Vacation Rental Market Outlook:

Vacation Rental Market size was over USD 95.78 billion in 2025 and is projected to reach USD 136.42 billion by 2035, witnessing around 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vacation rental is assessed at USD 98.88 billion.

The global market is expected to rise owing to an increasing consumer shift towards customized experiences that feel like home while traveling. This is also where the concept of vacation rentals started gaining traction among travelers interested in unique and tailored stays. Companies in the market are observing increased demand from the regions that are promoting sustainable tourism. In August 2022, Bornholmske Feriehuse was acquired by Oravel Stays Private Limited. The acquisition has been aimed at expanding Oyo's presence within Europe to meet the rising demand for vacation rentals in Denmark. This development underlines the growing consolidation within the industry.

Governments are also increasingly supporting the vacation rental sector by introducing policies to enhance tourism infrastructure and diversify accommodation options. A notable development is England's announcement of new regulations for short-term rentals, set to take effect in the summer of 2024. These regulations will require property owners to obtain permission from local councils before converting their properties into short-term rentals and will establish a mandatory national registration scheme.

Key Vacation Rental Market Insights Summary:

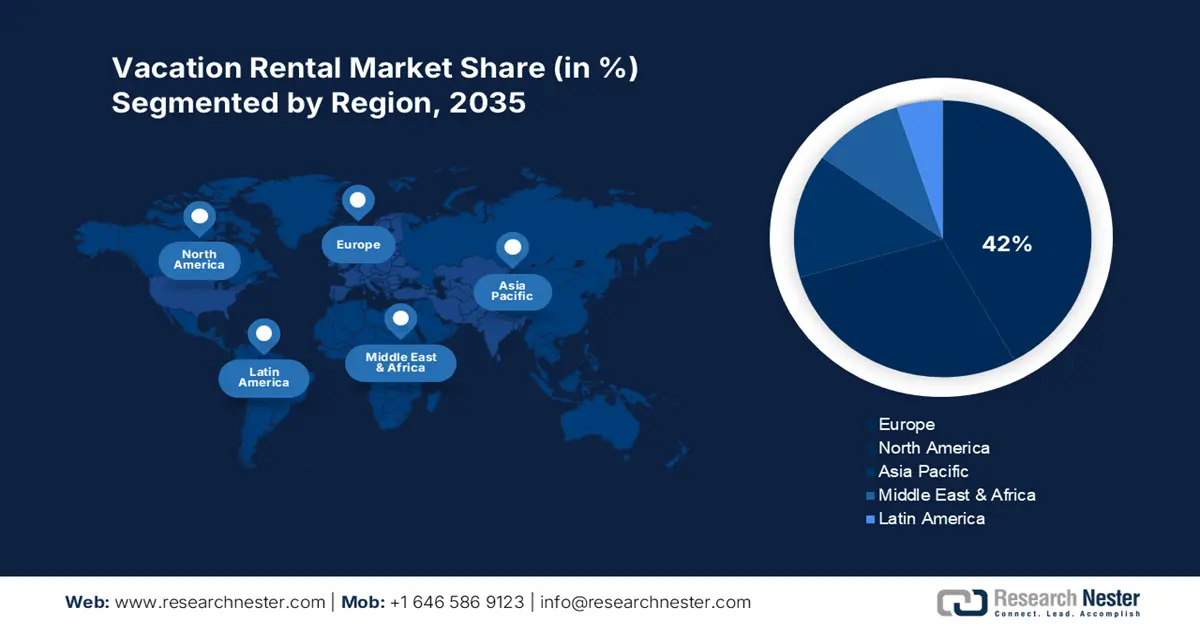

Regional Highlights:

- Europe leads the Vacation Rental Market with a 42% share, driven by sustainable tourism, enhancing its dominance through 2026–2035.

- North America is anticipated to maintain a substantial share in the Vacation Rental Market from 2026 to 2035, driven by favorable government policies, domestic tourism, and demand for flexible accommodation types.

Segment Insights:

- The Homes segment is forecasted to capture over 49.5% share by 2035, propelled by demand for flexible, private accommodations for families and long stays.

- The Offline Booking Mode segment of the Vacation Rental Market is forecasted to achieve over 72% share by 2035, driven by limited internet access in some regions and preference for traditional booking.

Key Growth Trends:

- Surge in digital platforms

- Growing preference for immersive local experience

Major Challenges:

- Regulatory compliance and zoning restriction

- Standardization and quality assurance

- Key Players: OYO Hotels & Homes, TripAdvisor LLC, Wyndham Destinations, Trivago, Agoda Company Pte. Ltd., Yatra Online Private Limited, Hotwire, Inc., HotelsCombined, Hotels.com, BookingBuddy.com, Inc., 9flats, Airbnb, Booking.com, Expedia, Hotelplan Management AG, MAKEMYTRIP PVT. LTD., NOVASOL, priceline.com LLC, KAYAK, Google.

Global Vacation Rental Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 95.78 billion

- 2026 Market Size: USD 98.88 billion

- Projected Market Size: USD 136.42 billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, France, Italy, Spain, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 14 August, 2025

Vacation Rental Market Growth Drivers and Challenges:

Growth Drivers

- Surge in digital platforms: The expansion of digital booking platforms like Airbnb and Booking.com has facilitated seamless and secure rental processes, enhancing traveler confidence. Digital growth also supports scalability and international reach for property owners. In July 2022, Planet acquired Avantio, a company offering software and services for managing vacation rentals, expanding its presence in the hospitality industry and demonstrating booming interest in the sector.

- Growing preference for immersive local experience: Travelers are more likely to dive into the culture and authenticity of the local experience by opting for rentals that afford a view of the local way of life. This is indicative of a travel style that increasingly favors authenticity over ordinary tourism hotspots. In May 2023, Airbnb verified around 300,000 accessible elements of its rentals to further drive consistency and quality in vacation rental listings. This was a part of the bigger plan to accommodate travelers who seek an authentic local experience without sacrificing comfort or quality.

- Growing popularity of remote work and longer stays: The rise of remote work has brought various changes in travel patterns, with people opting for longer stays combining work and leisure. The space and amenities, like kitchens and workspaces, make vacation rentals well-suited for such workstations. This trend is driving demand for properties that achieve the right balance between comfort and practicality to satiate professionals seeking a temporary change of scenery.

Challenges

- Regulatory compliance and zoning restriction: Most governments across the globe have been initiating increased regulation of short-term rentals, citing negative impacts on housing affordability and neighborhood disturbance. Many cities are turning to stricter zoning laws and rental capping, which would directly affect the available properties for vacation rentals. Changing regulatory compliance has now become one of the biggest challenges faced by property owners and platforms while negotiating a tricky legal landscape with profitability in mind.

- Standardization and quality assurance: With highly diversified rental properties, standardization of services and quality provided still remains a challenge in view of changing customer expectations. Unlike traditional hotels, where set standards may apply, vacation rentals are diverse. Guests increasingly expect rentals to be more akin to hotels in everything from cleanliness to certain amenity availability. Property owners are now tasked with adhering to much more stringent guidelines.

Vacation Rental Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 95.78 billion |

|

Forecast Year Market Size (2035) |

USD 136.42 billion |

|

Regional Scope |

|

Vacation Rental Market Segmentation:

Accommodation (Apartments, Homes, Resorts, and Others)

Homes segment is projected to hold over 49.5% vacation rental market share by the end of 2035. Homes offer flexibility and comfort to vacationers with much privacy, which is highly desirable compared to other modes of vacation rentals, especially for families and large groups. In March 2023, Zumper introduced Vacations by Zumper, which shows how companies invest in services to make managing home rentals easier. Moreover, extended stays and work-from-anywhere have the potential to continue boosting the demand for homes for leisure and work purposes.

Booking Mode (Offline and Online)

By the end of 2035, offline segment is expected to hold over 72% vacation rental market share. The offline mode continues to play an important role in regions with limited internet facilities or when travelers may want to opt for the traditional ways of making bookings. In May 2023, MakeMyTrip Pvt. Ltd. partnered with Microsoft to provide voice-assisted booking in various Indian languages, entailing the deep interaction of digital with offline services to make the booking processes reach a wide demography of consumers.

Our in-depth analysis of the vacation rental market includes the following segments:

|

Accommodation |

|

|

Booking Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vacation Rental Market Regional Analysis:

Europe Market Analysis

Europe industry is likely to account for largest revenue share of 42% by 2035. High focus on sustainable tourism and cultural heritage in Europe are some of the major drivers behind this dominance. On the other hand, the rise in the number of eco-conscious travelers has motivated more property owners towards green practices, thereby further fueling the vacation rental market growth. Additionally, several historical sites, cultural diversity, and an authenticity-seeking mindset among travelers make Europe a desirable destination. This strong appeal is likely to continue to keep Europe at the forefront of the global vacation rental industry.

Germany benefits from a robust infrastructure and cultural tourism appeal. In April 2023, Evolve introduced a seasonal analysis of vacation rental trends that would inform and support property owners through changing demands and make vacation rentals in Germany even more appealing to those coming for cultural experiences. These insights also provide property hosts with opportunities to shape their offerings and meet the growing number of travelers showing interest in local festivals and historical hotspots. Its strong infrastructure for public transportation further allows anyone who wishes to gain easy access to any region, thus turning vacation rentals into an attractive option when touring the country.

The vacation rental market in France is supported by its vast cultural attractions and evolving traveler preferences. France is turning into a popular vacation rental market due to its art, food, and landmarks for which it is well-known, and continues to receive millions of visitors every year. This factor helps companies diversify the different types of accommodations available to visitors and further cement their position within the vacation rental sector. In addition, promoting lesser-known regions, such as the countryside and small towns of France, helps extend the supply of vacation rentals beyond more traditionally popular destinations. Such strategic growth is key to keeping competition healthy in the vacation rental market.

North America Market Analysis

By 2035, North America vacation rental market is anticipated to account for around 28.5% share. North America is a prominent market, with major players like Airbnb and newcomers. In addition, favorable government policies encourage domestic tourism, which is likely to boost industry growth. The demand is further driven by the emphasis on experiences such as cabin stays, beach houses, and other alternative types of accommodations. Another catalyst in driving a positive outlook for the North America vacation rental sector is the trend for combining work with leisure travel.

The U.S. remains a significant vacation rental market, driven by an increasingly higher interest in unique and flexible accommodation options among domestic travelers. In January 2023, The Interhome Group partnered with Sol og Strand to extend the companies' service offerings into Denmark. Such a development illustrates how international collaborations are anticipated to drive growth in the U.S. market. Also, vacation rentals are flexible, serving the needs of families and digital nomads for more personalized experiences in trips. Regular investment in property management technology is further improving the customer experience, making the U.S. market more appealing to both renters and owners.

Canada vacation rental market is bolstered by a surge in outdoor and nature-based tourism, with many travelers opting for secluded cabins and homes to enjoy the vast natural landscapes of the country. In September 2022, Arrived Homes extended its platform through investments in short-term vacation rentals, developing unique properties, and contributing to the growth of the vacation rental sector in Canada. The popularity of national parks and lakeside communities remains a strong appeal to tourists who want to get away from the metropolis. Also, Canada focuses on sustainable tourism, for which more eco-friendly vacation rental properties are being developed, which in turn is one of the major reasons for vacation rental market growth.

Key Vacation Rental Market Players:

- Airbnb

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Booking.com

- Expedia

- 9flats

- Hotelplan Management AG

- MAKEMYTRIP PVT. LTD.

- NOVASOL

- OYO Hotels & Homes

- TripAdvisor LLC

- Wyndham Destinations

- Trivago

- BookingBuddy.com, Inc.

- priceline.com LLC

- KAYAK

- Agoda Company Pte. Ltd.

- Yatra Online Private Limited

- Hotwire, Inc.

- HotelsCombined

- Hotels.com

The vacation rental market is highly competitive, comprising several well-established players and a plethora of emerging companies that compete for market shares. Leading companies like Airbnb, Booking.com, OYO Hotels & Homes, and Expedia have established companies in the sector that offer dynamic features. Each of these businesses brings a different value proposition to the table, from offering more property listings to value-added services that are digitally accessible in an attempt to make consumer experiences more enjoyable. Competition like this fuels only improvement, ensuring that for the traveler better services, wider accommodation choices, and enhanced booking flexibility are fostered.

The entry of new platforms offering different slices of experiences, such as eco-friendly stays or heritage homes, increases the level of competition in the market. In May 2024, Munich-based vacation rental firm Holidu acquired Clubrural in a move that furthered its reach into rural Spain and Portugal. With this strategic acquisition, the competition in the market further heats up, proving that strategic expansion is very important in gaining a competitive advantage. This is anticipated to place the company in a position to tap into increasing interest in rural tourism and authentic local experiences that grow in popularity among travelers. Acquisitions of this kind reflect the growth strategy by companies to meet the diverse preferences of a wide range of travelers and broader geographic reach.

Here are some leading players in the vacation rental market:

Recent Developments

- In June 2024, OYO launched its premium vacation home rental brand, Belvilla, in the UK, offering short-term stays in prime locations such as London, Milton Keynes, Birmingham, Sheffield, and Leeds. OYO partnered with SOJO, a luxury apartment rental management company that operates over 250 apartments in cities including Manchester, Suffolk, and Berkshire.

- In May 2023, Airbnb announced that it had inspected and confirmed the accuracy of around 300,000 accessible features in homes worldwide. These features include step-free entrances, installed grab bars, and bath or shower chairs, aiming to enhance accessibility for all travelers.

- Report ID: 6607

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vacation Rental Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.