Global UV-C LED Market

- An Outline of the Global UV-C LED Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Opportunities

- Growth Drivers

- Major Roadblocks

- Prevalent Trends

- Government Regulation

- Comparative Analysis of the Current Technologies

- Application Analysis

- Upcoming Applications of UV-C LEDs

- Growth Outlook

- Growth Outlook

- Risk Analysis

- SWOT Analysis

- Supply Chain

- Customers: Identification of Key Target

- Regional/Country Demand

- Recent News

- Strategic Initiatives

- Mergers and Acquisitions (M&A)

- Comparative Positioning

- Competitive Landscape: Key Players

- Competitive Model: A Detailed Inside View for Investors

- Market Share of Major Companies Profiled, 2023

- Business Profiles of Key Enterprises

- ams-OSRAM AG

- Crystal IS, Inc.

- Harvatek Corporation

- High Power Lighting Corp.

- IBT Group

- INTERNATIONAL LIGHT TECHNOLOGIES, INC.

- IRTRONIX, Inc.

- Laser Components

- Luminus, Inc.

- NICHIA CORPORATION

- NKFG CORPORATION

- Seoul Viosys Co., Ltd.

- Signify Holding

- STANLEY ELECTRIC CO., LTD

- U.S.UV-C LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- U.S.UV-C LED Market Segmentation Analysis (2024-2037)

- By Application

- Sterilization, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Industrial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Water/Air Disinfection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Application

- Europe UV-C LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Europe UV-C LED Market Segmentation Analysis (2024-2037)

- By Application

- Sterilization, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Industrial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Water/Air Disinfection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Country

- UK, Market Value (USD Million), and CAGR, 2024-2037F

- Germany, Market Value (USD Million), and CAGR, 2024-2037F

- France, Market Value (USD Million), and CAGR, 2024-2037F

- Italy, Market Value (USD Million), and CAGR, 2024-2037F

- Spain, Market Value (USD Million), and CAGR, 2024-2037F

- BENELUX, Market Value (USD Million), and CAGR, 2024-2037F

- Poland, Market Value (USD Million), and CAGR, 2024-2037F

- Russia, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of Europe, Market Value (USD Million) and CAGR, 2024-2037F

- By Application

- Asia Pacific excluding Japan UV-C LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Asia Pacific excluding Japan UV-C LED Market Segmentation Analysis (2024-2037)

- By Application

- Sterilization, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Industrial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Water/Air Disinfection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Country

- China, Market Value (USD Million), and CAGR, 2024-2037F

- India, Market Value (USD Million) and CAGR, 2024-2037F

- South Korea, Market Value (USD Million), and CAGR, 2024-2037F

- Australia, Market Value (USD Million) and CAGR, 2024-2037F

- Indonesia, Market Value (USD Million) and CAGR, 2024-2037F

- Malaysia, Market Value (USD Million), and CAGR, 2024-2037F

- Vietnam, Market Value (USD Million), and CAGR, 2024-2037F

- Singapore, Market Value (USD Million), and CAGR, 2024-2037F

- New Zealand, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of Asia Pacific excluding Japan, Market Value (USD Million), and CAGR, 2024-2037F

- By Application

- China UV-C LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- China UV-C LED Market Segmentation Analysis (2024-2037)

- By Application

- Sterilization, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Industrial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Water/Air Disinfection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Application

- Japan UV-C LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Japan UV-C LED Market Segmentation Analysis (2024-2037)

- By Application

- Sterilization, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Industrial, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Water/Air Disinfection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Application

- About Research Nester

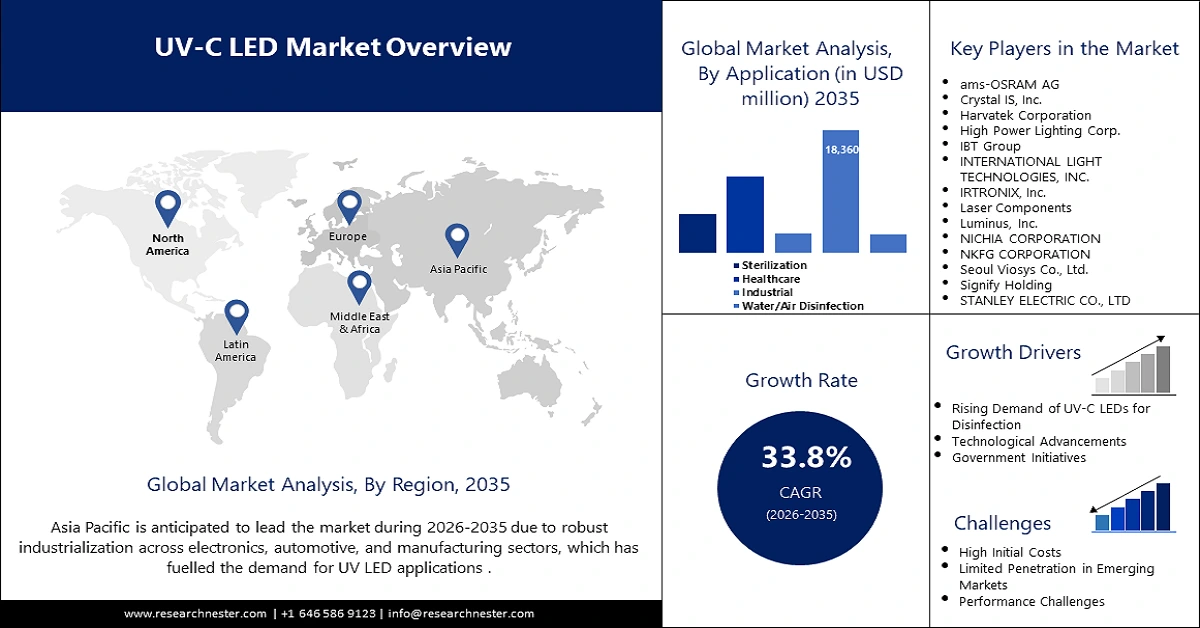

UV-C LED Market Outlook:

UV-C LED Market size was valued at USD 1.06 billion in 2025 and is set to exceed USD 19.49 billion by 2035, expanding at over 33.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of UV-C LED is estimated at USD 1.38 billion.

The UV-C LED market is steadily growing due to increasing requirements for small-sized, energy-friendly, and mercury-free disinfection solutions in healthcare, industrial, and home use. The demand for the replacement of conventional UV mercury lamps has spurred development, and the major participants have concentrated on increasing the power, efficiency, and dependability. In October 2024, ams-OSRAM released OSLON UV 3535 LED with an output power of 115mW at 265nm for enhanced germicidal disinfection of air, water, and surfaces. This advancement reflects the increasing trend towards safer and more environmentally conscientious disinfection methods that support UN sustainable development goals.

The UV-C LED market expansion is also being driven by government policies and awareness of the population’s health. This has led to the encouraging of mercury-free disinfection by the regulatory authorities thus increasing the usage of UV-C LEDs. In November 2023, Marktech Optoelectronics launched Silanna’s 235nm and 255nm UVC LEDs that can decrease the risk of cancer while increasing energy efficiency. This development demonstrates the growing regulatory pressure on safe and efficient germicidal technologies, which strengthens the position of UV-C LEDs as the future of disinfection solutions.

Key UV-C LED Market Insights Summary:

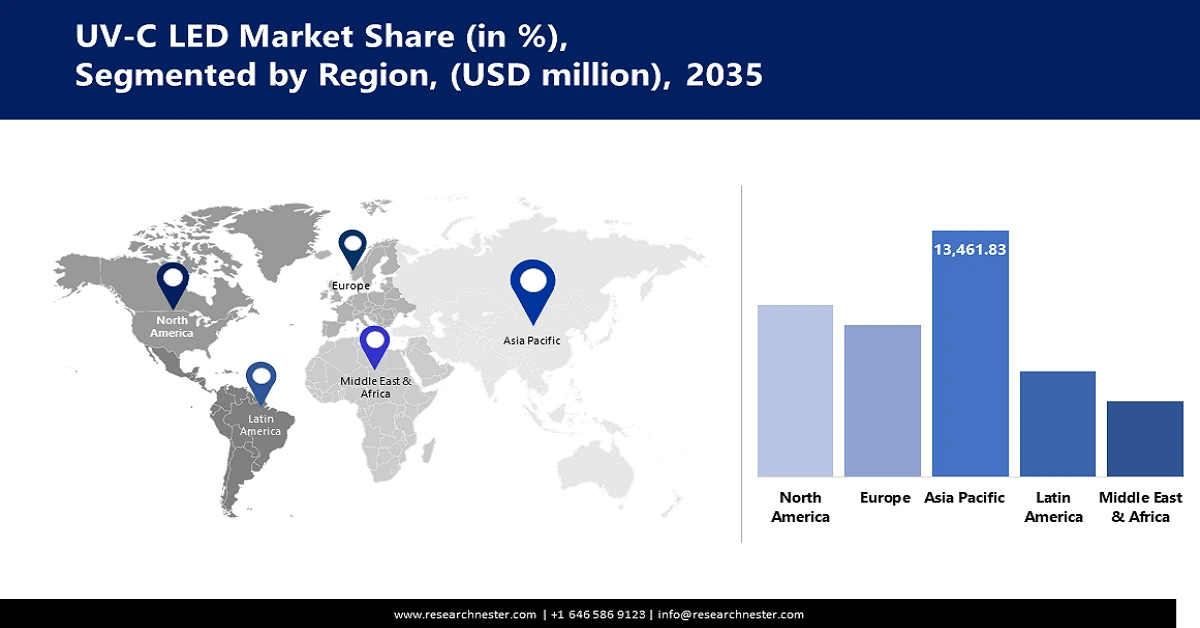

Regional Highlights:

- Asia Pacific leads the UV-C LED Market with a 34.5% share, propelled by the region’s industrial growth and emphasis on cleanliness, ensuring robust expansion through 2026–2035.

- The UV-C LED market in North America is expected to achieve a lucrative CAGR by 2035, attributed to increasing concerns towards sustainable and energy-efficient products and systems in water purification and surface sterilization.

Segment Insights:

- The Water/Air Disinfection segment is expected to hold over 45% market share by 2035, propelled by increasing concern for airborne diseases and waterborne pathogens boosting UV-C disinfection demand.

Key Growth Trends:

- Growing need for mercury-free disinfection products

- Higher uptake in water and air filtration applications

Major Challenges:

- Shorter and less efficient UV-C LED lifetime

- Challenges of standardization and regulation

- Key Players: ams-OSRAM AG, Crystal IS, Inc., Harvatek Corporation, High Power Lighting Corp., IBT Group, INTERNATIONAL LIGHT TECHNOLOGIES, INC., IRTRONIX, Inc., Laser Components, Luminus, Inc., NICHIA CORPORATION, NKFG CORPORATION, Seoul Viosys Co., Ltd., Signify Holding, STANLEY ELECTRIC CO., LTD.

Global UV-C LED Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.06 billion

- 2026 Market Size: USD 1.38 billion

- Projected Market Size: USD 19.49 billion by 2035

- Growth Forecasts: 33.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, Japan, South Korea, Taiwan, India

Last updated on : 13 August, 2025

UV-C LED Market Growth Drivers and Challenges:

Growth Drivers

- Growing need for mercury-free disinfection products: Rising environmental and health concerns of using mercury-based UV lamps are a major reason for the growth of UV-C LED market. In March 2023, ams-OSRAM introduced the OSLON UV 3535, a mercury-free UV-C LED with mid-power range suitable for scalable air and water disinfection solutions. As more governments impose rules on the use of hazardous chemicals, industries are progressively using UV-C LEDs as a less dangerous and more effective solution, which is promoting the development of new products and expanding the UV-C LED market.

- Higher uptake in water and air filtration applications: UV-C LEDs are gradually playing crucial roles in water and air disinfection, responding to the increasing demand for water and a better environment. In June 2022, Typhon Treatment Systems, in partnership with Seoul Viosys, deployed Violeds technology at the Cumbria water treatment plant to prove that UV-C LEDs are efficient in water treatment for municipalities. This trend is witnessing a surge as UV-C LEDs are being used in large-scale public infrastructures due to raised awareness of environmental issues and improvements in LED technology.

- Growth of the healthcare and consumer electronic industries: The use of UV-C LEDs is growing fast in healthcare, surface sterilization, and portable disinfection devices. In January 2023, Nichia launched the NCSU434C, a high power UV-C LED with 110mW forward voltage, which is used in medical and air disinfection applications. The increasing application of UV-C LEDs in healthcare and the increasing incorporation of germicidal LEDs in consumer electronics for increased safety shows the increasing relevance of this technology in daily life.

Challenges

- Shorter and less efficient UV-C LED lifetime: UV-C LEDs are still a relatively emerging technology, and there are still challenges related to the device’s lifetime and power conversion efficiency. However, the working efficiency of the UV-C LEDs can deteriorate with time, thus reducing their efficiency in disinfection. This is even more so in areas such as healthcare and water treatment as the UV-C disinfection has to be steady and effective over time. However, manufacturers are putting money into the research on how to increase the operational life, but scalability is an issue.

- Challenges of standardization and regulation: The absence of standardization regarding UV-C LED technology is a major drawback in terms of regulation and implementation. Variables such as the output level and the wavelength stability produce unequal disinfection efficacy. This is a challenge to manufacturers because they cannot achieve standard safety and performance requirements in all the markets of the world. Standards are being developed by the regulatory bodies to provide a more defined structure to the market, but the lack of standardized norms acts as a restraint to UV-C LED market growth.

UV-C LED Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

33.8% |

|

Base Year Market Size (2025) |

USD 1.06 billion |

|

Forecast Year Market Size (2035) |

USD 19.49 billion |

|

Regional Scope |

|

UV-C LED Market Segmentation:

Application (Sterilization, Healthcare, Industrial, Water/Air Disinfection, Others)

Water/air disinfection segment is expected to capture over 45% UV-C LED market share by 2035. The small size and high efficiency of UV-C LEDs allow their application in air conditioning systems and water treatment systems. Typhon Treatment Systems and Seoul Viosys showcased the use of UV-C LEDs for large-scale water treatment in municipalities in June 2022. The growth of this segment is driven by rising awareness of airborne diseases and waterborne pathogens to advocate for UV-C disinfection as a solution. The growing concern for cleanliness in indoor environments of commercial and residential buildings also fuels the growth of UV-C air purification technologies.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

UV-C LED Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific UV-C LED market is set to capture revenue share of over 34.5% by 2035, due to the region’s industrial growth and emphasis on cleanliness. The region’s strength in electronics manufacturing and technology places it as a major producer and user of UV-C LED technology. Growth of the medical, residential, and commercial segments is attributed to the increasing incidence of airborne and waterborne diseases.

The UV-C LED market in India is rising at a rapid pace due to the government’s campaigns on clean water supply and better hygiene. The availability of local UV-C LED manufacturers and the rising need for cost-effective disinfection are also driving the growth. Indian start-ups and technology companies are leveraging new-age UV-C LED products to tap the rural and the urban markets in order to meet the hygiene and healthcare needs of the country.

China remains the most prominent UV-C LED market in Asia Pacific due to large-scale production capabilities and increased technological developments. In the year 2024, September specifically, two companies, MASSPHOTON and Sino Innovation Lab, introduced the first medical-grade air sterilizer in the world that uses deep UV-C LED technology. This non-ozone-depleting sterilizer that is also energy efficient was awarded gold medals at international invention fairs. The country’s focus on innovation and healthcare, especially in UV-C LED technology, reflects the prospects available for players due to the growing focus on air and water purification.

North America Market Analysis

North America UV-C LED market is poised to register steady growth till 2035, due to growing applications in water purification, air disinfection, and surface sterilization. The increasing concerns towards utilizing sustainable and energy-efficient products and systems in residential, commercial, and healthcare industries are also driving the growth of the market. Increased knowledge of waterborne diseases and the push towards reducing plastic use are also promoting the use of UV-C LEDs in consumer products.

The application of UV-C LED technology in the U.S. is growing rapidly because of increased awareness of health and environmental issues. In February 2024, Amway introduced the eSpring Water Purifier, which is equipped with UV-C LED technology and treated 1,320 gallons of water annually which helped in reducing the use of plastic water bottles. This innovation shows that sustainable water purification systems are becoming more important and that UV-C LEDs are key to green solutions.

The UV-C LED market in Canada is on the rise due to various government policies and private investments that focus on improving the healthcare system. As the product is being used for water treatment facilities and HVAC systems, the market is also growing in the residential and industrial sectors. Canadian firms are working with international UV-C LED producers to enhance the quality of air and water, which enhances the standard of regulation and safety. The use of UV-C LED in healthcare and public facilities also contributes to UV-C LED market expansion.

Key UV-C LED Market Players:

- ams-OSRAM AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Crystal IS, Inc.

- Harvatek Corporation

- High Power Lighting Corp.

- IBT Group

- INTERNATIONAL LIGHT TECHNOLOGIES, INC.

- IRTRONIX, Inc.

- Laser Components

- Luminus, Inc.

- NICHIA CORPORATION

- NKFG CORPORATION

- Seoul Viosys Co., Ltd.

- Signify Holding

- STANLEY ELECTRIC CO., LTD

The UV-C LED market is saturated with key players such as ams-OSRAM AG, Nichia Corporation, Crystal IS, and Seoul Viosys, who are continuously working to develop new germicidal LED technologies. The market is characterized by high R&D investment to improve power density, minimize the cost of production, and extend the market to new applications. In March 2023, Asahi Kasei’s Crystal IS division released the Klaran UV-C LED with an output of 160mW and higher efficiency for application in the healthcare and water treatment industries. This can be attributed to the fact that the market is constantly evolving, with new products being introduced and new partnerships being formed. With more and more governments coming up with policies requiring the use of UV-C disinfection and banning mercury, competition is set to rise in the coming years, and more so, innovation and uptake across various sectors.

Here are some leading companies in the UV-C LED market:

Recent Developments

- In November 2024, Incofin committed EUR 3 million to SPOUTS International, supporting clean water initiatives in East Africa. The investment, made through the Water Access Acceleration Fund, aims to expand water treatment solutions and provide safe drinking water to underserved communities. This initiative highlights the increasing focus on sustainable water technologies and the role of UV-C in global clean water access.

- In April 2024, Violumas expanded its UV LED lineup with the introduction of the VC3X3 COB Module, catering to UV-B and UV-C applications. The new module features a fan-cooled heatsink, boosting performance and reliability in demanding environments. This innovation targets applications such as spectroscopy, medical sterilization, and industrial disinfection. Violumas aims to deliver comprehensive UV solutions that meet the evolving needs of the disinfection market.

- In March 2024, Nichia Corporation began mass production of UV-B (308nm) and UV-A (330nm) LEDs in its 434 Series package. These LEDs align with efforts to promote mercury-free environments and carbon neutrality. Their high performance supports applications in healthcare, phototherapy, and industrial disinfection. Nichia’s commitment to advancing UV LED technology continues to drive innovations across multiple sectors.

- Report ID: 6955

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

UV-C LED Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.