs). Such strategic formations are further inspiring other bio-producers to engage their resources in this field, diversifying options and fostering new possibilities for wide adoption. These key players are vaccine contract manufacturing market:

Recent Developments

- In February 2025, Valneva earned the contract for manufacturing and supplying a vaccine for Japanese encephalitis, IXIARO, over one year from the U.S. Department of Defense. The deal is worth USD 32.8 million, which consolidated the company’s presence in this sector by expanding its network across government bodies.

- In February 2024, Biovian combined its expertise with 3P Biopharmaceuticals to establish a region-wide network of biologics CDMO services, 3PBIOVIAN. The joint force aimed to attain a gross sale of USD 75.0 million by availing state-of-the-art manufacturing and development commodities for biopharma leaders.

- Report ID: 7258

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.