UV Stabilizers Market Outlook:

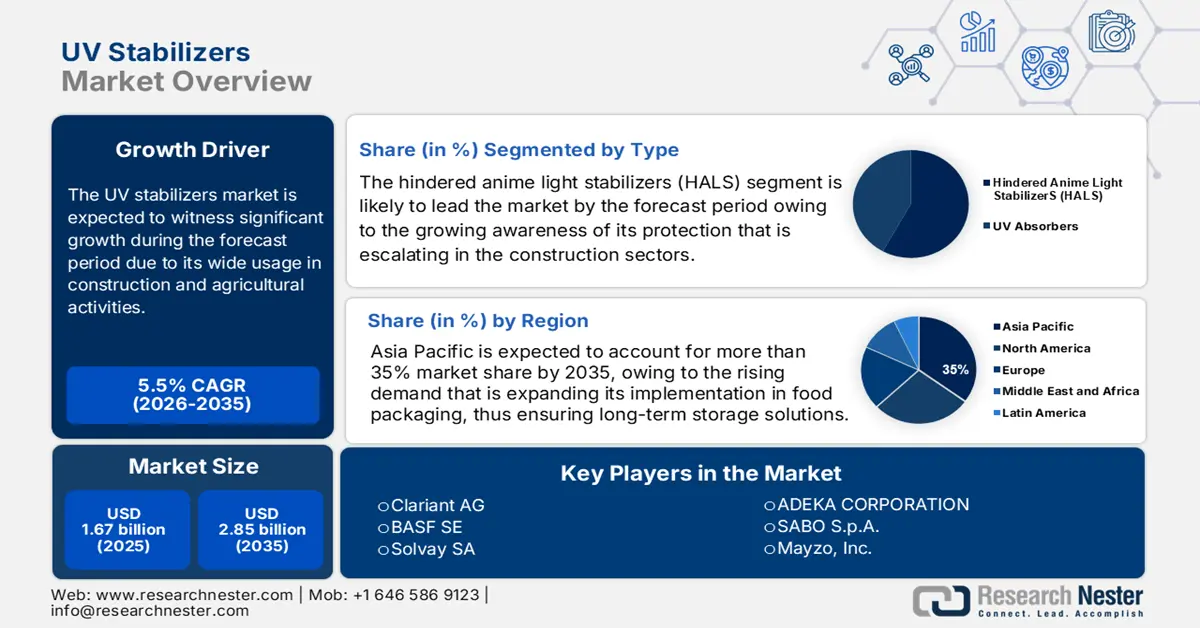

UV Stabilizers Market size was over USD 1.67 billion in 2025 and is projected to reach USD 2.85 billion by 2035, witnessing around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of UV stabilizers is evaluated at USD 1.75 billion.

UV stabilizers or additives not only prolong polymer resistance to UV degradation but also offer antibacterial properties that may stop pathogens from spreading and stop microbially driven biodegradation. Using polyurethane formulations to create lacquer films, we added various UV stabilizers, such as a hindered amine light stabilizer (HALS), Tinuvin 770 DF and Tinuvin PA 123, or a hybrid HALS/UV-absorber, Tinuvin 5151, and evaluated their antimicrobial activity against methicillin-resistant and -sensitive strains of Staphylococcus aureus, Escherichia coli, and Candida albicans, according to Frontiers.

The most often utilized UV-stabilizer agents in polymeric materials are UV-absorbers and HALS. Benztriazoles, benzophenones, and hydroxyphenyl triazines are a few types of UV absorbers. HALS, on the other hand, works by preventing the autoxidation process and causing its parent amines to produce nitroxide radicals. By joining forces with alkyl radicals, these nitroxide radicals prevent the material's oxidative deterioration. BASF sells HALS under the brand name Tinuvin, which includes Tinuvin 770 DF, Tinuvin 5151, Tinuvin 326, Tinuvin 328, Tinuvin 1130, and Tinuvin PA 123. The supplier's technical data sheet states that Tinuvin 770 DF is approved for use in solvent-based adhesives (including acrylic and PUR), sealants (MS polymer), ethylene-vinyl-acetate (EVA) polymer systems, polyurethane (PUR), polyamide (PA), styrene-butadiene-styrene (SBS), and styrene isoprene-styrene (SIS). The biodegradation of polymeric materials has attracted attention in recent years because it may reduce the amount of microplastic that accumulates in ecosystems.

Certain UV stabilizers, such as compounds based on HALS, have been reported to possess both antioxidant and antibacterial qualities in addition to their primary purpose. Metal-based substances like zinc oxide (ZnO) and titanium dioxide (TiO2) are examples of antimicrobial UV-light stabilizers, as are non-metal substances (3,5-benzamide-2,4-dihydroxyphenyl) (phenyl) methanone (UV-CB). According to Trading Economics, Titanium surged 1 CNY/KG or 2.25% since the start of 2025, based on the contract for difference (CFD) that benchmarks the market for Titanium. Historically, Titanium reached a record high of 152.43 in May of 2022.

Top 5 TiO2-based Pigments & Preparations Global Exporters, 2021

|

Country |

Tradeflow Value (1000USD) |

Quantity (Kg) |

|

China |

3,685,779.29 |

1,325,470,000 |

|

The U.S. |

1,507,691.31 |

491,562,000 |

|

EU |

1,295,389.65 |

380,057,000 |

|

Germany |

1,272,521.13 |

359,846,000 |

|

UK |

654,205.74 |

219,436,000 |

Source: WITS

Key UV Stabilizers Market Insights Summary:

Regional Highlights:

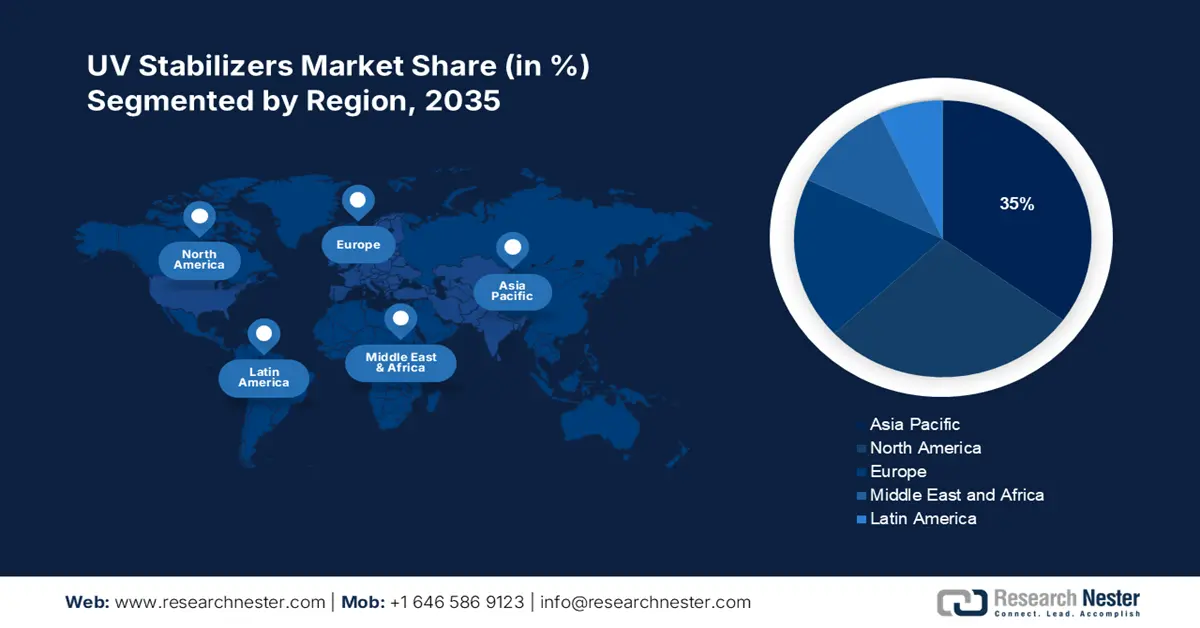

- Asia Pacific UV stabilizers market achieves a 35% share by 2035, attributed to the thriving beauty and cosmetics industry, especially demand for sunscreens and skincare products.

Segment Insights:

- The hindered amine light stabilizer segment in the uv stabilizers market is anticipated to capture a 58% share by 2035, attributed to their UV protection abilities and demand in industries like construction.

Key Growth Trends:

- Widespread adoption in packaging

- Growing demand in the automotive sector

Major Challenges:

- Fluctuations in the prices of raw materials

Key Players: Clariant AG, SONGWON Industrial Group, BASF SE, Valtris Specialty Chemicals Inc., Solvay SA, ADEKA Corporation, Evonik Industries AG, SABO S.p.A., Everlight Chemical Industrial Corp., Mayzo, Inc.

Global UV Stabilizers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.67 billion

- 2026 Market Size: USD 1.75 billion

- Projected Market Size: USD 2.85 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 9 September, 2025

UV Stabilizers Market Growth Drivers and Challenges:

Growth Drivers

- Widespread adoption in packaging: UV radiation affects the packaging and products, especially electronics, cosmetics, and textiles. UV additives protect the other packaging from visible effects such as color changes and cracks and color changes, and block the release of dicarboxylic acids that can degrade the products. The growth in packaging industry is fueling the use of UV additives and stabilizers.

Global e-commerce plastic packaging market by product type, 2022

|

Product Type |

Market Share |

|

Protective packaging |

35% |

|

Pouches and bags |

32% |

|

Shrink films |

12% |

|

Others |

21% |

UV stabilizers are pivotal in the food packaging sector. A significant portion of food is lost in the supply chain as a result of environmental factors, comprising radiation and thermal degradation, moisture, oxidation, and microbial contamination. Approximately, 30% of the global food production is wasted in the supply chain and more than 2 million tons of vegetable and fruit waste will be generated each year by 2030, says the NCBI. Barrier property of food packaging with a capacity to block 200-400 nm UV and 400-700 nm visible radiation. The exposure of food products to natural or artificial UV light throughout harvesting, storage, distribution, procurement, sales, and consumption induces photo-degradation and photo-oxidation, thereby, adversely impacting food quality and nutritional value.

- Growing demand in the automotive sector: Automobiles are a key end user of UV additives to improve the durability of paint & coatings and other vehicle parts. The massive rise in automotive sales has driven the UV stabilizers market adoption. The U.S. light trucks (CUVs, SUVs, vans, pickups) market share surged 3.4% to reach 79.3% in 2022, while cars accounted for 20.7%. Auto manufacturing contributes USD 1 trillion to the economy annually in the form of sales and servicing. Roughly, USD 280 billion is collected as state, local, and federal tax revenues, including USD 79 billion in state and USD 69 billion in federal income.

Challenges

- Fluctuations in the prices of raw materials: Raw materials such as aluminum chloride, benzene, sodium nitrite, benzoyl chloride, and others are used to produce UV stabilizers. The prices of these raw materials fluctuate regularly, owing to this attribute the prices of UV stabilizers also fluctuate and this affects the market growth further. The prices of UV stabilizer raw materials are - benzene for USD 696.7 per MT, sodium nitrite for USD 40 for 1kg, and benzoyl chloride for USD 38 for 1000g.

UV Stabilizers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 1.67 billion |

|

Forecast Year Market Size (2035) |

USD 2.85 billion |

|

Regional Scope |

|

UV Stabilizers Market Segmentation:

Type Segment Analysis

The hindered amine light stabilizer segment in the UV stabilizers market is estimated to witness the highest revenue share of 58% by the end of 2035. Considering their UV protection abilities, they are high in demand in multiple industries such as the construction sector. Growing awareness about UV degradation, rising demand for high-performance materials, escalating construction sectors, and regulatory needs are driving the demand for this segment.

Application Segment Analysis

The packaging segment in the UV stabilizers market is expected to record significant revenue in the forecast timeframe. UV stabilizers mainly offer protection to products from the harmful UV radiation of sun at the same time being properly stored and transported this property of UV stabilizers raises its demand in the packaging industry. UV radiation can result in discoloration, fading, and other degradation results in products especially the ones that are sensitive such as food products, skin care products, cosmetics, or pharmaceuticals. Moreover, factors such as demand for product protection, regulatory needs, consumer expectations, and advancement in technology in UV stabilizers are estimated to propel the demand for UV stabilizers in the packaging sector.

Our in-depth analysis of the global UV stabilizers market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

UV Stabilizers Market Regional Analysis:

APAC Market Insight

The UV stabilizers market in Asia Pacific is poised to witness the highest share of 35% during the forecast timeframe. This can be ascribed to the thriving beauty and cosmetics industry. South Korea-based cosmetic labels, popularly known as K-beauty are booming globally. As one of the top 10 global markets, South Korea market size was USD 3.9 billion in 2022, emerging as the fourth largest cosmetics exporter after France, the U.S., and Germany. The cumulative skin care and cosmetic imports including sunscreens spiked in 2021 and were valued at USD 1.3 billion. As per the International Trade Association (ITA), France held an export value of USD 462 million, the U.S. was USD 274 million, and Japan USD 126 million.

China UV stabilizers market is driven by the high import of HS63304 products (make-up and skincare preparations, comprising sunscreens). The total import value stood at USD 14,430,329 in 2023, according to an ITC report. Regulations revolving around the production, procurement, and utilization of sunscreens in the country are governed by China's National Medical Products Administration (NMPA), Standardization Administration of the P.R.C. (SAC), China Association of Fragrance Flavor and Cosmetic Industries (CAFFCI), and China Food and Drug Administration (CFDA).

North America Market Insight

The UV stabilizers market in North America is set to grow substantially and mark a lucrative market value between 2026-2035. The UV stabilizers market in this region is expected to grow owing to the increasing import of polymers in Canada and the U.S. Of the total world ethylene polymer trade of USD 104 billion in 2022, the U.S. emerged as the top exporter and valued at USD 17.4 billion and Canada exports were worth USD 4.95 billion. Both countries were among the top five exporters, along with Saudi Arabia, Souths Korea, and Singapore. Furthermore, according to the OEC, the U.S. was among the top five exporters of natural fibers in 2022 and held an outbound value of USD 347 million.

The U.S. UV stabilizers market growth is ascribed to the thriving polymer manufacturing sector. In July 2024, the Economic Development Administration (EDA) recommended the Sustainable Polymers Tech Hub for grant funding of USD 51 million for the development of polymer lifecycle management and new sustainability capabilities. Additionally, regional R&D collaborations to establish global leadership by the National Institute of Standards and Technology (NIST) to develop additive manufacturing (AM) of polymers to support advanced production.

UV Stabilizers Market Players:

- Clariant AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SONGWON Industrial Group

- BASF SE

- Valtris Specialty Chemicals Inc.

- Solvay SA

- ADEKA Corporation

- Evonik Industries AG

- SABO S.p.A.

- Everlight Chemical Industrial Corp.

- Mayzo, Inc.

- Evonik

The global players are engaged in strategic activities like new product launches, collaborations, extensive R&D, and partnerships to expand their geographical presence. Companies have identified the potential hazards of traditional UV stabilizers and are keen to bring new-age filters to the UV stabilizers market. Some of them include:

Recent Developments

- In July 2024, BASF launched Tinuvin NOR 211 AR UV stabilizer catering to agricultural applications. It is a significant advancement in prolonging agricultural plastics, marking a shift away from inorganic chemicals like chlorine and sulfur.

- In September 2023, Evonik introduced TEGO RC 2000 LCF as part of its next-gen TEGO RC solutions product line. The product launch is aligned with the company’s sustainability goals with excellent aging stability.

- In July 2022, Solvay rolled out a line of new UV-C stabilizers with antimicrobial properties. Polyolefin surfaces are treated for UV-C spectrum (200-280 nm), targeting and mitigating hospital-acquired infections.

- Report ID: 3886

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

UV Stabilizers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.